How To Trade in Alice Blue?

Check All Frequently Asked Questions

With Alice Blue demat account you can trade in different segments, but here comes the question of how to trade in Alice Blue?

Well for that the broker offers you the trading app that further gives you access to trade in equity, commodity, currency etc.

There are much more trading features in the Alice Blue app that makes your trading journey seamless.

So, let’s delve in to learn how to buy and sell shares.

How to Buy Shares in Alice Blue?

Let’s begin the understanding of trading with Alice Blue by learning how to place the buy order.

For this first and foremost step is to login to the app and then picking the stock by doing the analysis using the indicators and charts.

Although there are multiple steps involved, but with the advanced mobile trading app the overall trading process seems to be simpler and easier.

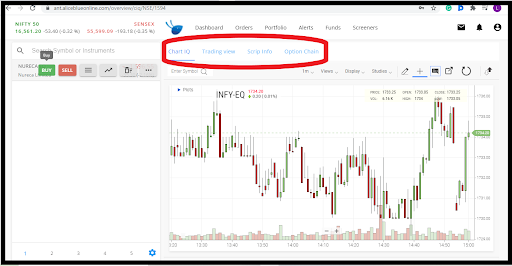

- Select the stock by using various features like Chart, information of the scrip, and the option chain if you want to trade in options.

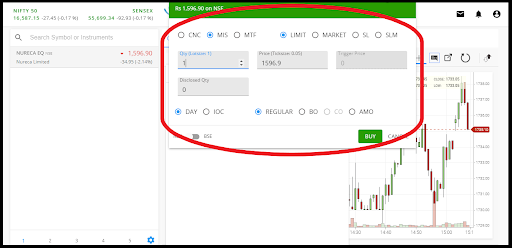

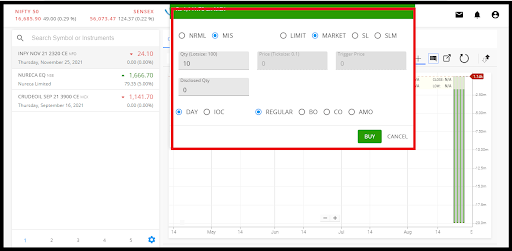

- After selecting the stock, click on the buy option, and a new pop-up window will appear on the screen.

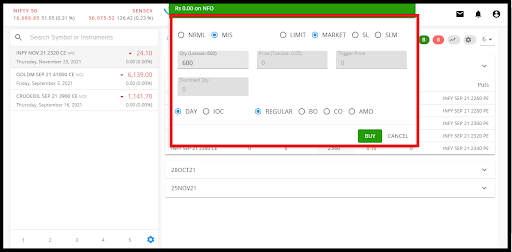

- Fill in the necessary information like advanced order types (Limit, Market, Stop Loss, Bracket, Cover, or AMO).

- Apart from this, fill in the quantity of the stocks you want to purchase along with the price (if selected limit order).

- Choose the validity, i.e., Day or IOC, and then click on the ‘Buy’ option to execute the order.

After the steps are done, the order will be successfully executed through the desired Alice Blue app.

How to Trade Equity in Alice Blue?

The very first segment that most traders use trades in is equity. It can be done in intraday or delivery or futures and options. Now equity segment offers you the opportunity to trade in different products like delivery, intraday, futures and options.

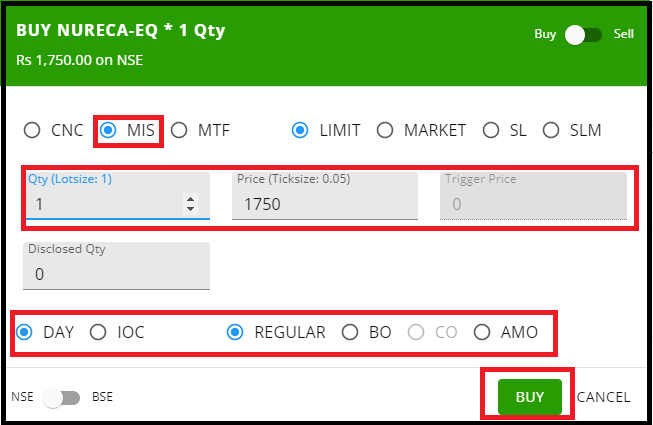

Now let’s suppose you want to trade in Nureca stock by executing the intraday trade.

For this you have to follow the steps below:

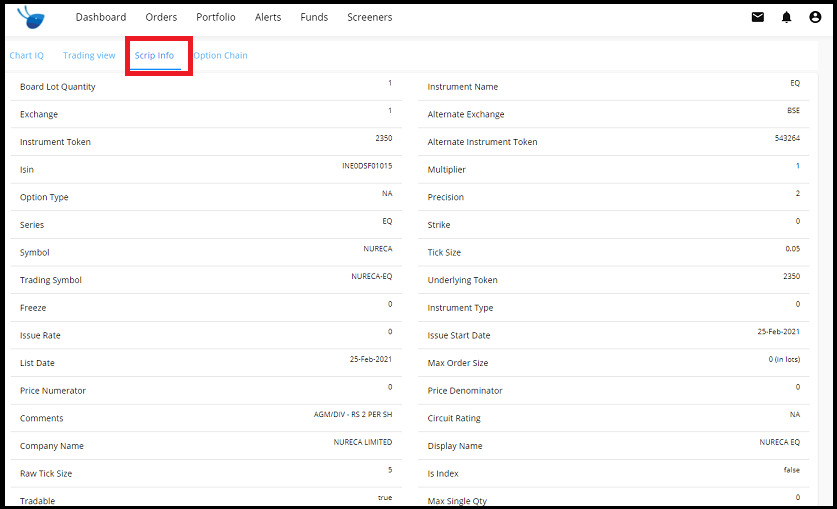

- Know more about the stock by analyzing the stock detail.

- Analyze the trend further by using the advanced charts provided in the app.

- Once you have done your analysis click on the buy button and execute the trade by entering the details:

- Product type

- Entry price

- Trigger Price

- Stop Loss

- Validity of Order

- Click on Buy Button and on the confirmation the order gets executed.

Alice Blue Equity Brokerage

Once you execute the trade, the broker impose certain charges the detail of which is provided to you in the table below:

| Alice Blue Equity Brokerage | ||

| Equity Intraday | ₹15/trade or 0.01%, whichever is lower | |

| Equity Delivery | ZERO | |

| Equity Futures | ₹15/trade or 0.01%, whichever is lower | |

| Equity Options | ₹15 per trade | |

If trading in intraday, then it is essential for the traders to exit the positions before 3:15 pm. In contrast, in the case of equity intraday futures, the trader is required to square off the position till 3:10 pm, or else the broker will auto squares off the trade and will charge ₹20 plus GST as a penalty.

How to Trade Options in Alice Blue?

The broker allows the traders to trade in the options contracts. The traders can select the call or put options according to the preferences.

To perform the trade, it is important to have the knowledge of option trading and how does it work. Likewise, the trader can book the profit and trade with Alice Blue, one of the best apps for option chain analysis.

It is essential to go with the steps to place the order accurately. For that, let’s consider the following steps:

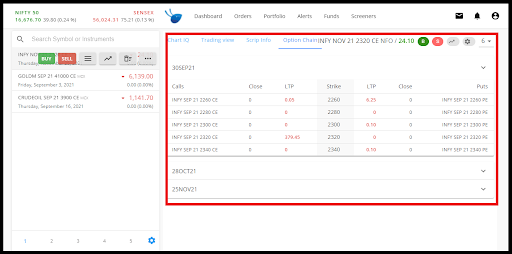

Step 1: To start trading in options, the very first step is to select the contract type in which you want to trade in.

Step 2: It is the time to check the option chain and select the strike price of your choice.

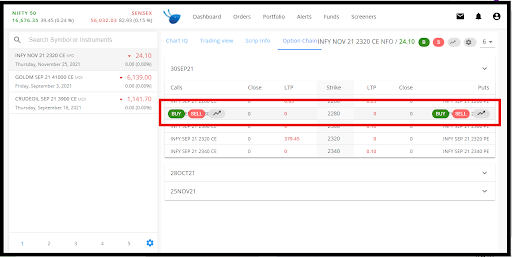

Step 3: From the selected strike price, click on the Buy or Sell button to buy call or put option.

Step 4: In the following window, fill in the necessary information like the Trading Type (Normal or MIS), Order Type (Limit, Market, Stop Loss, SLM), Advanced Order Types (Bracket, Cover, AMO, Regular Order).

Step 5: The last step is to click on the ‘Buy’ button to execute the contract.

Alice Blue Options Charges

The brokerage for trading in options depends upon the size of lots. But being a discount stockbroker, Alice blue provides the benefit by imposing the option brokerage per trade.

Check the information of charges in the table below:

| Alice Blue Option Brokerage | ||

| Equity Options | ₹15 per trade | |

| Commodity Options | ||

| Currency Options | ||

How to Trade Commodity in Alice Blue?

Here comes another type of trading, i.e., commodity trading, and the trader can execute the order in derivatives, i.e., Options and futures. If you too want to go with the commodity trading, at that point, the broker offers the options and option chain of the specific commodity.

Simply select the strike price according to the preference and execute the order.

If the contract moves accordingly, the trader who has given the premium or the upfront fees has the right to either exit the trade or execute the trade.

Other than this one can trade futures in commodity. Keeping and maintain the required margin in the trading account, you can execute the trade in a specific agri or non-agri commodities.

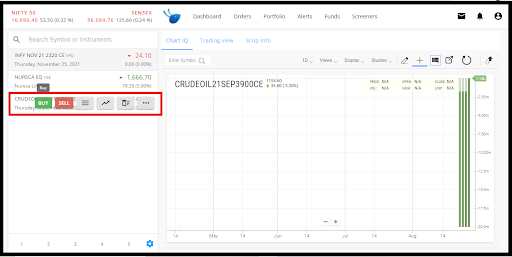

How to Trade Crude Oil in Alice Blue?

Under the commodity segment, the traders can trade under various commodities, including agri or non-agri commodities.

Likewise, by defining your preferred commodity, if you have decided to trade in Crude Oil, then why not let’s check out the procedure of trading in Crude Oil with Alice Blue.

- Select the Crude Oil according to the expiry date you are comfortable with, and then click on the ‘Buy’ button.

- On a new pop-up window, fill in the information like Order types and other necessary details and at last click on the ‘Buy’ button.

- Likewise, the contract will be executed, and the order will get placed.

Alice Blue Commodity Charges

Next comes the commodity segment where you can trade futures and options as described above and pay the charges accordingly.

Here is the detail of commodity charges in the table below:

| Alice Blue Commodity Brokerage | ||

| Commodity Futures | 0.01% of turnover or ₹15 per trade (whichever is lower) | |

| Commodity Options | ₹15 per trade | |

How to do Algo Trading in Alice Blue?

For starting algo trading with the stockbroker, the trader is required to get the knowledge over the Alice Blue algo trading.

The broker allows the traders to use various paid strategies like Money Machine, Eagle Strategy, Intramax, and Supertrend. In contrast, the Chart Bridge is offered to the traders for free of cost.

Furthermore, the broker allows the opportunity to trade with MT4 links that further creates a unique link that automatically got connected to the Alice Algo Terminal that supports both web and mobile platforms of the broker.

By paying for the strategies mentioned above, the trader can book the profit in the trading.

How to Sell Shares in Alice Blue?

After purchasing the shares, the trader booked the profits and decided to sell out the share or exit the position. For that, he again entered the Alice Blue app and sold out the shares with the following steps.

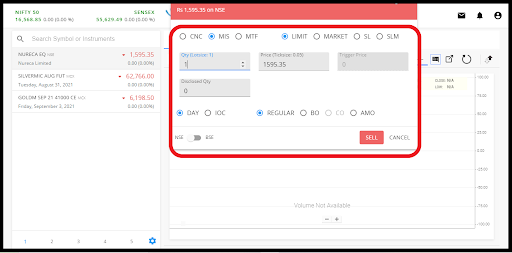

- The trader can either sell out the shares directly by clicking on the exit button provided on order or else can sell the share by visiting the ‘sell’ tab of the stock.

- After visiting the app (ANT Web in this situation), click on the sell button.

- A new window appears on the screen.

- Fill in the quantity and the necessary information as can be seen below, and then click on the ‘Sell’ button.

- Likewise, the order will get executed, and a trader will exit the position after gaining a specific profit.

How to Check Trade History in Alice Blue?

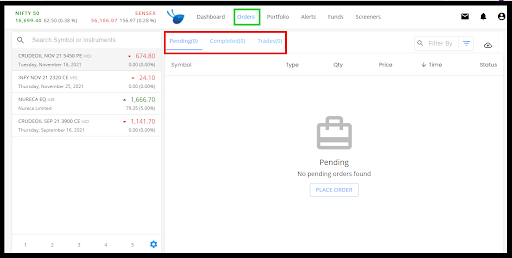

After executing the trade, the major query that appears in the mind of the traders is where to check the trade history in the Alice Blue.

So now, whenever you trade with Alice Blue, the orders can be checked in the trade history of the broker. Whether you are trading with ANT Mobi, ANT Web, or ANT Desk, you can easily check the trade history by clicking on the ‘Orders’ option.

- Login the preferred app by logging into it with the credentials offered.

- Go to the ‘Orders’ option and you will get the three types of information regarding:

- Pending Orders

- Completed Orders and

- The trades that are performed by the traders.

- Afterward, the traders can check the above-mentioned orders in their order book.

Conclusion

After opening an account with the broker, it is the right time to get the answer on how to trade in Alice Blue.

A trader can easily trade in various segments offered by the stockbroker. Just check the desired segment in which you want to trade in and go with the buying and selling procedure for trading efficiently and successfully.

Let’s gather the knowledge, procedure and start trading in the share market with Alice Blue!!

Want to experience trade in multiple segments, start now by opening a demat account online for FREE!

More on Alice Blue

Video Review

Video Review