Groww Charges

Check All Brokerage Reviews

Groww is the new member of the stock market industry that is emerging as a discount broker in India. If you are keen to experience its services then it is important to grab complete information on Groww charges.

There is a lot of talk in the market of Groww being extremely cheap, but is it the reality or not? Let us find out together.

Groww Charges List

Groww is a discount broker and just like any other broker, they also levy numerous charges. How much Groww charges for selling stocks or investing in shares depends on different trading segments.

It is often believed that when you start trading or investing in the stock market, you have to be well versed with the brokerage charges. But, to add to it, it is not enough.

The reason behind this is that there are a lot of charges apart from the brokerage charges that you should know about. Here is the charges list of the broker that we will discuss in this article is as follows.

- Brokerage Charges

- Demat account charges

- Account opening charges

- Account maintenance charges

- STT charges

- DP charges

- Transaction Charges

Some people have doubt if they need to pay some fees for pledging of shares on Groww. Well, we must tell you that traders need not pay any Groww pledge charges but there are some charges levied during unpledging.

Similar to this, you need not pay any Groww withdrawal charges in general. But you are liable to pay some exit load in some cases.

So, let us begin by having a look at the Demat account charges.

Groww Demat Account Charges

Before you start your trading journey, it is very essential that you have a Demat and a trading account. Without these your chances of holding positions in the stock market are bleak.

When you open a Groww Demat account, there are certain fees that you should be aware of. These are as follows.

- Account opening charges

- Account Maintenance Charges

Let us begin by having a look at the opening charges of opening a Demat account with Groww.

Groww Account Opening Charges

When you open a Demat account with a stockbroker, they charge you some account opening charges. Though in today’s time a lot of stockbrokers have ditched that concept and Groww is one of them. There is no Demat account opening charges in Groww.

You also need a trading account when you want to start trading in the stock market. There is no trading account opening charges.

| Groww Account Opening Charges | |

| Demat account opening | Nil |

| Trading account opening | Nil |

Groww AMC Charges

Once you have completed the Groww Account Opening process, you don’t need to pay the account maintenance charges while using this stockbroker

The details of Groww AMC are as follows:

| Groww AMC Charges | |

| AMC Charges | ₹0 |

It is almost fascinating to see that you just have to pay the brokerage and not the AMC charges. Groww is better than other brokers in this context.

For instance, if you focus on Angel One vs Groww broker comparison on the criteria of AMC fees, Angel One levies some amount from the second year onwards. Whereas this is not the case with Groww.

Groww Brokerage Charges

One of the most important and the most talked-about charges is the brokerage charges. Different brokers have different brokerage charges.

The brokerage charges also vary according to the segment that you are trading in. The different segments are intraday, delivery, futures, and options.

Note that there aren’t any Groww quarterly charges levied on traders. But there are small amount of brokerage fee that is charged as per the trading segment.

So if you want to know what is the total brokerage that you will be charged on your trades, given below are the details pertaining to each segment.

Groww Intraday Charges

Intraday trading is one of the most liked segments for traders these days. There are certain charges that broker levies on the intraday trades. The intraday charges levied by Groww are as follows.

| Groww Intraday Charges | |

| Intraday Brokerage Charges | 0.05% of trade or ₹20/- (whichever is lower) |

Groww levies 0.05% or ₹20 per trade for intraday trading. What does it mean? Let’s understand it with an example.

Suppose RAHUL executes an intraday trade amounting to ₹50,000. So the brokerage charges will be,

0.05% of ₹50,000= ₹25

Since in this case ₹25 is greater than the flat ₹20 brokerage, so Rahul, in this case, will be charged ₹20.

On the other hand, if he executed the smaller trade of the turnover value ₹20,000, then

0.05%*20000= ₹10

Since ₹10 is less than ₹20 thus he ends up paying the minimum fees of ₹10.

Groww Equity Delivery Charges

There are different charges for different segments and the case is the same for delivery trading as well. This is the best segment for a beginner in the stock market as he/she can buy and hold the positions and the huge risks are reduced.

The Groww equity delivery charges are as follows.

| Groww Delivery Charges | |

| Delivery Brokerage Charges | 0.05% of trade or ₹20/- (whichever is lower) |

Groww Option Trading Charges

Options is another fascinating arena where the trades place their bets. It is usually a part of currency and commodities segments. Since Groww is not registered with the commodity exchanges, MCX and NCDEX, hence you are not allowed to trade in the commodity segment.

This is where when comparing Groww vs Zerodha, the two discount broker differs from each other.

The details of Groww Option trading charges are given below.

| Groww Options Charges | |

| Equity Options Charges | 0.05% or ₹20 per trade (whichever is lower) |

| Currency Options Charges | ₹20 per order |

Groww Futures Trading Charges

Similar is the case with futures trading charges as well. The currency futures trading charges for Groww are as follows.

| Groww Futures Charges | |

| Equity Futures Charges | 0.05% or ₹20 per trade (whichever is lower) |

| Currency Futures Charges | ₹20 per order |

Seeing the information above, it is concluded that you can trade at the minimal cost of ₹20 per order in derivatives with Groww.

Groww Hidden Charges

Mr. Ramesh opens a Demat account with Groww and executed the delivery trading of ₹80,000 in the Infosys stocks. To his knowledge, he has to pay the flat fees of ₹20 to execute the trade.

But on receiving the contract note he found some additional fees charged on the trade. On going through the information he came across some of the charges like:

- Transaction Charges

- STT charges

- GST

- Stamp duty

He then found that these are some regulatory charges as well, that are levied by the central/state government. These are the general taxes.

If you too remain confused about these charges then have a look at the hidden charges levied by Groww to avoid any confusion while calculating the brokerage and overall profit and loss percentage.

Groww Transaction Charges

Groww in addition to all the other charges also charges transaction charges. These are levied on both sides i.e. while buying and selling of shares and the transaction charges levied by Groww are as follows.

| Groww Transaction Charges | |

| Segments | Charges |

| Equity Delivery | NSE: 0.00345% (both buy and sell) |

| BSE: 0.00345% (both buy and sell) | |

| Equity Intraday | NSE: 0.00345% (both buy and sell) |

| BSE: 0.00345% (both buy and sell) | |

| Equity Futures | NSE: 0.002% |

| Equity Options | NSE: 053% (On Premium) |

| Currency Futures | NSE: 0.002% |

| Currency Options | NSE: 053% (On Premium) |

STT Charges in Groww

STT charges are also levied every time you carry out a trade. These are the taxes that are charged by the state government. The STT charges levied by the broker on their different segments are given below.

| Groww STT Charges | |

| Segments | Charges |

| Equity Delivery | 0.025% (On Sell) |

| Equity Intraday | 0.1% (On Buy & Sell) |

| Equity Futures | 0.01% (On Sell) |

| Equity Options | 0.05% (On Premium) |

| Currency Futures | 0.01% (On Sell) |

| Currency Options | 0.05% (On Premium) |

DP Charges in Groww

As already discussed that the above charges information could be easily found on the contract note. But still, there are charges the information of which is not disclosed in the contract note and thus sometimes might come as a shock.

One of those charges is the depository participant charges or the DP charges. They are usually levied on the sell-side.

The DP charges in Groww are as follows.

| Groww DP Charges | |

| DP Charges | ₹13.5+GST per scrip |

Suppose Rahul buys 100 shares of ₹100 each of an ABC company. He decides to sell 50 of the shares on Monday and the remaining 50 on Tuesday. So the DP Charges that will be levied on him will be, Let us understand this with the help of an example.

Monday (50 shares)= ₹13.5+GST

Tuesday (50 shares)= ₹13.5+GST

So it becomes ₹27+GST.

Rather than this, if he decided to sell the shares all in one day, he would have been charged ₹13.5+GST only.

The DP charges also depend on per trading day and per company. So if you are selling shares of two different companies on the same day, you will be charged the DP twice.

Groww US Stocks Charges

Can we buy US stocks in groww? It is a common question of many Groww users. And they often remain skeptical that they need to pay a heavy amount for investment in the American stock market. But they are completely wrong here.

If you want to invest in the US stocks, you need not pay any charges as Groww doesn’t charge any money for it.

However, you are liable to pay some fees in the form of currency transfer, transaction and account maintenance charges related to your foreign brokerage account. Here is the list of charges:

| USD-INR Exchange Rate | As Applicable by Your Bank |

| Bank Charges on Additional Dollars | As Applicable by Your Bank |

| Withdrawal Charges | $9 per withdraw transaction, charged by US Counterpart Bank |

| Exchange Fee | $0.02 per sell transaction, charged by exchange |

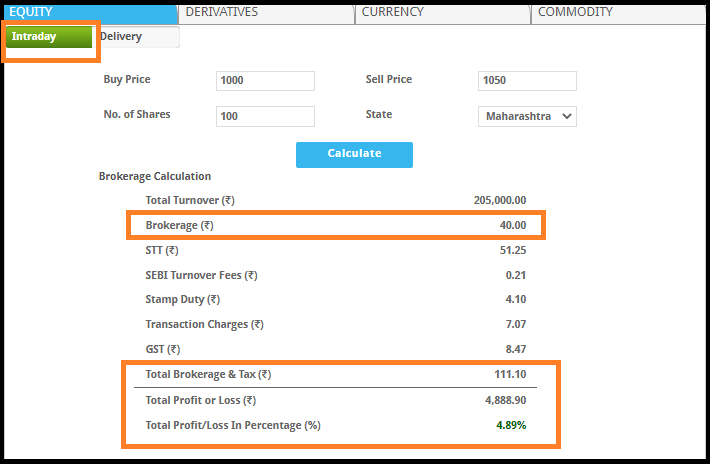

Groww Brokerage Calculator

Sometimes it becomes quite difficult for traders/investors to calculate the appropriate brokerage that they will be charged. What to do in such cases? You can easily refer to the brokerage calculator and calculate the appropriate brokerage for your trade.

Just enter the buy and sell price along with the number of shares. Not only the brokerage, but the calculator helps you in evaluating the total profit and loss you can make with the entire trade.

Groww Mutual Fund Charges

Groww is known for offering mutual fund services to its clients since 2016. Many investors find choose it to invest in the right and profitable mutual fund.

This is not only because of better recommendations and a smooth process for investing in SIP but also because of the zero charges imposed for investing in the MF using its platform.

| Groww Mutual Fund Charges | |

| Mutual Fund Commission | Nil |

Conclusion

If you stumbled upon our article to clear your doubts regarding the discount broker Groww’s charges, then we hope that you were able to find all your answers here.

Now we hope that you will be able to calculate the charges that you have to pay when you start trading in the stock market.

If you want to start your trading journey with Groww, then open a Demat account now.

Want to open a Demat account for FREE!

More on Groww