Zerodha Commodity Charges

More on Zerodha

Commodity trading in the stock market is risky but gives traders an opportunity to earn a good profit. If you too are interested in doing commodity trade with Zerodha, then here we are with the complete information on Zerodha commodity charges.

There are multiple charges that have to be borne and they have all been listed below:

- Commodity Account Charges

- Brokerage Charges

Zerodha Commodity Account Charges

If you are willing to buy commodities in Zerodha then it is important to consider various charges like account opening and account maintenance charges.

All these charges are discussed in detail in the upcoming sections.

Zerodha Commodity Account Opening Charges

Some brokers offer a free account and some charge a fee for the same. Zerodha is categorized under the latter. It charges you ₹100 for an individual account that is opened online.

The Zerodha commodity charges for other account types offered by the broker are tabulated below:

Zerodha Commodity Account Maintenance Charges

Account maintenance charges are popularly known as AMC. It is generally charged annually but can be paid in multiple instalments like monthly, quarterly, bi-annually, or annually.

Zerodha has recently shifted to the quarterly mode. It charges ₹300 + GST per annum. Here are the details:

Since it is charged quarterly, an account holder pays approximately ₹120 per quarter.

Now, let’s talk about one of the most prominent Zerodha commodity charges in trading – brokerage.

Zerodha Commodity Brokerage Charges

Every trade executed in the share market attracts a brokerage charge against it. This charge varies with the trading segment and the trading style used by the trader.

In the case of brokerage for Zerodha commodity charges, it is the same for all, i.e., 0.03% or ₹20 per executed order, whichever is lower. But the list of charges to be borne does not end with the brokerage.

There are multiple charges for the same. All of the Zerodha commodity trading charges have been tabulated below for your reference:

Let’s understand these charges with the help of an example.

Karanjit is a commodity trader and traded in copper. He traded in commodity options with a total turnover value of ₹2,500.

The brokerage will be ₹2,500 X 0.03% = ₹0.75.

Since the amount is less than ₹20, you have to pay the said amount and in case the brokerage exceeds ₹20, the highest amount deducted from your trading account is ₹20.

You also need to understand that different formats of trading require different kinds of charges. For instance, Zerodha futures trading brokerage will be different from Zerodha options charges. Also, Zerodha Sell charges are calculated separately whether your position for day trade or overnight.

The next section actually calculates the exact amount of brokerage you will be levied.

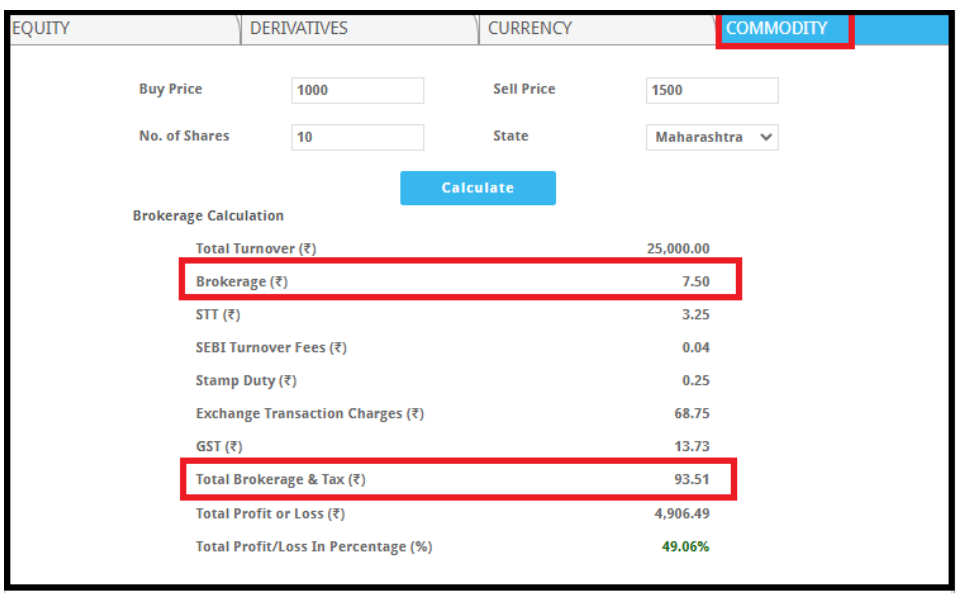

Zerodha Commodity Charges Calculator

Calculating the charges multiple times to finalize the strategy for trading could be difficult for many traders and also time-consuming. So, to ease this, A Digital Blogger provides their clients with a brokerage calculator.

The process is quickened and simplified and helps the traders to trade with ease.

Conclusion

Zerodha is a discount broker that is extremely popular due to its huge active client base. It offers trading in multiple segments and has low charges as compared to its competitors.

The Zerodha commodity charges are varying according to the trading instrument, i.e., futures or options. The account opening and maintenance charges are the first ones to be charged to you.

Apart from the brokerage, there are certain MIS auto-square-off charges equal to ₹50 charged per trade. To prevent paying the extra fees one must keep in check the commodity trading time in Zerodha.

We hope that your query about Zerodha commodity trading and corresponding charges is sorted.

Happy trading!

Nonetheless, if in case, you feel talking to us to learn more or maybe you need any sort of help in Zerodha commodity account opening, just fill in the details below and we will call you back: