Open Interest in Options

Did you think of starting to trade options but took a step back because of the complexities associated with options trading? Let us understand the open interest in options so that you can understand options and option chain a little better.

There was a rush outside the ground on Friday afternoon. People were hurdling and were very excited.

But why? What was it that attracted people’s attention?

Well! The rush is for the ‘Diwali Bumper Festival Offer’ where the vendors have put up their stalls representing their state’s culture.

On the first day, there were 20 stalls. So, there were 20 open positions for shoppers on day 1.

On the first day, almost all the stalls saw a good footfall except Madhya Pradesh and Kerala were a little less appreciated.

The excitement of the people thus went down in no time.

Analyzing the least interest of people in their goods and services, two MP and Kerala vendors decided to quit the festival as they did not see a profit out of it.

So, now the open shops for the shoppers are 18.

As the footfall started to decrease on day 3, there were more exits and there was a reduction in the shopping chances for the vendors.

Now, what do you think, how this example is related to the options contract and options analysis?

The number of shops opened or operational in the festival is actually related to the open interest value of the options contract.

Let us now understand the open interest for options in detail in the upcoming sections.

Let’s get started!

What is Open Interest in Option?

What is open interest in options? If this question has been lingering in your mind as well, then don’t worry because you will have all your answers here.

When we talk about open interest in option definition, it is simply the number of open option contracts in the derivatives market. Or simply saying, the contracts which have not been settled.

To give a general idea, let us quickly understand how options contracts generally function and how are they created in the market. Whenever a buyer enters a market, he will definitely need a seller corresponding to him.

In this way, whenever a new buyer or seller enters the market, they create one contract. This contract will remain open, till the time it is not executed or settled.

The number of these open positions is the open interest in options. Whenever a buyer or a seller decides to exit a contract, the open interest decreases by one.

Seems to be confusing, considering the above example, so here the number of stalls was 20 on the first day.

Right?

Now seeing the least interest of people in the stalls selling the traditional and cultural items of Madhya Pradesh and Kerala, these two exits the second day.

But at the same time, seeing the heavy demand for goods in Gujarat stalls, they increased their stall number by one.

Thus the total number of open stalls was reduced to 18 but due to one more entry, it was 19 by the end of the second day.

Thus, the number of stalls represented by a particular state depicts its demand among people.

Similarly, open interest is very useful and it provides more relevant data when it comes to the derivatives market.

If the open interest is increasing, it signifies that there is more money flowing in the market as more buyers and sellers are entering the market.

Similarly, when the open interest is decreasing, it means that money is flowing out of the market.

Thus, it wouldn’t be wrong to say that open interest in options can give you a fair and better idea of how the options market is functioning and about the flow of the money.

Wouldn’t it be clearer if we understood open interest options with an example?

So, let’s dive in!

What is Open Interest in Options with Example

To understand what is open interest in options better, it is important that we decode it with the help of an example.

Last Friday, Sharukh Khan’s new movie was released and there was a huge rush outside the theatre.

People were eagerly waiting outside the theatre to grab a ticket.

There are 200 seats in the theatre. So as of now, there are 200 tickets, that is 200 open positions. Slowly each individual grabbed a ticket and eventually the open positions also decreased.

So, the open seats are the open interest in options. Let us now understand this with another example.

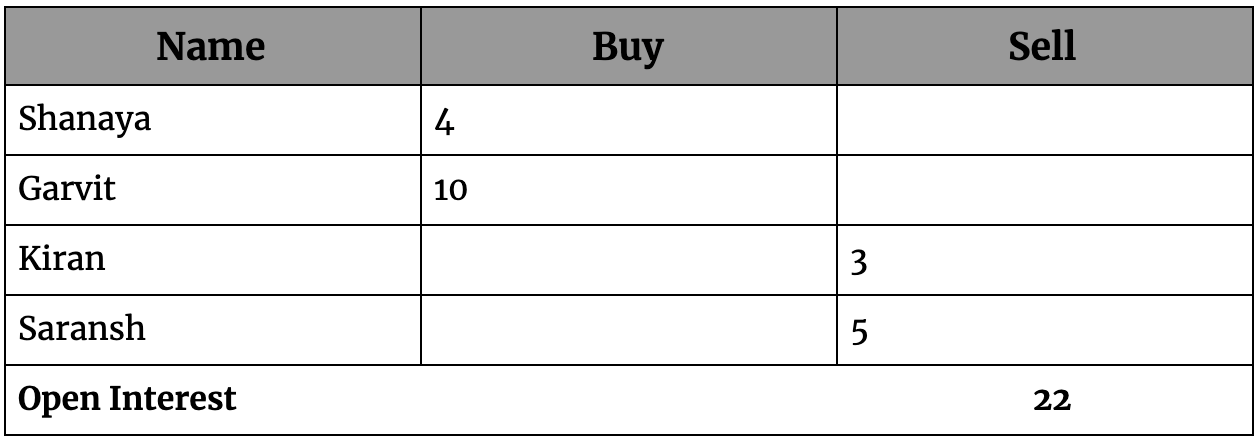

There are 4 traders in the market. Shanaya, Garvit, Kiran and Saransh. They enter the market and held some positions.

Shanaya bought 4 contracts, Garvit bought 10 contracts, Kiran sold 3 contracts and Saransh sold 5 contracts.

The open interest, in this case, becomes 22 as there are 22 new positions being created in the market.

If Shanaya decides to execute 4 contracts, then the open interest will drop by 4 and become 18.

Open interest can be a good indicator for deciding the market trends and confirming the sentiments of the market.

Before understanding how it affects the overall market and how to make decisions based on it, let us first try to understand how open interest is calculated!

How is Open Interest Calculated?

When you know how to calculate the open interest, you can ease your way in analyzing the market and thus make good trading decisions.

When you want to calculate the open interest, you just have to add all the open positions and the new contracts.

Whenever there will be a new buyer or seller in the market, the open interest will change and add up.

For example, if there are 2 traders entering the market A and B. They both bought 4 contracts each.

The open interest, in this case, is 8. The next day C also entered the market and sold 5 contracts. The open interest now is 8 plus the 5 new positions, that is, 13.

On the other hand, whenever a position gets settled, the open interest decreases.

In this simple way, you can calculate the open interest and then further your analysis.

So if A & B exercise their contract the open interest decreases to 5.

Open Interest vs Volume

A lot of traders usually get confused between trading volume and open interest and then do not make the right decision. It is very important to understand the basic differences between open interest and volume to proceed.

Stock market volume refers to the total number of transactions that take place in a given period.

So, it is the number of option contracts that are traded in that time frame.

Stock market volume can be a great indicator to figure out what is happening in the market.

If the volume is high in the market, it shows that there is high liquidity in the market. This gives traders a chance to increase their probability of execution.

On the other hand, if the volume is low, it shows low liquidity.

When we talk about open interest in options, it is the number of open contracts and not the total number of traded contracts.

The open contract only changes when there is a new position in the market.

Let us understand the difference between volume and open interest with the help of an example.

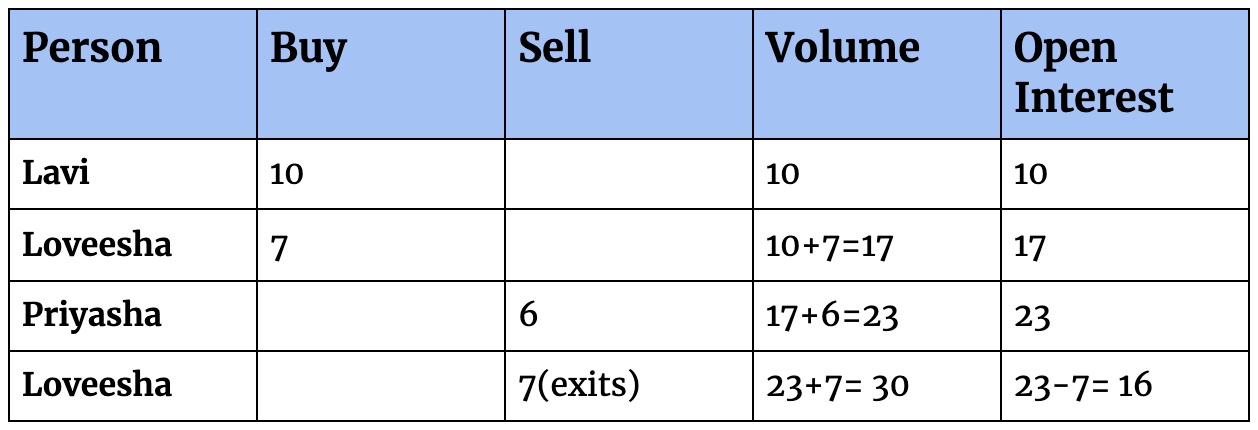

There are three traders entering the market, Lavi, Loveesha, and Priyasha. The following situations define their trade.

- Lavi bought 10 contracts, that is, she went long on 10 option contracts.

- Loveesha bought 7 option contracts.

- Priyasha goes short and sells 6 option contracts.

- Later Loveesha exits her 7 option contracts.

So, let us see how the volume and open interest change accordingly.

So, whenever a new trading day begins, the trading value is kept at zero and then changes according to the trades that take place during that time.

In the case of open interest, it will change only when there is a new position in the market or a previous one is closed.

Now that we are aware of the difference between open interest and volume, let us have a look at how and why the open interest changes.

What is Change in Open Interest?

It is very essential to keep an eye on the change that occurs in the open interest because it can help the traders make the right decision at the right time.

Let us have a look at the situations in which the open interest for options might change.

- Every time a new position is created in the market. When a new seller and a buyer enter the market and open a position, the open interest adds up by one.

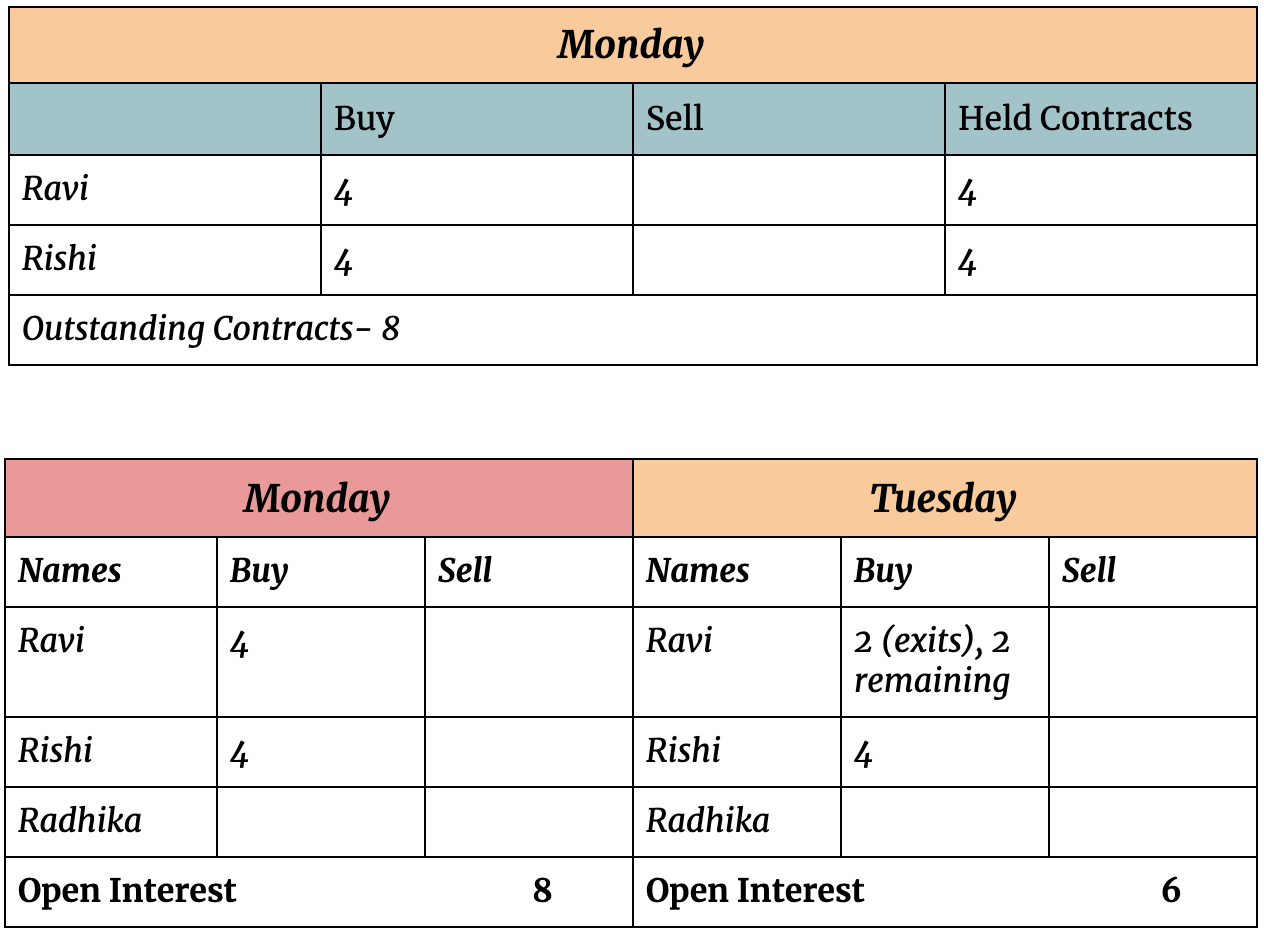

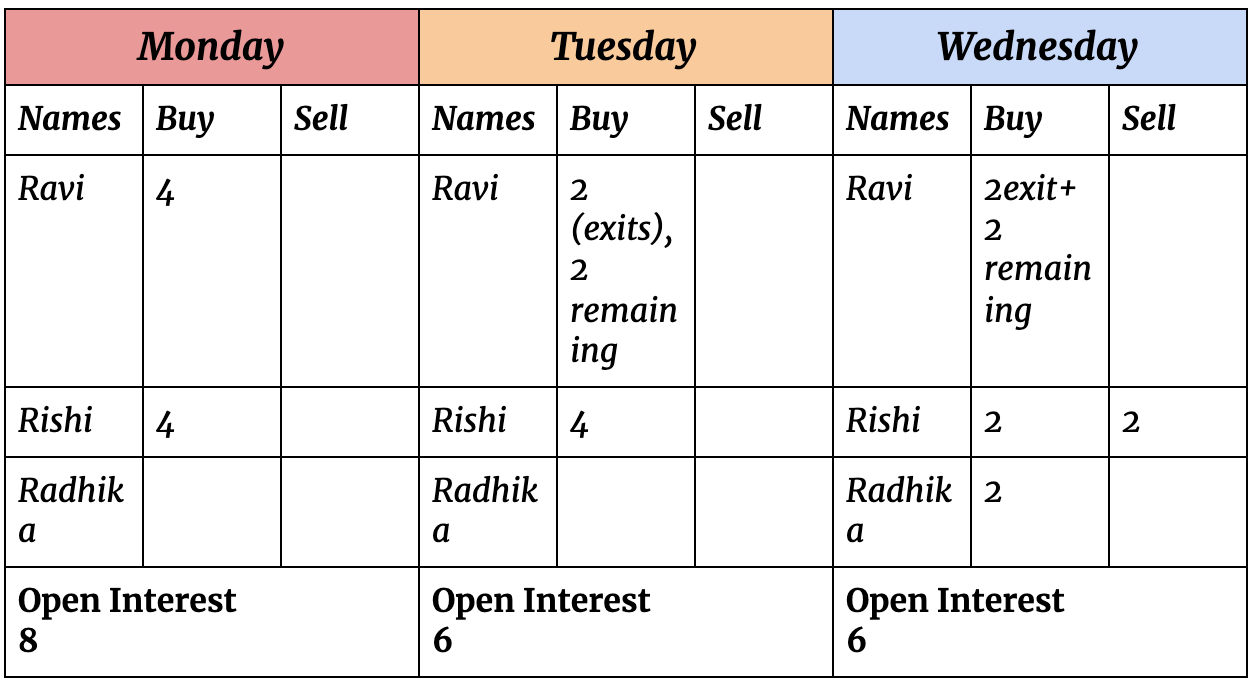

For example, if Ravi and Rishi buy 4 contracts each on Monday, they are creating 8 open positions, thus 8 is the open interest.

- When a contract is settled, the open interest reduces by one.

If on Tuesday Ravi now decides to exit his 2 contracts, the open interest will decrease by 2 and become 6.

- In the case when there is just transfer of contracts and not executing, the open interest remains the same.

If on Wednesday Rishi chooses to go short on his 2 positions and Radhika takes over, the open interest will still remain 6.

High Open Interest

So, what does open interest indicate? Open interest usually indicates the interest of the traders in the market. It also gives a surety that the trend that you are going with is a strong one.

What if the open interest is high in the market? If the open interest is high in the market, and along with it the price is also high, then it is a signal that there is money coming into the market.

There are more open positions being created and that there are a lot of traders who are now interested in the asset. It indicates that the market is going in the right and positive direction.

Low Open Interest Option

Just like an increase in open interest, the open interest can also decrease. If you see a decrease in the open interest that means that the interest of traders for that particular asset is decreasing.

The money is basically moving out of the market. If the price and open interest both are decreasing, then that means that there is a bearish trend ongoing in the market.

Open Interest Analysis

Now that we know what open interest means, how it changes and why it changes.

Let us have a quick look at how it is analyzed.

Let us first look at how an open interest analysis can benefit traders.

- It helps in identifying the market trends.

- It gives a better idea of the options activity in the market.

- It can significantly also tell you about the trend reversals.

- Shows the increasing and decreasing interest of the traders for that particular asset.

The open interest when analyzed alone cannot give you potential and good signals. So to get the best out of open interest analysis, you can analyze it with the help of volume and price.

Let us first have a quick look at the open interest and volume analysis.

Open Interest and Volume Analysis

In the earlier segment of this article, we talked about the relationship between volume and open interest. Let us now have a look at how they both influence each other.

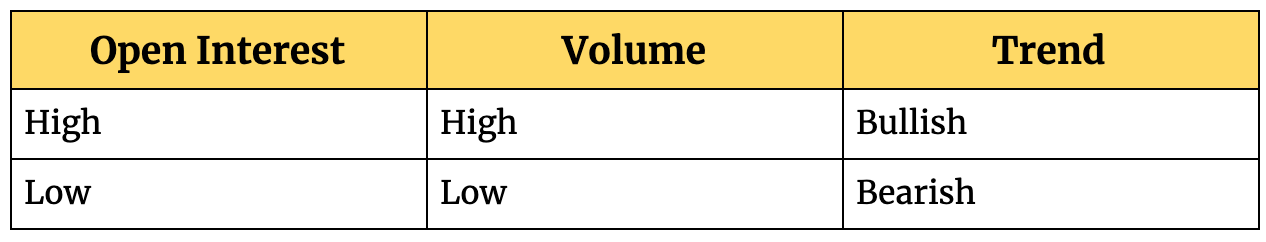

- If the open interest and volume both are increasing, this means that the market is bullish.

- If the open interest is decreasing and the volume is also decreasing, it gives a bearish signal.

Price Volume Open Interest Analysis

There is also another analysis that can be done to find the proper signal from the open interest analysis.

The price action plays an important role when it comes to not just options trading but also all other types of trading as well.

The increase in price also signifies a proportionate increase in demand as well.

There can be some situations in which you can analyze the price action, volume, and open interest to find the significant signals in the market.

- If the volume is increasing, the open interest is also increasing, and simultaneously the prices are also on an uphill, this gives a strong bullish signal in the market.

The reason being the increased interest, also the demand, and more money flowing in the market.

- If the open interest is decreasing, the price is increasing, then the market is bearish.

- The increase in open interest, the decrease in price, then also the market is significantly weak.

- If all the open interest, prices, and volume are decreasing, then the market is bearish but the trend can reverse if the selling stops.

In this simple way, you can easily analyze the market using open interest and efficiently carry out your options trading.

Significance of Open Interest in Options

Now that we have significantly understood the open interest and the aspects related to it, the question is how is open interest beneficial?

Let us now have a quick look at the significance of open interest in options.

- If the open interest is used in the right way, it is very beneficial in finding the right bullish and bearish signals. Many traders consider it as an open interest indicator and manage to do efficient trades.

- The analysis of open interest can also help a trader choose a stock with high interest and the one which is more active.

With this, you can make great profits in the derivatives market as well.

Conclusion

Open interest in options can be a great source when you are looking to trade-in options.

Its number of open or outstanding contracts, not only helps you to know the most active stock but also with analysis, the right bullish and bearish signals as well.

We hope that your doubts regarding open interest are now sorted and you can make great profits in options trading.