Crude Oil Trading in Zerodha

More on Commodity Trading

Crude oil has always been the talk of the town, and its fluctuating prices often cause hustle in the market. If you plan to do crude oil trading in Zerodha, you should have a Zerodha demat account and then activate the commodity segment to begin.

What exactly is crude oil trading, and why is the buzz around it? And most important how to trade in crude oil in Zerodha?

To grab all this information, let’s dive into the information below:

How to do Crude Oil Trading in Zerodha?

Crude oil trading is done with a futures contract where you purchase it today but expect delivery sometime in the future. The maximum order size of crude oil trading is generally 10,000 barrels, and the lot size is 100 barrels.

The prices of crude oil also vary with the variation in demand and supply. A trader can effectively use different analyses and reap good benefits from trading crude oil.

Now when it comes to trade, first you need to open a Zerodha commodity account.

Post this, you need to activate the futures and options segment by submitting few documents like income statements, bank details, ITR acknowledgement slip etc.

Once done you can trade using the Zerodha Kite.

How to Buy Crude Oil in Zerodha?

As we discussed earlier, Crude oil is one of the most traded commodities, and its international importance takes it up by a notch. Like buying and selling shares, crude oil trading in Zerodha is also easier and can be done using mobile or web applications.

Once you have activated your Zerodha commodity account, you need to follow the given steps to trade crude oil effortlessly:

- Log in to your account with the suitable login ID, password, and a pin.

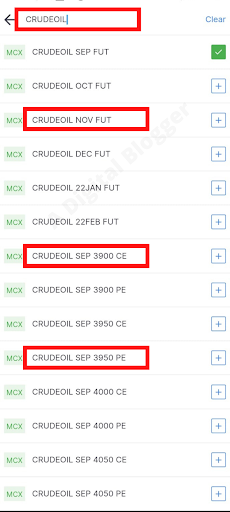

- After you have logged in to the account, you will see the dashboard with a search bar on the top.

- You can now search crude oil in this search bar.

- You will see FUT, CE, and PE options that stand for futures, call options and put options, respectively.

- You will also see their expiry dates, so choose the most suitable one for you.

Suppose you are planning to buy crude oil commodity options. In that case, you can also refer to the Sensibull option chain, where you can do open interest analysis, apply great filters, and then trade according to your option strategies.

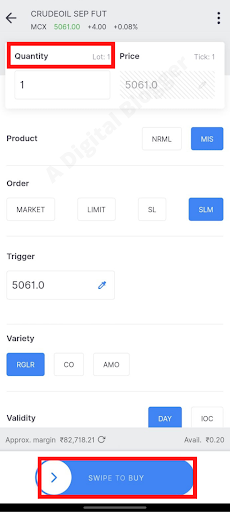

Now, click on the desired strike price. A buy window will pop up. In this window, enter the price, quantity, order type, and then click on the ‘buy’ option.

In these simple steps, you can easily buy crude oil in Zerodha.

How to Sell Crude Oil in Zerodha?

Just like buying crude oil, you can also sell crude oil commodities in Zerodha. You can follow the given steps if you are looking to sell crude oil in Zerodha.

It is also important to note that the Zerodha crude oil lot size is 100 barrels. Now to sell crude oil here are the steps you must follow:

- Log in to your demat account using your login credentials.

- Now search for crude oil in the search bar.

- From the various futures and options, choose the one that suits you the most.

- You can analyze the Zerodha option chain in the case of crude oil options trading .

- Once you are done with this, you can click on the sell option.

- A sell window will appear. Enter the price, quantity, and order type, and click on the sell option.

- Your order will be executed as soon as you follow these steps.

Now there are some futures and options strategies that allow you to buy and sell futures or options contracts. In simple terms, you need to place multiple orders to execute the strategy. This eats away your time and sometimes you skip taking the right position.

To reduce such chances and the value of the used margin in Zerodha you can opt for basket order in Zerodha where you can place multiple orders and execute them simultaneously. This not only reduces the time but also minimizes the margin cost.

Crude Oil Trading Time in Zerodha

Now that you know how to buy and sell crude oil in Zerodha, it is very important to know what are the crude oil trading hours in Zerodha, so that you can effectively and efficiently place orders.

The commodity trading time is different from the equity trading time and is given in the table below.

| Zerodha Commodity Trading Time | |

| Non agri commodities (internationally referenceable) | 9 AM-11:30 PM (daylight savings hour) |

| 9 AM-11:55 PM (November-March) | |

| Agri Commodities (International Referenceable | 9 AM-9 PM |

| All the other agri commodities | 9 AM-5 PM |

Marking the time is important especially in commodity trading, as its trading hours are generally different from the normal equity trading hours.

MCX Zerodha Brokerage

It is essential to keep an eye on the commodity brokerage and also the other Zerodha commodity account charges when you are trading in the commodity market. Here are the details below for your reference:

| Zerodha Crude Oil Brokerage Charges | ||

| Charges | Commodity Futures | Commodity Options |

| Brokerage | 0.03% or ₹20 per executed order, whichever is lower | 0.03% or ₹20 per executed order, whichever is lower |

| STT/ CTT | 0.01% on the sell side (Non-Agri) | 0.05% on the sell side |

| Transaction Charges | Group A Exchange Txn Charge: 0.0026% | Exchange Txn Charge: 0 |

| GST | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) |

| SEBI Charges | Non-Agri: ₹10 per crore | ₹10 per crore |

| Stamp Charges | 0.002% or ₹200 per crore on the buy side | 0.003% or ₹300 per crore on the buy side |

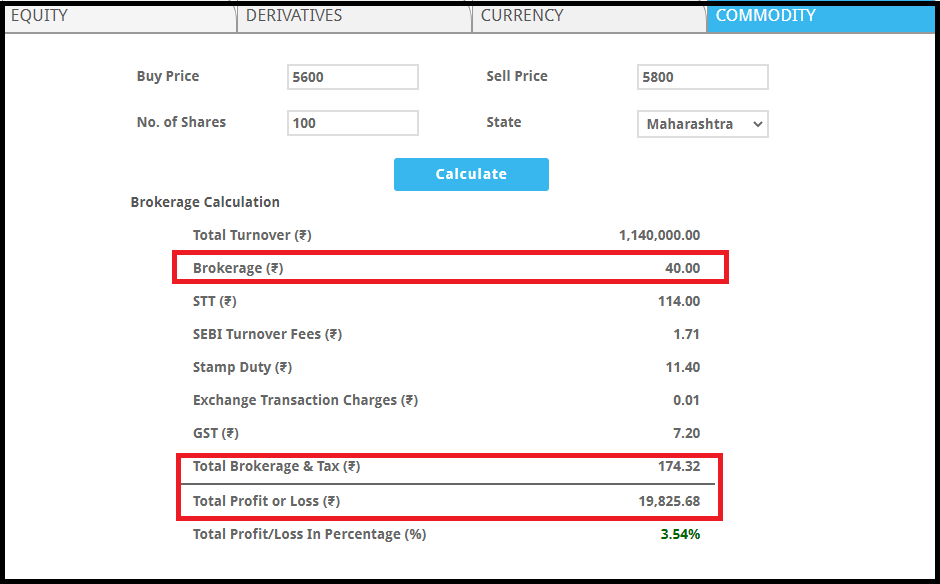

Now the Zerodha brokerage includes many different taxes including STT charges in Zerodha which often makes it challenging for the traders to evaluate the net brokerage and profit they can make in the trade. To help with this here is the Zerodha Commodity brokerage calculator

Zerodha Commodity Brokerage Calculator

This digital calculator helps in finding the exact brokerage as per the turnover value. Also, you can have a complete break up of the fees and taxes.

Wondering how to use it?

Just enter few details like buy price, sell price, quantity, and state.

Click on Calculate the brokerage information will display on the screen.

Crude Oil Zerodha Margin

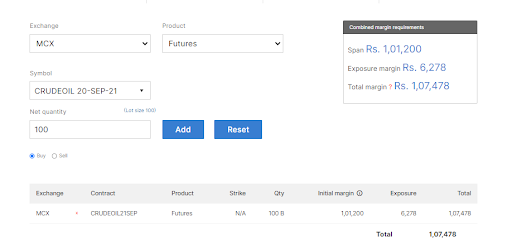

Often the traders worry about trading crude oil because it is an expensive bet. Some of this issue is solved by the margin that is provided by the broker just as a bank loan.

Since commodities are traded with a future date, a broker requires the trader to maintain some money in the account. This is usually the NRML margin.

Out of this margin, you need to maintain the 20%, and the rest 80% is provided by the broker. The crude oil Zerodha margin is also of no exception i.e. the same applies to the Zerodha Option Selling Margin too.

If the current market price of crude oil is 5061/ barrel, then to purchase one lot of crude oil, you need ₹5,06,100 (lot size=100). The margin that you will be required to maintain in your account, in this case, will be around ₹1,07,478. This is approximately 20% of the total cost.

| Zerodha Commodity Margin | ||

| Commodity | Lot Size | NRML Margin |

| Crude Oil | 100 BBL | 20X |

Conclusion

Crude oil trading in Zerodha can reap great results when done using the right strategies. If you are willing to start crude oil trading with Zerodha, you can activate the commodity segment and trade between 9am-11:55 pm.

If you are interested in starting commodity trading, then open your demat account today!

Start trading in crude oil by opening an account with the renowned stockbroker.

More on Zerodha