Religare Online

List of Stock Brokers Reviews:

Religare Online is a subsidiary of Religare Enterprises Limited. Launched as a full-Service stockbroker in the year 1986, Religare Online serves 8,00,000 clients with a presence in more than 500 locations in the country.

The stockbroker has a running membership with BSE, NSE, MCX-SX and USE.

Through these memberships, the broker allows its clients to trade and invest across multiple trading products. Furthermore, since it is a full-service broker, the clients are assigned with a dedicated account manager who takes care of the client’s investments, guides him/her based on the risk appetite, total capital to be invested and the overall investment horizon.

Let’s take a quick look at the different aspects of this broker.

Religare Online Review

It is also a depository participant with CDSL and NSDL. Religare Online Limited also offers some unique services such as TIN & PAN facilitation at select branches and works as NSDL-appointed enrolment agency for Aadhaar UID (Unique Identification Number) as well.

“Religare Online has a total of 1,56,212 registered active clients as per 2019-20.”

With this full-service stockbroker you can trade or invest in the following market segments:

- Equity

- Derivative Trading

- Currency Trading

- Commodity Trading

- Mutual Funds

- NCDs

- IPOs

- NRI Demat Account

Nitin Aggarwal, CEO – Religare Online

Religare Online Trading Platforms

Each stockbroker provides a set of trading applications to its clients so that they can perform trades across different indices. Religare Online also provides multiple such platforms across web, mobile and desktop.

Let’s quickly look at these trading applications:

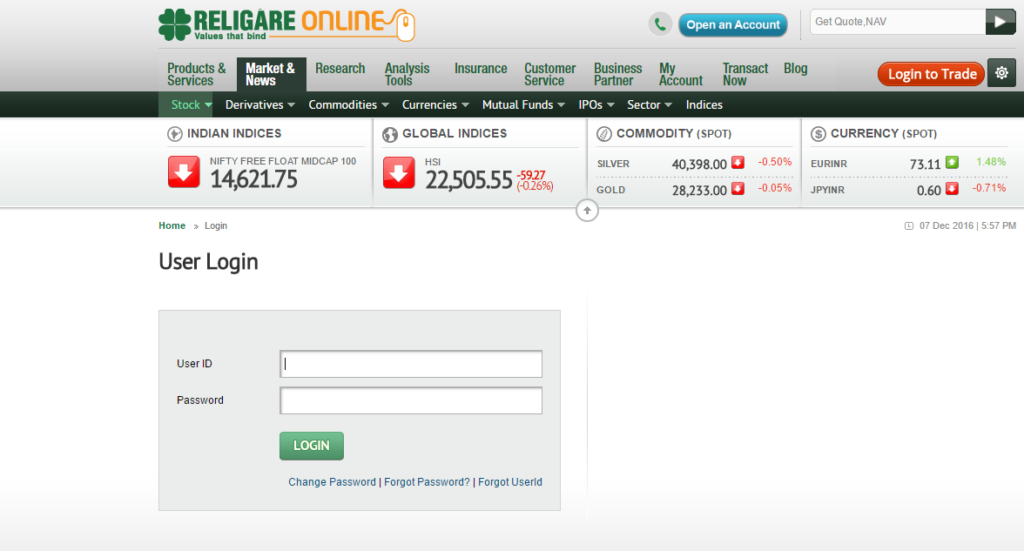

Religare Online Web

Religare Online is a browser-based trading platform where the clients can just log in and proceed to trade from any desktop or laptop without any installation involved. The tool provides the following features:

- Market Watch

- Customized lists

- High speed and real-time quotes and trending charts

- The flexibility of trading from anywhere

- Intraday data for the last 10 days and historical data for the last 5 years available.

Here is how the main screen of the application looks like:

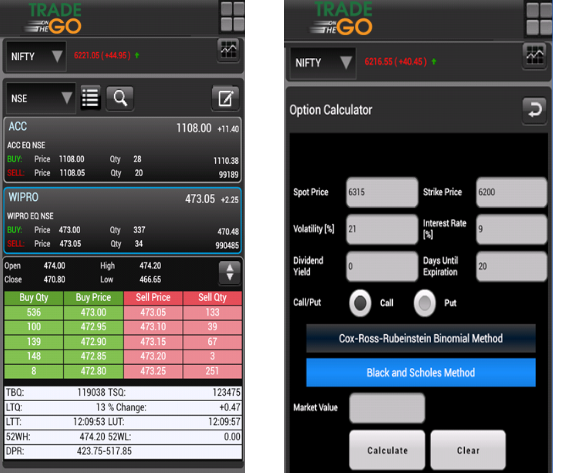

Religare – Trade on the Go

Trade On the Go is a mobile app from Religare that allows its customers to trade through their mobile phones. The app is available on Android and iOS platforms. The broker also provides a downloadable file that users with phones such as Blackberry can download and install on their phones. Some of the features of the mobile app include:

- Order placement from anywhere

- Live quotes streaming customized as per internet bandwidth

- Personalized Market watch

- The app allows tracking of the order book, trade book, market depth, stock portfolio etc

- Advanced charting with market trends, indices, and corresponding indicators

Here are some of the screenshots of the app:

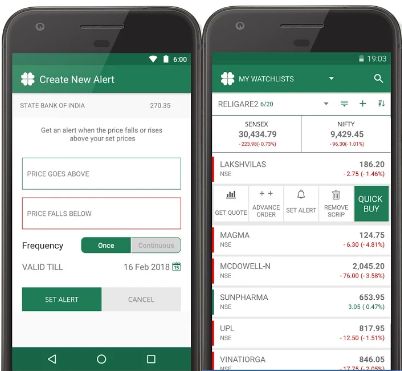

Religare Dynami

This is another mobile-based trading application from Religare Online. The app is available in both Android and iOS versions with a simple and clean user interface. Some of the features of this mobile app include:

- Allows you to trade across multiple segments such as Equity, Commodity, and Currency

- Provision to add various watchlists

- Customization and personalization allowed along with alerts and notifications set up.

- Single swipe order placement feature

At the same time, there are certain concerns with the application as well:

- The application gets stuck or crashes at times.

- Funds transfer can be a concern.

- Does not work smoothly on some of the Android smartphone models

Thus, to give you an idea, there are much better mobile apps available in the market as compared to the one offered by Religare Online.

Here is the snapshot of the Google Play Store stats of this mobile app from this stockbroker:

| Number of Installs | 100,000+ |

| Mobile App Size | 8.5 MB |

| Negative Ratings Percentage | 23.3% |

| Overall Review |  |

| Update Frequency | 14-16 Weeks |

| Android Version | 4.1 and Up |

| iOS Version | 9.1 and Up |

Equity ODIN Diet Application

ODIN DIET application is an executable file that can be installed on a desktop or laptop. Although, old school, the application works at a high speed. Some of the useful features of the software are:

- Allows to trade in equities, currency, commodities, Mutual funds, IPOs all in one screen

- Advanced portfolio tracker and live market watch

- Recent features such as Stock screener

Here is how the software looks like:

Religare Online Account Types

Religare Securities offers its customer to choose from a wide range of financial services through its sophisticated and customized trading platform called R-ACE (Religare Advanced Client Engine). Given below are 3 types of R-ACE accounts available to investors.

R-ACE (Basic): R-ACE (Religare Advanced Client Engine) is a basic online trading account provided by Religare. This goes well with clients who do not want to install or download any software on their machines. Customers can get information about their account both online as well as through phone calls.

R-ACE Lite (Advanced): R-ACE Lite is the advanced trading platform, which provides all the features as provided by R-ACE (Basic) account. On top of it, it also provides real-time streaming stock quotes and alerts. This account comes with a browser-based online trading platform. So you do not need to install any additional software.

R-ACE Pro (Professional): As the name indicates this account is meant for high volume professional traders. In addition to the features mentioned above, it also comes with a Trading Terminal Software which needs to be installed on your computer.

This terminal directly connects the investor to the stock market and is equipped with all industry standard Trading Terminal features such as technical charting (intra-day and EOD), multiple watch list, advanced hot-key functions for faster trading, derivative chains, futures & options calculator etc.

Religare Demat Account

Religare offers a 2-in-1 account thus, offering trading and demat account in a single bundle. For opening a Religare demat account you can either apply online or offline.

Just gather all the essential documents and follow the simple steps to open a demat account.

For opening a trading account you have to pay the charges of ₹500 while the Religare Demat Account Charges is Zero and the AMC charges applicable only on the demat account equals to ₹500.

Thus, you can reap the benefit of Religare free demat account and get into trade in different segments without delay.

Religare Online Research

This full-service stockbroker provides research at both technical and fundamental levels to its clients depending on their preferences.

In other words, you will be provided with both Intraday calls and research reports on a regular basis through email, SMS. These recommendations can be accessed through the different trading platforms provided by the broker via the ‘Research’ tab.

As per the broker claims, this is what it does in the research segment:

- Covers more than 30 listed companies under its fundamental reports (from a competitive point of view, the number is really less since there are a few brokers covering more than 150 stocks on a regular basis).

- The broker claims to have provided more than 150 intraday calls with a success rate of 65% (again both the numbers mentioned here – no. of calls and the corresponding accuracy percentage are pretty mediocre).

- More than 200 positional calls with a success rate of 61%.

Overall, it can be concluded that Religare Online cannot be counted among the top stockbrokers in research in India for certain.

Therefore many users stop using their demat account by simply placing the request for the Religare Demat Account Closure offline.

Religare Online Customer Care

The full-service broker provides the following communication channels for its customer service:

- Toll-free number

- Offline Branches

- Social Media (Twitter & Facebook)

The customer service quality is one area that is just average in quality when it comes to Religare Online. The areas that can be improved include:

- Turnaround time – is time Religare Online times to resolve your query or concern

- Quality of resolution

Since the customer service of Religare Online is mediocre, the expectations from a full-service stockbroker from this aspect are pretty awry. This feedback is provided by the clients on a consistent basis (check Google play store for instance), however, the broker has not felt the need to improve on this aspect till date.

Religare Online Pricing

Let’s talk about money!

How much you will end up paying to this stockbroker across different areas, is what we will be talking about in this section:

Religare Online Account Opening Charges

To open an account with Religare Online, here are the charges you need to bear:

| Demat Account Opening Charges | ₹0 |

| Trading Account Opening Charges | ₹500 |

| Demat Account Annual Maintenance Charges (AMC) | ₹300 |

| Trading Account Annual Maintenance Charges (AMC) | ₹0 |

“Religare Online provides lifetime Free AMC for ₹2500 upfront payment”

Religare Online Brokerage

Here is the detailed pricing structure of the brokerage Religare Online charges across segments:

| Equity Delivery | 0.5% |

| Equity Intraday | 0.05% |

| Equity Futures | 0.05% |

| Equity Options | ₹70 per lot |

| Currency Futures | 0.05% |

| Currency Options | ₹30 per lot |

| Commodity | 0.05% |

Yes, this is a full-service stockbroker but definitely not among the premium brands such as ICICI Direct or HDFC Securities. Still, the brokerage charges are one of the highest ones in the industry which does not make much of a sense.

Make sure to negotiate on the brokerage charges you finally pay to Religare Online, especially if you are looking to start with high initial trading account deposit.

Use this Religare Securities Brokerage Calculator for complete charges and your profit.

“Call and Trade facility at Religare Online is charged at ₹10 per executed order”

Religare Online Transaction Charges

Religare Online charges the following transaction charges from its clients across multiple segments. These transaction charges along with the brokerage are part of the overall payment you make to your stock broker:

| Transaction/Turnover Charges | Services Tax | Education Cess | Higher Education Cess | SEBI Charges | |

| Equity Delivery | 0.00325% | 12% | 2% | 1% | ₹20 per Crore |

| Equity Intraday | 0.00325% | 12% | 2% | 1% | ₹20 per Crore |

| Equity Futures | 0.004% | 12% | 2% | 1% | ₹20 per Crore |

| Equity Options | 0.06% | 12% | 2% | 1% | ₹20 per Crore |

| Currency Futures | 0.004% | 12% | 2% | 1% | ₹20 per Crore |

| Currency Options | 0.06% | 12% | 2% | 1% | ₹20 per Crore |

| Commodity | 0.05% | 12% | 2% | 1% | ₹20 per Crore |

Religare Online Margin:

This needs to be known that this full-service stockbroker provides margin across trading segments based on the stock category. There are categories such as A, B, C and D. Each category has a corresponding allocated margin value.

However, here are some basic details on the margins provided by Religare Online:

| Equity | Upto 10 times Intraday, Upto 4 times delivery @interest |

| Equity Futures | Upto 3 times for Intraday |

| Equity Options | Buying no Leverage, shorting upto 3 times for Intraday |

| Currency Futures | Upto 2 times for Intraday |

| Currency Options | Buying no Leverage, shorting upto 2 times for Intraday |

| Commodity | Upto 3 times for Intraday |

Religare Online Disadvantages:

At the same time, there are few concerns regarding Religare Online:

- Call and trade facility is charged at ₹10 per executed order

- Manual Payment-outs to your bank account

- Automated trading not allowed

- Trading Platforms can be improved, especially the mobile app.

- No support for MAC platforms

“Religare Online has received 31 complaints from its clients for the financial year 2019-20 at the National Stock Exchange (NSE) making the complaint percentage of 0.02, which matches the industry average.”

Religare Online Advantages:

Some of the advantages of trading with Religare Online are:

- You have the option of dropping a cheque at their branches and the amount will be transferred to your account

- Clients get interest on the unused cash in your account

- State of the art trading softwares across devices

- NRI Trading provision

Conclusion

Religare Online provides multiple trading and investment options to its clients with a wide range of trading platforms.

Furthermore, their research quality also seems good enough for you to make some quick judgments but the performance of these trading platforms and customer service can certainly be improved for users to have seamless trading experience.

It is suitable for long-term investors who have the patience of average customer service and who can pay high brokerage charges.

How to open an account?

In case you are interested to open a demat account, let us assist you in taking the next steps forward:

Next Steps:

Post this call You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review on documents required for demat account.

Also Read:

More on Religare Online:

If you are looking to know more about this full-service stockbroker, here are a few reference articles for you: