Short Call Condor

All Option Strategies

Short call condor is an effective option trading strategy, which is most useful at the times when the market is expected to be highly volatile and this can help you to avoid Option Trading Mistakes.

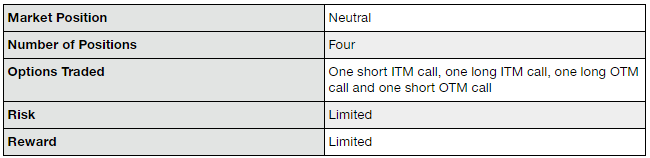

The strategy works in a neutral market and helps the trader to be unaffected by the direction of the trend. The profits can be earned irrespective of the direction in which the prices move.

The only requirement is high implied volatility.

Short call condor is a four-legged strategy and is formed by the combination of selling one in-the-money call, buying one lower-middle strike ITM call, buying one higher middle strike OTM call and selling one OTM highest strike call.

All the options are taken on the same underlying asset and with the same options expiration date. It is, thus, a combination of a lower strike bear call spread and a higher strike bull call spread.

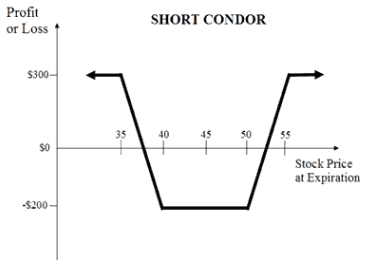

The strategy has limited risk and limited reward profile.

The reward is limited to the total premiums collected due to the expiration of all options worthless when the price of the underlying is outside the range of all the strike prices. The risk is limited to the difference between the two middle strike prices, less the net premium collected.

It happens when the price of the underlying does not show volatility and remains within the range of the strike prices.

Short Call Condor Timing

The perfect situation to use the short call condor is when the investor is expecting a sharp movement in the price of the underlying due to an expected event or news. The investor is unsure of how the market will process the information, and if it will climb up or down.

In this situation, short call condor comes at the rescue as it is a direction-neutral strategy.

Therefore, when the investor is expecting high movements in price and is uncertain of the direction, he sets up a short call condor. The investor sells the lowest strike ITM call, buys a lower-middle strike ITM call, buys a higher middle strike OTM call and sells a highest strike OTM call.

This construction ensures that profit is generated if the price moves beyond the lowest and highest strike prices, indicating high volatility. However, if the price does not move a lot and remains within the range of the middle strike prices, a loss will be incurred.

The short call condor strategy is an improvisation on the short call butterfly. The difference is that short call butterfly has three legs and the middle strike price is the same whereas the short call condor has different strike prices for the two middle calls.

Due to this arrangement, the risk potential of the strategy gets reduced as there is a wider range for profit. However, the tradeoff is that the profit potential also gets reduced.

The maximum profit is obtained when there is high volatility and the price of the underlying is beyond the lowest and the highest strike price, at the time of expiration.

At this time, all the options expire worthlessly and a net credit is received in the form of premiums.

This is the maximum profit possible.

The maximum loss is incurred in this strategy when the price does not move as expected, and it remains within the range of the strike prices.

The maximum loss is calculated as the difference between the strike prices, minus the net credit received.

Short Call Condor Example

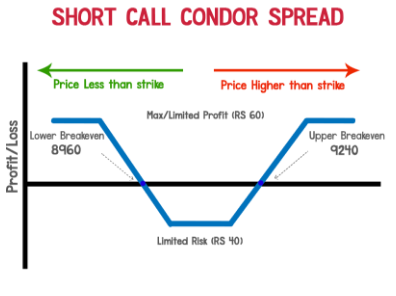

Considering the similar situation as in long call condor, let us assume NIFTY is at 9100 points and the investor expects high volatility due to a foreseen event. The short call condor is set up.

It is done by selling the ITM call at 8900 for a premium of ₹240, buying one ITM call at 9000 at a premium of ₹150, buying one OTM call at 9200 at a premium of ₹40 and selling one OTM call at 9300 for a premium of ₹10.

The net premium received from the set up is 240-150-40+10= ₹60.

Thus, it is a net credit strategy.

Scenario 1:

If NIFTY closes at 9600, the strategy will generate the maximum profit as the price has risen sharply from the current price of 9100.

All the options will be exercised. The lowest ITM call will bring in a loss equal to (9600-8900)= ₹700.

After receiving a premium of ₹240, the net loss will be 700-240= ₹460.

The lower middle strike call will generate a profit of (9600-9000)= ₹600, and after the paying a premium of ₹150, the net profit will be 600-150= ₹450.

The higher middle strike call will also generate a profit of (9600-9200)= ₹400, and after paying a premium of ₹40, the net profit will be 400-40= ₹360.

The highest strike price call will cause loss of (9600-9300)= ₹300, and after receiving a premium of ₹10, the net loss will be 300-10= ₹290.

The net payoff from the strategy is -460+450+360-290= ₹60.

The strategy will generate a profit of ₹60, which is the maximum profit and is equal to the net premium received.

Scenario 2:

If NIFTY closes at 9000, which is within the middle strike range and indicates low volatility, the strategy will incur a loss. The highest strike OTM call will expire worthlessly and a premium of ₹10 is received.

The higher middle strike OTM call will also expire worthlessly and a premium of ₹40 will be paid.

The lower middle strike ITM call will be exercised and will bring in loss of ₹150.

The lowest strike ITM call will be exercised and the loss generated will be (9000-8900)= ₹100, and after receiving a premium of ₹240, the net payoff will be a profit of 240-100= ₹140.

The net payoff from the strategy will be 10-40-150+140= – ₹40.

This is at the maximum loss from the strategy.

Short Call Condor Advantages

Here are some of the top benefits you get when you use the Short Call Condor strategy in your option trading:

- The strategy is capable of generating profit in a volatile direction-neutral environment.

- The investment in the stagey is very less, due to the net credit spread.

- The risk in the strategy is comparatively less than the other strategies because of a wider profit zone.

Short Call Condor Disadvantages

At the same time, there are few issues with this options strategy you must be aware of:

- The premiums paid are more due to the more number of legs.

- The profit potential of the strategy is less, compared to other strategies.

Short Call Condor in a Nutshell

As a bottom line, short call condor can be used in a highly volatile market situation. However, the profit potential of the strategy is highly capped and the trade-off of lower risk is not substantial enough.

This is not a very popular strategy because, in spite of producing a net credit, it offers very small returns with only slightly less risk.

In case you are looking to get started with options trading or share market investments in general, just fill in some basic details in the form below.

More on Share Market Education: