Options Trading Example

All Option Strategies

Whenever people hear option trading, there is a sense of fear that comes along. It is often seen and observed that the traders are scared of options trading because the concepts are usually not clear. Let us make it easier by understanding through options trading example.

Options trading or derivative segment, in general, is a quite popular and widely used option in India. If you want to understand options in a very simple term, it is an agreement between two traders who have absolutely different sentiments regarding the market.

There is a stark difference between Option trading vs Stock trading and you will get to realize this, once you get into the further details of this review.

To understand this even further, let’s take an example.

During the month of June-July, India usually sees a heavy downpour in the majority of parts. Wondering why we are talking about this here? Don’t worry, you will soon see a connection.

Now, early in the morning, the weather was cloudy so Hunar was confused about whether he should carry an umbrella or not. He checked the weather forecast but seeing how the monsoon is, he found it very difficult to rely on. So, what should he do?

Not able to come to a conclusion, he made a pros and cons list.

Advantage:

If it rains, he will be protected from drenching and thus falling ill.

Disadvantage:

There is a constant responsibility and extra luggage that he has to carry everywhere.

So now he has to make a choice, based on which his benefits and disadvantages will get impacted.

This is exactly how options function, you get into an agreement and decide to buy/sell at a particular price and at a particular point in time.

You have a right to execute your order but it is not an obligation. So, this means that the one with a stronger sentiment, who has given the premium can also leave the agreement.

There are two option trading ways available for different market sentiments, call option and put option. Let us understand these with the help of examples in the further segments of the article.

Call Option Example

As already discussed in the beginning, options trading generally comes with a contract where the buyer or seller gets the right but not obligation to execute the trade.

To get the right one party has to pay the premium amount.

Now when it comes to the call option, here the buyer pays the premium and thus gets the right to exercise the contract or not.

Still not clear?

Let’s make it understandable with the help of the options trading example.

Investing in real estate comes with risk as you need to invest a large amount with getting the assurance of whether or not your investment proves to be profitable.

But what if you get the option of making a buying decision in the future at the price fixed by you today.

Wouldn’t it be amazing?

To get that fair deal, Sakshi entered into a contract with Nikhil to buy the plot.

Here, Sakshi is quite bullish with the price as she came across the news that the government is planning for the adventure park near the plot that would eventually increase its price, but at the same time does not want to take the risk.

So what she actually did?

She paid the premium of ₹1,00,000 on the basis of the current evaluation of the plot which is ₹1 Cr.

So, similar to the above options trading example, the call option works in the derivative market. Here the buyers are bullish and are ready to take the risk by paying the premium amount to the option seller.

The risk proves to be fruitful if the trend goes in the favor of Sakshi and the price of the plot increases in the future.

The option seller on the other hand makes the best profit by earning maximum with the premium amount if the trend consolidates or reverses.

Confused?

Well, going back to the above example, where Sakshi (call option buyer) paid the upfront (premium in the options trade) if the price of the plot does not increase, then Sakshi exits the deal and thus Nikhil (call option seller) would be able to make the profit of ₹1,00,000.

So, the call or put option is actually a zero-sum game where either of the two parties involved is able to make a profit on or before the expiry date.

In an option contract, the one who pays the premium has the right to leave the contract whenever he/she feels that the situation is not going in their favor.

In that case, the loss which the buyer will bear will just be of the premium.

You can either buy or sell(usually known as writing the option) the options. Let us understand it better with some options trading examples.

Call Option Buy Example

Call option buyer is the one who is bullish for the particular stock and enters the contract by paying the premium amount.

Now considering the above-given options trading example of Sakshi and Nikhil, let us understand the call option buy example.

Sakshi is bullish regarding the whole scenario as she potentially believes that there will be an adventure park constructed near that plot which will gain the attraction of a lot of tourists.

In this case, she bought a call option by giving ₹1,00,000 upfront fees, which is the premium.

Note- When somebody buys a call option, the buyer here gives the premium thus has a right to leave the contract whenever he wishes to.

The market price of the plot currently is ₹1 crores and the deal between Sakshi and Nikhil is set at this price.

Now, on the date of expiry, the price goes up to ₹1.5 crores. This has worked in Sakshi’s favor and she can ask Nikhil to deliver him the land at the predefined price i.e. 1 crore.

But the question here is how much money is Sakshi gaining?

She purchased the plot for ₹50 lakhs and gave ₹1,00,000 (non-refundable) fees

Total expense- ₹1.01 crore.

The open market price for the plot is ₹1.5 crore, so in all, she made ₹49 lakh extra, which is a win-win deal for her.

This is the case when Sakshi bought the call option and the market ended much higher.

But what if the open market ends at ₹1 crore? Will she execute the order in such a case?

Well evaluating the total cost here, she had to pay the amount of the plot i.e. 1 crore plus 1 lakh premium she paid in the beginning of the deal.

Thus, she would be a loss and hence not execute the deal, suffering the overall loss of ₹1 lakh.

And same is the case when the market moves bearish.

Similarly, in the case of the stock market, when a trader is buying the call option, he will execute the option only when the stock prices go up.

If not, then he will have to bear the loss of the premium amount and leave.

Call Option Sell Example

The one who is selling the call option like the one Nikhil in the above options trading example is called the Call Option writer.

They generally predict the market movement opposite to what the Option buyer has thought of.

They enter the contract only with the objective of making a profit with a premium.

Thus, the one person in the option call contract who is bearish regarding the whole market scenario is the call writer.

He receives the premium and does not have the right to leave the contract whenever he wants to.

Let us bring Sakshi and Nikhil into the picture again. As we saw in the example, Sakshi is giving Nikhil an upfront fee of ₹1,00,000 and asking him to sell her the plot at the same price after 8 months if the market goes in her favor.

If the market prices increase up to ₹1.5cr, then it is quite clear that Sakshi will execute the trade as she will be in profit, but if the market ends lower, say at ₹90 lakhs by the end of 8 months then what?

In this case, the call writer (Nikhil in this case) will benefit from the contract. Since he was bearish and the market moved in his direction, he will make a profit from the premium i.e. ₹1 lakh.

Similarly in the case when the market ends flat, or at the same price, the writer will make a profit in this case as well, since the buyer will not execute the option and the writer will get the premium.

Put Option Example

When entering the stock market, everyone assumes that one can make a profit only when the trend is bullish.

But what if you come across the fact that the bearish or downtrend in the market can also give you enough opportunity to end up trading in your favor.

Options trading gives you that opportunity. To make it a little more simple, let us understand this with the help of an options trading example.

Geetansh is a farmer who has a paddy(rice) field. He always monitors the weather conditions just to be on the safer side. Going by the same way he figured out that the country will receive good rains this year.

This in turn will definitely boost the production of good quality and ample rice crops. The increased supply will cause the prices of rice to slip down. This leaves Geetansh with sleepless nights as he tries to figure out a solution.

Now he meets Mohit who is a wholesale dealer, and he tells Geetansh how he is sure that the prices of rice will soar this season. Now Geetansh gets an idea and convinces him to get into a deal with him.

Geetansh proposes that Mohit has to buy the rice from him at ₹5000/Quintal, no matter what the market price will be. Mohit finds it a sweet deal and agrees. Now, to be on the safe side, Geetansh gives ₹500 to Mohit so that the deal stays intact and he can minimize his losses.

Now the upfront ₹500, in this case, is the premium amount. Since Geetansh who is a seller has given the premium in this case, he has the right to withdraw from the deal before the expiry.

This is an example of a put option. In the put option, the seller is bearish and therefore wants a deal in which he/she can sell the product at a higher price even when the market value is less.

So, if the market moves downwards, Geetansh will benefit, otherwise, Mohit will take the gains.

Let us now see, how when Geetansh and Mohit enter a put contract they gain from the market.

Buying a Put Option Example

Now just like in the call option, you can buy the put option as well. Now in the case of buying a put option, the seller who is actually paying the premium becomes the buyer of the put option.

Let us take the above options trading example again. So Geetansh is giving Mohit ₹500 so that Mohit purchases the rice at ₹5,000/Quintal irrespective of the market cost, in this case, Geetansh is the buyer of the put option.

So, what happens if the cost of the laptop decreases? In that case, Geetansh will benefit as he sold the product at a higher cost. Let us assume that the cost of rice now is ₹4,000/Quintal. So the profit of Geetansh will be 5,000-4,000= 1,000. He gave an upfront fee of 500, so the total profit will be ₹500.

The put option buyer benefits only when the market is going down and matching with the bearish sentiments of the buyer.

Just like this, in the case of the stock market as well, if a trader is speculating that a stock whose current price is ₹100, can decrease in the future, he/she can buy a put option and get into a contract with another trader who has a bullish sentiment.

Now, let us say that you pay a premium of ₹5 to buy a put option, so now if the market in the future goes from ₹100-₹80, the buyer will benefit as he will execute the order at ₹100 which was decided on the option contract.

Selling a Put Option Example

Just like buying a put option, you can also sell a put option. The catch here is, since the buyer is receiving the premium, in the case of the put option, the buyer serves as the seller.

So, let us reconsider the case of Geetansh and Mohit, now let us say that the actual price of rice now increases and becomes ₹6,000. What will happen in this case?

In general market conditions, Mohit will benefit as he will get the rice to produce for ₹5,000. The put option buyer, that is Geetansh will not only lose the extra money but also the upfront fees that he paid.

But here is a catch, since he has paid the upfront fee, he has the option to just bear the loss of the upfront fees and back off from the deal. So in this case, he will lose ₹500.

A similar thing happens in put option trading as well. If the market increases, then the put option buyer gets the premium amount and the seller does not execute the order.

This is the way in which put options work in the share market.

How to Trade Options Example?

Now that you know the option trading basics and how popular they have become, the question here is how to trade options?

To begin your trading journey in the derivatives segment, you require a demat account with an activated derivative segment.

There are some stockbrokers which give you a pre-activated derivatives segment as well but in some cases, it can be a charged facility as well.

You can trade-in options either through your stockbroker or using the various trading platforms. For this it is good to pick the stockbroker offering the best app for option trading.

In India, you get a wide number of securities to trade in options.

To trade in options properly, it is very essential that you have the apt knowledge and strategies so that you can minimize your losses.

There are various option trading strategies, some of which are bull call spread, bull put spread, long straddle, short straddle, etc.

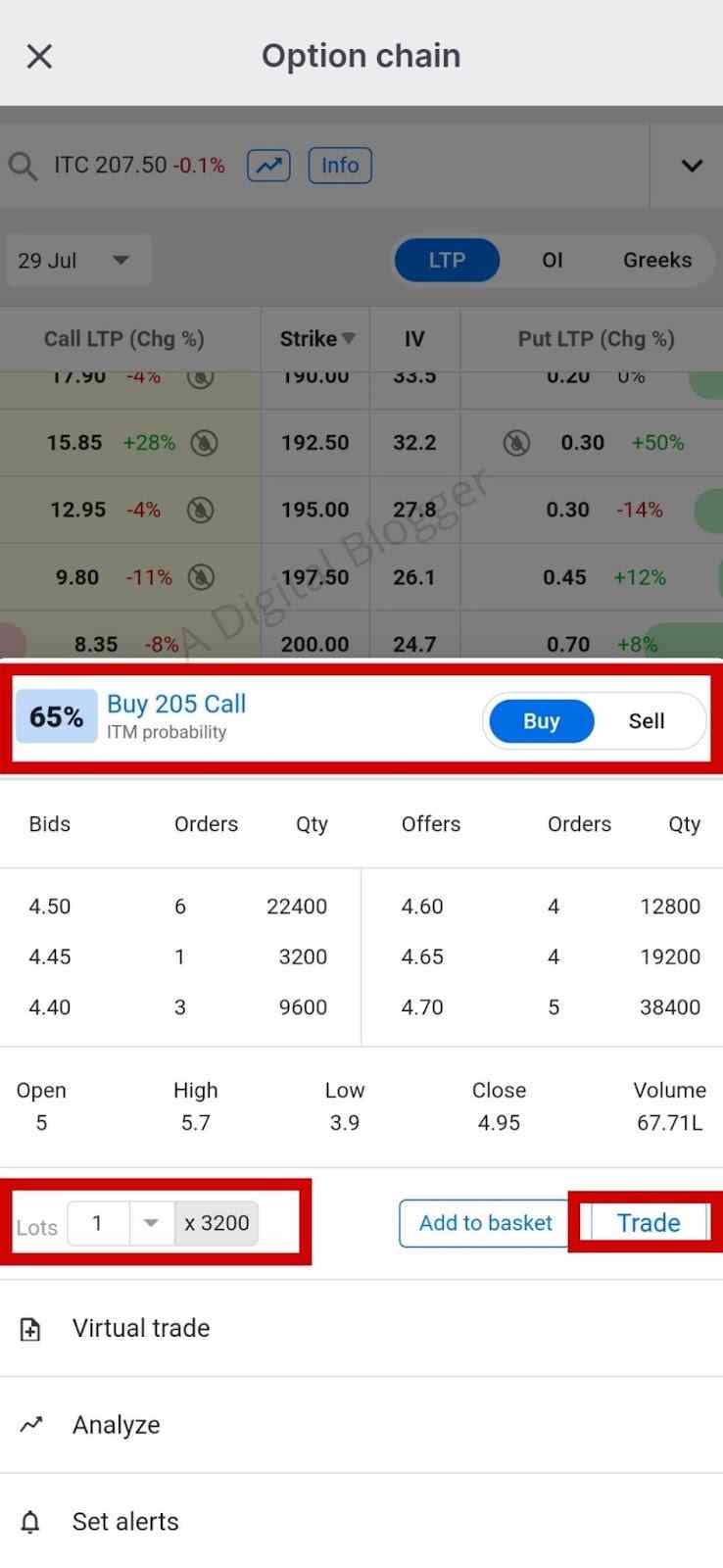

Now to understand how to trade in options let’s take an example of trading options in Zerodha.

Let us say that you have a Demat account with Zerodha, you will have to activate your derivatives segment.

Once you are done with that, you need to select the option that you want to trade in, and with the strike price that suits you.

The CE represents the call option and PE represents the put option. The options ladder consists of the strike price in the center, call option on the left and put on the right.

Once you have selected that on your analysis of the options ladder, click on the ‘buy’, enter the number of lots, your type of order and trading style and click proceed. In this way, you can easily trade in options on different trading platforms.

Conclusion

Options trading can be a tricky business to understand and also execute, so it is always useful to connect it with real-life examples so that you can understand it properly.

If the right option trading strategies are used, it can reap great results. We hope that you were able to understand the option trading with the help of the above examples.

If in case you need any assistance in going ahead from this explained options trading example, feel free to put in your details below and we will get in touch with you: