How To Apply For Burger King IPO?

More on IPO

If you are keen to apply for Burger King IPO, then you might be having a thought or question of How to apply for Burger King IPO. So, today we will be discussing the same in a quick and simple way.

So, stay tuned and quickly find the answer on How to apply for Burger King IPO.

However, before applying for the Burger King IPO, let’s discuss its details in full detail.

Recently, Burger King has launched its IPO with the objective to broaden the restaurant’s chain, which is estimated to be around 700, and the deadline for this objective is December 21, 2026.

After getting a green flag from SEBI, the firm tends to raise an Indian subsidiary of Rs. 810 crores through public issue.

Furthermore, Rs. 450 crores as a fresh issue have been announced in the equity shares, and the offer for sale by the QSR Asia Pte Ltd is nearly 6 crore.

Before understanding the process on how to apply for Burger King IPO it is crucial to have complete detail on the same such as price, Burger King IPO Date, company’s financials, and a lot more!

Once you have complete information on the same, it’s time to begin with our main topic of How to apply for Burger King IPO.

Apply For Burger King IPO

Now, if you are interested, then there are two different ways to apply for Burger King IPO.

But, before applying, you will be required money. So, do you have enough money to apply for Burger King IPO?

Do you know that you can either use your savings or you can even borrow some money from the financial and non-financial banks.

Also, to apply for Burger King IPO, you must have a demat account with any CDSL or NSDL registered stockbroker.

In case you have a Zerodha demat account, then you can also refer to the link on How to apply for IPO in Zerodha.

Now, let’s talk about two different ways that can help you to comprehend how to apply for Burger King IPO. These ways or methods are given below

- Apply for IPO through UPI

- Through ASBA (Application Supported by Blocked Account)

Let’s discuss them in detail.

How To Apply IPO Through UPI

Applying through UPI is quick and simple. All you need is to download the UPI app from the mobile and select this Burger King IPO.

Then enter the bid details, and once the details are successfully entered, the application amount will be blocked from the bank authorities.

Hence, as you can see, the process is completely hassle-free.

Through ASBA

Now, what if you opt to apply for Burger King IPO through the ASBA method?

Well, it’s also not so difficult.

Let’s see how to apply for Burger King IPO through ASBA or Application Supported by Blocked account process.

Many of you may be unaware of ASBA, so firstly, have a look at what it is?

ASBA is an application that permits a bank to quickly block the amount in your account until the shares of the IPO are issued to him.

So, simply if the Burger King IPO shares are allocated to you, then the total value will be automatically deducted from your account.

However, if the shares are not allocated to you, then the bank will not deduct any value from the account.

It is also important to know that to apply for Burger King IPO through the ASBA process, you must be linked with Self Certified Syndicate Banks (SCSBs) as they fulfill the eligibility and other conditions laid by SEBI.

To apply for Burger King IPO through this process, you are required to fulfill certain eligibility conditions. These conditions are listed as below

- You must be an Indian native or citizen

- You must have a Demat account.

- You must be registered with the stockbroker who is linked with NSDL or CDSL.

- You must have a valid PAN (Permanent Account Number) card.

- You must apply below Rs. 2 lakh as per the rules for the retail customers.

- You will be sending an application for any reserved category

- Finally, you cannot revise or modify your application.

These are some of the eligibility conditions to apply for Burger King IPO or any other IPO. Now, let’s discuss how to apply for Burger King IPO with the ASBA method.

Some of the leading banks like HDFC Bank, ICICI Bank, Axis, etc., offer online methods of applying for this IPO.

To apply, follow the steps given below

- Login to your registered Bank account.

- Find the option of Demat and ASBA services in the Bank portal and click on the same. You can also search for the IPO application button.

- Now, fill in the details as required. These details include PAN card number, Demat account number, bid details, etc.

- Then, complete the verification process.

- Finally, the amount will be blocked by your registered bank, and if the shares of the IPO are not allocated to you, then the amount will not be dedicated otherwise vice-versa.

Besides this, if you feel the online method is a bit complex and time-consuming, you can opt for the offline method.

This is a traditional form to apply for Burger King IPO. In this method-

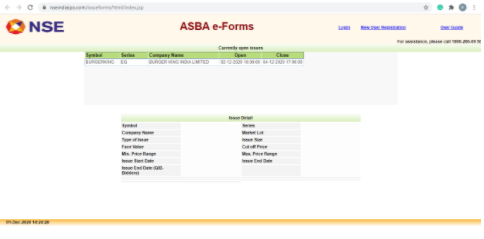

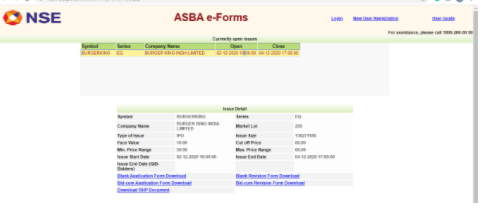

- You are required to find ASBA e-forms on the NSE or National Stock Exchange official website.

2. Now, select the company name and a complete detail will be shared along with forms, just like the below image-

- Download the form from the given link, and enter the details in the same.

- After entering the details, submit the form along with a copy of the PAN card to the nearest branch of your registered bank.

- Within 2 to 3 hours, the amount will be blocked in your bank account.

Closing Thought

In the end, we get the answer of how to apply for burger king IPO online via UPI or ASBA as a payment mode.

ASBA IPO will be available in the net banking of your bank account, whereas UPI is offered by the brokers himself who don’t provide banking services.

You just have to fill in all the details correctly while applying for Burger King IPO or any other IPO.

Wish to open a Demat Account? Please refer to the form below

Know more about Share Market