Best Thing To Invest Right Now

Check Stock Market Education Topics

Are you an investor and planning to start your year with new investment goals? But do you know the best things to invest right now in the stock market? If not, then you are at the right place.

From the best companies and stocks that can help you in creating wealth and eventually in meeting your financial goals are here.

The right kind of investment can help you in several ways, like:

- It will provide you with another income stream.

- This can assist you in financing your retirement.

- It can take you out of the financial squeeze.

Apart from this, the proper goal based investing can help you in growing the wealth that helps you in achieving your financial goals, and then assists in improving the purchasing power with time.

The investments become interesting when investors are able to balance the potential return along with the Share market risk management.

What to Know Before Investing in Stocks?

If you want to buy the stock of a particular company, it is necessary to make a qualitative and quantitative study for the same.

Here are the several factors for choosing stocks for long term investment.

- Financial strength is a must

- Firm’s business model

- Company’s management

Now let’s discuss the above-mentioned factors in brief.

Financial Strength is a Must

Check the company’s financial statement and look at the issues if they appeared. The profitability, operating income, leverage, liquidity ratios are to be checked by an investor before investing in the company.

For this, there are many financial ratios like P/E, P/B ratio, ROE, etc that gives you a clear picture of the company thus making it easy for you to make an investment decision.

Business Model of Firm

An investor must check whether it supports the company’s business model or not for potential events.

The investor needs to research the variables capable of providing the business with a competitive advantage at the present time and whether these variables will benefit them in the future.

Company Management

Apart from understanding the other information, it is better to comprehend and check the company’s management for a long term investment.

The historic data, graph, and debt ratio can be checked before investing in a company.

Check the various criteria of the company that will guide you in investing in the right company. The parameters are like:

- Detailed analysis

- Check the growth parameters (charts, graphs)

Best Companies to Invest In Right Now

Now, if you are looking for opportunities where you can invest, then here are some of the companies where the investments can be made with higher profits.

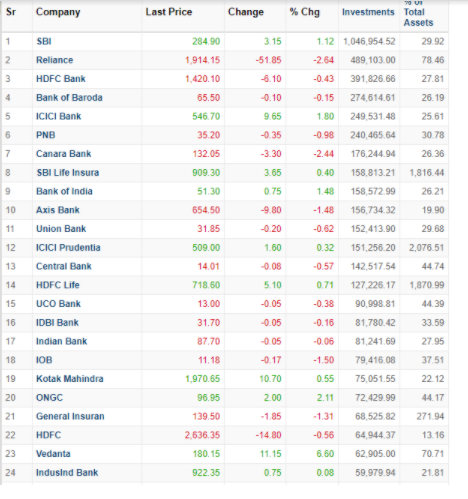

The following list is considering the Indian Brands with various parameters along with the number of investments it has till date.

Now, let’s consider the best companies to invest in right now in the following table:

| Best Companies to Invest In Right Now | |||||

| Company | Last Price | Change | % Change | Investments | % of Total Assets |

| Wipro | 406.55 | 0.40 | 0.10 | 26,698.50 | 62.61 |

| Sun Pharma | 605.30 | 2.15 | 0.36 | 17,361.72 | 66.83 |

| ICICI Lombard | 1607.55 | 26.10 | 1.65 | 26,326.73 | 425.27 |

| Oil India | 113.00 | 1.05 | 0.94 | 18,388.74 | 61.51 |

| SBI | 284.90 | 3.15 | 0.12 | 1046954.52 | 29.92 |

| Tata Steel | 68395 | 3.25 | 0.48 | 50,096.07 | 45.53 |

The above picture shows the best companies in which you can invest, and at the same time, the table shows the other famous firms that can provide you greater returns in 2021.

Apart from Reliance, HDFC bank, Axis bank, Vedanta, other companies like Wipro, Sun Pharma, ICICI Lombard, Oil India, SBI, Tata Steel will also offer better profits in the investments.

Best Stocks to Invest in India

At this point of time, the curiosity must be at its peak to know about the best shares to invest in India. Isn’t it? If yes, then here is the presentation of the few out of best that can offer the more significant returns.

The segments will cover the various sb-sections that includes the following:

- Best shares to invest in right now.

- Best mutual funds to invest in right now.

- Best bonds to invest in right now.

Let’s not wait for more, and start grabbing the detailed information on the best stocks, mutual funds, and bonds for 2021.

Let’s get started!

Let’s begin with the stocks. A lot of investors would ask this: Can I invest 100 Rs in Share market? Well, what do you think the answer is.

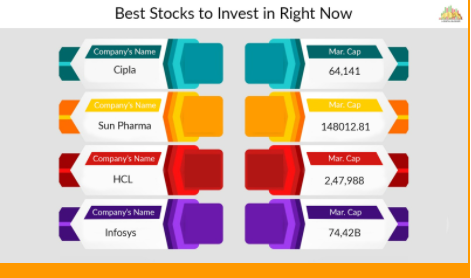

Here is the collection if you want to seek the right stocks to invest in right now.

The list consists of the domestic industries with more significant returns.

Refer to the following image to learn more about them.

Apart from these, let’s check out the other industries with the more significant market capitalization.

Here is some additional information on a stock that can help you in making a decision and plan your long term investment.

| Best Shares to Invest in Right Now | |||

| Company’s Name | Market Capitalization | Net Sales (Rs. Cr) | Net Profit Margin % |

| Cipla | Large Cap | 12,659 | 16.99 |

| Sun Pharma | Large Cap | 32,838 | 13.06 |

| HCL | Large Cap | 70,676 | 15.55 |

| Infosys | Large Cap | 90,791 | 17.93 |

Best Mutual Funds to Invest in Right Now

After getting the details about the stocks, now let’s hold the attentiveness to check more information about the mutual fund and the best mutual funds where you can invest.

The mutual fund section is distributed into three sections, which are as follows:

- Equity Mutual Funds

- Debt Mutual Funds

- Hybrid Mutual Funds

Also, the above three distributed sections is one amongst the investment segments of goal based investing in India. Now, we will read about the equity mutual funds in detail as it is covered in the below section. Refer to the table below to find out more about it.

Equity Mutual Funds

In equity mutual funds, there are three segments in which the mutual funds are divided according to the type of the firm. Those segments are:

- Large Cap Funds

- Mid Cap Funds

- Small Cap Funds

If you want to make better money, you can go with large-cap funds, while the returns are smaller with small caps, which means the profit is lower.

So let’s get started!

| Fund’s Name | Segment | 1 years Return | 3 Year Returns |

| Axis Bluechip Fund | Large Cap Funds | 14.80% | 13.87% |

| Kotak Bluechip Fund | Large Cap Funds | 13.36% | 8.85% |

| Axis Midcap Fund | Mid Cap Funds | 22.98% | 13.26% |

| DSP Midcap Fund | Mid Cap Funds | 25.55% | 7.87% |

| Axis Small Cap Fund | Small Cap Funds | 22.53% | 10.80% |

| Kotak Small Cap Fund | Small Cap Funds | 33.84% | 6.36% |

To understand the concept quickly, let’s consider an example that is described below.

Let’s assume you have taken the Axis Bluechip Fund at Rs. 1 lakh with 1-year plan, then the return that you will get will be 14.80% of 1 lakh, i.e. Rs.1,14,800.

So, after putting 1 lakh in AXis Bluechip Fund, you will be able to earn a profit of ₹14,800 which is much more than that you can earn from any other form of investment product.

Best Bonds to Invest in Right Now

Bonds are authorized and securitized units of corporate debt as tradable business properties.

A bond is connected to a fixed income instrument since bonds typically charge debt holders with a fixed rate (coupon). The variable or floating interest rates are also now fairly popular.

Bond prices are indirectly linked with interest rates: bond prices decline as rates increase, and vice versa.

Bonds have expiration dates at which stage it is appropriate to repay the total amount in full or face default.

Bonds are used to fund programs and activities by corporations, counties, states, and sovereign governments, and the bondholders are debtholders or issuer creditors.

Here investing in Sovereign Gold Bond can be a better option, since it is issued by the RBI on behalf of the government of India. But here is the question is demat account required for Sovereign Gold Bond?

It is not compulsary, however if you want to secure your investment then YES having a demat account is a better option for investing in sovereign gold bonds and other bonds.

So, here’s a table showing the best corporate bond funds for 2021.

| Returns (%) | |||||

| Fund Name | 1 year | 3 year | 5 year | 7 year | 10 year |

| HDFC Corporate Bond Fund | 11.59 | 9.37 | 9.11 | 9.28 | 9.17 |

| Sundaram Corporate Bond Fund | 10.69 | 8.85 | 8.77 | 9.63 | 8.09 |

| Kotak Corporate Bond Fund | 9.59 | 8.88 | 8.61 | 8.99 | 8.76 |

| Invesco India Corporate Bond Fund | 9.97 | 8.07 | 8.12 | 7.93 | 8.08 |

| ABSL Corporate Bond Fund | 11.68 | 9.39 | 9.02 | 9.26 | 9.33 |

Get confused after looking at the table? Don’t worry. Let’s consider an example to understand the table in an easier way.

Let’s start!

Let’s assume that you have applied for the HDFC Corporate Bond Fund for 1 year whose return is 11.59%. Now, you have paid Rs. 1 lakh in the 1-year plan, which means you will get the 11.59% of 1 lakh in the return, and that will be Rs. 11,590.

Like that, if you opt for the 3-year plan, you will get a 9.37% return on the corporate bond. Again take the same numbers. If you go for 1 lakh at HDFC Corporate Bond Fund, you will get 9.37% of 1 lakh, which will be equals to Rs. 9370.

The investor usually gets a question in his mind about what to invest in stocks?. No worries we are here to give you information. They can easily invest in stocks, mutual funds, and bonds in 2021 to get higher returns.

Apart from the companies mentioned here, there are many more companies that can be included in the best shares to invest in right now. But here, few have been mentioned.

Note: There is a long list of stocks, mutual funds, and bonds where you can invest. This article consists of a few which are offering higher profits from various sectors.

Conclusion

By converting into another source of income, investments will benefit you. In addition, it will help you manage your retirement and get you out of the financial pressure.

The investment will help to create wealth, strive to accomplish your financial objectives, and help you increase the buying power over time.

Many other variables for choosing stocks for long-term investments are financial ability, the company’s business model, and the company’s management.

Now, after reading the sections, it is clear that an investor can invest in various firms and at the same time can earn better profits.

The data and information in the article will help you to understand the best thing to invest in right now.

The investment can be helpful in earning the side money if you have an understanding of the stocks and knowledge about the share market.

It is high time to research, compare and trade!

Wish to start investment in Stock Market? Look into the form below