How to Apply for IPO in Motilal Oswal?

Check All Frequently Asked Questions

Opening a demat account with Motilal Oswal opens a gateway for you to subscribe for the particular Initial Public Offerings. But here comes the question of how to apply for IPO in Motilal Oswal.

Well! These days applying for the IPO is as simple as booking a movie ticket. All that is required is the best app for IPO, a good internet connection and enough funds in your bank account.

But most of the newbie investors think, “Can I buy IPO without demat account?”

If you too thinks the same, then just recall the importance of demat account, where the SEBI made it compulsory to ensure the security of your investment and further to trade shares online.

So, buying IPO shares without demat account, makes no sense, and hence to apply for the IPO, the foremost step is to have a demat account with a broker like Motilal Oswal.

Once you have an account, you can easily apply for any of the IPO using the MO investor app.

How to Apply for IPO in Motilal Oswal App?

The process remains almost similar in most of the trading platforms. But today as we look into the Motilal Oswal App, there is no doubt that Motilal Oswal has an advanced trading platform with multiple features for its customers.

Without wasting much time, let’s get straight into the process of how to apply for IPO in Motilal Oswal.

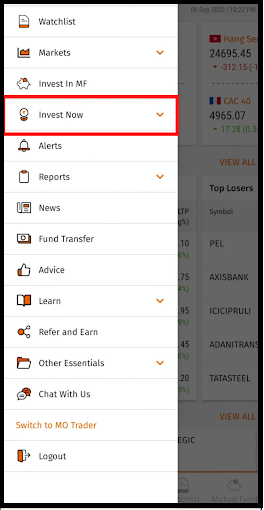

- Login to your Motilal Oswal trading app.

- Click on your profile icon in the top left corner of the interface

- Form the list of options click on “Invest Now”

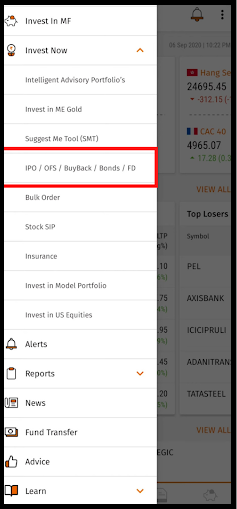

- Click on “IPO/OFS/BuyBack/Bonds/FD” option

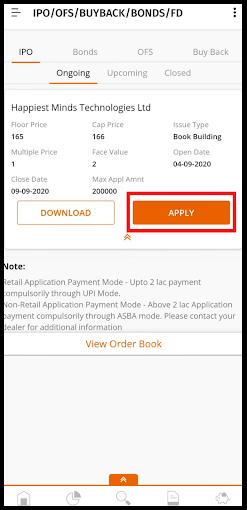

- You’ll see the list of ongoing, upcoming and closed IPOs in different tabs.

- Under ongoing, you may check the price band along with the type of issue, which will help you in understanding the affordability based on your investment capital.

- Click on the IPO where you’ll see the option “APPLY”, snap on it.

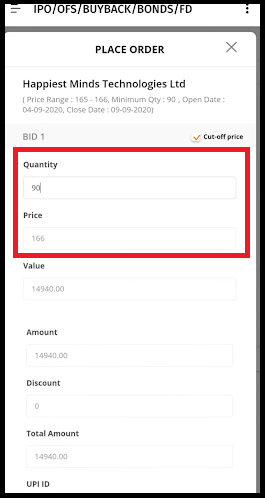

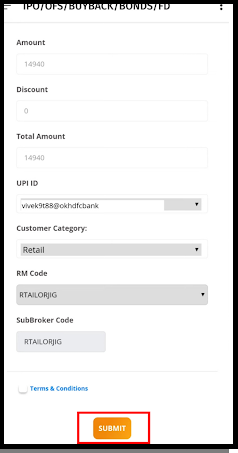

- IPO application will be opened, where you’ll need to fill in the details such as the lot size based on the market lot details (minimum and maximum lot size), bid price.

The interesting part is that Motilal Oswal offers you the option to go for 3 bids. Thus for let’s say an IPO with price band of 90-92 is launched then you can fill three different bids as:

- 1 lot: ₹92

- 2 lots: ₹90

- 1 lot: ₹91

This increases the chance of allotment and hence offering you the opportunity to benefit from the listing gains.

- Further which you will need to mention your UPI id through which your transaction will take place in case the lot is allotted to you.

- Then, click on “SUBMIT”.

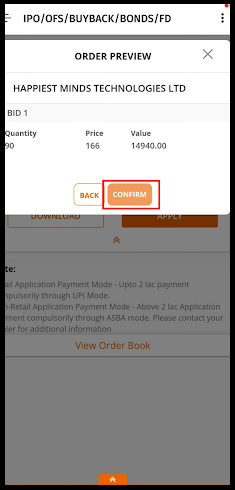

- Post which you’ll see a dialogue box pop up with your order review.

- Click on “CONFIRM”

This is all about how to apply for IPO in Motilal Oswal.

Not just that, the Motilal Oswal app has the option where you can easily cancel your order or even modify it anytime before the launch.

So you see, how smoothly you can place your IPO order in Motilal Oswal App.

Now this is the whole process of IPO application through Motilal Oswal.

So why to wait more, open your demat account in Motilal Oswal for Paytm IPO apply.

Another question that generally investors ask is, “Can I apply for IPO from two demat account“?

Looking for the answer for the same?

You cannot apply for the IPO with the Demat accounts registered with the same PAN number, however, can use the multiple demat accounts registered with Motilal Oswal with different names for IPO multiple bids.

How to Check IPO Allotment Status in Motilal Oswal App?

After learning the process to apply IPO in Motilal Oswal, what’s the next step you would look for? It’s definitely the allotment status.

Luckily, MOSL app offers you the benefit where you just need to login to your Motilal Oswal demat account through the app.

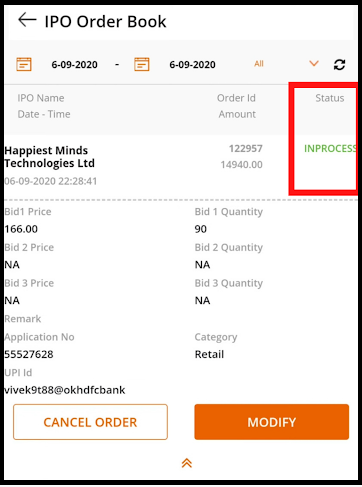

- Go to the IPO tab and under the upcoming IPO section you’ll find “View order Book”.

- As soon as you click on it. You’ll find a new interface where you’ll see your order details along with a separate tab of status.

- If your bid has been approved and you have been allotted the lot, you see the “ALLOTTED” under status in front of the IPO.

- In case the application is still in process, you’ll see “INPROCESS” in front of that particular IPO along with your order summary.

Conclusion

Now that we have come to the end of the article it is important to understand the precautions that you must take to avoid any capital risks or huge losses, as it is not necessary that all IPOs will give you good returns.

To analyze the return percentage, you must always focus on a few details such as;

- Whenever the company launches its IPO, try to know the details in depth like issue price, OFS, fresh issue, etc.

- IPO objective

- DO NOT forget to look at the company’s fundamentals including the part records.

- Most importantly your investment capital.

Most of this information is provided to you in the app and the rest can be availed in the DRHP report. The best part or say benefit of Motilal Oswal demat account is you can get all the details and recommendations of the IPO in the app that makes it easier to take an investment decision.

The above process explained how to apply for IPO in Motilal Oswal and also how one can check the status of your application.

If you do your homework carefully, you reduce the capital risks to a much larger extent.

Till then Happy Investing!

Plan and start investment now by opening a demat account online for FREE!

More on Motilal Oswal