Sushil Finance Franchise

View All Sub-Broker Reviews

Sushil Finance Franchise business comes with a variety of business models, limited initial costings and a reasonable amount of benefits. In this review, we will have a quick look at the different propositions the broker has to offer and hopefully, you will be able to see whether you would like to go ahead with this business idea or not.

Sushil Finance Franchise Review

Sushil Finance, with its establishment way back in the 1980s, is one of the oldest stockbroking houses in full-service space in India. It offers trading and investment services in multiple segments such as Equity, Currency, Commodity, Mutual Funds, IPO, Insurance etc.

As per last checked from NSE sources, Sushil Finance has an active client base in the range of 37,000 making it one of the top 50 stock brokers in India in terms of the active client base. As far as the offline presence is concerned, the stockbroker has a presence in 22 states of the country with offices in more than 650 different locations through its various kinds of partners.

We will discuss Sushil Finance partnership models, their respective eligibility criteria, revenue sharing percentages, fees involved and any other aspect that you should know before you decide to choose this stockbroker as your share broking partner.

Sushil Finance Partnership Models

There are in total 4 business partnership models that Sushil Finance Franchise has opened up to their potential partners. Each of these models has its own set of requirements, costs, revenue sharing, functioning and product offerings.

Make sure you have your own set of preferences in mind so that it is easy for you to relate to the business model you may be interested in.

Sushil Finance Center Partner

The Sushil Finance Center Partner is suitable for both new as well as existing sub-brokers (with other stockbrokers). This model is similar to a sub-broker or a franchise business partnership itself with the role title being a Center Partner.

Your role will be to acquire and service the client base. Furthermore, you may need to execute trades on their behalf as well in case they decide to use the call and trade channel for share market trading.

You will be required to provide strong sales support for acquiring new clients, influencing them in such a way that brings value to both the parties (client as well as the Sushil finance brand).

Products Offered: Equity Cash, Equity F & O, Commodities & Currencies Futures.

Criteria:

Some of the requirements you need to take care of in case of Sushil Finance Franchise or Center Partner are:

- Must have an owned or rented space to run the business. The broker is flexible to the extent that you can choose to run the business even from your residence, however, managing the team and the inquiring client base will solely be your responsibility.

- Strong Selling Expertise along with client acquisition techniques.

- You are required to pay an upfront initial deposit of ₹1 Lakh which is refundable in nature.

- You will be provided with terminal software and connection so that you can place trades for your clients. There will be an additional charge of ₹250 per month for this software usage.

- There is a one-time registration cost of ₹2,360 per segment. It increases depending on the number of segments you pick for trading.

- You will need to provide some necessary documentation to your professional experience along with other business-related documents as mentioned below (Make sure all the documents provided by you are attested by a Chartered Accountant or Notary officer, if not the documents stand a chance to get rejected):

- PAN Card

- Aadhar Card

- Education Proof (you need to be at-least educated till Intermediate level or 10+2 for this business)

- Residential Address Proof

- Office Address Proof (can be an electricity bill, phone bill, bank statement)

- 4 passport sized photographs

- Reference letter from a Chartered Accountant)

Sushil Finance Resident Partner

Apart from the Center Partner, you have the option of choosing the Resident Partner option as well where you do not need to set-up an office for the broker. You just need to sit on the office premises of Sushil Finance and operate your business undertakings from that location itself.

The role, however, is similar to where you are required to acquire new clients and serve the existing ones through the products and offerings of the stockbroker. You will be provided with a dedicated trading terminal as well to run these operations.

Criteria:

The selection criteria more or less are similar to what is mentioned in the requirements of a centre partner, with no office requirement being the only exception. This model is suitable for all kinds of individuals such as Mutual Fund advisors, Sub-brokers, Insurance agents etc.

You have to, nonetheless, make sure to serve the client base acquired by you within the market hours by sitting in the broker’s office. You may be required to put in trades for these clients if and when needed.

Products Offered: Equity Cash, Equity F & O, Commodities, Currencies Futures.

Sushil Finance Managing Partner

All the details and requirements of this model are similar to what is mentioned in the Center Partner model. The only difference, however, is that you will need to advise clients and execute trades at Sushil Finance office through a dealer.

In other words, you will need to manage clients of the stockbroker through their respective dealers. In this model, you will be mapped to different dealers and centre partners and your sole responsibility will be to make sure all these parties involved have a smooth time in dealing with their respective clients.

You may also be required to place orders for a client through the respective dealer as well. You may choose to sit in your own office, Sushil Finance’s office or even work from your home.

Sushil Finance Introducing Partner

This business model has no generic restrictions or dependability where you are required to acquire or serve the client base. In this model, you just need to introduce a potential client to the Sushil Finance team. Rest of the operations including client acquisition, serving, advising etc will be taken care of by the stockbroker itself.

You don’t really need to set-up any office, hire anyone in this mode.

All you need to take care of is making sure you provide a sizable number of potential clients on a regular basis to the stockbroker and there will be a specific percentage of brokerage that will be shared with you.

In simpler terms, you will be providing business leads to the stockbroker team and they will be looking at the rest of the business processes. You will get a revenue share out of the brokerage generated on a monthly basis of the converted clients.

Sushil Finance Franchise Revenue Sharing

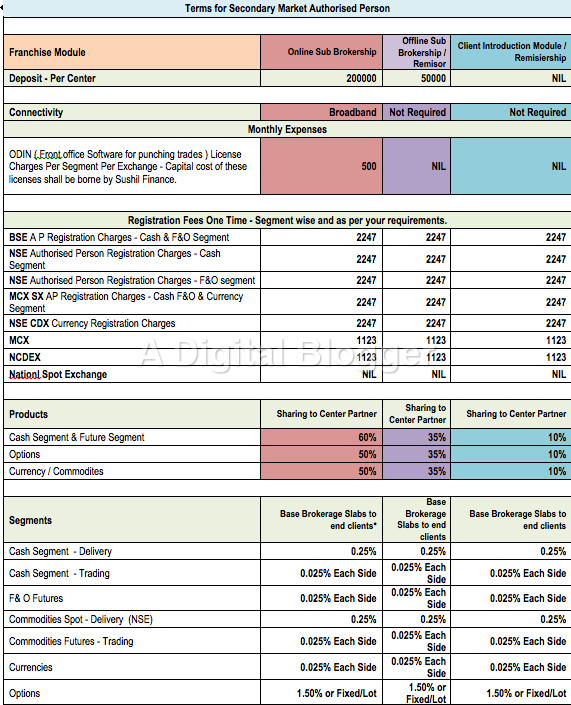

The revenue sharing percentage depends on the business model you choose to partner with Sushil Finance Franchise to go along with the overall brokerage you create from your business.

On a generic basis, Sushil Finance works at a 70:30 model in the NSE, futures segment where 70% of the overall brokerage you generate stay with you while the rest 30% goes back to the brand.

In exchange for that, the broker provides you with a brand name to associate with, regular training for customer acquisition and servicing, share market research, well designed and high-performance trading platforms etc.

Apart from that, for segments such as currency, commodity, options the revenue sharing is placed at a 50-50 percentage. This implies that half the brokerage you generate from your client base comes back to you as your business revenue.

This revenue sharing, although, can be negotiated (the executives will decline in the first go) depending on your turnover. For instance, if you think you have a client base of 50+ clients and/or if you are churning out a business revenue of ₹10 Lakh or more – then there is a good chance that that revenue sharing can go as high as 80% in your kitty.

Business models such as Introducing partner attracts a revenue sharing in the range of 20% to 50%.

There are a few set-ups in which the partnership is done on the basis of fixed monthly payment to Sushil finance and the complete brokerage generated by the sub-broker is kept by the party itself.

There is no revenue sharing with the broker in this model. However, you need to churn out a sizable fixed amount to the broker for such a model.

Lastly, there is a small segregation that the stockbroker has done based on the mode of partnership – Online or Offline. Here is a quick glimpse:

Sushil Finance Franchise Benefits

Some of the benefits of choosing Sushil Finance Franchise as your stockbroking partner are:

- Relatively an old name in the share market space

- Decent offline presence

- A wide range of investment products offered to the potential client base.

- Marketing, Business Development, Research support offered by the broker on a regular basis

- Training provided on client acquisition, business servicing etc.

- Dedicated Relationship Manager is aligned with you.

Read this Sushil Finance Franchise review in Hindi as well.

Sushil Finance Franchise Concerns

The other side of the coin tells us some of the related concerns of partnering with this stockbroker:

- Brand recall value limited to a few parts of the country

- Trading platforms have a room of improvement.

Stockbroking Franchise Registration

In case you are looking to open a Sushil Finance Franchise, you just need to fill the form below:

Once you fill that form, a callback from the corporate team will be arranged. The executive will need some basic details from you to get you started and also provide answers to any queries you may have.

This initial ‘screening’ call will take you to the next step of a face-to-face discussion with the broker executive. In this meeting, a few other requirements will be discussed and finalized. You will need to fill the business partner form, sign it and may also need to provide the deposit cheque to the broker.

Once these formalities are taken care of post verification of your documents, a token ID will be generated for you as a Sushil Finance Franchise or business partner. You will be given access to back-office and trading platforms offered by the broker so that you can carry your business operations smoothly.

Furthermore, there will be a relationship manager (RM) aligned with you from the broker’s side who will assist you with any concerns or issues you may face during your business partnership with the broker.

With this, we wrap up the review of Sushil Finance Franchise. In case you have any feedback or any experience to share, feel free to mention that in the comments section below.

Lastly, if you wish to talk to an executive to know more about these partnership programs, just fill in basic contact details and we will get it initiated for you: