Zerodha Active Clients

More on Zerodha

stock market The number of active clients says a lot about the brokers’ service. Looking into the details of the Zerodha active client base, we know what makes it one of the leading stockbrokers in India.

But what is it that makes this broker different from the rest? Let’s dive into the details of the active number of clients of Zerodha and other related information.

But before that, we should know a little about the popular discount broker.

Zerodha is the first discount broker of India and the organization that brought the concept of discount brokers to India. It was established back in 2010 by Mr. Nithin Kamath.

Currently, there are multiple reasons that are helping the broker gain popularity in the stockbroking industry.

We will discuss this later in the article.

How Many Active Clients Are There in Zerodha?

First, you must get an answer to your question – current active clients of Zerodha amount to 36,02,074, which is more than 3.6 million.

| Stockbroker Name | Active Clients |

| Zerodha | 36,02,074 |

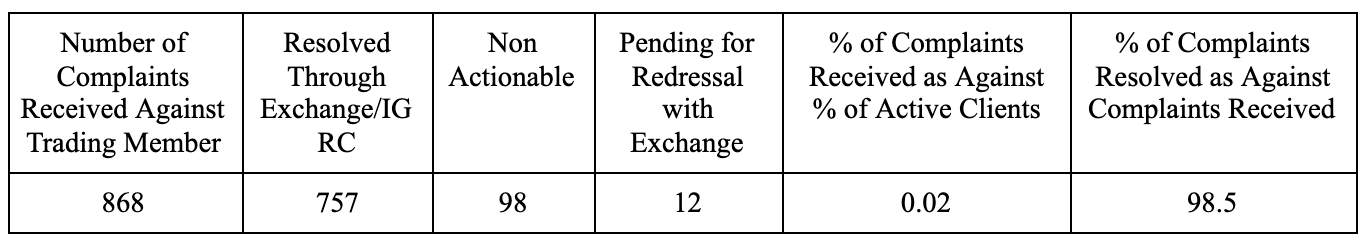

But as the famous saying goes – “With more power comes more responsibility,” the broker has to sustain its services and resolve customer’s complaints. The latest data related to this is tabulated below:

Having discussed all this, you must be curious why traders and investors are choosing this broker above all. So, let’s help you with the answers in the next segment.

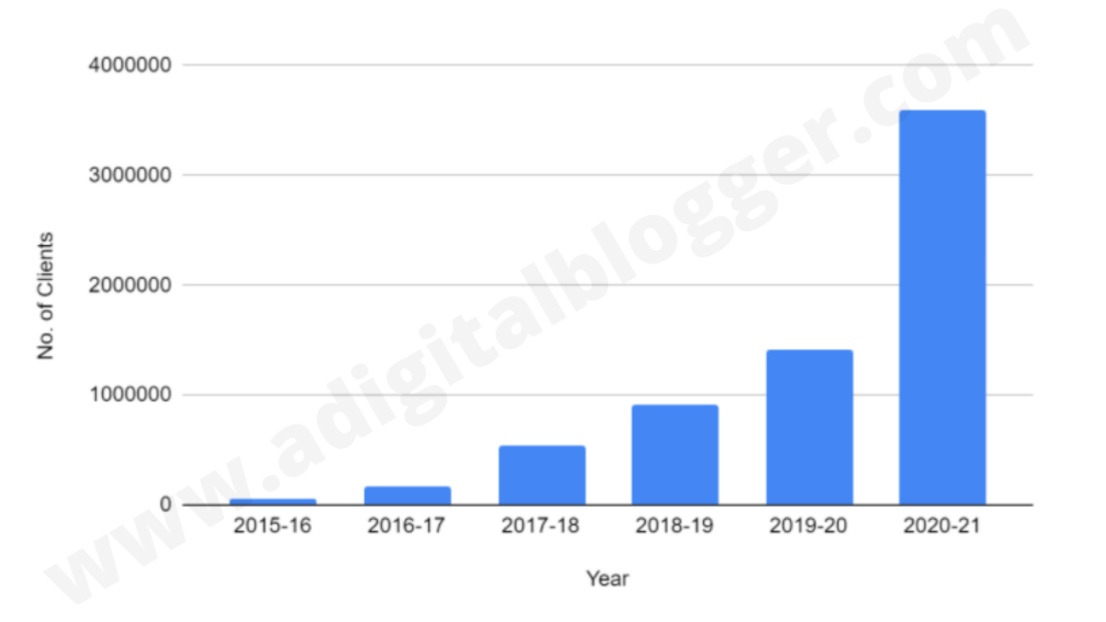

The stockbroking industry has seen a trend of a sudden increase in clients during the COVID-19 lockdown. Zerodha is no exception in the market. Below is a chart that shows the growth of clients over the last few years.

This jump in the number of clients actively trading with Zerodha is proof of the broker’s services. Now, let’s talk about the reasons for the common choice among traders and investors.

Here is a list of services and products that, we believe, make the broker stand out and help in increasing Zerodha active clients:

- Technologically advanced trading platforms like Zerodha Kite, Coin, Zerodha Pi and Kite Connect.

- Zerodha offers a mutual fund trading platform – Coin, that helps you buy commission-free mutual funds directly from the AMCs (Asset Management Companies).

- The trading platforms are stacked with multiple innovative and unique trading tools like:

- Market Monitor

- Options Strategy

- Market Intel

- Trailing Stop Loss

- Bracket Orders

- SPAN Calculator and many more.

- The exchange connectivity of Zerodha is 140 orders/second, whereas the industry average is 40 orders/second.

- Third-party integrations with some of the best players in the market. They are:

- Streak

- Smallcase

- Sensibull Zerodha

- GoldenPi

- You don’t have to make a commitment for the turnover.

- There are various support portals like Trading Q&A, Z-Connect, and an interactive blog that sort your queries with precision.

- Almost all queries can be sorted through the discussions in the above support portals, but if you want to talk to the support team executive, they have an amazing turnaround time (TAT). It has the fastest TAT in the industry via email or phone.

- You can learn to trade using their educational platform – Zerodha Varsity. They provide stock market courses on trading and investment option like intraday trading, technical analysis, fundamental analysis, etc.

- Lastly, a very important aspect. Zerodha has been one of the safest stockbrokers in India as it is debt-free and profitable from the first day of its establishment.

These are some of the main aspects that a trader considers before associating with a broker. The element of Zerodha charging only ₹20 as a brokerage is not exclusive to the broker anymore. Almost every broker in the industry has switched to this pricing model.

Conclusion

The rising numbers of Zerodha active clients speak volumes about the quality of service and how much priority it gives to customer experience over all other aspects.

The technologically advanced platforms and super fast turnaround time has assisted in increasing its credibility in the market.

Over the years, the number of clients has risen from approximately 62,000 in 2015-16 to more than 3.6 million in 2020-21.

We hope that your query was resolved. In case of any other doubts, you can reach out to us by entering the details below!

My complain about Fund related