ICICI Direct Option Brokerage

Check All Brokerage Reviews

While trading with ICICI Direct, certain brokerage charges are related to an options trade that can change the game of profit and loss. Hence, today we are going to look at “ICICI Direct Option Brokerage” and will cover all the amounts related to an option order execution.

ICICI Direct Securities is known to offer the lowest and most convenient option trading charges; maybe that’s the reason why the firm is joined by 1.4 million customers till 8 April 2021.

Let’s understand ICICI Direct Charges under the options category!

ICICI Option Brokerage

After an ICICI demat account has been opened, the initial step in activating the derivative or option segment is to submit income proof to the broker along with other necessary documents.

Once activated, you can find a plethora of brokerage plans (such as ICICI Direct Prime Plan, ICICI Direct Neo etc) offered by this full-service stockbroker and can trade in options segments seamlessly.

Here are the different ICICI Direct option brokerage charges under various plans:

| ICICI Option Trading Charges | ||

| Prime Plan | ||

| Plan Value | Brokerage on Options (per lot) | |

| 299 | ₹ 40 | |

| 999 | ₹ 35 | |

| 1999 | ₹ 25 | |

| 2999 | ₹ 20 | |

| Currency options: ₹ 20 per order | ||

| Neo Plan | ||

| Options: ₹ 20 per order | Options: ₹ 20 per order | |

| Currency options: ₹ 20 per order | Currency options: ₹ 20 per order | |

| Prepaid Plan | ||

| Prepaid Card Value (₹ ) | Brokerage on Options (per lot) | |

| 5000 | ₹ 35 | |

| 12,500 | ₹ 30 | |

| 25,000 | ₹ 25 | |

| 50,000 | ₹ 20 | |

| 1,00,000 | ₹ 15 | |

| 1,50,000 | ₹ 10 | |

| Currency options: ₹ 20 per order | Currency options: ₹ 20 per order | |

| I-Secure Plan | ||

| Options- ₹ 95 per contract lot | Currency options: ₹ 20 per order | |

ICICI Direct option brokerage varies from plan to plan. Further, sub-plans are also available in these brokerage plans that are based on your budget. The higher the plan cost, the lower will the brokerage.

Through the broker, you can buy or sell options contracts in currency, commodity, or in the equity segment at pretty nominal prices by choosing the right brokerage plan.

To understand the fees structure let’s take an example:

Mr. Gaurav Bhandari buys 100 shares (10 lots) of a company at ₹100 each under the equity options category. In this first leg, he is required to pay ₹200 (lot size x brokerage i.e. ₹20).

After a while, Mr. Bhandari plans to change his plan to Prepaid one. Now, as per his ₹ 1,50,000 value card plan, here he is only required to pay ₹10 per lot. By the way, feel free to check out the ICICI Direct Prepaid brokerage plan to find what Mr Bhadari was contemplating.

Hence, the total option brokerage will be around ₹100. But, that’s not all! He is charged with a few other taxes and additional costs too!

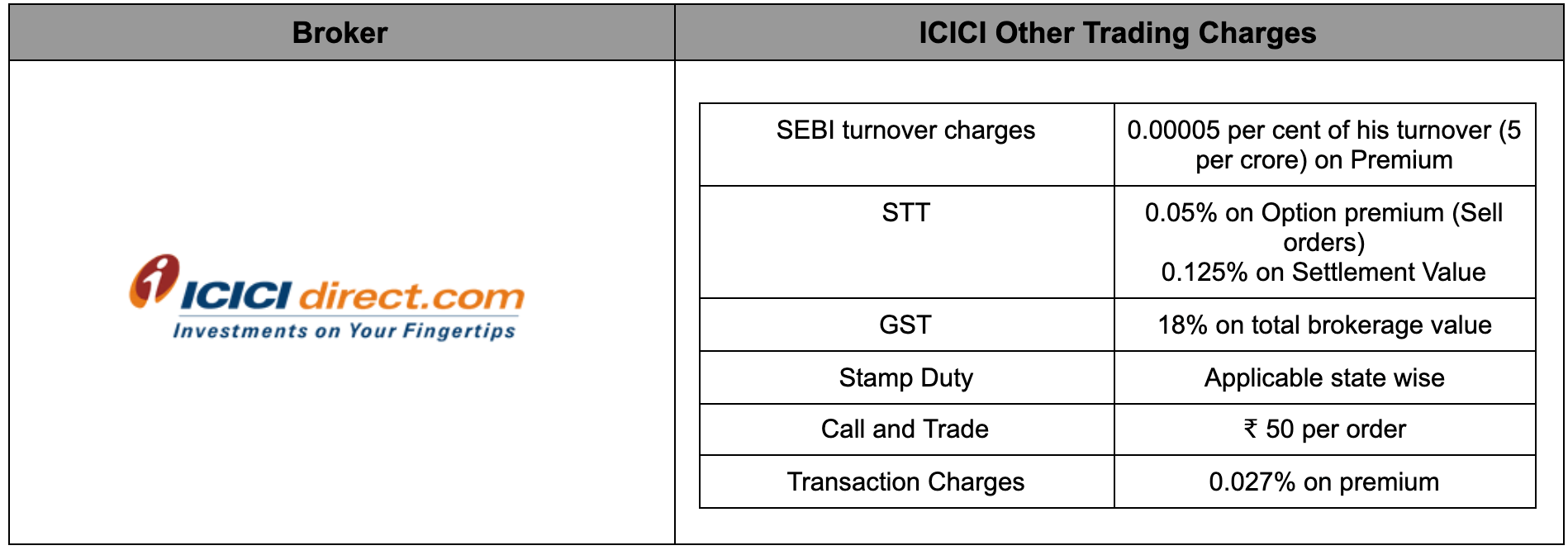

These charges are generally hidden from the trader and investor and a complete list of these charges along with the pricing is shared as below:

Hence, you will be mandatorily required to pay these charges along with ICICI Direct option brokerage.

ICICI Option Calculator

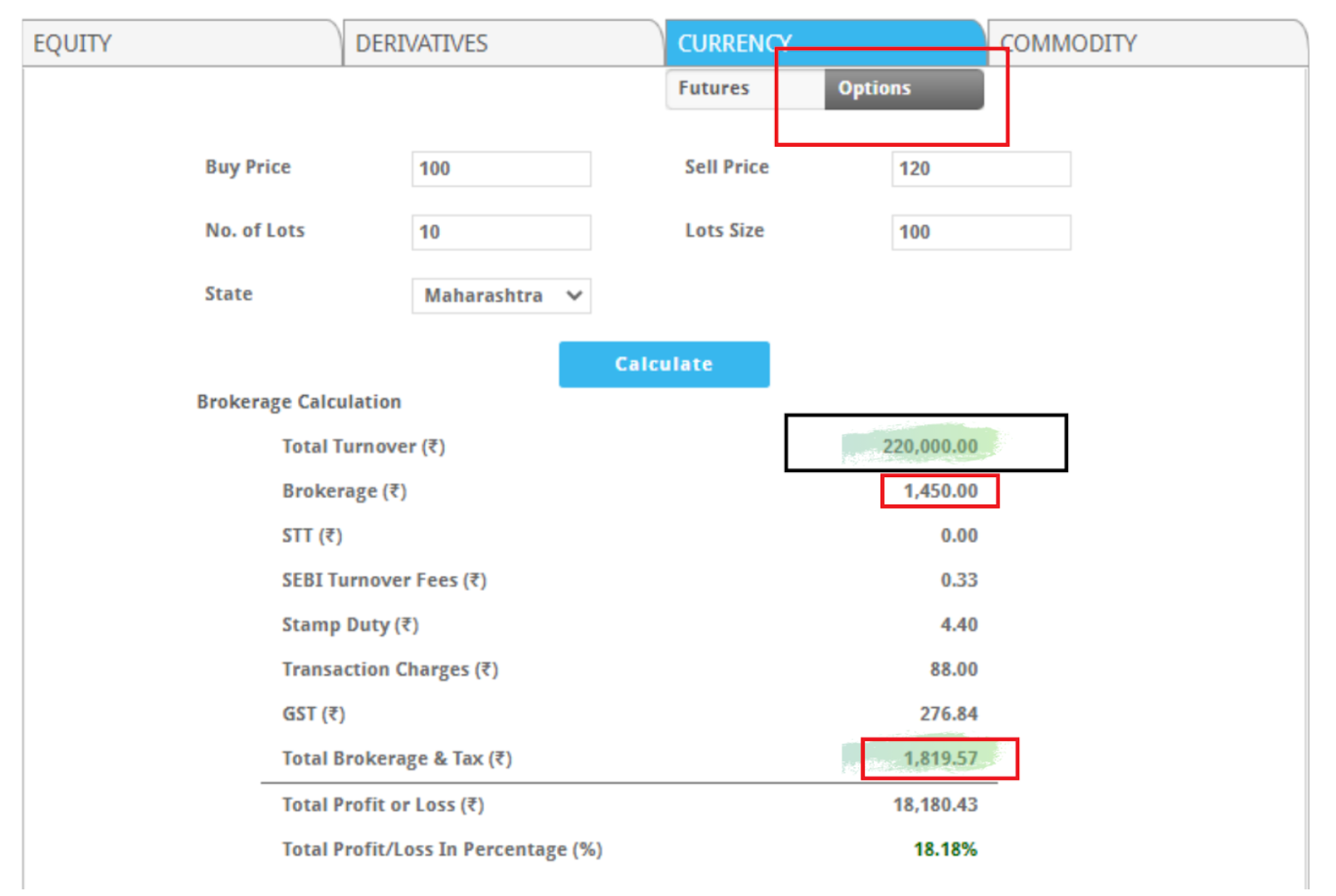

To calculate such miscellaneous charges, an options calculator is really helpful. You can find the option calculator for ICICI Direct at the “A Digital Blogger” website.

Here you can evaluate the exact brokerage plus the profit and loss you can earn by executing a trade in a particular segment.

Let’s have a look at the brokerage calculator.

As you can see, the ICICI brokerage charged on the basis of trade transaction was ₹1,450 but with additional fees and other taxes, the total brokerage the trader ended up paying was ₹1,819.57.

Similarly, you can calculate the brokerage for other segments too.

Closing Thoughts

ICICI Direct allows an options trader to smoothly execute orders through their trading platforms. It’s not just the smoothness that is allowed by the broker, but it also offers various plans with the lowest and cheapest brokerage in options trading.

The lowest ICICI Direct option brokerage is ₹10 per lot; which is significantly attractive.

Found this broker fascinating? Then allow us to open a free Demat account for you: