Advantages of IPO

More on IPO

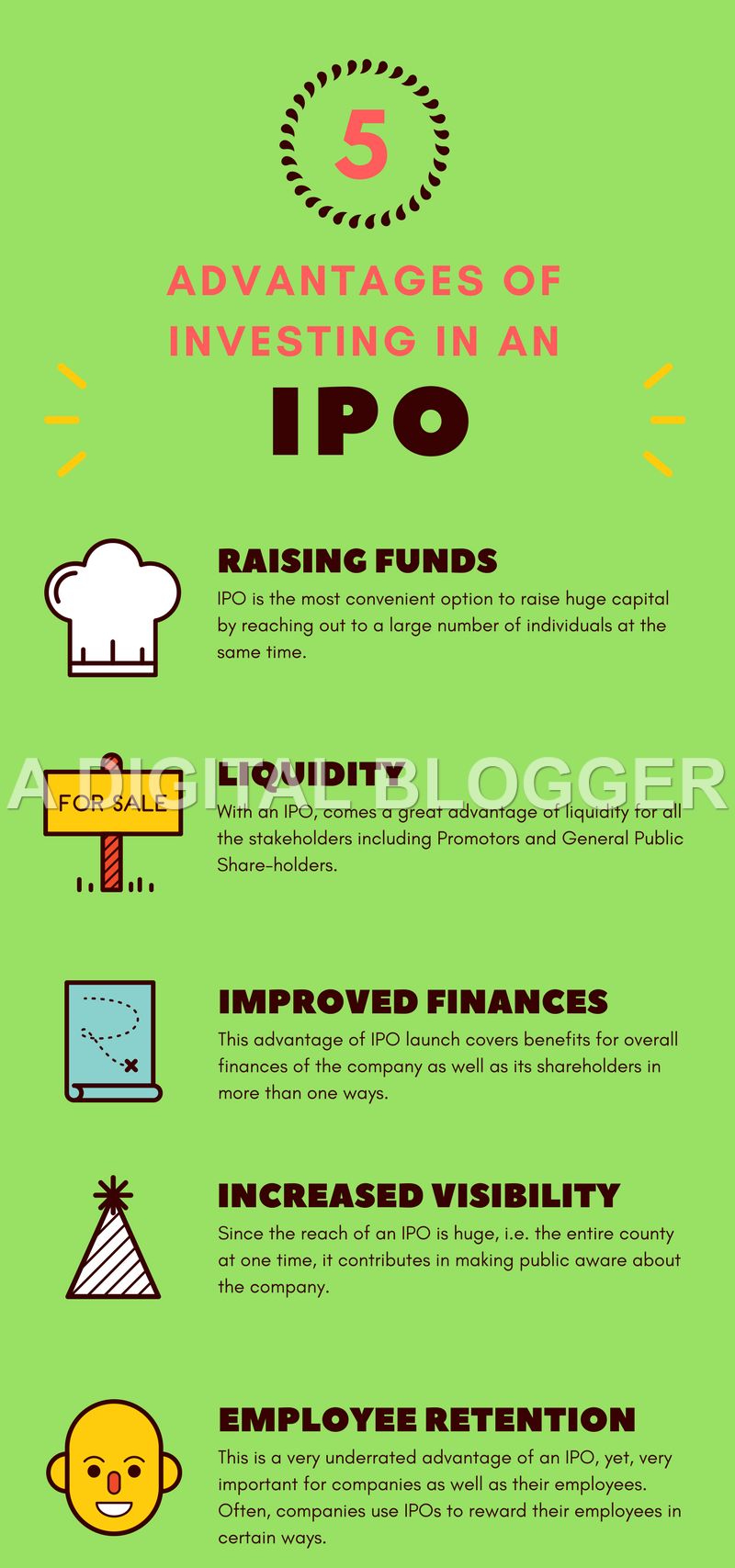

Advantages of IPO are certainly beneficial to different stakeholders. At the same time, these stakeholders put important assets into a riskier spot until they start getting benefits in lieu of all the risks taken.

Initial Public Offer (IPO) is a way for companies to open up their share capital to the general public. There are multiple stakeholders in the overall IPO process and each of these parties has something to gain (or lose).

At the end of the day, it really depends on the ground-level strategy and execution that happens to complete the overall IPO launch.

There are many advantages of IPOs due to which companies opt for them instead of choosing other options available to them for raising funds.

Advantages of IPO to the Company

The company raising the IPO is certainly at an advantage at multiple level.

Let us discuss these advantages of IPO one by one:

#1 Raising Funds:

This is the first and one of the most common advantages of IPO launch.

IPO is the most convenient option to raise huge capital by reaching out to a large number of individuals at the same time.

The funds raised through an IPO not only help a company in the modernization of technology, the opening of new facilities and manufacturing units but also for acquisition purposes.

A lot of companies use the raised funds for business expansion or even early investors’ exit.

While there are a few companies that get rid of their loans from banking and financial institutions, thereby, removing the interest cost that eats up the profitability of the business.

Getting funds through an IPO removes such loans out of the business’s balance sheets and improves the overall financials.

It is comparatively easier for public companies to use their publicly traded shares to acquire other businesses. For example, Prataap Snacks raised ₹200 crore through fresh issue of shares to enhance the capacity of their production of chips by 50% and their namkeens by 100%.

With the intention of raising funds, SBI Card is coming forward with the IPO.

By knowing all the details it becomes easier for keen investors to invest their funds smartly.

#2 Liquidity

With an IPO, comes a great advantage of liquidity for all the stakeholders. This is one of those advantages of an IPO that has a direct monetary impact on the stakeholders.

For example:

Promoter and early shareholders: Along with the promoter, all the early shareholders like angel investors, PE firms, employees, etc. can cash out their stakes for their needs any time they want.

For example, in the year 2017 alone, many PE firms like ChrysCapital sold their stakes in their portfolio companies and marked their exit from them after earning over six-fold returns worth approximately $1.2 billion.

General public shareholders: This is a good advantage of IPO for the general public too. If they are no longer interested in a particular company or need funds for any purpose, it is very convenient to sell their shares in the stock market. There is no lock-in period for retail investors for investing in shares of a company.

Reap the best benefits from the company’s IPO.

#3 Improved Finances:

This is one of those advantages of IPO launch that cover benefits for the overall finances of the company as well as its shareholders in more than one way. Let us first discuss the impacts of IPO on the company itself.

- Valuation: The valuation of a publicly-traded company is generally higher than any private company. The main reason behind this is that public companies are strictly required to disclose all the information related to their business to the public as per regulations by the Securities and Exchange Board of India (SEBI).

- Avoiding Debt: Also, since the company has gone through the IPO route, it has avoided huge amounts of debt in the process. The financing costs related to short and long-term loans from banks have been saved up to a large extent.

- Due to the transparency factor in information regarding public companies, banks are happy to provide loans to them at better rates of interests for longer durations of time.

#4 Increased Visibility and Publicity:

This is a decent advantage of an IPO for the company going public. It gets a lot of publicity required at this stage. Since the reach of an IPO is huge, i.e. the entire county at one time, it contributes towards making public awareness about the company.

Being listed on a recognized stock exchange gains wide media coverage. Launching an IPO also says a lot about consistency in the performance of the company.

There are regulations that need to be followed before launching an IPO and not every company can do that easily.

Being public puts companies into better positions with suppliers, customers, other third parties. It also helps the business to acquire new clients, new business, new partnerships since they are relatively a much trustable brand now.

#5 Better Retention of Employees:

This is a very underrated advantage of an IPO, yet, very important for companies as well as their employees. Often, companies use IPOs to reward their employees in certain ways. Employees are given shares at discounted prices.

They are motivated to support the growth of the company as the performance of the company is directly related to their own profits. The efficiency of employees gets enhanced in this way.

There is a recent example to show this. Ahmadabad-based MAS Financial Services issued “share quotas” to their employees. They allotted approximately 1.6% of their total share issue, which is worth ₹460 crores to employees at a discount of 9.8% to its IPO price.

Reap the benefit of investing in IPOs by subscribing to them on time. Keep a track on the Upcoming IPO Calender In India 2021, and know whether they are worth investing by just looking at the below table. Select the IPO that you want to review about and grab all the information:

Advantages of IPO for Investors

Now, let us see how holding publicly traded shares on recognized stock exchanges help in improving the financial condition of shareholders:

For Public Shareholders: Two main advantages of IPO for the general public have been discussed below.

People have become millionaires by investing in IPOs. The thing that made all the difference was to choose the right IPO at the right time. For example, Maruti launched its IPO in 2003, and allotted shares to the general public at ₹125 per share.

As of April 10, 2018, the share price of Maruti has reached more than ₹9200. Imagine the worth of a shareholder who had retained her/his shares since the IPO!

That is why know whether it is worth investing in Upcoming IPO 2021 by referring to the below table. Click on the IPO you want to know the details about and you will have an idea about the company and investing in it:

A common man holding publicly traded shares of a company can use held shares as collateral for loans, etc. Shares can easily be pledged to financial institutions as they can be traded easily on stock exchanges. So, shares of a company are an asset for the common man.

Check this review in Hindi.

In case you are looking to invest in an upcoming IPO, you will need a Demat account for that. Refer to thr form below:

More on Upcoming IPO 2021

| Upcoming IPO List | ||

|---|---|---|

| IPO | Issue Size | |

| Craftsman Automation IPO | ₹820 Cr | |

| Laxmi Organics IPO | ₹600 Cr | |

| Anupam Rasayan IPO | ₹760 Cr | |

| Easy Trip Planners IPO | ₹510 Cr | |

| MTAR Technologies IPO | ₹596.41 Cr | |

| Kalyan Jewellers IPO | ₹ 1750 Cr | |

| Bajaj Energy IPO | TBA | |

| Nureca Limited IPO | TBA | |

| Nazara Technologies IPO | TBA | |

| Studds Accessories Ltd IPO | TBA | |

| Suryoday Small Finance Bank IPO | TBA | |

| Stove Kraft Ltd. IPO | TBA | |

| Barbeque Nation IPO | TBA | |

| Home First Finance Company IPO | TBA | |