Galaxy Surfactants IPO Review

Check All IPO Reviews

Galaxy Surfactants Background

Galaxy Surfactants is a leading brand in surfactant manufacturing and was established back in the year 1986. For people who don’t understand surfactants, basically in simpler words, they manufacture special ingredients for personal as well as home care industry based companies.

With their head office in Mumbai, Galaxy Surfactants has an employee base of 1200 and has 5 offices in India and abroad. Their manufacturing facilities are in the regions including Tarapur, Taloja, Jhagadia, Suez (Egypt), New Hampshire (USA).

In total, Galaxy Surfactants has a client base of around 1000 and some of the clients of this business include Henkel, Loreal Beauty, P&G, Reckitt Benckiser, Dabur India etc. Thus, you can observe that the client base is pretty prominent and visible through the kind of products they offer at the retail level.

The Global Surfactants market was a $30.65 Billion Market as of FY2015 which is projected to grow at a CAGR of

4.4% till FY2024 to touch $45.16 Billion. Thus, globally and certainly in a developing market such as India, there is a huge opportunity for the players to gain reasonable revenue as long as they can maintain their market share.

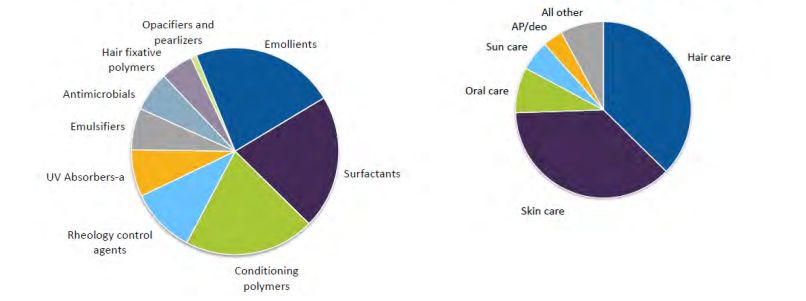

Coming back to Galaxy Surfactants, their product lines can be divided into the following sets:

- Mild Surfactants

- Surfactants

- Rheology Modifier

- Pearlizing Agents

- UV Filters

- Syndet & Soap Base

- Speciality Chemicals

- Active Ingredients

With different offerings, Galaxy Surfactants targets the following market segments, including:

- Skin Care

- Hair Care

- Oral Care

- Sun Care

- Home Care

- Baby Care

This is how the product lines are segregated in terms of the value share:

This also needs to be noted that Galaxy Surfactants tried for an IPO back in 2011, but the subscription was a disaster and the IPO has to be withdrawn. At that time, the IPO was opened in the ₹325-₹340 range and was subscribed only at a meagre 0.30 times.

Galaxy Surfactants Management

Generally, potential investors overlook the importance of the role of the management team. Checking their credentials, education, industry experience helps a lot to understand whether the money you are going to invest is going in the right hands.

In other words, you have the right to know whether the management of the company is credible enough to use the crores of monetary funds raised through these issues.

When it comes to Galaxy Surfactants, the management team includes a range of industry experts at both executive and non-executive management positions. Let’s check the specific details:

Furthermore, if we talk about respective stakes in the company:

- Mr Unnathan Shekhar holds 4,226,740 equity shares

-

Mr Gopalkrishnan Ramakrishnan holds 2,362,758 equity shares

- Mr Sudhir Dattaram Patil holds 4,145,290 equity shares

- Mr Shashikant Shanbhag holds 4,097,684 equity shares

Apart from increasing the brand visibility and trust for the company, one of the major reason for the IPO is that few shareholders are looking to liquify their stakes in the company.

Galaxy Surfactants IPO – Data Points

This also needs to be known that in the recent past, there have been few disruptions in the Chinese manufacturing space. Apart from rising operation cost, quality has been in the realm for some of the major brands and that is what shifting the manufacturing base from China to India, although at a very slow pace.

This is a good news, in a way, for the Indian manufacturing companies irrespective of their industry as global companies are pivoting towards them. Without a doubt, this goes well with companies such as Galaxy Surfactants who already have a reasonable reputation at domestic and international levels.

Galaxy Surfactants IPO is the last IPO of this month and is getting opened on 29th of January, 2018. With a normal subscription period of 3 days, you can apply for the IPO anyway between these days. At the same time, the price band of this IPO falls in the premium range of ₹1470 to ₹1490.

Thus, if you are looking to invest in this IPO, you are going to get 10 shares per lot with a single lot costing you somewhere between ₹14,700 to ₹14,900.

In a total, Galaxy Surfactants is going to raise close to ₹1,000 Crore (₹937 Crore to be specific).

IPO is managed by ICICI Securities, Edelweiss Financial, JM Financial & Link intime.

Galaxy Surfactants IPO – Financial Information

This is how the financials of Galaxy Surfactants have stacked up over the last few years. From revenue’s perspective, the numbers’ look promising. At the same time, PAT or Profit After tax look reasonable too but there is one glitch that happened in the Financial year 2015 where the company saw a loss of around 11% in their overall Profit after tax (PAT).

This is how Galaxy Surfactants’ has performed from revenue’s perspective in the recent past (FY2018 is a year in progress so that data is incomplete).

But revenue talks about top-line performance only. It is equally important to understand how the company has been performing from the bottom-line perspective.

This is how the company has performed when it comes to profits:

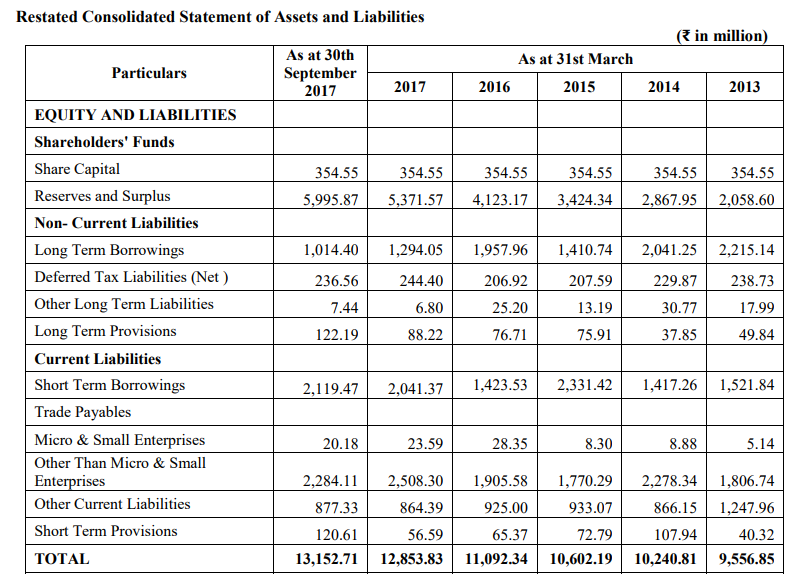

Furthermore, let’s talk about the situation of Galaxy Surfactants’ performance when it comes to their assets and liabilities or basically their balance sheet:

This is really crucial to go through all these financial statements in order to get a very clear and objective idea of company’s overall performance and monetary worth. This helps you to decide whether your hard-earned money will be going in the right direction or is it going to get wiped out.

Furthermore, below are some of the crucial metrics that can assist you in understanding the company valuation, the kind of return expectations and overall risk associated with the offering:

Galaxy Surfactants IPO Events

As mentioned above, this is the last IPO of this month and falls under the mid-price range segment. If interested, you can bid for this IPO any day between 29th January to 31st of January. You will get to know whether you got the allocation or not by 5th of February.

However, in case you are unfortunate and not get any allocation, then your refund will get initiated by 6th February. If you applied for the IPO using ASBA, then your blocked amount will be unblocked the same day.

Investors with allocation will start getting shares into their demat account by 7th February and finally, Galaxy Surfactants will (hopefully) get listed on NSE & BSE by 8th February 2018.

Galaxy Surfactants – Contact Information

You can get in touch with the team of Galaxy Surfactants regarding any specific information about the IPO through these details:

Registered and Corporate Office

Galaxy Surfactants Limited

C-49/2, TTC Industrial Area

Pawne, Navi Mumbai – 400 703

Maharashtra, India

Tel: +91 22 2761 6666

Fax: +91 22 2768 6523

Email: investorservices@galaxysurfactants.com

Website: www.galaxysurfactants.com

Corporate Identity Number: U39877MH1986PLC039877

Registration Number: 039877

Galaxy Surfactants IPO – Our Recommendation

Honestly, the Galaxy Surfactants IPO is overpriced at the range of ₹1470 to ₹1490. Coming from a disappointing history of IPO withdrawal back in 2011, Galaxy Surfactants has a big load of low reputation when it comes to going public.

Having said that, the company has been coming off well in the recent past as far as numbers are concerned.

To be completely sure and to avoid any risk, our suggestion is simple!

Check out the IPO is subscribed on day 1 and day 2 at the institutional level. If it gets subscribed well enough, then you can be sure enough to go ahead and apply your hard earned capital in the IPO.

Otherwise, you may choose to pass this one! There are a lot more IPOs coming.

Read: 50+ IPOs coming in 2018

* The recommendation is just our viewpoint and you are advised to check with your financial advisory and/or stockbroker before investing any money in this IPO. A Digital Blogger bears no responsibility in such investments and the corresponding profits/losses.

Looking forward to applying in this IPO?

You will need a Demat account for that! Provide your details here and open a Demat account in 1 Day!

dear sir,

many thanks for your valuable services. pl. keep it up.

how can i get the full list of the unlisted companies?

pl. help me. looking for your early response.

a very happy and prosperous new year to your team.

Happy New Year to you too Kaushiki. You can check all the upcoming IPOs in 2018 here: http://www.adigitalblogger.com/upcoming-ipo-2018/