Long Combo

All Option Strategies

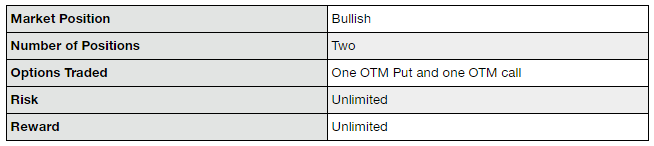

Long Combo is an options strategy that involves the combination of a put option and a call option. This strategy is almost similar to being long on stock directly, however, there are certain advantages that set it apart.

The long combo is used when the investor is bullish towards the market and is certain that the prices of the shares will go up. In this case, the trader sells one out-of-the-money put option and buys one out-of-the-money call option.

The put option is at a lower strike price and the call option is at a higher strike price.

If implemented strategically, the long combo can generate high profits, because when the stock prices start rising as predicted, both the put option and call option generate profit.

The same can be achieved by taking a long position on the stock itself, however, with the use of long combo, the trader can buy the security at a fraction of the price that he would need to pay for buying the stocks upfront. The net effect is an inexpensive trade, with unlimited risk and unlimited reward.

Thus, it is a high-risk high returns strategy.

Long Combo Strategy Timing

The most appropriate time to use the long combo strategy is when the trader is bullish towards the market and is certain of the prices to go up.

At the same time, the trader does not want to invest a lot of capital in the trade.

When both these factors are combined, the long combo strategy is the most effective one.

The trader expects the price of a stock to rise due to certain foreseen events. He can take a long position in the stock and earn unlimited profits, however, he will need to invest a lot of money upfront.

By implementing the long combo, the trader sells an OTM put option and buys an OTM call option on the stock.

The put option has a lower strike price and the call option has a higher strike price. The risks and rewards are unlimited, just like long stock, but by using the long combo, the same trade can be done at a fraction of initial investment.

The leverage provided by this strategy makes it very beneficial.

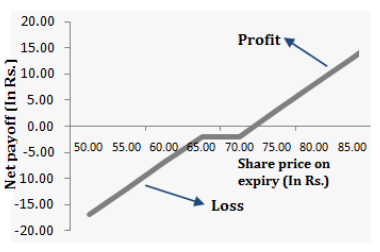

The maximum profit is unlimited as the investor will keep earning as the price of the security keeps going up, above the higher strike price.

Similarly, the risk is also unlimited as the investor will keep losing money as the price of the security keeps going down, below the lower strike price.

Most of the traders who implement the long combo strategy, do it for the purpose of leverage. They do not intend to remain in the position until the options expiration.

So, with a very small initial capital requirement, high profits can be earned, if the strategy is implemented correctly.

Long Combo Strategy Example

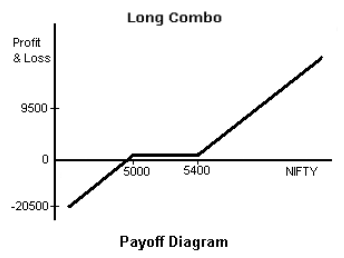

To understand the long combo options trading strategy in detail, we will consider NIFTY prices.

Let’s consider that NIFTY is at 5200 points at the current time. The trader expects that the market will go up. Although, he does not wish to invest a large amount of capital.

In this situation, the trader, instead of buying by paying 5200 upfront, uses the long combo strategy.

He sells one OTM put option at 5000 for a premium of ₹25 and buys an OTM call option at 5400 at a premium of ₹35. Assuming the lot size as 50, the only investment the investor will make is equal to the net premium.

The premium received is ₹35 and paid is ₹25. So, net investment is (35-25)*50= ₹500.

Scenario 1:

If NIFTY closes at 5600 points at expiry, the total profit is (5600-5400)*50= ₹10,000. The net premium paid will be Rs 10*50= ₹500.

The net payoff will be 10,000-500= ₹9500.

If the investor had not used the long combo and gone long on the stock instead, the profit would have been ₹20,000.

However, the initial investment for buying the stock upfront is very high and long combo make the position possible with the initial investment of only ₹500.

Scenario 2:

If NIFTY closes at 5100 at expiry, the loss incurred will be (5200-5100)*50= Rs 5000 and the premium paid will be 10*50= ₹500.

Thus, the net loss will be ₹5500.

Therefore, it is evident from the example that long combo offers unlimited risk and unlimited reward. This risk/reward portfolio is similar to the long stock.

The biggest difference is in terms of the capital invested.

Using the long combo, high profits can be made with very less capital. Therefore, the return on investment is quite high.

Long Combo Advantages

Here are some quick benefits you will get while using the long combo strategy:

- The biggest advantage of the long combo strategy is the ability to provide leverage. The requirement of capital investment is low and the returns are high.

- The strategy has an unlimited reward profile. The returns keep on increasing with the increase in the stock price.

Long Combo Disadvantages

At the same time, the other side of the coin needs to be looked at as well. Here are some concerns you must be aware of:

- Along with unlimited rewards, the strategy has an unlimited risk profile. The losses can keep on increasing as the price of the stock goes down.

- The premiums paid on the options may end up increasing the amount of loss.

Long Combo in a Nutshell

This is to be considered that long combo is a complex strategy. It needs to be implemented very carefully. Along with providing high profits, the strategy also has the potential for unlimited losses.

If the stock market prediction of the investor does not come true with respect to the price rise, he may suffer huge losses. Still, it is an effective strategy for those not willing to invest a large amount of capital in the trade.

The strategy is inexpensive, with the same amount of risk and return as holding a long position on the stock directly.

In case you are looking to get started with Options trading or share market investments in general, let us assist you in that.

Just fill in some basic details in the form below.

More on Share Market Education:

You can read this review in Hindi as well.