IIFL Options Brokerage

Check All Brokerage Reviews

Thinking of trading in the derivatives segment in IIFL? If yes, then here is the complete review of IIFL options brokerage.

Before getting into the derivatives trade, activate the segment by submitting the income proof and other valid documents. Now let’s look into the detail of the options brokerage charges of IIFL.

IIFL Options Brokerage Charges

India Infoline, one of the leading full-service brokers in India has now come up with the discount brokerage plan, IIFL Z20 plan that offers relaxation to its customers from paying hefty trading fees.

Now, you can trade-in options in the equity segment and in the commodity or currency segment as well at a minimal cost. However, the overall IIFL options brokerage depends upon the segment you pick.

IIFL options brokerage for different segments are tabulated below:

| IIFL Options Brokerage | ||

| Equity Options | ₹20 per lot | |

| Commodity Options | ₹20 per lot or 0.05% per trade (whichever is lower) | |

| Currency Options | ||

Let’s understand these charges with an example.

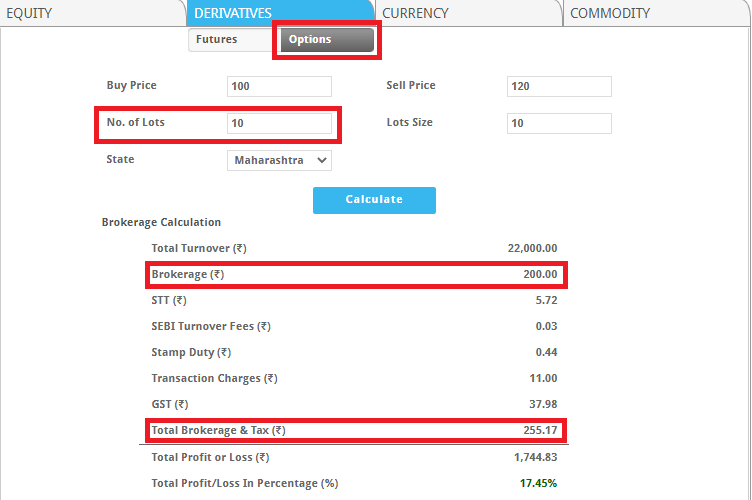

Mr. Sharma buys 10 lots (100 shares) of Reliance CE at ₹100 each to trade in equity options. Here he pays the flat brokerage of ₹20 per lot i.e ₹200.

Coming to the next segment, let’s say that you trade in commodity or currency options. Now here, the brokerage is either ₹20 per lot or 0.05% per transaction.

Now let’s say you buy 100 lots of copper available at a total turnover value of ₹1,00,000.

Flat brokerage for options would be= ₹200 (20*10)

On the other hand calculating 0.05% of total turnover= ₹50 (0.05%*1,00,000).

The trader needs to pay the least brokerage and thus will execute the trade by paying ₹50.

IIFL Option Calculator

When executing IIFL options trading, the trader not only has to pay the brokerage fees but also transaction fees, STT charges, stamp duty, etc.

So it means that although the brokerage is ₹20 per lot but including all other charges the total amount differs.

Wondering how to get detailed information on the net brokerage you have to pay to your broker? To ease this, here is the brokerage calculator for you that helps you to get an exact calculation of the IIFL options charges.

Not only the brokerage, but you would also be able to calculate the profit or loss percentage of the particular trade.

Conclusion

Options trading with IIFL can be done easily using any of its trading platforms. Thus, the broker not only helps in doing a seamless trade but also helps traders to increase their profit margin by offering the minimum trading charges for options.

Get started now by opening a demat account with the broker. Just fill the basic details below:

More on IIFL