Open Interest Analysis

All Option Strategies

Kabir is an ardent admirer of the stock market and lately, the derivatives segment has his full attention. So now he started looking at the option chain but got confused when he saw OI written there and wondered how this number can affect his trading and wanted to know all about Open Interest Analysis.

Are you also stuck like Kabir? Then relax because we will take this confusion away from you!

Open interest analysis is a way that Kabir and you as a trader can use to identify market trends, and as an indicator to make your trading decisions. But the question here is, how?

So, it has been out of no one’s notice that open interest is used by a lot of traders to strengthen their market sentiments. Before diving deep into the option open interest analysis, it is very essential for you to know what open interest means.

So, let’s begin!

Open Interest In Options

If we have to simply define what open interest in options trading is, why not take the example of tic tac toe? Remember playing this game when you used to apply all your mind in putting the cross and zero at the right place?

You used to draw zeros and crosses at the empty spaces. And as there were more figures drawn, the spaces were filled. So here, the empty spaces represent the open interest, i.e, the spaces which are still outstanding and willing to get filled.

Open interest in options is the number of outstanding option contracts in the market. As soon as new buyers and sellers enter the market, the open interest increases by one.

On the other hand, when a position or a contract is executed, the OI decreases by one.

So, when the options open interest is simplified, it can give the traders the right opportunity to identify the market trends.

So, now let us dive into the open interest analysis in options.

How to Analyse Open Interest?

So, how to analyze open interest? As we saw earlier, that open interest can give the traders the right signals for their trading decisions. Whenever there is a change that occurs in the open interest, the market trend also changes significantly.

But, what causes this change, and how is open interest calculated, how will you analyze this change in options? Let us have a look.

Change in Open Interest Analysis

There are certain situations in which the open interest changes. Let us understand this with the help of a quick example. Raghav, Sachin, and Arun enter the market.

- Condition 1

Raghav buys 10 option contracts, Sachin sells 5 option contracts. Now, there are new positions being created in the market as they both enter the market. In this case, the open interest is 15.

So, whenever a new buyer or seller enters the market, there are new positions created in the market. Thus, in this case, the open interest increases by one.

- Condition 2

Now, Sachin decides that he wants to exit from his 3 contracts. This means that he wants to transfer his positions.

Arun comes into the market and takes these 3 contracts from him. In this case, the option contract remains the same, that is, 15.

In this case, there are no new positions being created in the market. There is merely a transfer of positions, therefore the open interest remains the same. So, whenever such a situation arises, the open interest remains constant.

- Condition 3

Raghav wants to execute his 4 contracts and they get executed. Now there are 4 outstanding positions which are closed now. So what will happen to the open interest?

The open interest, in this case, will decrease by 4. It will now be 11.

So when the contracts get executed in the market, the open interest decreases.

So, these are the three conditions in which the open interest in options changes.

Open Interest and Volume Analysis

In order to understand the option open interest analysis, it is also very important that the relationship between open interest and volume is also understood.

So, if you are also confused let us first understand the open interest vs volume and see that differences exist between them.

Volume, generally speaking, is the total number of trades that are carried in a span of a certain time.

For example, if Raghav buys 10 contracts and Arun sells 20 contracts, then the volume, in this case, will be 30, that is the number of transactions that happened.

Open interest, on the other hand, indicates the number of outstanding contracts in the market.

Volume plays an important role in analyzing the open interest. When a new trading day begins, the volume is usually set at zero but this is not the case with open interest.

It changes when there is an addition or removal of a contract.

Usually, the open interest is higher than volume, but if one day the volume is higher than the open interest. This means that there has been something sudden in the market which has caused excessive buying and selling.

The changing volume and open interest can give significant signals in the market. Let us see, how!

- When the open interest is high and the volume is also increasing, then that gives a strong bullish signal.

This means that there are more and more people interested in that position, thus attracting the capital as well.

- When the open interest and volume both are decreasing, then it is a bearish signal.

Just like the relationship between open interest and volume, open interest cannot be analyzed without analyzing the price action.

Let us have a look at the change that happens in the open interest because of the fluctuation in price and volume.

Price Volume Open Interest Analysis

Let us now have a quick look at the option open interest analysis with respect to price and volume.

To clear the concept, let’s take you directly to the cricket stadium first. Shall we?

Let’s suppose that on a particular week two matches are scheduled, the first between India and Australia followed by the match between India and Afghanistan.

Now, what do you interpret?

Will the same number of people reach to watch the match?

Of course not!

The popularity of the team says a lot about this number. Thus, it helps the organizer to plan seat numbers and further the price of the ticket.

So, what do you think between these two matches which match attracted more audience?

The answer is although clear, that India vs Australia would gain more reach as compared to India and Afghanistan.

But wait!

Why are we discussing this here?

Considering the above example and relating it with open interest says a lot about the Open Interest and Volume of the trade.

Here the number of seats available depicts the open interest which could change depending upon the kind of match and team.

So here, India vs Australia expects high reach and hence more seats would be available, hence one can say more open positions or contracts i.e. Open Interest.

On the other hand, the number of spectators actually reaching to view the match defines the volume.

Now the value of open interest and volume eventually defines the price or premium of the contract.

Thus, a large audience reached in India vs Australia match and thus the price of the ticket would be comparatively higher than the one between India and Afghanistan.

So, let us now look at the price volume open interest analysis.

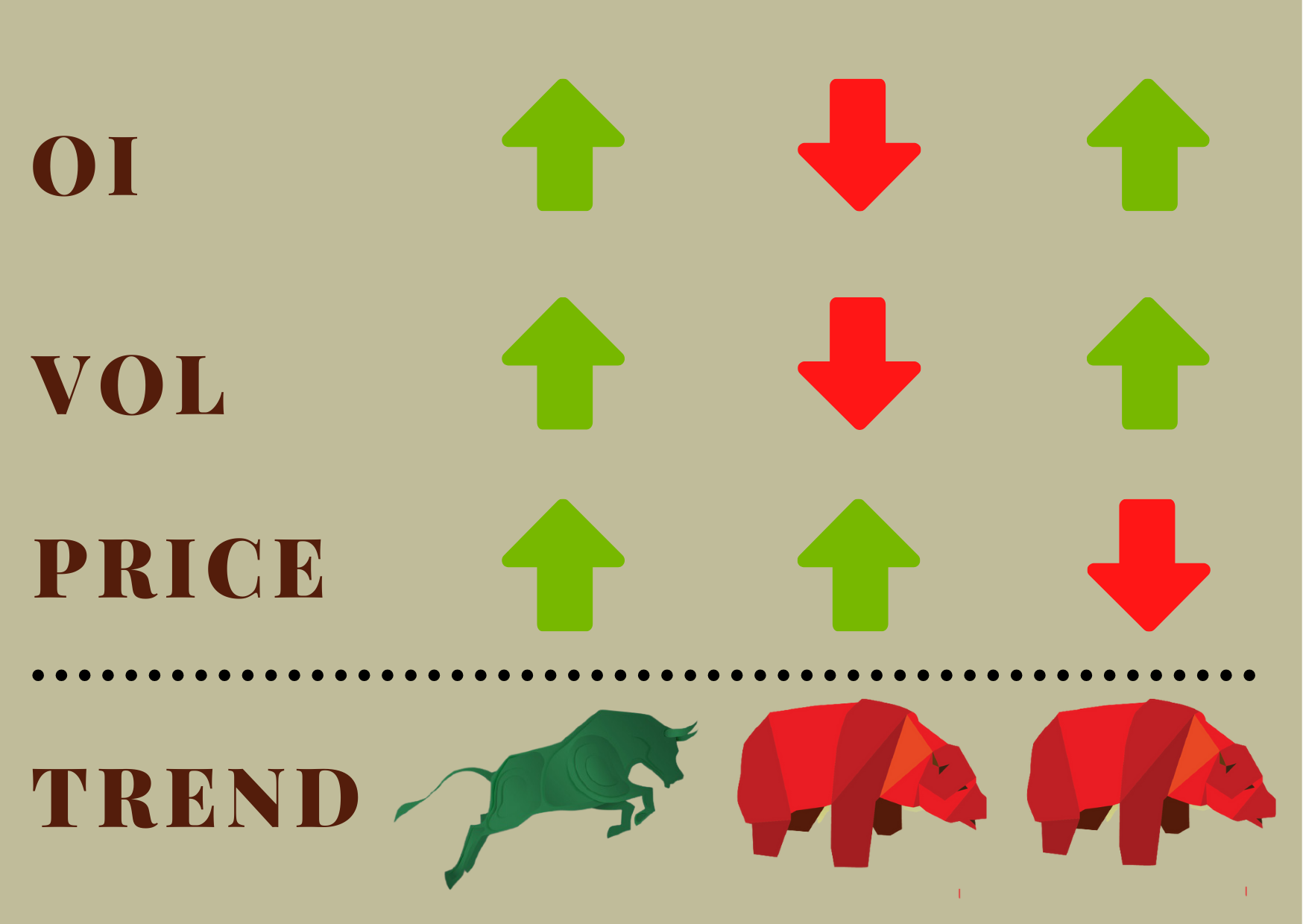

- If the volume is going up, and the open interest is higher along with rising prices, it depicts a strong bullish signal. The indication is that the money is coming into the market and this is the right time to enter into the trade.

- If the price is rising but the open interest is decreasing, then the overall market is bearish.

- If the open interest increases but the prices are decreasing, then the overall trend is comparatively weak. This is because there is new money entering the market with the new positions but the prices are seeing a significant short selling.

- If all the volume, open interest, and prices are declining, then according to some experts, there will be a strong signal in the market when the selling stops.

| Relation Between OI, Volume and Price | ||||||

| Open interest | Volume | Price | Trend | |||

| High | High | High | Bullish | |||

| Low | Low | High | Bearish | |||

| High | High | Low | Bearish | |||

So this is how you can do open interest analysis and set your trading decisions right.

Conclusion

Open interest analysis can help you determine the right trading decision and when and how you should place your option trade.

Watch out for the volume, price action, and open interest together to get a confirmed buy signal.

Open a demat account online for FREE and experience trading in options.

More on Options Trading