Kotak Demat Account Charges

If you are thinking of opening a Kotak Demat Account, then it is essential to acquaint yourself with the Kotak Demat Account Charges as well.

By the way, Kotak Securities is a full-service stockbroker which has made its space in the market. But here is the question, does demat account have charges too?

Well! every stockbroker charges a minimal fee for offering demat account services. Here is the list of fees associated with the Kotak Securities Account Opening:

- Demat account opening charges

- Account Maintenance Charges

- Account closing charges

Without wasting any time, let us quickly begin with the charges associated with Kotak Securities Registration

1. Kotak Demat Account Opening Charges

The account opening process in Kotak Securities is fast and convenient. With their newly launched Kotak Trade Free Plan, they guarantee that you can open your demat account for FREE.

But there are varied kinds of Kotak Securities charges and then there are a few charges that are specific to the Kotak Demat Account. We discuss the latter part in this review for you:

| Kotak Demat Account Opening Charges | |

| Account Opening Charges | ₹0 |

Apart from this, there are some additional charges associated with Kotak Securities account, the details of which is given in the table below:

| Kotak Demat Account Charges | |

| Dematerialization | 150 per certificate + 50 per request courier charges |

| Rematerialisation | Rs.10 for 100 securities |

| Pledge Charges | Rs.20 per ISIN |

| Invocation of Pledge | Rs.20 per ISIN |

| Charges for client master change (Applicable for Address, Email, Mobile and Bank Updation) | Rs.50 per modification request |

| DIS Re-Issuance | DIS Re-Issuance |

| Charges for CAS (Hardcopy) | Rs 200 per statement per year + Rs 50 courier charges (Digital is free) |

2. Kotak Demat Account Annual Maintenance Charges

A broker often charges you some fees for the maintenance of your account. For this fee, your demat account is kept secure with all your holdings and all other documentation/administration work is done for these charges.

These are the account maintenance charges. However, Kotak Securities charges this fee on a monthly basis. The AMC charges for demat account are ₹50 per month as far as Kotak Securities is concerned.

| Kotak Demat Account Annual Maintenance Charges | |

| Account maintenance charges | ₹50 per month |

3. Kotak Demat Account Closing Charges

Just as there are opening charges, there are various closing charges as well. In the case of a Kotak Demat account, you don’t have to pay any charges for closing your demat account.

You will need an account closure form, all the necessary details, and the process of your account closure will be completed conveniently.

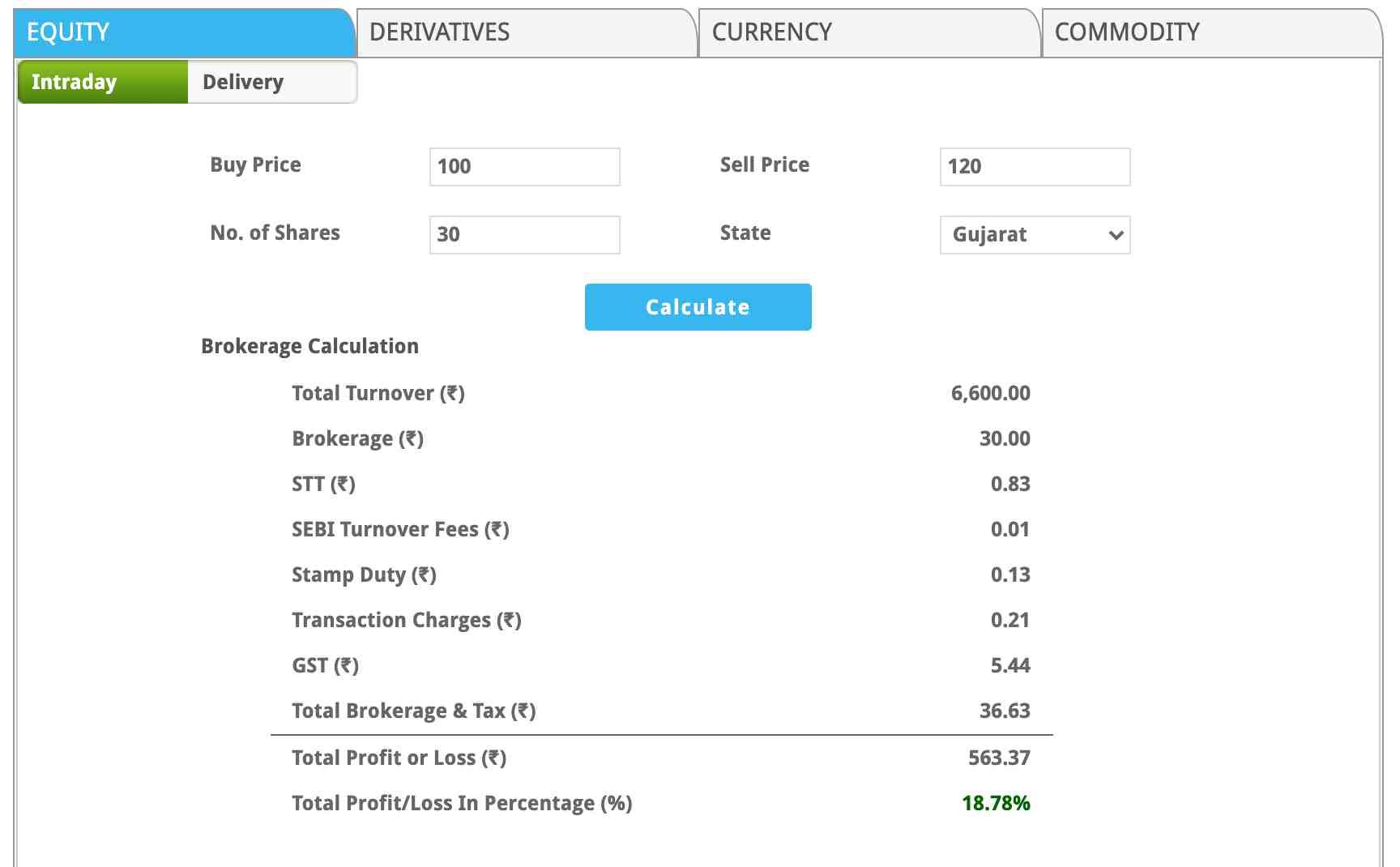

Kotak Demat Account Charges Calculator

It is often seen that there are certain conditions in which you can miss out on the correct brokerage once you start trading with your Kotak demat account.

To make it easy, you can make use of the calculator that helps you in calculating the transaction and other brokerage fees imposed on your trading account.

Conclusion

The Kotak demat account charges are comparatively less when compared to other full-service brokers. Also, the account maintenance charges are charged on the monthly basis thus offering relaxation to its customer.

So, grab a trading experience with the broker now by opening a Kotak Demat Account.

You can do that by putting your details in the form below: