Groww

List of Stock Brokers Reviews:

These days we often hear of new brokers in the market providing seamless tech-bound features to their investors to trade and earn more profits. One such broker is the Groww.

Today, we’ll present an in-depth Groww review. Let’s start by understanding, what is Groww?

What is Groww?

Groww is a discount broker that was founded in April 2016 by a group of 4 friends Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh in the streets of Bengaluru, Karnataka

The idea was generated in the Flipkart office when these 4 decided to quit their jobs to start a venture to make investing easy. They called it Groww and officially started operations in the year 2017.

Initially, Groww came out to be an investing platform to give its users the best and simplest way to invest securely. Further, the founders analyzed the market and growing demand for trading platforms, Groww registered itself as a stockbroker to facilitate the basic trading features on one platform, in the year 2020.

Recently, Groww has been entitled with a “unicorn” tag for raising funds of about $83 million with the participation of its existing investors who build companies like Flipkart. This fundraising campaign was led by Tiger Global Management.

While as of April 2021, it raised funds up to $140 million with the evaluation of $1 billion. Its parent company Nextbillion technologies however reported a loss of ₹7.92 crores in FY2020 with revenue of ₹ 0.76 crores.

These numbers clearly give an idea about how fundamentally strong this company is. Also, it is crucial to know the records of any organization to understand the level of reliability and sustainability.

As it just started its broking services, we need to understand the segments in which you can trade if you wish to go with Groww.

Registered with CDSL, it is a member of two stock exchanges namely,

Offering you to trade in equity, currency but not in commodity. And as it is a popular investment platform it facilitates the IPOs and Mutual Funds as well.

Also, it facilitates investment in the foreign markets. Out of ignorance, a lot of investors often ask, “Can we buy US stocks in Groww?” Yes, the stockbroker supports investing in the US stock market.

Coming to the active client base of Groww, about 32 complaints were registered out of 7.86 lacs active users. And about 28 of them were resolved so yes, Groww does give pretty decent services to its customers.

Let’s now see the account opening facilities that Groww offers.

Groww Demat Account

We all know in order to start trading one must open a Demat account. Groww offers you a 2 in 1 account opening facility that integrates a trading account with the demat account to make your trade transactions seamless and smooth to execute.

Groww sign up process is completely an online process that doesn’t take more than a few minutes.

Opening a Demat account with the broker gives you an opportunity to trade in equity, currency, mutual funds, and IPO.

Since the broker is not registered with NCDEX and MCX and hence you won’t be able to trade commodities with the broker.

To get into a trade in other segments, you can open a demat account with the broker via an online method.

Groww Demat Account Opening

Since Groww is a new discount broker, it doesn’t have any offline presence as of yet! However, as mentioned earlier you get a trading account with a Demat account. Let’s look into the process of how you can avail the benefits of this platform.

- First, you’ll need to log in to your Groww app or website.

- You’ll find the type: stock Demat account, click on the complete setup

- You may continue by clicking on “open stocks account”

- Further, move on to KYC verification; Enter Aadhaar and PAN details.

- Post which you’ll see a new page in which you’ll be asked to fill in personal and professional details such as name, DOB, occupation, etc.

- In fact, if you have any prior experience of trading, you may mention it in the space provided and proceed by clicking “proceed to next”.

- At this step, you need to upload a clear photo of yourself with your signature.

- Last comes your e-Sign AOF (account opening form), you’ll receive an OTP on the mobile number linked with your aadhaar card. Click on e-Sign AOF.

And thus after clicking on submit you’re good to go!

Groww Charges

Fees that are charged by the brokers are distributed, which means you don’t pay entirely to the brokers, but you are charged for your demat account activation, for the trade transactions you made and for the trade platforms you use, as in the technology charges.

The various charges included to avail the services from any broker are:

- Demat account opening charges

- AMC charges

- Withdrawal Charges

- Brokerage charges

- DP charges

- Transaction charges

Apart from these, investors need to pay Groww penalty charges if they fail to close auto-square off their positions on time. Now, let’s discuss the above listed charges one-by-one.

Groww Demat Account Charges

Let’s begin with the initial step to get into the trade and the fees associated with the same.

To open the demat account with Groww there are two major demat account charges that include:

- Account Opening charges

- Account maintenance charges

Groww Account Opening Charges

Here is a surprise for all the traders, that Groww offers a FREE account opening. Yes! And you have to pay absolutely nothing to get your demat account.

| Groww Account opening Charges | ||

| Account Opening Charges | ₹0 | |

Groww AMC Charges

Now along with the demat account charges, there are AMC fees that are charged on a monthly, quarterly, and yearly basis. Here one must stay aware of the Account maintenance charges especially when comparing brokers to choose the best.

Let’s now jump the fees imposed by Groww. Now similar to the free account opening, the broker does not charge any Account maintenance charges.

This means your AMC that is imposed to keep your Demat account active is for ₹0 per annum.

| Groww Account Maintenance Charges | Groww Account Maintenance Charges | |

| Account Maintenance Charges | ₹0 | |

*The broker keeps on updating their fees plan and therefore it is good to stay updated with the latest charges imposed by Groww to save yourself from paying an extra penny.

Groww Withdrawal Charges

If you are in doubt whether Groww charges any fees for withdrawal of money from account. Well, it doesn’t charge anything. However, if you exit your mutual fund or SIP before certain withdrwal limit. So, investors need to keep a check of it before leaving any investment scheme.

Groww Brokerage Charges

Next comes the brokerage charges that tell you how much brokerage will be charged if you trade in various segments.

Since you can trade in the equity, mutual funds, and IPO segment using the Groww trading app and hence here we are with the complete information of the brokerage imposed to trade in equity delivery, intraday and F&O.

Let us look at them one by one.

Groww Equity Delivery Charges

The first segment is the most common yet prominent one, Equity delivery Trading. The table below shows you the brokerage charges of Groww in delivery trading.

Although not many stockbrokers charge for the same, one such is Zerodha that offers free delivery trading for a lifetime, which is really amazing!

For a better comparison check the complete review of Zerodha vs Groww, as Zerodha is a good benchmark for the discount brokers in the country.

| Groww Equity Delivery Brokerage | Groww Equity Delivery | |

| Equity Delivery | ₹ 20 per order or 0.05% | |

As we move further, next is obviously the famous category- Intraday.

Groww Intraday Charges

For intraday traders, it is mandatory to be aware of these charges for it impacts the amount you get in your pockets at the end of the day.

The intraday brokerage is charged for both buy and sell and hence it is good to choose the stockbroker offering the services at the minimum cost.

| Groww Intraday Brokerage | Groww brokerage Plan | |

| Equity Intraday | ₹ 20 per order or 0.05% | |

Let’s understand these charges with the help of an example:

Suppose Mr. Sharma executed the trade of ₹10,000 where he bought 100 shares of ABC company @₹100 each.

In the middle of the day, he gets the profitable deal when the stock reaches ₹115 and so he decides to sell off the 100 shares thus making the total value of ₹11500.

As already discussed, Intraday or any brokerage is charged for both buy and sell, and thus evaluating the total turnover the trade is ₹21,500.

The intraday trading brokerage would be:

=0.05%*21,500

=₹10.75

If this turnover is around ₹2,10,000 then here 0.05%*2,10,000 would be ₹105 but the broker imposes the maximum fees of ₹20 to trade for each side and hence you would end up paying ₹40 to execute the intraday trade with Groww.

So, if you are opening an account to do intraday trading in Groww app than make sure you understand these charges beforehand.

Groww F&O Charges

Now this section includes three different segments namely, equity, currency, and commodity.

As discussed earlier Groww doesn’t offer trading in commodities but to trade in the Equity Futures and Option is ₹20 or 0.05% per trade while for the Currency Futures & Options the broker imposes the flat fees of ₹20.

| Groww Futures and Options Charges | Groww Margin Facility | |||

| Trading Segments | Futures | Options | ||

| Equity Trading | ₹ 20 per order or 0.05% | ₹ 20 per order or 0.05% | ||

| Currency Trading | ₹ 20 per order | ₹ 20 per order | ||

| Commodity Trading | NA | NA | ||

DP Charges in Groww

Now DP charges are hidden, these are made on all the sell transactions that you do while trading. Groww takes ₹13.5 plus GST per scrip as the depository participant charges.

| Groww DP Charges | Groww DP Charges | |

| DP Charges | ₹13.5+ GST per scrip | |

Groww Transaction Charges

Groww levies a certain amount of exchange transaction charges and securities transaction tax for buying or selling of shares.

Also, the broker imposes stamp duty, investor protection fund trust charge, demat transaction charges, etc. However, there is no question of Groww payment gateway charges as there are none.

The details for transaction charges are given below.

| Equity | Futures & Options | |||||

| Intraday | Delivery | Futures | Options | |||

| Exchange Transaction Charges | NSE:0.00325% BSE: 0.00375% (Buy/Sell) | NSE:0.00325% BSE: 0.00375% (Buy/Sell) | NSE:0.0019% BSE:0.00% (Buy/Sell) | NSE:0.05% BSE:0.0375% (Buy/Sell) | ||

| STT (Securities Transaction Tax) | 0.025% (Sell) | 0.1% (Buy/Sell) | 0.0125% (Sell) | 0.0625% on Premium (Sell) | ||

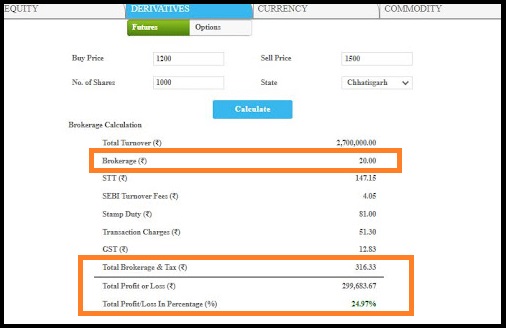

Groww Brokerage Calculator

Along with the trading charges, one needs to pay certain taxes and other hidden fees, which increase the total brokerage and reduce the profit percentage. To get a clear understanding of all those charges it is important to calculate all those taxes as well.

No doubt! it is little difficult for any trader or investor to calculate the exact brokerage fees and therefore here is the calculator that helps you to find the net brokerage and other taxes associated with your trade and turnover value.

Groww Margin

Looking for a high margin is always an Intraday Trader thing!. Low brokerage charges and high margin is deadly combo that anyone looks for.

| Groww Margin Facility | Groww Margin Facility | |

| Equity Delivery | - | |

| Equity Intraday | Up to 5X (based on stocks) | |

| Equity Futures | - | |

| Equity Options | 1.5X to 2X on selling | |

| Currency Futures | - | |

| Currency options | 1.5X to 2X on selling | |

From the table, you can see that Groww only offers margin in 3 segments of trading, Equity Intraday, Equity options and Currency options.

In intraday, you get up to 5X of margin based on the stocks. A huge margin increases the potential of earning maximum profits.

We can understand with the help of an example.

Ms. Julie is an Intraday trader. Let us assume she picked a stock of ABC company. With the share price of ₹100 per share. She has ₹10000 in her account.

The share price increased to ₹115, so her profit would be limited to ₹1500. On the other hand, let’s say, she avails 5X margin, so,

Her trading amount increased to ₹50000. Here her profit would be:

= (115*500)-(100*500)

=57500-50000

= ₹7500

Hope this concept is now clear for all.

Further, comes the platforms, after all, we’ve been looking at the charges so far but what about the platform that gives you the facility of trading?

Want to avail better margin and trading facility. you can explore it now by doing a comparative analysis of Groww with other stockbrokers. Here is the one for you, Groww vs Upstox. Know which broker provides more benefits and open an account online now.

Groww App

For now, Groww has just one mobile app for trading along with the web-based trading platform called Groww.

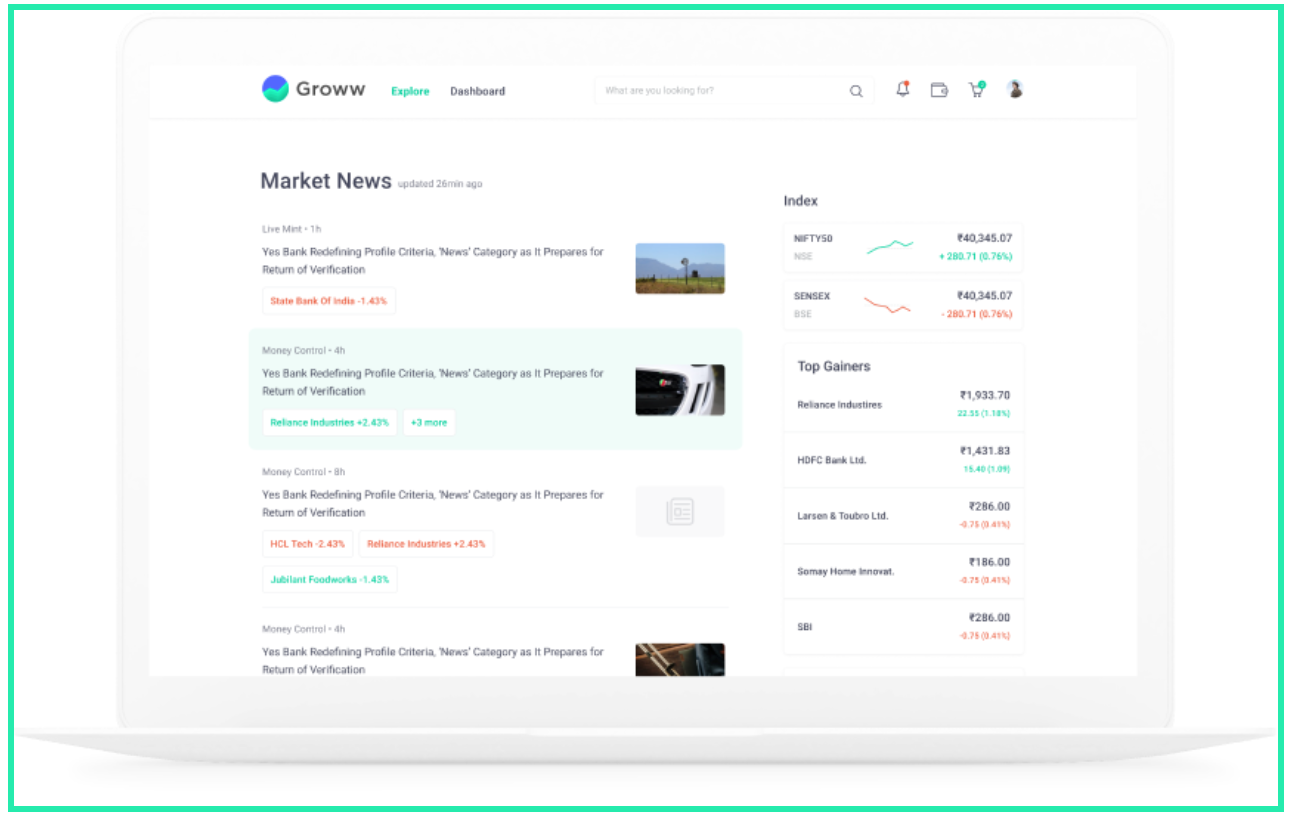

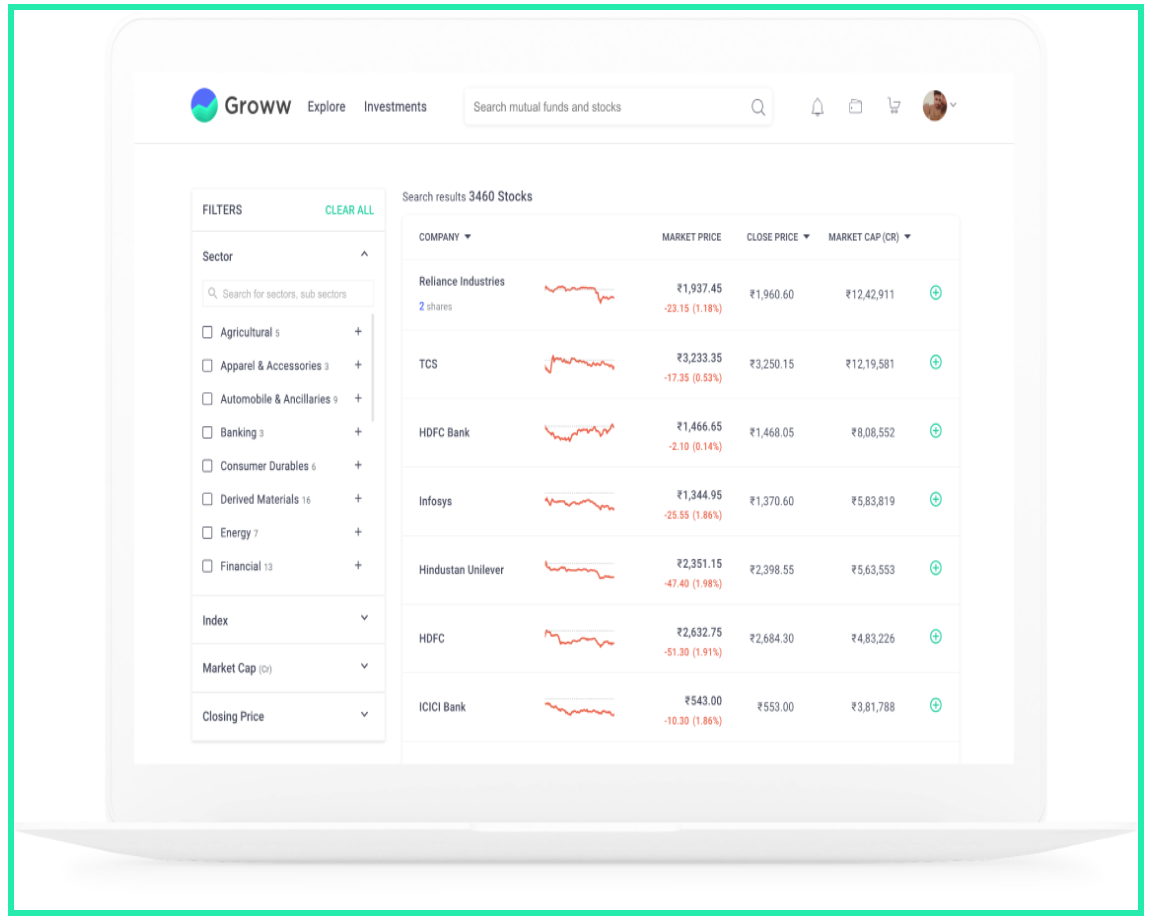

A convenient trading platform is one that offers a user-friendly interface with multiple features and options to trade such as multiple indicators and charts to see real-time updates making it easy to manage the watchlist and maintain the portfolio.

The overall rating of the app is 4.3 out of 5 with about 1 crore plus downloads as seen in the table below:

| Groww App | Groww Margin Facility | |

| No. of Installs | 1cr + | |

| Mobile App Size | 35MB | |

| No. of Charts | 3 | |

| No. of Indicators | 50+ | |

| Rating |  | |

First of all, Groww has a clean interface having “One-click order placement” facilitating quicker trade transactions to avoid the hustle and miss the profit-making opportunity.

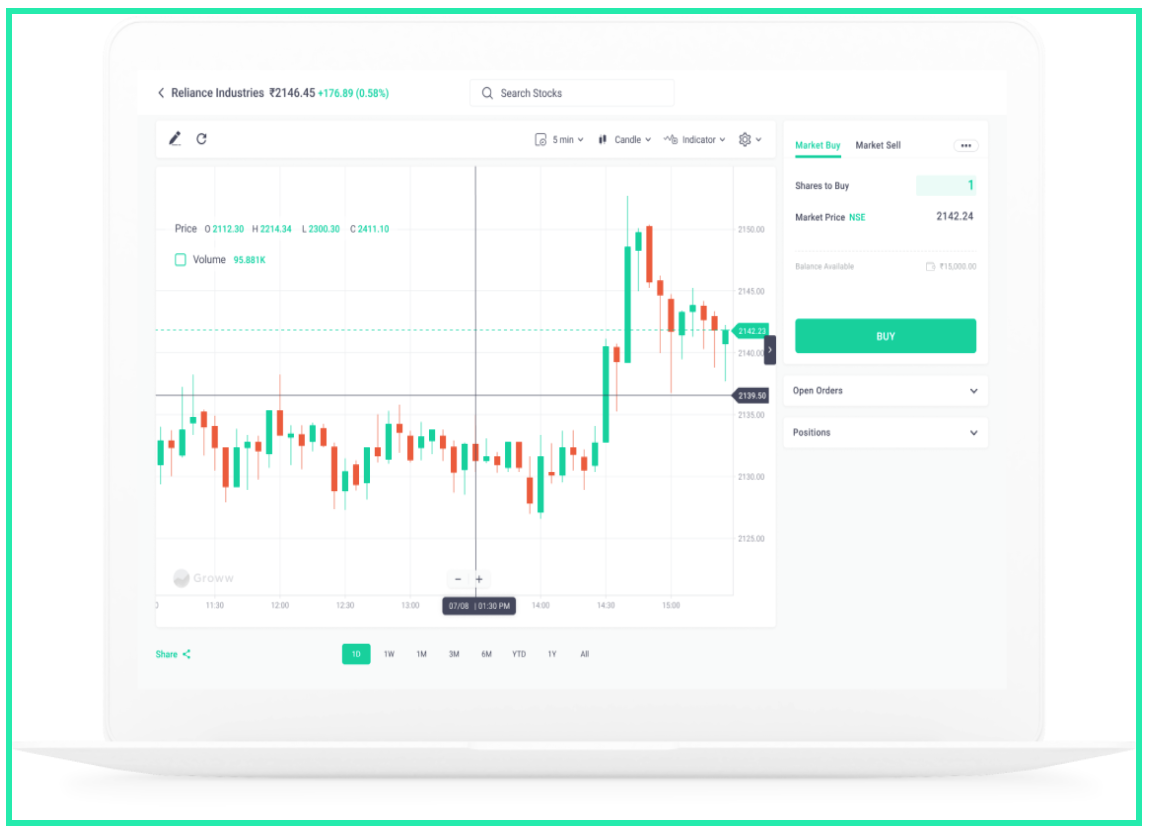

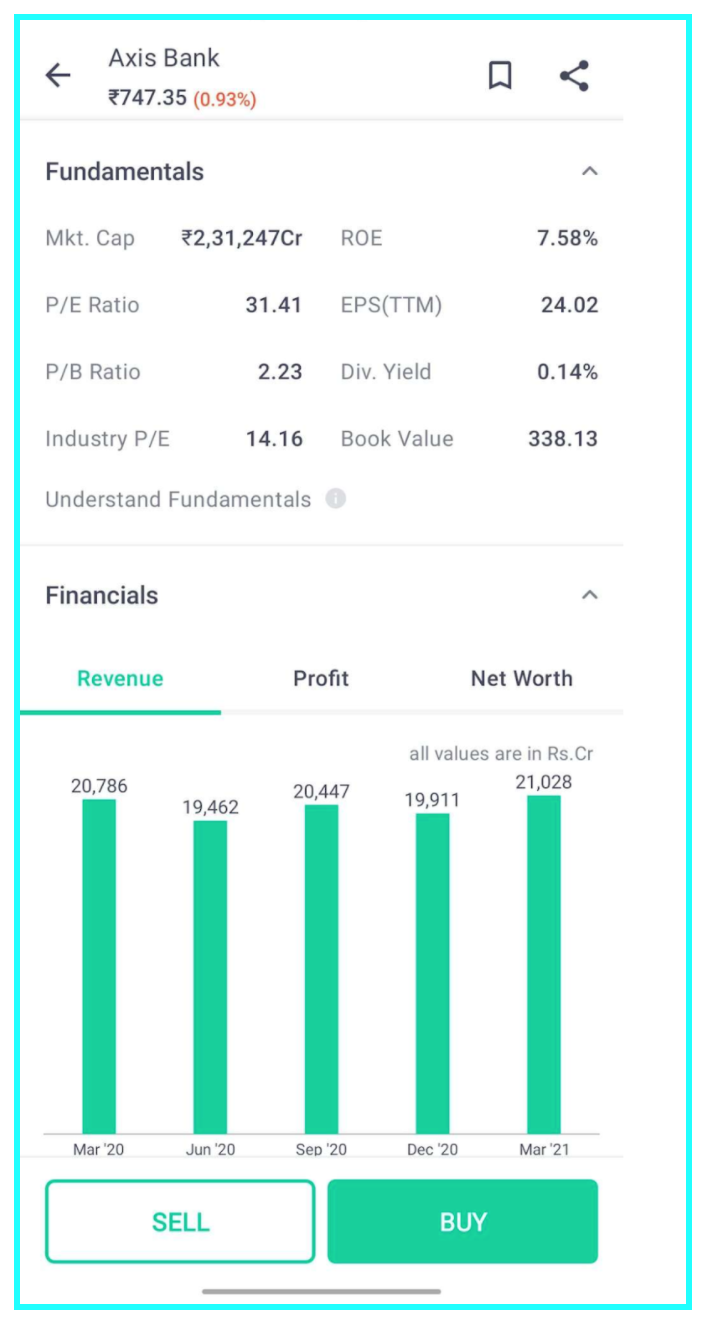

It gives you fundamental information on all listed companies with candlestick charts to provide a better insight of the trend and historical performance of the stock.

Groww gives you updates on top movers of the market with the latest market news so you never have to miss out on any important information.

You also get P&L statements with the balance sheets and other financial reports in one place to make informed decisions.

Technical Charts are also available in dark mode to give you a better experience in your analysis of the stocks. With the filter option, you can discover the next multibaggers.

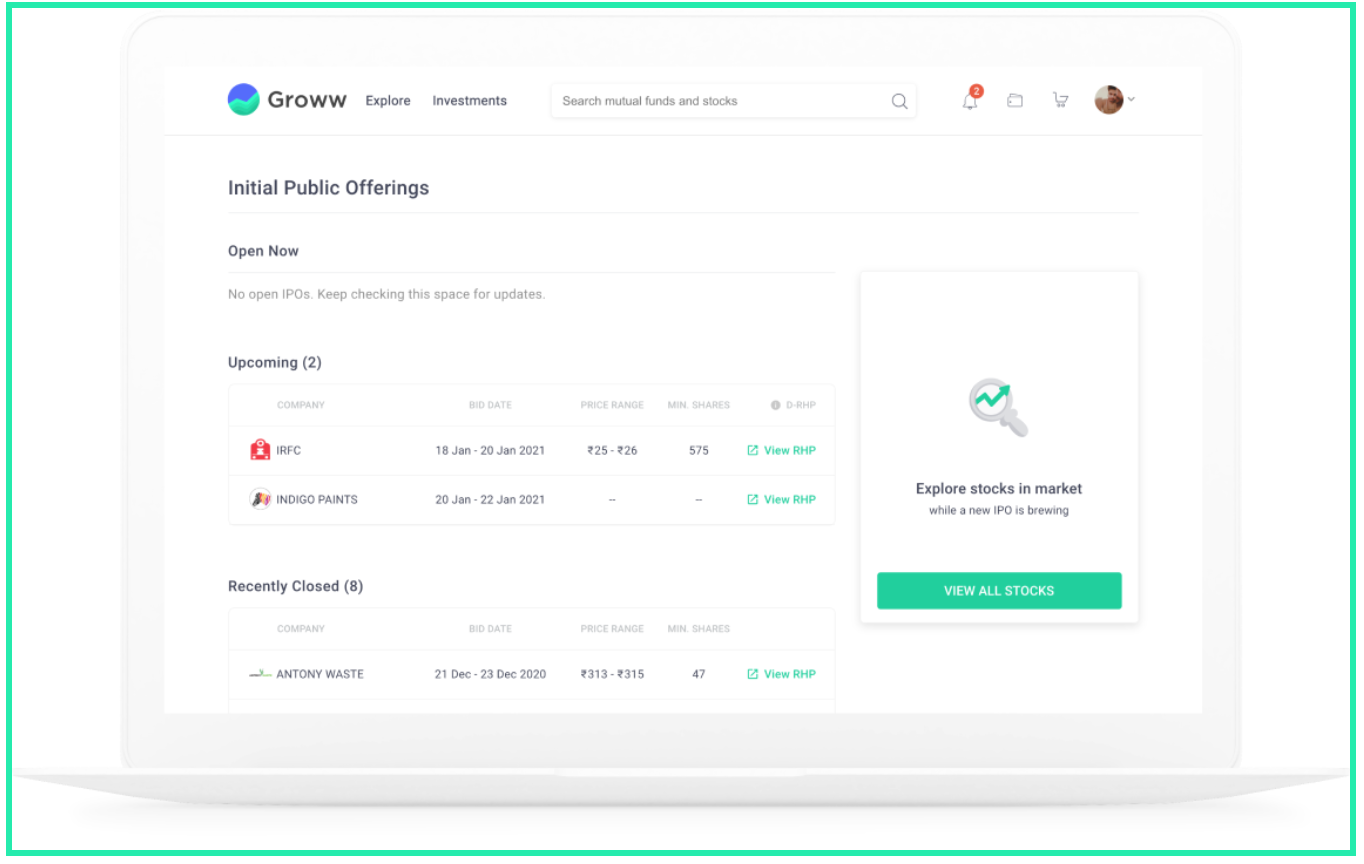

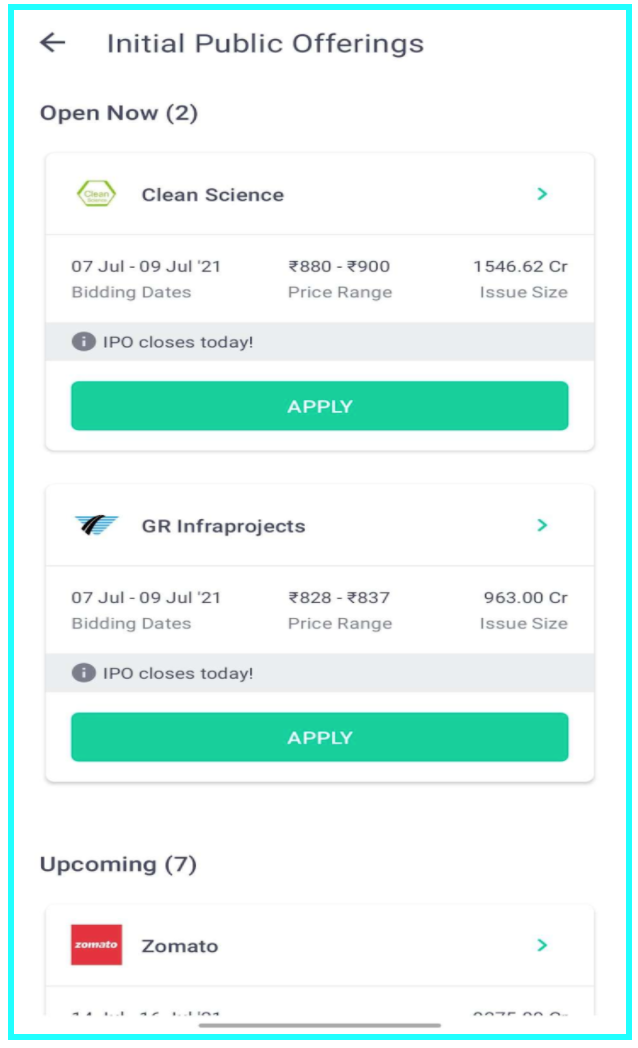

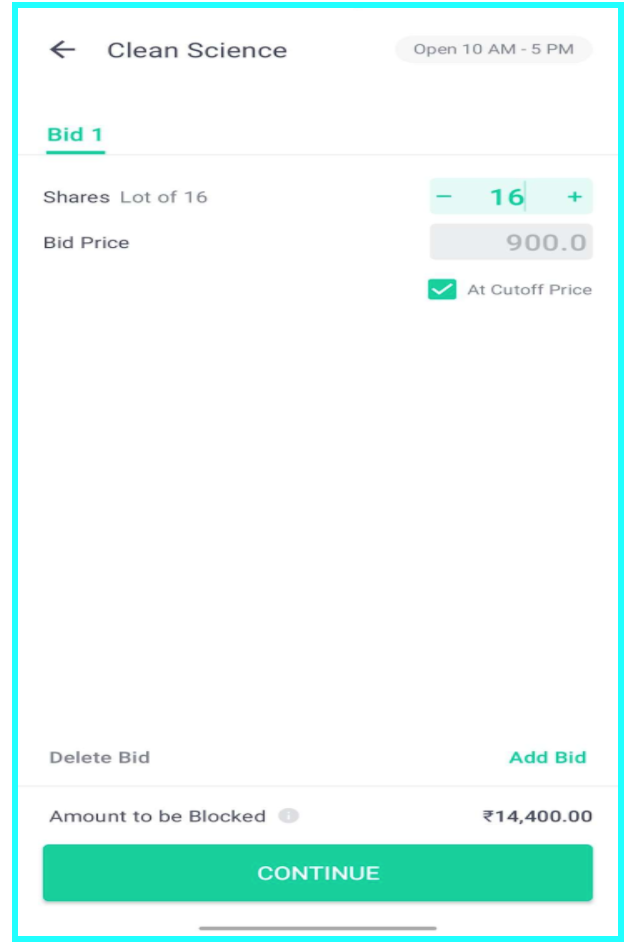

Along with trading, you can use the app to apply for the IPO in a few clicks. The complete information of the issue size, bid price, and lot size are provided to you that is helpful to you in subscribing for any of the Initial Public Offerings.

Along with all these features, you also get a transparent and secured platform to invest in digital gold that you can buy and sell anytime.

Also, the broker offers guest demo services. So, any beginner who is confused about how to use a trading platform can also opt for a guest demo where you get a guest login where you can try backtest your analysis and observations to learn about the fundamentals and technicality.

Once you’re ready to invest your actual capital you can happily switch to your main account and start trading.

Is Groww App Safe?

Even the broker offers the simplest UI for trading and investment to its stockbroker, yet it is important to ensure the safety of the app. One way to ensure the security of the app is to set a strong password. Other than this, it is important for every investor to keep the login credentials to themselves and not share any of those even with the broker.

Next comes the parameters like registration of the broker, complaint percentage, etc. How complaint percentage regarding the app usage and security generally raises the question of its reliability.

But looking at the data of Groww, there are no such registered complaints and also traders and investors using the app have provided a 4.5 ratings and 4.4 rating on Play Store and App store respectively.

How to invest in Groww App?

After talking about the features let’s get into the process of how to start trading with the Groww app.

Now Groww app helps you to trade across different segments in a seamless manner. Not only one can trade in stocks but can make the best use of the trading app to apply for the IPO.

The trading app is where traders and investors buy and sell stocks. Now here your trading account linked with your bank account comes into play. And the process id simple:

After you have opened your account with Groww

- Login to your trading account

- Choose the share you want to buy or sell.

This depends on your fundamental and technical analysis as per your trading needs.

If you’re looking for a long-term investment, then definitely you can look for fundamentally strong stocks, perhaps even do peer comparison.

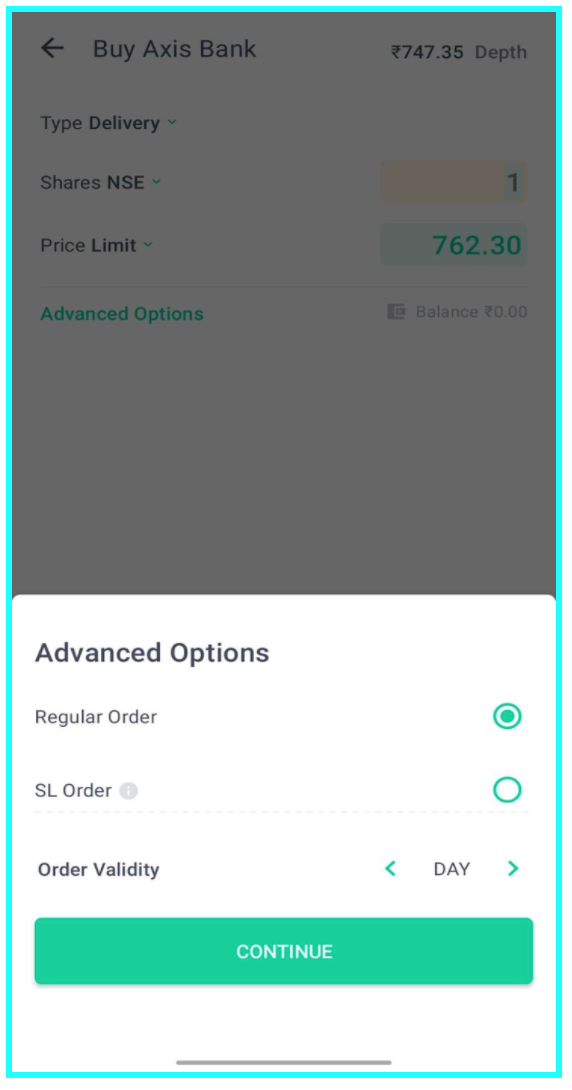

- After selecting the stock at the bottom of the page you’ll find a buy and sell option, you can click on buy and your order details page will open.

- You can then enter your price and as you can see in the image below, you may even click on advance order, under which you see various options that you may use as per your trading goal and needs.

- Mention the price at which you wish to place an order (buy or sell)

- Your order will be executed depending upon the availability of the buyer or seller in the market.

- Finally, complete the transaction.

Please note that before you place an order you need to ensure you have enough funds in your account to buy stocks or shares to sell.

Apart from the long-term investors, you can trade in different scrips in a few clicks. For this, it is good to do a proper and in-depth technical analysis of stocks.

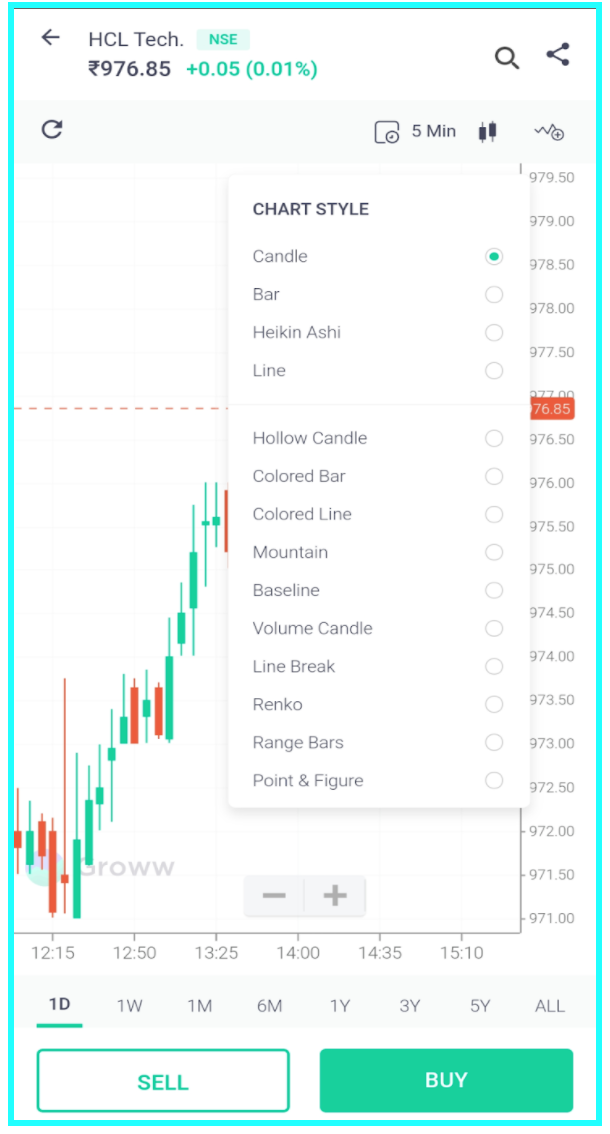

To make it convenient the Groww app offers you 14 charts and 100+ indicators for in-depth technical analysis so that you can make great buy or sell decisions to make your pockets heavy.

As you may see in the image below, you’ll see different chart styles such as the candlestick chart that helps you with in-depth technical analysis of the current market price, letting you evaluate the trend and temporary reversals to make entry and exit accordingly.

Not just that these charts when used with certain indicators will help you in identifying future buying and selling opportunities boosting profit earning potentials.

| Groww Margin Facility | Groww Margin Facility | |

| Number of Charts | 14 | |

| Number of indicators | 100+ | |

How to Apply in IPO in Groww?

Initial Public Offerings bring in a better opportunity for beginners and other investors to grab better returns on their investment. To apply for the IPO, you can simply log in to the app and proceed to fill the application using the ASBA method.

- To book your slot, you would need to login to your Groww app, type IPO in the search box, choose “Looking for recent IPOs from the results.

- On the page, you’ll find a list of new IPOs and Upcoming IPOs.

- Choose yours and click on Apply.

- Place your bid price, and hence your lot is booked.

- In this process, if you’ve applied for shares worth ₹100000 in IPO, the amount gets blocked in your bank account itself.

- After shares are allotted, the amount is debited from the account, and the balance is released. Further, it takes about a week to get listed in the stock exchange for trading.

How to Delete Account in Groww App?

If you are unsatisfied with the broker services then you can easily close your Demat account using the app. Just log in to the app and download the form PDF by clicking on the ‘Help & Support’ button.

Since the broker only offers the offline process to close the Demat services, hence you have to download the form, fill it and send it via courier to the headquarter. It usually takes 5-7 business days to deactivate the account.

Just make sure you enter all the details correctly and fill in the request to transfer your holdings before closing the account.

Want to close the Demat account, click here to download the form.

Groww Refer and Earn

Apart from all the trading and investment services, Groww also comes with its referral program where one can make additional money by referring Groww services to its client.

To use this service, one must do at least one trade or investment using the Groww trading platform. After this, click on the referral link provided in the app and share with your friends or contacts who are willing to invest in the share market.

On successful sign up of your friend using your referral link, you will get the instant cash directly in your bank account.

Groww Customer Care Support

It is also important to know what importance the company gives to its customers. The Customer Management System is thus crucial to establish a healthy relationship with the client that indeed helps in retention and gaining more loyal customers over the period.

As per the number of active clients we discussed earlier, we can analyze that a satisfactory customer support service is provided by Groww.

Although no offline branches are available for customers to reach, there is still a toll-free number and a support email that you can use regarding your queries. A chat box is also provided on the website where you can directly raise tickets and get your issues solved.

| Groww Customer Care Support | Groww DP Charges | |

| Customer Support Channel | Available? | |

| Chatbox/text | Yes | |

| Phone/Call | Yes | |

| Yes | ||

Do We Recommend Groww?

Finally, we can say that Groww overall is a decent trading platform and is perfectly compatible for beginners.

It is usually preferred by millennials who find trading and investing a fascinating way to earn profits and get more returns. These newbies get attracted to free account opening and account maintenance charges. Also, Groww BTST charges are nil which attract them in large numbers.

Often they forget to notice the limited features for technical analysis, not many charts are available as of yet. Although as a discount broker it does not offer any research ideas and tips, for such traders some research and advisory tools would be beneficial. Maybe a paid one!

Other than this, Groww further will need to add some Algo-Trading platforms with the growing demand and competition if it has to sustain itself in the market.

A few concerns were observed:

- The app interface lags with increasing trade volume.

- A new version has resulted in many technical glitches.

Happy Investing!

In case you need any assistance whatsoever, just fill in the details below and we will be getting in touch with you: