Zerodha Iceberg Order Charges

Charges

Whenever you place an order in your trading app there is something called impact cost that reduces profit percentages. Now to overcome this loss Zerodha introduces iceberg order with the minute validity feature. It is a multi-legged order and saves a lot of time and money but what are Zerodha iceberg charges.

This Zerodha iceberg order breaks down the larger order into the small transaction and executes them one after the other. Let’s now find out how much you have to pay to trade using this order.

How Much Zerodha Charges for Iceberg Order?

The iceberg order is divided into multi-legged, and you need to pay multiple brokerages depending upon the segment and trading product.

Here are the details of Zerodha brokerage:

| Zerodha Trading Brokerage Charges | |

| Equity Delivery | ZERO |

| Equity Intraday | 0.03% or ₹20 per executed order, whichever is lower. |

| Equity Futures | 0.03% or ₹20 per executed order, whichever is lower. |

| Equity Options | Flat ₹20 per executed order |

| Currency Futures | 0.03% or ₹20 per executed order, whichever is lower |

| Currency Options | 0.03% or ₹20 per executed order, whichever is lower |

| Commodity Futures | 0.03% or ₹20 per executed order, whichever is lower |

| Commodity Options | 0.03% or ₹20 per executed order, whichever is lower |

Let’s understand how Zerodha charges for iceberg order with an example, if you place an intraday order to buy shares of XYZ company with an expected trade value of 1,00,000 (initial share price ₹200), and let’s suppose it is divided into four legs with the following turnover value:

- First-legged order (100 shares at ₹200 each): ₹20,000

- Second-legged order (200 shares at ₹202 each): ₹40,400

- Third-legged order (150 shares at Rs 203 each): ₹30,450

- Fourth-legged order (50 shares at Rs 203.50): ₹10,175

Total Turnover: ₹1,01,025

Here,

1,01,025-1,00,000=₹1,025 is the impact cost

Now, Zerodha intraday charges are 0.03% or ₹20 whichever is lower, let’s calculate Zerodha iceberg charges for the above trade:

1. Trade value ₹20,000

0.03%*20000= ₹6

2. Trade value ₹40,400

0.03%*40,400=₹12.12

3. Trade value ₹30,450

0.03%*30,450=₹9.13

4. Trade value ₹10, 175

0.03%*10,175= ₹3.05

Total Brokerage= ₹(6+12.12+9.13+3.05)

=₹30.30

However, other fees and taxes like STT charges in Zerodha are also calculated on the total turnover value of the trade.

Now, if one leg of the order gets canceled it cancels the complete order. So, here is the question that arises in the traders’ mind, does Zerodha charges for cancelled order?

In case, your order is not executed, then no fees or additional charges are imposed by the broker.

Along with this, there are a few things that need to be considered:

- The minimum turnover value for equity should be ₹1,00,000 for equity and 5 lots for F&O.

- An iceberg order is not available for shares listed in BSE.

- You cannot place an SL-M order along with the iceberg.

- You cannot use iceberg orders to place pre-market and AMO trades.

- The brokerage is paid separately because every leg is in a different order. You can check brokerage charges in Zerodha in Console.

- Only after the execution of one leg of the major order is completed, the very next leg of the order is made, and so on until the sum total is traded.

- The customer chooses the number of legs.

- In case you cancel a single order all other order gets canceled automatically.

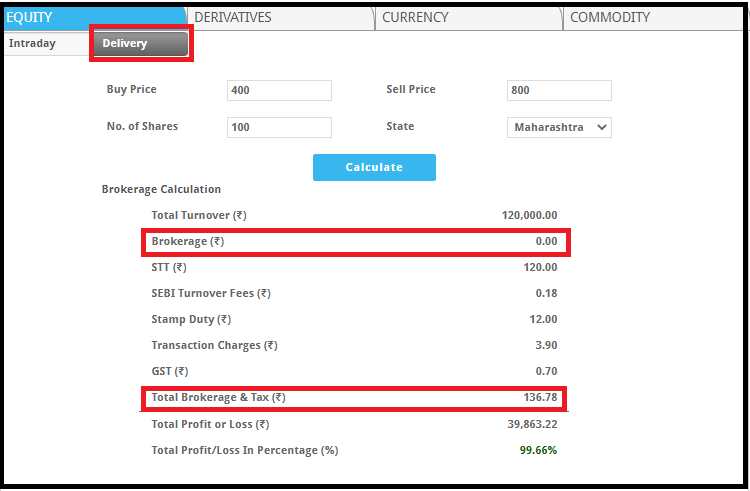

Zerodha Brokerage Calculator

Now apart from the brokerage, there are few taxes and hidden fees imposed by the stockbroker. This includes STT charges, stamp duty charges, GST, etc.

It is important to calculate the overall brokerage to get an idea of the profit or loss you can make with a trade.

This is a little difficult and complex, especially for beginner traders and therefore we come up with a solution. Zerodha brokerage calculator helps you to calculate the complete fees and charges along with Profit or loss percentage.

All you have to do is to enter the buy and sell order details along with the quantity to calculate the brokerage fees.

Conclusion

Zerodha iceberg order thus helps you to save a lot by reducing the impact cost from your order. Also, the order comes with the minute validity option that further makes it easier for you to trade at your desired value.

So, if you want to trade smartly, then get in touch with us now and we will assist you in choosing a broker and in opening a demat account online for FREE!

More on Zerodha