ICICI Direct Charges

Check All Brokerage Reviews

ICICI Direct Charges can be seen as one of the highest in the stockbroking space at most levels i.e. account opening/maintenance, brokerage, and so on. However, with premium pricing, the broker provides reasonable services at the brand trust, research, offline presence, service levels.

There are multiple ICICI Direct products in which the trader can invest, to get into a trade across these segments the investor has to pay certain charges.

In this detailed review, let’s have a quick look at some of the charges, brokerage plans this bank-based stockbroker has to offer.

ICICI Direct Trading Charges

ICICI Direct, being a full-service stockbroker, provides a gamut of services to its clients, and correspondingly ICICI Direct charges different fees. Some of the services provided by the broker include:

- Research & tips

- Quick support

- Terminal software for trading

- Reasonable exposure

For all these services, ICICI Direct levies different charges to its clients. You can detailed information here:

- ICICI Direct Account Opening charges

- ICICI Direct Annual maintenance charges

- Brokerage plans & corresponding charges

Some of the other charges that are levied by ICICI Direct but are further paid to different regulatory bodies are:

- Stamp Duty

- STT Charges

- GST

- Turnover Charges

- DP Charges in ICICI

ICICI Direct Demat Account Charges

There are no charges for opening a Demat account with the broker, thus you can have an ICICI Free Demat Account. But there are many other associated charges, in case you apply for the 3-in-1 account with ICICI Direct:

There are separate charges for opening a Demat and a trading account with most of the brokers and so is the case with ICICI Direct too. Furthermore, you are required to pay annual maintenance charges (AMC) as well for your trading account. These AMC charges are, obviously, charged each year.

ICICI Direct Brokerage Charges

They say, too many cooks spoil the kitchen.

Well, it is pretty much a similar story with so many plans offered by ICICI Direct depending on your choice of a trading segment and then within that segment, there are further multiple offerings.

Generally speaking, short-term traders do not prefer bank-based stockbrokers as the brokerage charges eat up a lot of their profits and that is why it is important for you to know about the ICICI Direct Intraday charges for your own sake.

Nonetheless, there are three plans at a high level as mentioned below:

- I – Saver Plan

- I – Secure Plan

- Prepaid Brokerage Plan (explained in the end)

- NRI Brokerage

- NRI Prepaid Brokerage

Here are the details for Brokerage in Cash:

The brokerage charge might look on a little higher side but it pretty much depends on the volume of transactions done.

ICICI Direct I-Saver Plan

Following are the brokerage charges levied by ICICI direct depending upon the trade turnover you put in a span of 3 months. The higher the turnover, the lower is the brokerage charge you end up paying.

Looking at the turnover slabs, you can imagine that ICICI Direct is customer-savvy for a premium segment customer base while a small investor pays relatively very high brokerage.

To understand it more clearly, let’s take an example. Imagine Ravish as a mid-size trader from Indore and he places an overall transaction of ₹30 Lakh in the 2nd quarter of this financial year.

With this amount, he will be paying 0.55% of that amount as brokerage. In other words, ICICI Direct charges ₹16,500 as brokerage from Ravish.

ICICI Direct I – Secure Plan

Then comes the generic ‘secure’ plan where there is no commitment or expectation of the overall turnover you, as a trader, will place through the broker.

In such a case, ICICI Direct offers a flat %age brokerage block (although, you may try to negotiate as well).

Also ICICI Direct does not offer its clients commodity trading, to know more about it please refer to ICICI Direct Commodity Trading.

Here are the details for Brokerage in Future & Future Plus:

ICICI Direct I-Saver Plan & I – Secure Plan

Similarly, these are the brokerage charges/slabs if you are trading in the futures segment. Remember, in this form of trading, the brokerage is decided based on the number of lots you trade for and not on your trading turnover amount.

Here are the details for Brokerage in Currency Futures:

I-Saver Plan & I – Secure Plan

At a similar level, here are the brokerage charges for trading in currency futures segments:

Here are the details for ICICI Direct Options Brokerage in the Currency segment:

I-Saver Plan & I – Secure Plan

In case you are trading in the options segment, here is what you will end up paying to ICICI Direct as brokerage:

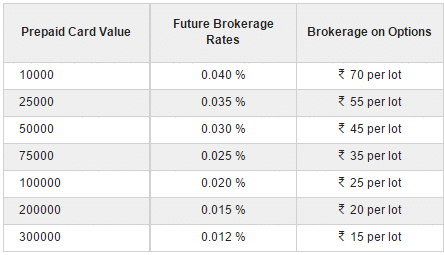

ICICI Direct Prepaid Brokerage Plan:

This is a unique plan from ICICI Direct where they provide discounted brokerage charges. The brokerage is valid for the lifetime or till the prepaid card is exhausted. ICICI Direct returns back any unused brokerage to a customer’s bank account.

Here are details on the brokerage charges under this plan:

Similarly, at Lot level, ICICI Direct charges the following amount(s):

Check out this ICICI Direct Brokerage Calculator for complete charges and your overall Profit.

Basically, depending on how much money a customer puts into the card, brokerage charges change. The higher the card value, the lower the brokerage.

ICICI Direct NRI Charges

In case you are an NRI and want to invest in the Indian stock market space through ICICI Direct, here is how the charges are structured:

ICICI Direct Charges: NRI Account Opening

ICICI Direct Charges: NRI Brokerage

ICICI Direct Transaction Charges

Apart from all the other types of charges levied, the broker also levies transaction charges which, however, do not end up in its own pocket.

You are supposed to be paying these charges based on your trade turnover. i.e. higher the turnover, higher these charges.

These charges are basically levied by different regulatory bodies and vary based on the trading segment. Here are the details:

You also need to know that all the above-mentioned charges are levied by ICICI Direct itself. There are some other charges such as transaction charges, stamp duty etc that are applied on top of ICICI Direct’s charges.

Here is how much they will be part of your overall payment:

- GST at 18% of the brokerage generated (not on trading turnover)

- Transaction charges at 0.1% of turnover (check ICICI Direct Transaction charges for more)

- SEBI turnover charges at 0.00015% of turnover

- Stamp duty depends on your state

Overall, ICICI Direct charges might look on a higher side overall. However, with so many plans around – you may choose based on your preference, trading appetite, and brand choice.

Is ICICI Direct Good?

While choosing a stockbroker, every trader and investor usually remains concerned about the brokerage fees. To ease the selection, the broker comes up with multiple brokerage plans that make it easy to make a smart decision.

There is no doubt that the broker offers great services, has years of experience in the broking industry, offers mobile trading and desktop trading app for seamless trade, so if you too want to grab such benefits of trade, then get started by opening a demat account with the firm.

Are you looking to Open an account and start trading?

Just fill in some basic details and we will arrange a callback for you, right away:

More on ICICI Direct

If you wish to know more about ICICI Direct, here are a few reference links for you: