Angel Broking Account Opening Form

More Demat Forms

The account opening process in the stockbroking space, these days, has been very simplified. One can go online, go through the digital process of putting in the details, uploading documents, etc, and can get it done. The same applies to Angel broking too. However, there are a few cases where you’d want to use the Angel Broking account opening form for your demat.

In this quick review, we will talk about how to use this form so that you don’t get stuck in your account opening journey.

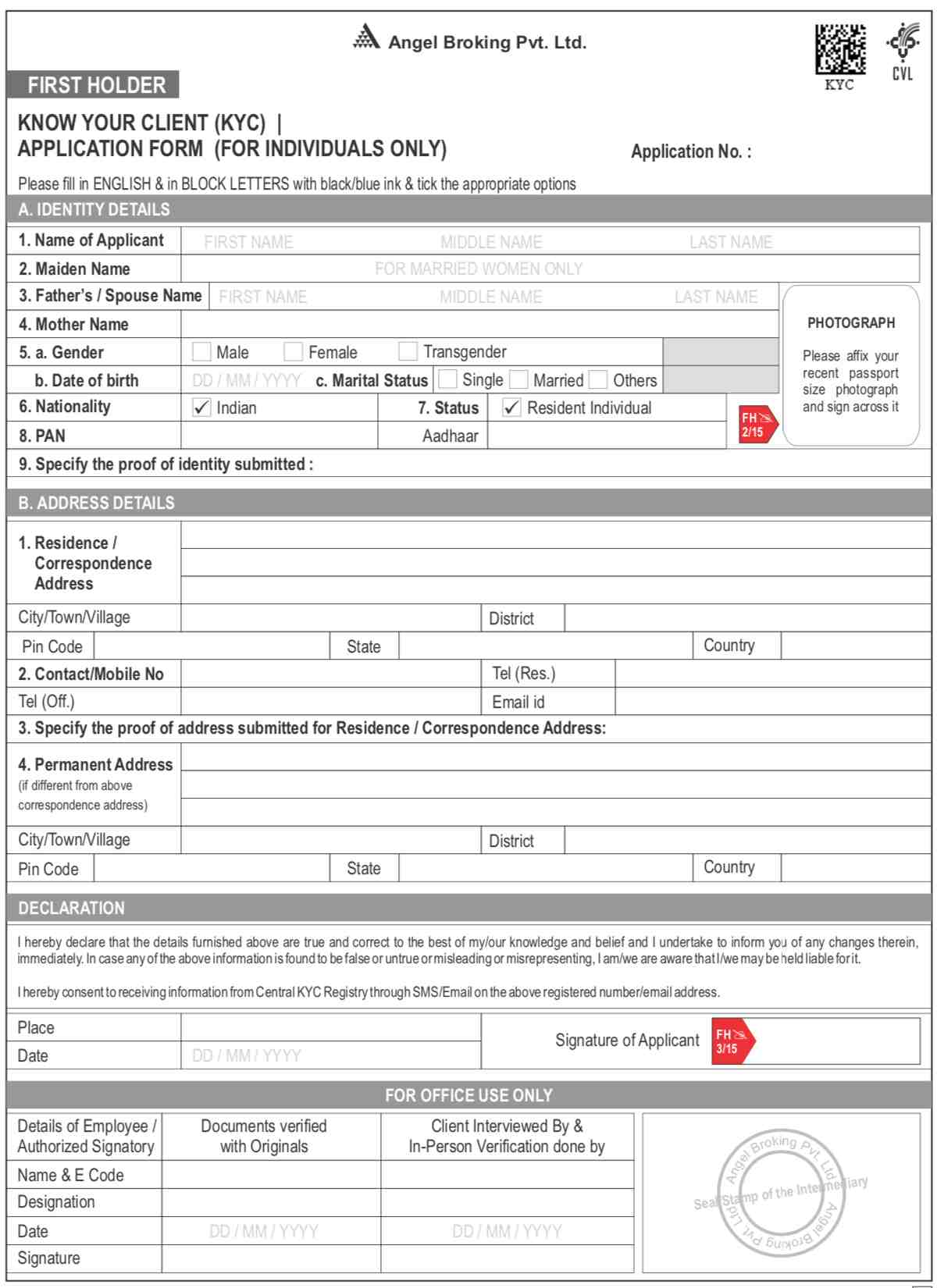

Angel Broking Demat Account Opening Form

Angel Broking demat account can be opened offline too by filling the form offline. Here are some of the sections covered under opening form:

- KRA Form and Account Opening Form

- Charges Information

- Policies

- Obligations to be fulfilled

- Guidance and notes

- Rights of Investors and Traders

While you fill up the angel broking account opening form, you need the following documents as part of the process:

- PAN Card (mandatory)

- ID Proof (any of the following)

- Aadhar Card

- Passport

- Voter ID

- Driving License

- Address Proof (any of the following)

- Passport

- Voter ID

- Driving License

- Aadhar Card

- Bank Statement

- Passbook

- Electricity bill

- Registered Flat Sale Agreement of Residence

- Resident Landline Tel. Bill

- Registered Lease/Leave & License Agreement

- Ration Card

- Bank Proof (any of the following)

- Bank Statement

- Passbook

- Banker’s Certificate on letterhead of the Bank

- Canceled Personalized Cheque leaf

- Proof Income

- Copy of ITR Acknowledgement

- In case of salary income – Salary Slip, Copy of Form 16

- Net-worth certificate (Not more than 1-year-old)

- Copy of Demat Account Holding Statement

- Bank Account Statement for last 6 months reflecting income

Make sure that you attach the above-mentioned documents along with the opening form else your application will be definitely rejected.

Here if do not have Aadhar Card, still you can apply and open Angel Broking demat account without Aadhar Card. For this although there is no offline process but can open online via EMudhra.

By submitting these documents, you are letting the broking company know that you are:

- An Indian Citizen

- Residing at a particular location in the country

- holding a valid bank account from which you will transact using your trading account

- Earning regularly through a valid means.

By the way, if you are interested to go ahead with your trading, you may choose to fill the below-shown form as well to get a callback:

Angel Broking Account Opening Form PDF

In this section, we will talk about the different sections of the angel broking account opening form.

First of all, the user needs to enter personal details such as

- Name

- Father’s Name

- Gender

- DOB

- Nationality

- PAN Card

- Address

- Mobile Number

- Email and so on.

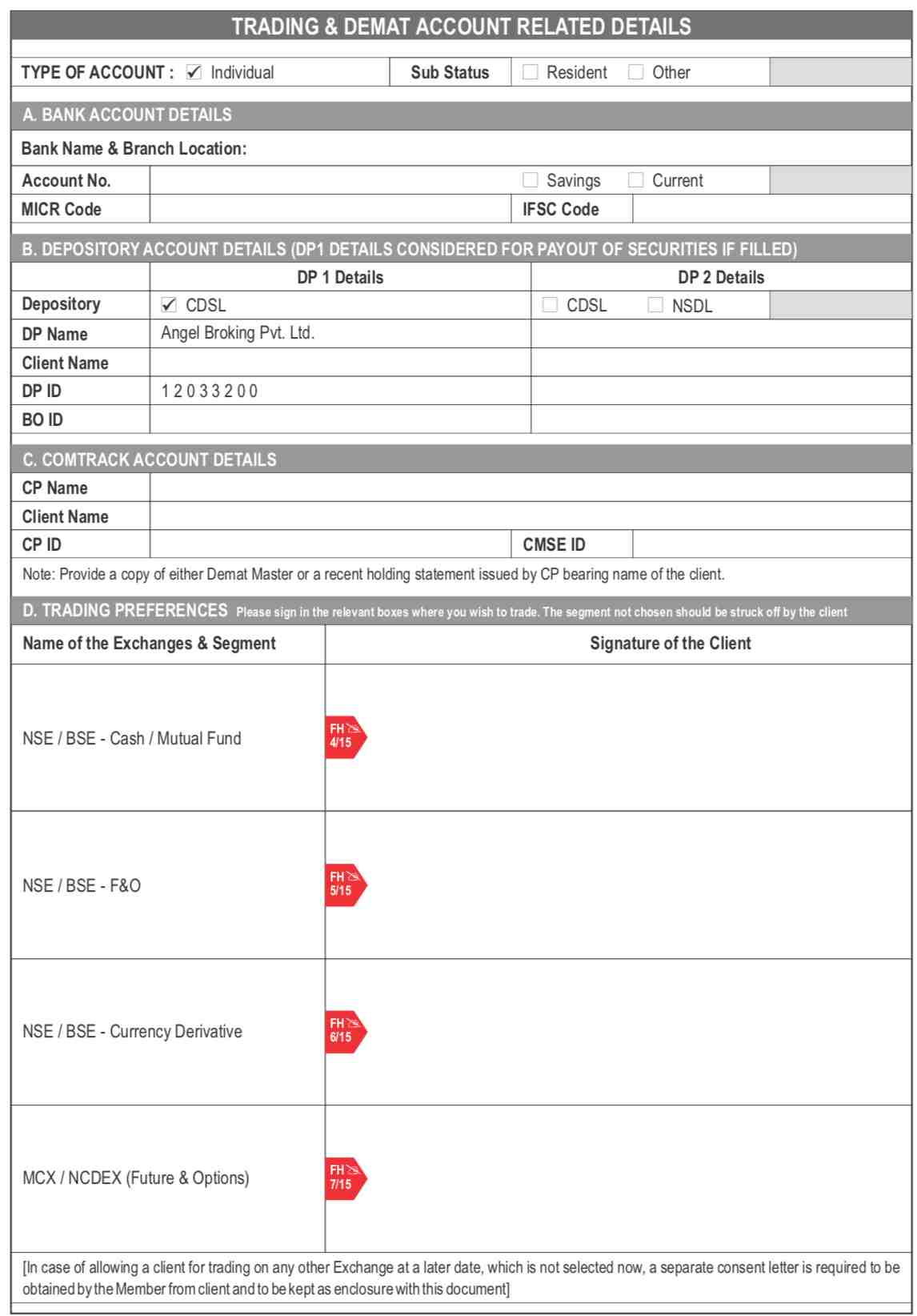

The next section requires you to add details such as:

- Type of Account

- Bank Account Details

- Depository details (i.e. stockbroker details)

- Signatures

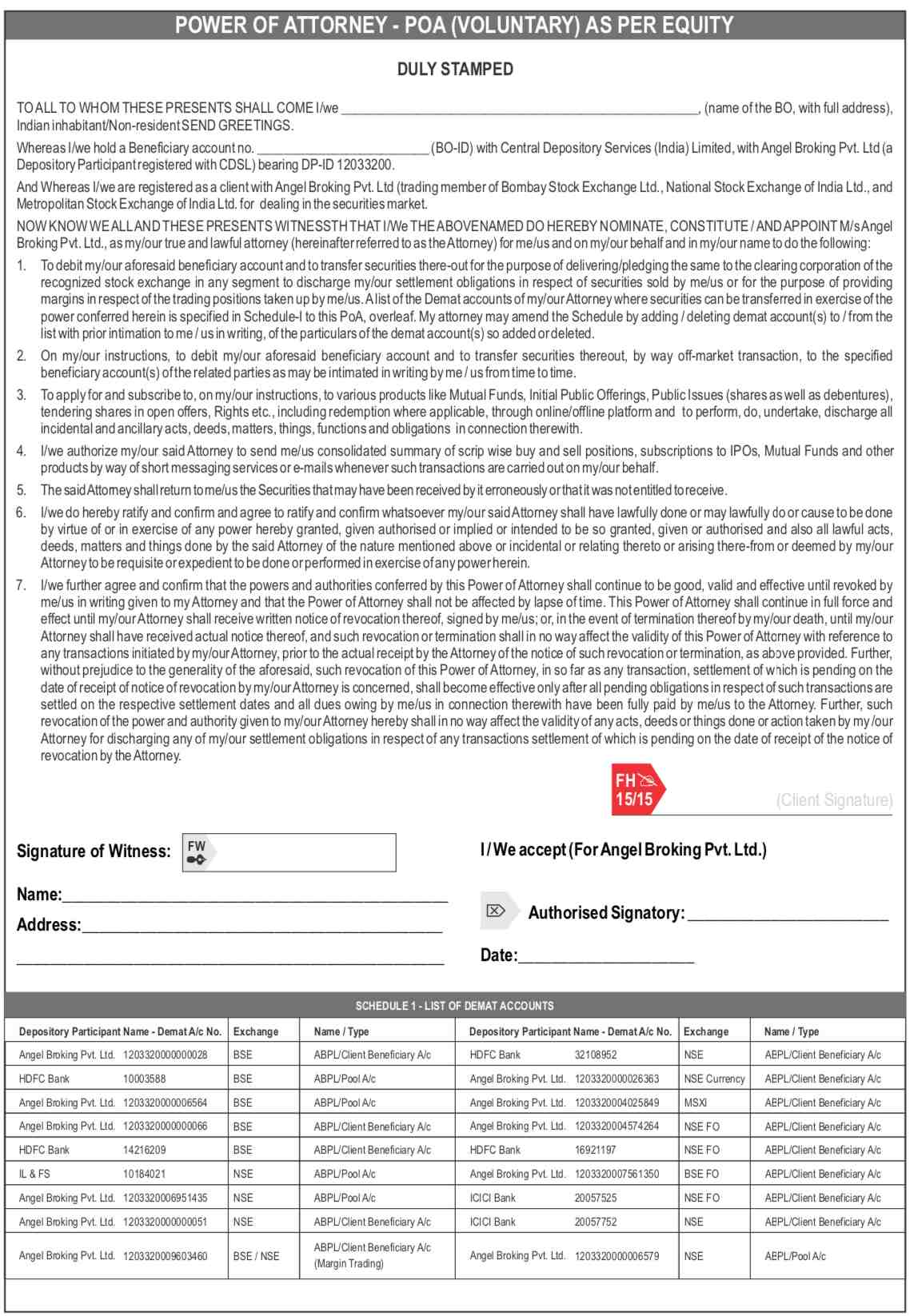

There would be other details as well. You’d need to add POA (Power of Attorney) documentation as well where you provide the stockbroker the right to use your demat account on your behalf.

This is how the POA in the Angel Broking Account Opening form looks like:

If you would like to download the complete Angel Broking Account Opening form for yourself, just click on this link, download this, print this, fill this up and hand it over to the stockbroker executive.

Make sure that you download the retail investors’ form for there is. a separate form for institutional investors.

Otherwise, you may choose to courier the form to the closest Angel Broking branch as well.

Lastly, if you would like to have a word around any of the confusions around the Angel Broking Account Opening form, just fill in the form below and we will assist you: