ICICI Direct Intraday Charges

Check All Brokerage Reviews

Are you planning to set your foot in intraday trading with ICICI Direct? Well, then the first thing that you must be aware of is the ICICI Direct Intraday Charges.

Opening an account with ICICI Direct Securities gives day traders an option to choose different brokerage plans and to trade at the most affordable and convenient charges.

Here is a list of various charges associated with ICICI Direct Securities during Intraday trading:

- Brokerage charges

- STT (Securities Transaction Tax)

- Stamp Duty

- GST

- Transaction fee

Let’s cover these ICICI intraday trading charges in detail.

ICICI Direct Brokerage Charges for Intraday

Being a reputed full-service stockbroker in the industry, ICICI Direct tends to offer personalized plans to its customers; depending on their needs.

You can perform intraday trading at both Equity and Derivatives segments. However, make sure you understand that ICICI Direct Option brokerage could be very different from ICICI Direct Intraday brokerage.

So, before learning how to do intraday trading in ICICI Direct, here it is important to know the brokerage you end up paying to trade.

Each brokerage plan has its own pricing list and benefits. Once your ICICI Demat account is opened, you can choose or modify any brokerage plan as desired.

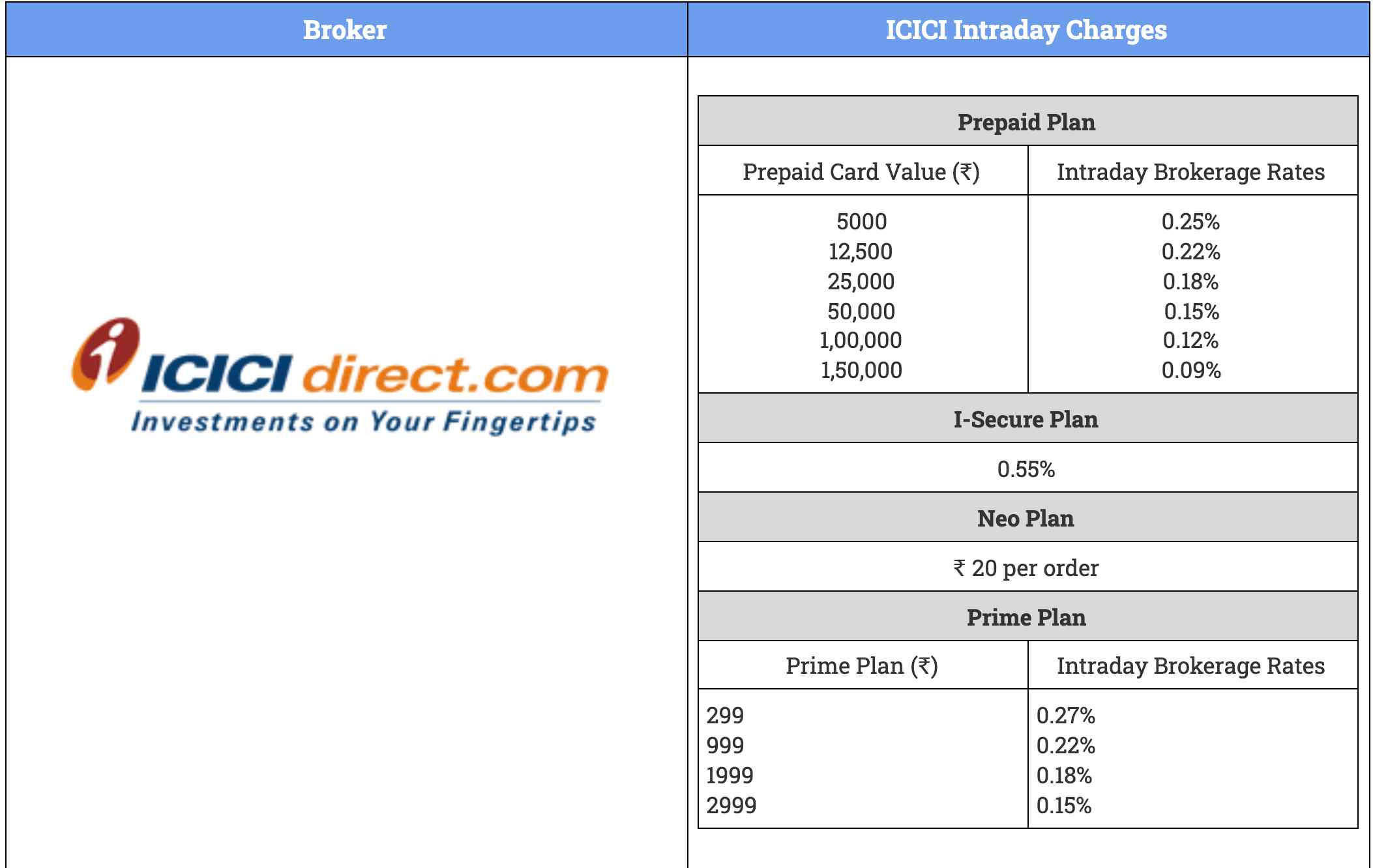

As part of ICICI Direct Charges, below is the complete detail of the broker’s Intraday Charges:

From the above table, it is clearly shown that each plan has further sub-plans that depend on your budget or card value.

Let’s try to understand the concept with the help of an example.

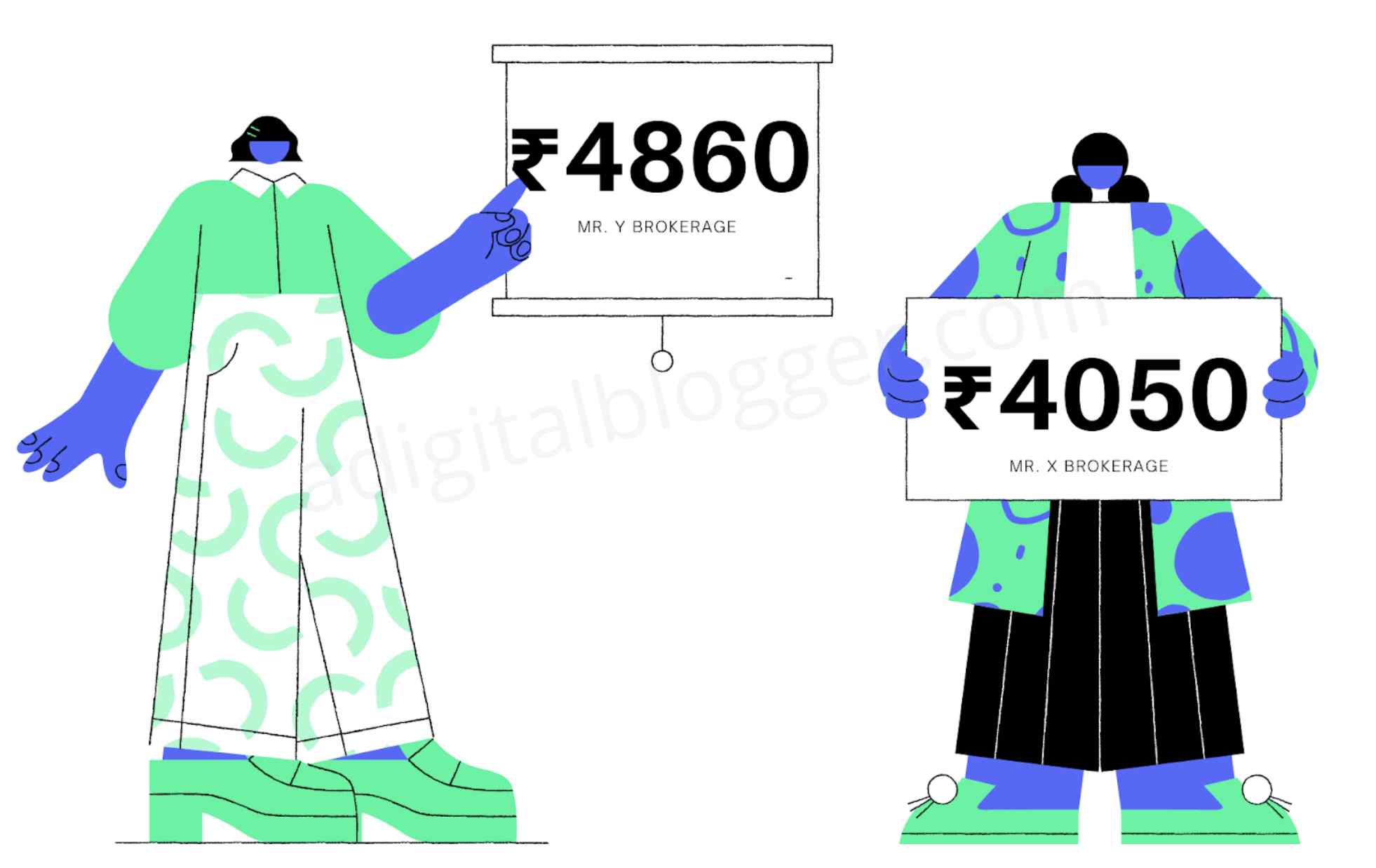

For instance, Mr. M and Mr. N are two good friends who have chosen ICICI Direct as their stockbroker.

Mr. M opted for a lifetime discounted plan namely the ICICI Direct Prepaid Brokerage Plan of ₹50,000. On the other hand, Mr. N was keen to avail exclusive Research service of ICICI, which is why he chose ₹1999 Prime Plan.

Consequently, both the friends got interested in XYZ company shares who were presently available in the market at a value of ₹120 for each share.

Mr. M made an investment in 100 shares with a total turnover value of ₹2,70,000. On the basis of the brokerage plan flat brokerage of 0.15% (as per his plan value). Hence, he needs to pay ₹4050 to execute the trade.

However, Mr. N paid ₹4860 flat brokerage amount on his 0.18% imposed brokerage on the total turnover value of ₹2,70,000 on a similar trading deal. Hence, he paid higher brokerage than his friend.

Therefore, it’s vital to choose the right plan that fits your trading needs and your budget!

Choosing these plans is easy and quick. Simply follow the below three steps-

- All you need is to log in to the ICICI Direct account.

- Now, tap on settings and select Brokerage and Charges.

- Here, you can choose or modify any brokerage plan as desired.

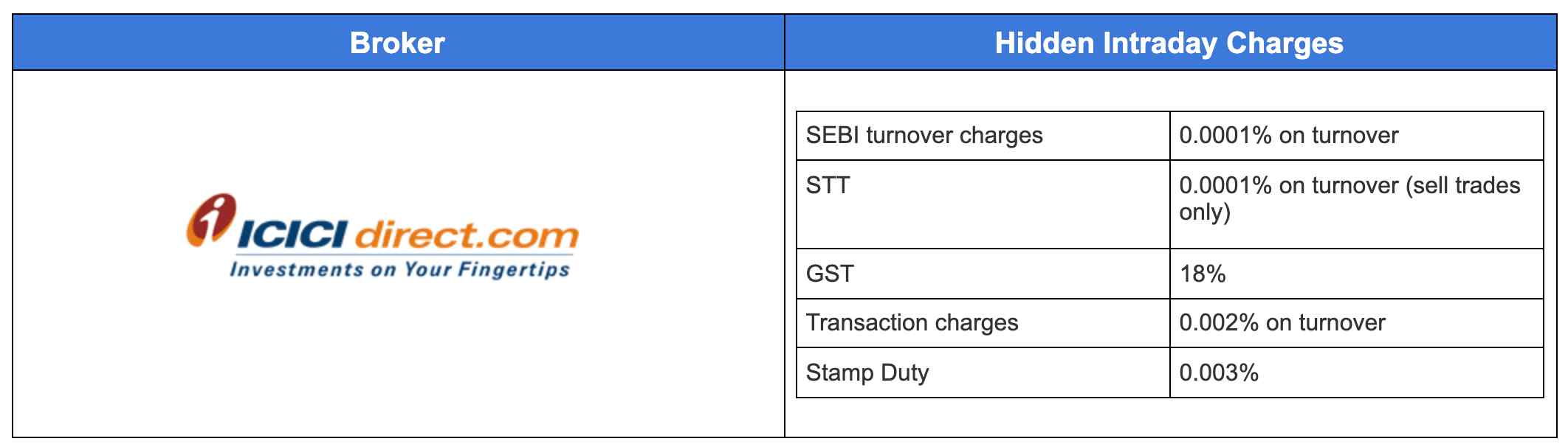

In addition to these ICICI Direct Intraday trading charges, the following list of fees is also imposed on day traders:

ICICI Intraday Brokerage Calculator

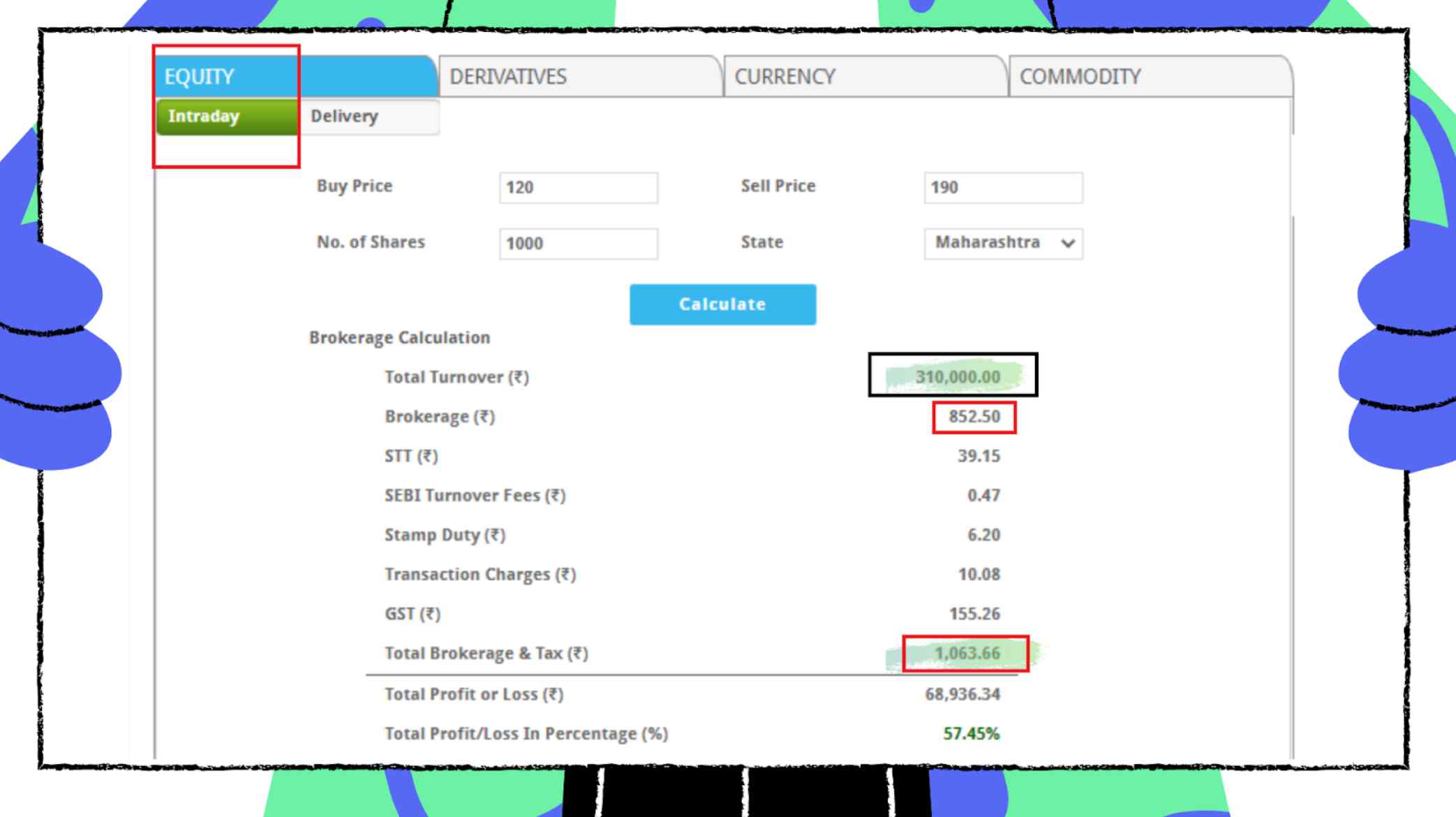

If you have decided to go through Intraday trading after carefully observing the ICICI Direct Intraday charges, then it’s pretty sure that you want to use the digital calculator to find all the taxes, fees, and charges related to it.

To calculate the brokerage using a calculator,

- Select your segment – equity intraday.

- Fill the spaces with buying price, selling price, the number of shares, and your location.

- Finally, tap on the “Calculate” button.

So, if you opt for the ₹299 Prime Plan then you need to pay the brokerage as calculated below:

Similarly, you can calculate the brokerage of any trade and can determine the total ICICI Direct Intraday charges imposed on you.

Which Brokerage Plan is best in ICICI Direct?

From the aforementioned details, we come to know that intraday charges in each segment vary depending on the chosen ICICI brokerage plan.

But which brokerage plan is best for you? Well! It is a bit challenging as each plan comes up with specific benefits and costs for the trader.

For example, on one hand, where the Prepaid plan comes up with a validity of 15 years, the ICICI Direct Prime Plan offers advanced research options that help beginners to trade smartly.

Hence, choosing the best brokerage plan for you requires two key requirements:

- Your trading goal

- Your budget exclusive of expenses

Overall, the ICICI Direct Intraday charges seem to be higher on the cost value, however, by looking at its plans, trading platforms, and other impeccable services it’s wiser to take some time for evaluation and then make the next move!

In case you would like to understand more about ICICI Direct Intraday charges or anything related to it, just fill in some basic details below and we will call you back to guide you further: