Zerodha Equity Charges

Charges

Zerodha is a discount broker known for offering trading services in the share market at the minimum brokerage fees in all trading segments. To get started here is the detail of the Zerodha equity charges.

Zerodha Equity Account Opening Charges

Although Zerodha is the discount broker when it comes to opening an account, it is one of the brokers that charge account opening fees.

This fee again varies on the basis of the trading segment.

For an equity account, in which you can trade in listed shares and currency you need to pay ₹200 as Zerodha account opening charges. Other than this, for account maintenance, there are AMC charges which are charged quarterly.

The detail of fees is given in the table below:

Zerodha Equity Brokerage Charges

The equity segment allows you to hold shares for a few hours to days and years. Also, there are few equity shares for which futures and options contracts are available in the share market.

But does Zerodha charges the same brokerage for all kind of trading products? Also, does Zerodha brokerage on Penny stocks remain the same as other shares?

To get better clarity on fees and other charges let’s learn about Zerodha brokerage for different each trading type.

Zerodha Delivery Charges

Delivery trading allows you to hold your position overnight. Now, here you open a position on one particular trading session and close it on any other trading day that could be another day, week, month, or year.

Whatever the holding period and type of share is the brokerage charges are same and here the broker does not charge any fees. Thus you can trade in the equity delivery segment using Kite app without worrying about the brokerage.

However, there are a few taxes, the detail of which is given in the table below:

Zerodha Intraday Charges

Next comes intraday trading where you can take single or multiple positions in a single trading day. However the brokerage for equity intraday is not zero but you can trade at the minimum brokerage of 0.03% of the turnover value or ₹20 per trade, whichever is lower.

Here it is important to note, that the brokerage is charged per executed order, thus the maximum intraday trading brokerage in Zerodha is ₹40.

Here is the detail of Zerodha charges for intraday trade along with taxes and other fees.

Zerodha Option Charges

Equity trading can be done in options as well where you can buy different available option contracts of the companies available in the share market.

Here for each position the broker charges a flat brokerage of ₹20 per trade. So, whether you trade in 1 lot or in 10 lots you need to pay a fixed cost on the execution of the order.

Check the detail of the broker’s fees along with the exchange charges and taxes in the table below:

Zerodha Futures Charges

Futures trading is another type of derivatives trade where you can trade in the contracts of different companies and thus get the right to trade at the pre-determined value in the future.

Here to take a position in the equity future contract, you are charged 0.03% of the turnover value or ₹20 per trade, whichever is lower.

Other than this, the taxes details are provided in the table below:

Zerodha sell charges for different trading products are the same as discussed above.

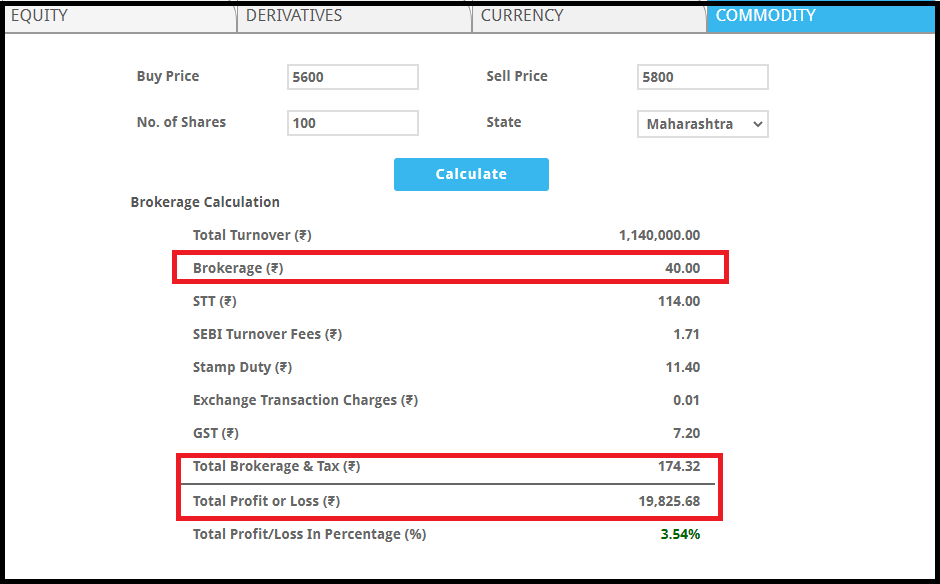

Zerodha Brokerage Calculator

No doubt, it is easy to calculate Zerodha brokerage charges, but with taxes like Zerodha STT charges and other fees, it becomes difficult for a trader to analyze the net brokerage.

To make it easier for you, here is the brokerage calculator Zerodha intraday and other trading products that not only calculate the brokerage fees but also the profit and loss percentage of a trade.

Conclusion

Zerodha equity brokerage charges thus vary on the product and segment you choose. Make sure you evaluate these charges in advance to avoid any confusion later.

Also, you can get in touch with Zerodha customer care at 080 4718 1888 for more details.

Interested in beginning a share market journey? Get in touch with us and we will assist you in choosing the right stock broker and in opening a demat account online for FREE!

More on Zerodha