IOC in Zerodha

More on Zerodha

Zerodha is a renowned discount broker in India. Like any other broker, it offers you different validity to place an order. If you are having an account with the broker or looking ahead to open it, then here is a detailed review of IOC in Zerodha.

In general, when we talk about the order validity, it is of two types, IOC and intraday.

On one hand, where intraday order remains valid for the whole day, the IOC order is immediate or cancel, i.e. if you opt for an IOC order then it will be executed or canceled immediately if the given entries do not match with the current market condition.

Moving ahead to understand the concept of IOC in Zerodha and how to place the order using the Zerodha Kite app?

What is IOC in Zerodha?

As already discussed, Immediate or Cancel is one of the many order types that any trader or investor can initiate in the market.

In clear terms, this order validity depicts that as soon as the order released in the market it is either executed or canceled immediately.

Since with the help of validity of an order, the investor is the one who decides the duration for which he or she wants an order to be active in the market.

But the IOC order is the one that is of zero duration as there is a second of timelapse between the order placement and its execution.

In Zerodha Kite, you can make use of this order type by choosing the order validity. This order is either executed at that very instance or gets canceled if it does not match the set criteria.

Day and IOC In Zerodha

Many people confuse between day and IOC in Zerodha. So, to clear the air of confusion, let’s compare them with an example.

Suppose you wish to buy 100 shares of TATA. There are two options available for you.

- If you buy the stocks at market price, you place an order to buy 100 shares currently at ₹96, and the order is executed irrespective of the validity type of the order (Day or IOC).

- In the second option, i.e limit order, you wish to buy shares at a price lower than the market price as you assume that the price will fall. You place a buy order at ₹95 as you think that the price will reduce.

If you select the IOC validity of the order, it will be canceled as it can’t be executed immediately. If you choose day validity, your order will be pending for the day and is completed when the price reaches ₹95. If it doesn’t, the order is canceled.

A point of caution here – If the order matches partially, the partial order is executed, and the rest gets canceled.

IOC in Zerodha Kite

You can select this validity type in order in all trading platforms provided by the discount broker. In this segment, we will talk about using IOC in Zerodha Kite.

Below are the steps that give you a clear idea of how to execute the IOC in Zerodha Kite.

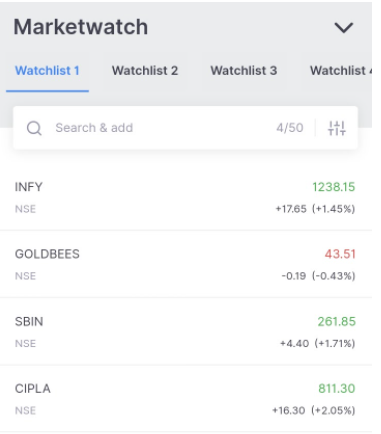

Step 1 – Select the stock from your watchlist.

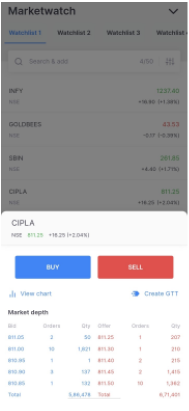

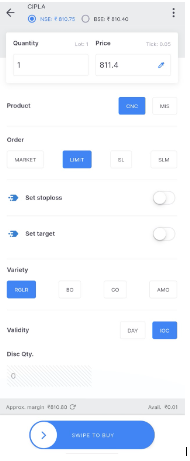

Step 2 – Click on the stock you want to buy. (e.g. – CIPLA)

Step 3 – Select the validity as IOC.

Step 4 – Swipe to Buy, and the order gets placed online.

Similarly, you can place the IOC in Zerodha to sell any particular scrip.

IOC Charges in Zerodha

Now comes the important part!

How much does Zerodha charge for IOC orders?

Now, since it is a validity the charges or brokerage depend on the product type you choose. For example, if you choose the product type intraday then you have to pay the Zerodha intraday brokerage charges, while for delivery trade the charges are imposed accordingly.

So, here if you choose the IOC validity for delivery trade, then you do not have to pay any fees while for the intraday trading using IOC, the trader has to pay ₹20 per trade. However, if the order gets canceled in any of the cases then you do have to pay any charges to the broker.

IOC Zerodha Margin

Next to brokerage, comes the margin.

Can you avail the leverage for executing IOC orders? If yes, then how much margin does the broker provide to trade efficiently in IOC order?

The answer is simple! It depends on the product type you choose.

So, here if you choose intraday trading then you are liable for reaping the leverage of up to 20x.

On the other hand, no margin is offered to you for trading in the delivery segment.

While executing IOC orders, it is therefore become important to choose the product type by doing proper analysis and reap more profit by reaping the leverage facility on intraday trade.

Conclusion

So here is the detail of the IOC in Zerodha details that helps you in executing orders in seconds. Make the right analysis and execute the buy or sell order simply by using the advanced trading platform provided to you by the broker.

Open a demat account with the broker now and get started with the trading at the least brokerage charges.

Happy trading!

Wish to open a Demat Account? Look into the form below

Know more about Zerodha