Motilal Oswal Trading Charges

Are you looking forward to opening a trading account with Motilal Oswal? But confused and want to know is Motilal Oswal a discount broker? If yes, then it is good to know about Motilal Oswal trading charges.

So, let’s delve inside the informative world of Motilal Oswal Trading Charges.

Here we start!

Motilal Oswal Trading Account Charges

Being a full-service stockbroker, Motilal Oswal offers 2-in-1 accounts to customers that include the Demat account and trading account.

So, while opening a Demat account, the Motilal Oswal trading account is opened by the broker without charging any fees, which means the trader is not required to submit or pay the extra charges.

Apart from this, you can also opt for opening a trading account with the broker. Here you are charged with certain account opening fees and other charges related to trading.

Let’s start by considering the Motilal Oswal trading account opening charges in the following segment.

Motilal Oswal Trading Account Opening Charges

It is essential to note the account opening charges before connecting to the broker. Hence, here are the charges tabulated below to understand the account opening and AMC of Motilal Oswal.

| Motilal Oswal Trading Account Opening Charges | |

| Trading Account Opening | Nil |

| AMC Charges | Nil |

Apart from the account opening charges, there are AMC charges as well. But unlike Motilal Oswal Demat account, there are no such account maintenance fees for trading accounts.

In the case of a trading account, the investors do not need to pay a single penny to the broker.

Motilal Oswal Trading Brokerage Charges

Now, to trade in the various segments, there is a specific fee that is to be paid to the broker as a brokerage fee that depends on the total turnover.

Let’s get a brief about the brokerage offered by the firm with different plans.

To get the details of each segment, dive into the following segment.

Motilal Oswal Intraday Brokerage

You can trade in the equity intraday by choosing any of the plans. With the standard plan, the broker offers the range of 0.05% to 0.01%. However, you can reduce these fees up to 0.007% with Motilal Oswal Value Pack.

Here is a brief data that has been tabulated below to make the understanding of brokerage charges intraday easier to understand.

| Segment | Brokerage Plan | Margin/Upfront Fees (in ₹) | Brokerage |

| Equity Intraday | Standard Plan | <25,000 - 6,00,000+ | 0.05% - 0.01% |

| Equity Intraday | Value Pack | 2,000 - 3,00,000 | 0.040% - 0.007% |

Motilal Oswal Delivery Brokerage

To trade in delivery the brokerage depends upon the margin or upfront fees you pay to the broker. In the case of delivery trading, here are the details of delivery trading charges.

| Segment | Brokerage Plan | Margin/Upfront Fees (in ₹) | Brokerage |

| Equity Delivery | Standard Plan | <25,000 - 6,00,000+ | 0.5% - 0.01 |

| Equity Intraday | Value Pack | 2,000 - 3,00,000 | 0.40% - 0.07% |

Motilal Oswal Commodity Brokerage

You can trade in commodity futures and options with Motilal Oswal and here are the details of how the charges vary according to the plan.

In the standard plan, the commodity brokerage ranges from 0.04%-0.01% according to the initial margin at the time of opening a Demat account.

To know the commodity brokerage in futures and options, refer to the following table for detailed information.

| Segment | Brokerage Plan | Margin/Upfront Fees (in ₹) | Brokerage |

| Commodity Futures | Standard Plan | <25,000-6,00,000 | 0.05%-0.01% |

| Commodity Options | Value Pack | <25,000-6,00,000 | ₹100-₹25 |

| Commodity Futures | Value Pack | ₹2,000-3,00,000 | 0.040%-0.007% |

| Commodity Options | ₹2,000-3,00,000 | ₹50-₹15 |

Currency Brokerage In Motilal Oswal

Now, here comes the time to check the currency brokerage of Motilal Oswal. Like the commodity segment, you can trade currency in derivatives.

The charges differ according to the segment and plan you pick. Here is the detail.

| Segment | Brokerage Plan | Margin/Upfront Fees (in ₹) | Brokerage |

| Currency Options (Standard Brokerage) | Standard Plan | <25,000-6,00,000 | ₹100-₹25 per lot |

| Currency Futures (Standard Brokerage) | Value Pack | <25,000-6,00,000 | 0.05%-0.01% |

| Currency Options (Standard Brokerage) | Value Pack | ₹2,000-3,00,000 | ₹20-₹6 |

| Currency Futures (Standard Brokerage) | ₹2,000-3,00,000 | 0.040%-0.007% |

Motilal Oswal Futures Brokerage

Apart from other segments, let’s put some light on the futures brokerage too.

For that, refer to the following table:

| Motilal Oswal Futures Brokerage | |||

| Segment | Brokerage Plan | Margin/Upfront Fees (in ₹) | Brokerage |

| Equity Options | Standard Brokerage | <25,000-6,00,000+ | ₹100-₹25 per Lot |

| Equity Options | Value Pack | ₹2,000-₹3,00,000 | ₹50-₹15 |

| Currency Options | ₹20-₹6 |

Motilal Oswal Options Brokerage

Now, if you want to trade in an options contract, then it is important to check the brokerage that has to be submitted to Motilal Oswal according to the different plans mentioned below:

| Motilal Oswal Futures Brokerage | |||

| Segment | Brokerage Plan | Margin/Upfront Fees (in ₹) | Brokerage |

| Equity Options | Standard Brokerage | <25,000-6,00,000+ | ₹100-₹25 per Lot |

| Equity Options | Value Pack | ₹2,000-₹3,00,000 | ₹50-₹15 |

| Currency Options | ₹20-₹6 |

Motilal Oswal Call and Trade

You also have the option to use the call and trade facility from Motilal Oswal. When you use this, you don’t need to place the trade yourself across any of the segments. You just need to call up the broking company or your local sub-broker and they will place the trade on your behalf.

Rest assured, none of the trades you place can be done without your confirmation as each of the calls made to the sub-broker get recorded.

The broker places a charge of INR 25 per ex

Motilal Oswal Trading Charges Calculator

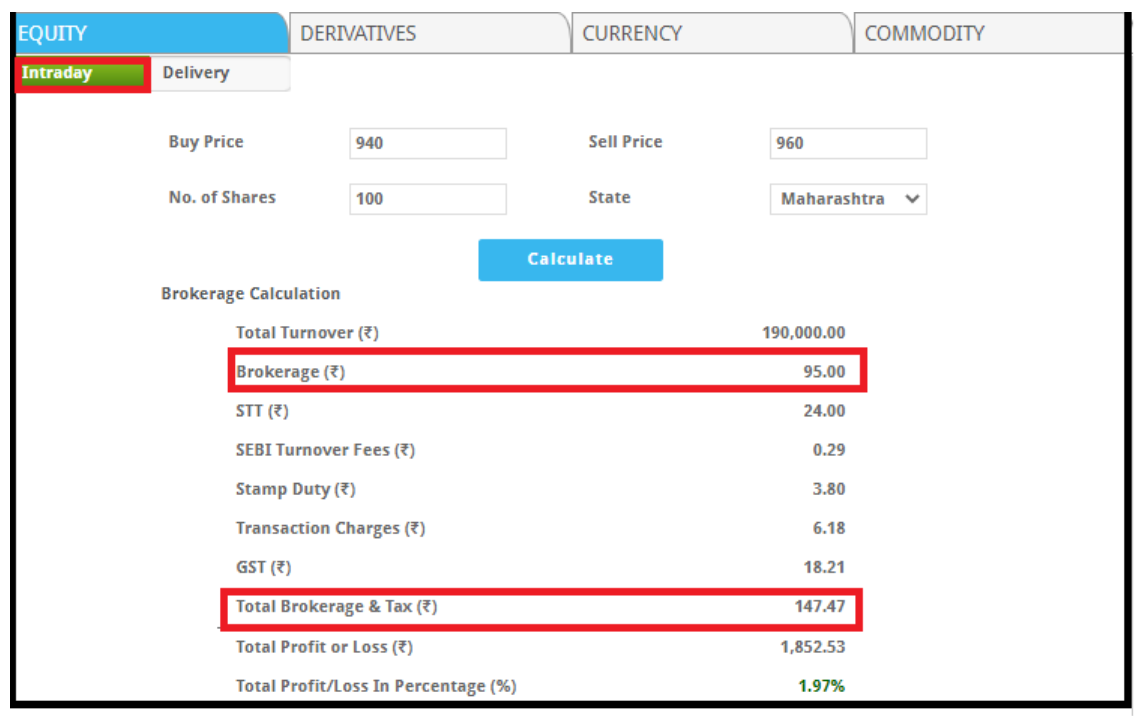

Raman opens a trading account with Motilal Oswal and trades in the shares of Infosys. He bought 100 shares of INFY @₹940 each. The total turnover of the trade is ₹1,96,000.

He opted for the Standard plan with a margin of ₹15,000. According to the brokerage, he estimated the charges of ₹95.

But the actual brokerage deducted from his trading account was higher.

Can you think why he needs to pay extra brokerage fees to trade?

Well! That is because of the taxes and other fees associated with a brokerage. Many traders like Raman often forget to consider the additional fees and therefore sometimes fails to earn the calculated profit.

To prevent yourself from such conditions, either you can check the hidden fees, taxes in the contract note or refer to the brokerage calculator, which provides you the exact calculation to trade in different segments and also the profit or loss percentage.

DP Charges in Motilal Oswal

Apart from the brokerage fees, taxes and other charges, there are transaction charges levied on selling. So if you are into long term delivery trade, then every time the shares debited from your Demat account, certain fees are deducted, called DP charges. These charges can only be levied since there is a valid Motilal Oswal DP ID with the broker.

This fee is levied on scrip and not on the number of shares. So whether you debit 100 shares or 1000 shares of a particular scrip the charges remain the same.

Motilal Oswal DP charges are ₹75 or 0.075% whichever is higher.

| Motilal Oswal DP Charges | |

| DP Charges | ₹75 or 0.075% per scrip (whichever is higher) |

Is Motilal Oswal Good For Trading?

After considering the charges many among you might be willing to trade with the broker. No doubt the broker offers impeccable services by providing a highly advanced trading platform and research tips that help beginners to trade across segments with the minimum chance of loss.

The best part is the broker offers the best trading apps in India, MO Trader and MO investor that further make it easy to trade and invest in their desired stocks.

So start investment today, by opening a Demat account with the broker. Here is the form for you to get started: