Pullback Meaning

More On Technical Indicators

Many of you who are learning Technical Analysis might have come across the term – Pullback; and if you have a clear understanding of this concept, Bingo! But, if you are not sure what it is, read along to learn the pullback meaning.

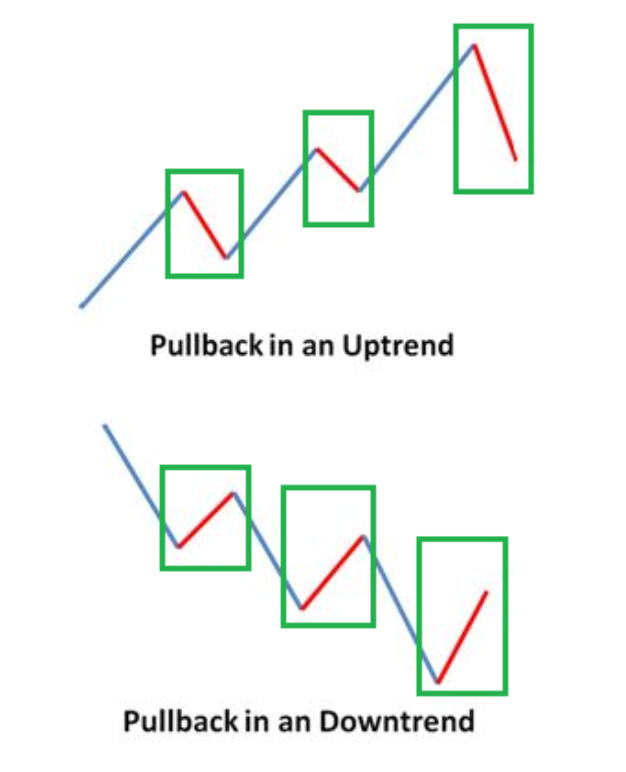

A pullback is a small pause or a moderate drop or rise in the prices of any financial security from the recent peaks of a continuing uptrend or downtrend respectively. In other words, it is a slight price movement against the trend.

Pullback occurs when the prices of a financial asset move one bar (at least) against the trend’s direction. It is also referred to as price correction. It is like consolidation or retracement and is often used as synonyms by many traders and individuals in the share market.

It is used for price drops or rises that are comparatively short in terms of time. For instance, some consecutive sessions before the uptrend returns.

Pullback Meaning In Trading

In the process of trading, a pullback is seen as an opportunity to buy or sell any share, commodity, or other trading instruments that have experienced a substantial upward or downward price movement.

Below is a simple diagram that will help you understand the pullback meaning in the simplest terms.

A pullback can happen for many reasons.

One such instance where the upward trend commences is when a company announces a positive earning, and their shares climb the price ladder.

After a few trading sessions, the instrument starts to experience pullback as many traders begin exiting their position in the market after gaining enough profit from the trading table.

In this situation, these positive earnings act as a fundamental signal which suggests that the stock will retrace itself on the uptrend.

A word of caution in understanding the pullback meaning is that almost every pullback makes the price move into a technical support area, i.e., pivot point or moving average.

This price movement has to be analyzed in detail to know if the breakdown is a signal of reversal or a pullback. Although, sometimes, it is a trend reversal, and you must be cautious.

Therefore, it is essential to understand the difference between pullback and reversal.

Let’s understand this with a simple example.

Pullback Example

We know that the meaning of pullback is to provide some jerks in the upward or downward price movement of a particular financial segment.

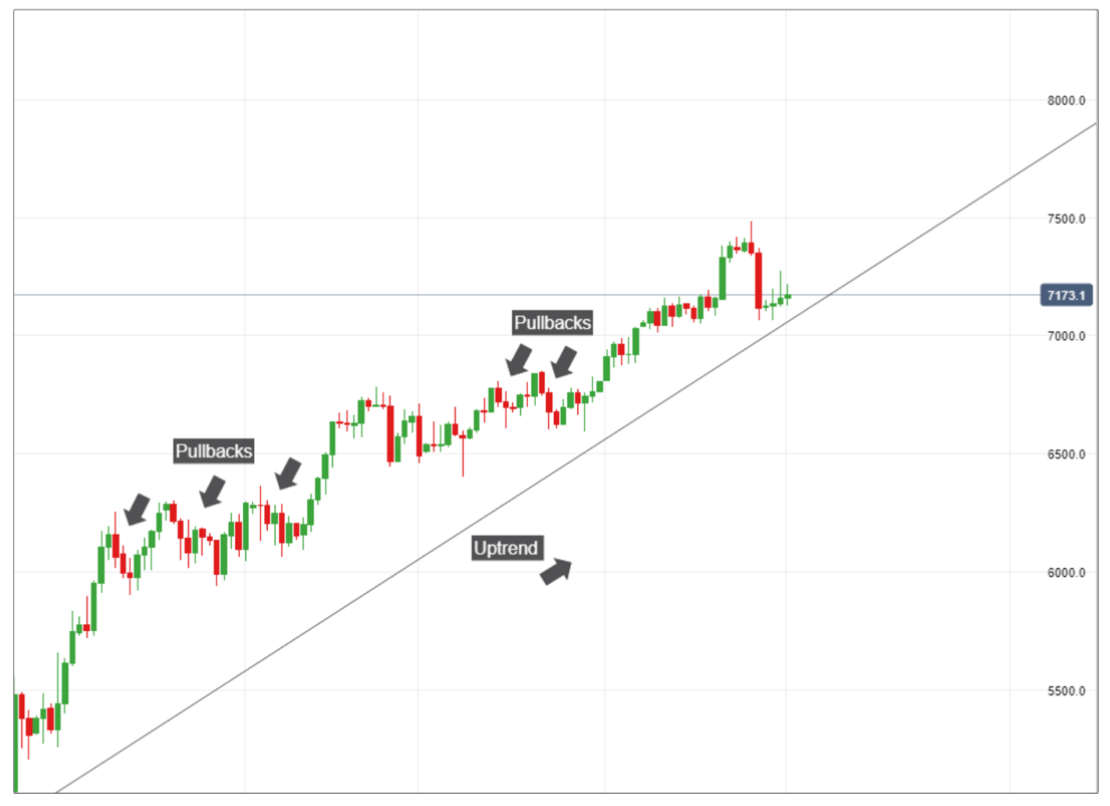

They are seen as profit-taking opportunities by the traders for the strong upward or downward run of the chart prices.

Suppose that Reliance Industries reports blowout earnings. As a repercussion, the Reliance shares see a jump of 25%. But this sudden price rise triggers the short-term traders to sell their positions.

Such situations often lead to a pullback the next day as these traders lock in their profits.

But what if the report announced by Reliance points towards the right approach adopted by the company’s top management?

Here many traders will buy for short-term profits, and the investors will look forward to higher returns in the long run.

The increased demand for the share will hike the prices further, supporting a sustained uptrend. The sudden rise will point towards continuous pullbacks after every few trading sessions.

On the other hand, suppose that Yes Bank announces a financial crisis. As a result of this news, the shares of the bank see a sharp dip of 20%. Now, the short-term traders might panic and start to sell all their positions.

It will lead to a sudden drop in the demand, thus triggering more sharp reductions. The next day, there will be a pullback wherein the prices will recover a bit only to fall again. This small rise can be used by the traders to minimize their losses and sell away the shares at a better price.

Since the news clearly depicts a failure of the top management of the company, the prices will fall inevitably for a long time. It will support a downward trend and lead to continuous pullbacks for a few trading sessions.

Every single financial security has an example of pullbacks wherever you find a prolonged uptrend. It becomes very easy to spot them in retrospect but is equally hard to assess in real-time.

Below is a price chart that depicts all the pullbacks during an upward trend:

Next is the chart that shows a downward trend with multiple pullbacks.

Now that we have understood what is a pullback in stocks, we shall move forward to learning about the meaning of pullback in Forex.

Meaning Of Pullback In Forex

If you are doing Forex trading and want to trade using the pullback strategy. Well, don’t worry because we will help you understand it with the help of a simple example.

Yogesh, a currency trader, enters the trading market while the USD (US Dollar) to INR price is on an upward trend. He wishes to buy at the least possible price and leverage the benefits of the upward trend.

Thus, he looks for the pullbacks and places his trade at the most suitable price. Since the currency pair is on an upward price movement, Yogesh is certain to make huge profits with the constant rise.

On the other hand, Aditya is a currency trader who has invested in USD (US Dollar) to INR currency pair at a high price. Suddenly, some sort of conflict between the two countries arises and causes the pair to crash.

Now, he wants to minimize his losses in the crash and hence, looks for the pullbacks. Just when the pair has a pullback, he executes the trade and achieves his aim.

Conclusion

Pullback meaning is important to understand as Pullback Strategy is commonly used by many traders to buy a financial segment at the most suitable time and price. The definition of pullback is simple.

When the price charts are moving in a certain trend, they tend to go in the reverse direction for a few trading sessions. These small deviations for a short duration are known as pullbacks.

Many people confuse them with Trend Reversals which might be harmful to their trades and trading goals. Thus, the necessity to understand the meaning of pullback clearly.

We hope the examples have helped you understand the concept of trading and currency trading in an easy way.

Happy learning!

In case you wish to talk to us in order to understand this better, just fill in the details below and we will call you back right away: