Stove Kraft Limited IPO

Check All IPO Reviews

There is a long list of upcoming IPOs, and we are on a mission to guide you through each one of them. So, here we are with all the information about Stove Kraft Limited IPO.

Let’s go!

Before we delve into more in-depth information about Stove Kraft Limited IPO, let’s first understand what IPO is?

Initial Public Offering is popularly known as IPO. It is a method of raising capital from the retail investors and traders of the share market. IPO is a way of getting listed on the stock exchanges of India.

With an IPO, a private company goes public and offers its shares with the objectives of raising everyday expenses, expansion of the organization, reducing debts, enhancing technology, etc.

The complete IPO Process is followed, and a Draft Red Herring Prospectus is formulated. The DRHP (Draft Red Herring Prospectus) for this IPO was published back in January 2020. But, the IPO is yet to go on floors.

Now, let’s jump into the specifics of this IPO.

Stove Kraft Limited IPO Review

If you are going to invest in a company, you must be clear about its objectives and operations, and even Warren Buffett suggests the same. So, before you decide to buy an IPO, know the background of the company.

Stove Kraft Limited is the largest kitchen appliance manufacturing company in India. The company began its operations in 1994 by manufacturing a Kerosene Wick Stove, and by 1997, it was the largest manufacturer of LPG Stoves in India.

It is a fully integrated enterprise that helps you in realizing your Dream Kitchen. They have multiple brands like Pigeon and Gilma, which are popular among the people. All the products manufactured and designed by them are user friendly, efficient, and innovative.

While designing products, they follow some crucial aspects, and they are:

- Value for money

- The durability of the product

- Safety of users

- Efficiency

- Features that are user friendly

For more information about the Stovekraft business, click here.

The objective of issuing this IPO is bifurcated according to the issue size. The objectives for both Fresh Issue and Offer For Sale are as follows:

- Fresh Issue: the net proceeds will be utilized in repayment or pre-payment of the company’s debts, which is 76 Crores. The rest would be used for general corporate purposes.

- Offer For Sale: the proceedings from this will be given to the respective shareholders entirely, and the company would not retain any part of it.

The Stove Kraft Limited IPO Price is ₹ 95 Crore + 82.5 Lakh equity shares worth ₹ 317.62 Crores. A quick review of Stove Kraft Limited IPO has been tabulated below:

It also helps you know the reasons behind issuing an IPO and if the company is worth investing in, in the long run. So, let’s do a quick review of the finances of Stove Kraft Limited as mentioned in the DRHP.

Further, it is also essential to keep an eye on the financials of the company. There is a famous saying – “Numbers never lie.” In the case of reviewing an IPO for investing, it is mandatory to study the financial statements in depth.

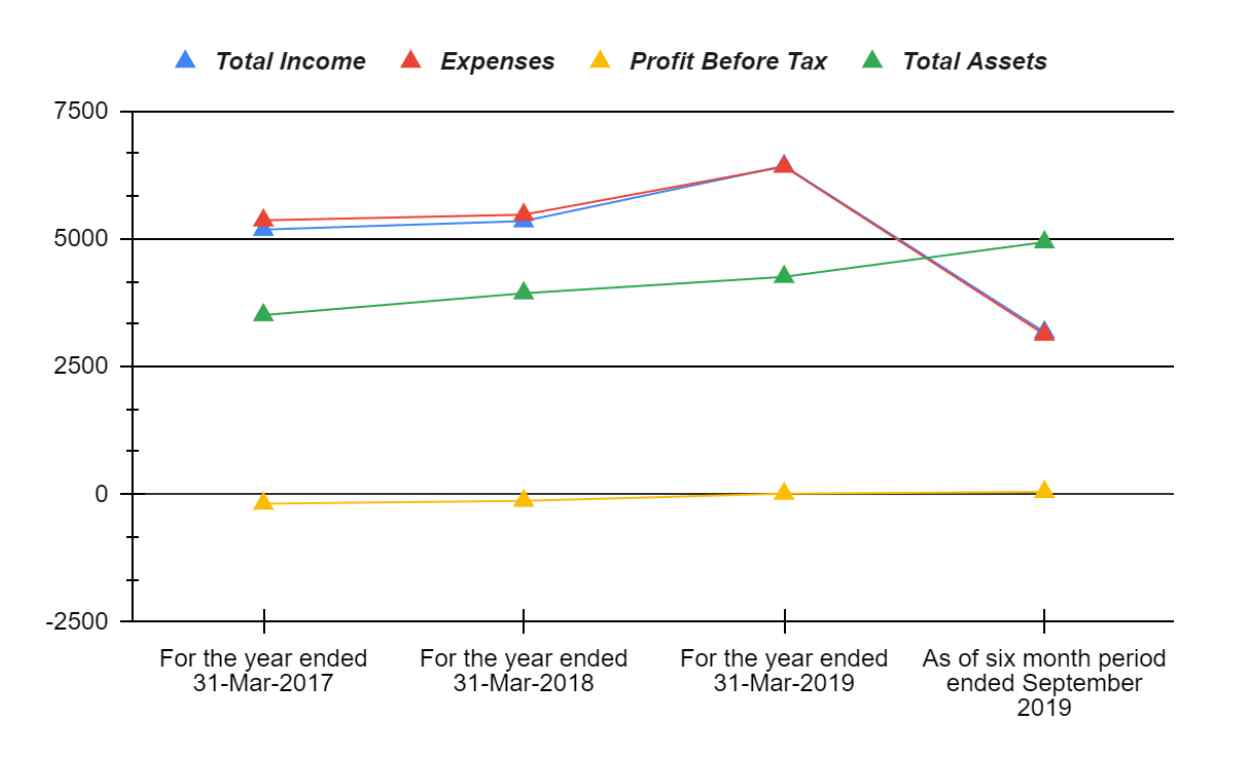

The latest data provided is for the six month period ended in September 2019.

The total income is ₹ 3,174.33 million, expenses are ₹ 3,126.80, profit before tax is ₹ 47.53, and the total assets owned by the company are worth ₹ 4,934.77.

A piece of detailed information about the finances for the last 3.5 financial years have been tabulated below:

Stove Kraft Limited IPO Promoters

A promoter is a company or an individual that plays a crucial role in raising capital for the company. There are two promoters of Stove Kraft Limited IPO:

- Mr. Rajendra Gandhi

- Mrs. Sunita Rajendra Gandhi

They are offering a varied number of equity shares to be sold. Mr. Rajendra Gandhi has offered 6,90,700 equity shares, and Mrs. Sunita Rajendra Gandhi has offered 59,300 equity shares.

The rest equity shares are being sold by the selling shareholders.

Stove Kraft Limited IPO Date

The DRHP was made public in December 2020. So, the expected date of this IPO going on floors is just around the corner. The important dates for Stove Kraft Limited IPO have been tabulated below:

Whenever you choose to invest in an IPO, you must make sure that you have accurate information about the market lot and the minimum amount you need to invest in that IPO.

Stove Kraft Limited IPO Market Lot

Shares are bought in the form of Lots. A lot consists of a number of shares, and the company decides this number. The lot size is announced beforehand. Thus, the value of one lot becomes the minimum investment amount.

Similarly, the company also sets a bar on how many lots an individual can buy. Thus, this is known as the maximum investment amount.

For Stove Kraft Limited IPO, the information has been mentioned below:

- Lot Size: Minimum Shares: 38

- Minimum bidding amount: ₹14,630

After the willing traders and investors have applied for the Stove Kraft Limited IPO, the company will take some time to allocate the shares to the individuals they deem fit. The registrar of the IPO carries out this process.

Stove Kraft Limited IPO Allotment Status

Further, the registrar also announces the basis of IPO allotment. The registrar for Stove Kraft Limited IPO is KFin Technologies Private Limited. The information details about the allotment status include the demand for IPO in the public, refunds, and the basis for the same.

The detailed information about the allotment status has been tabulated below:

Before we jump to the details of Grey Market Premium (GMP), let’s first understand what Grey Market is?

Stove Kraft Limited IPO Grey Market Premium

Grey Market is a trading place for IPOs outside the purview of the authorized channel and appointed authority. It translates to this transaction between buyer and seller being unofficial.

A note for the readers in this regard is that the grey market is highly volatile compared to the general market places. The rate at which the prices change, and the market fluctuates is volatile and highly unpredictable. Thus, it becomes very challenging to trade here.

The Grey Market Premium or GMP of Stove Kraft Limited IPO is ₹ 486 currently. Further, Kostak is ₹ [•] and Subject to Sauda is ₹ [•].

Stove Kraft Limited IPO How To Apply

You can apply for the Stove Kraft Limited IPO in various ways. If you don’t have a demat account, you need to open a demat account with a stockbroker. On the other hand, if you have one, you can apply via ASBA with the approved banks or use the UPI payment method.

The UPI payment method was added in 2019 by SEBI after it became common among the citizens of India.

So, let’s learn how to apply for the Stove Kraft Limited IPO through both of these methods in detail in the following sections.

Apply For Stove Kraft Limited IPO Through ASBA

Before understanding the process of applying through ASBA, let’s learn what it stands for. ASBA is an acronym for Application Supported By Blocked Amount. This process allows you to avail of the facility of applying through the approved banks.

Under ASBA, the bank transacts on your behalf, i.e., as you apply for the IPO and pay the corresponding amount for the bid. The amount is not debited from your bank account. Instead, it is borne by the bank, and in return, the same amount from your account is blocked.

The amount is blocked till the allotment process gets concluded. If you are allotted the shares, the respective amount is debited. Otherwise, the among is unblocked for you to utilize it.

There are more than 65 banks that are authorized to extend this facility to investors and traders. All major banks of the country, like State Bank of India, Bank of Baroda, Union Bank of India, Axis Bank, Citi Bank, HDFC Bank, etc., are on the list.

You can access this list on the official website of SEBI. There are some eligibility criteria to avail of this service. They are:

- The bid should not be under any reserved category of the IPO.

- The individual should have an active demat account.

- The trader or investor should apply for the corresponding security in the demat form and hold the shares in their demat account.

- The individual should apply for the IPO shares or security worth ₹2 Lakhs at least.

- Lastly, the IPO application should be made through a bank, approved to be on the ASBA list.

The process of applying through ASBA can be carried out in two ways – Online and Offline. So, let’s discuss them in detail.

Online Method

The complete process to apply for Stove Kraft Limited IPO through ASBA (online method) is as follows:

- Sign in to your Online Net Banking Portal.

- On the Menu page, click on the request button.

- You’ll be redirected to the page for “IPO Application”.

- Select the IPO you want to buy.

- Fill the complete application form.

- Place the bid. Here, you are permitted to place up to 3 bids.

- Fill in the other mandatory depository details.

- Confirm your application.

Post the application, an amount corresponding to the bid placed will be blocked in your account till the allotment process gets concluded.

The next section talks about the offline method of the same process. So, let’s dive in.

Offline Method

If you wish to apply for the IPO via the offline method for ASBA, you must visit the nearest bank branch and fill the IPO Application form. Some information you have to mention in the document is listed below:

- Demat Account Number

- PAN Number

- Bid Quantity

- Bid Price

- Bank Account Number

After you fill and submit the form to the respective bank executive, the bank will process it for further stages through the designated portal.

Apply For Stove Kraft Limited IPO Through UPI

To accommodate the then-emerging payment method – UPI, SEBI approved UPI as a method to apply for all IPOs in 2019. As this payment mode is much more comfortable, it is convenient to apply for Stove Kraft Limited IPO.

The entire process of applying through UPI is listed below:

- Install a UPI mobile application.

- Register your bank account in the application, and you’ll receive a UPI ID in the end.

- When you fill the application form of the IPO, enter this UPI ID as the payment method.

- You will receive a request for an amount block in the UPI mobile application for the IPO.

- Approve the request to place your bid.

- This amount will stay blocked till the IPO allotment process concludes.

- If you are allotted the shares, the amount will be debited. Otherwise, it will get unblocked.

Now we have discussed all the processes of applying for the IPO. So, let’s now learn about the company in detail.

Stove Kraft Limited Company Information

Stove Kraft Limited started its operations in 1994 by manufacturing Kerosene Wick Stoves. But, became an incorporated company in 1999. Currently, the company is headquartered in Ramnagar, Karnataka.

Today, almost four decades later, the company has launched its brands, namely Pigeon, Gilma, Pigeon LED, Black + Decker, and is considered every Kitchen Maker’s dream. Further, the company is ISO certified.

The company has more than 660 product portfolios. It has a significant presence globally, with more than 34,000 dealers across India and stores in 14+ countries, like Kenya, Middle East, Uganda, Qatar, Sri Lanka, etc., across the world.

The company aims to create masterpieces that enhance the sophistication and aesthetics of the technology involved so that even dull household chores can be a pleasurable experience. Their brands have a unique customer proposition and different market strategies.

They offer a wide range of kitchen products like non-stick cookware, pressure cookers, induction and gas cooktops, chimneys, mixer grinders, and much more. These products ensure individual safety.

The company currently employs more than 2,000 employees and is committed to providing equal employment opportunities and work for social welfare. The company has a vast clientele among some prestigious USA firms like Walmart, Big Lots, and Belk.

The company has the largest manufacturing facility in Bengaluru, and another one is at Baddi in Himachal Pradesh.

In case you are looking to apply to this IPO, why don’t you put your details in the form below and we will assist you further in this process:

Conclusion

With all the information about Stove Kraft Limited IPO pot together, we hope that your decision to invest or not in this company has been finalized. But, if you are still looking for our opinion, we are a little confused.

Why?

That’s because the primary objective of issuing this IPO is to pay off the company’s debt. An IPO raised with this purpose has a lot of risks involved in it. The investment might or might not work in your favor.

Below a chart to depict their total income, expenses, profit before tax, and total assets according to the DRHP.

Looking at these financials, it is a tough call. So, we suggest you have a more in-depth look at their financial statements and analyze them in detail. It would help you understand the company in greater detail and guide you towards a well-calculated decision.