When it comes to Options Trading, there are different complexities involved in terms of choosing a specific strategy that works the best for you.

At the same time, each strategy has its own set of advantages as well as limitations, thus making the concept of options trading even more challenging. Thus, in case you are looking to fit a particular strategy in your option trades, just check few areas before you make a choice.

In this detailed comparison of Bull Call Spread Vs Long Combo options trading strategies, we will be looking at the below-mentioned aspects and more:

- Current Market Position

- Your Risk Appetite

- Your Trading Experience

- Profit Potential

- Intention and Expectation of a trader

- Break-even point of your trade

Apart from the Bull Call Spread Vs Long Combo strategies, there are more than 25 comparisons of each of these strategies with other option strategies. With all these comparisons, you should be able to filter the ones that work the best for you.

Here is the detailed Bull Call Spread Vs Long Combo comparison:

| Comparison Aspect | Bull Call Spread | Long Combo |

| View |  |  |

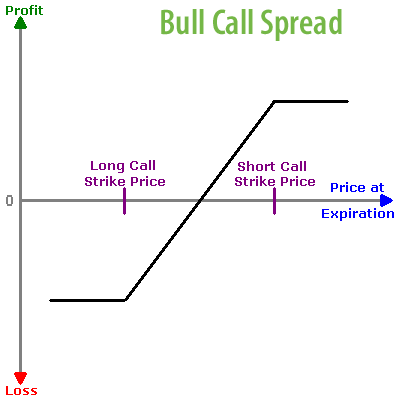

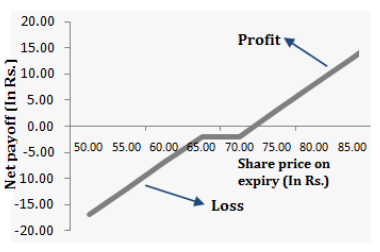

| Strategy Introduction | Bull Call Spread is a vertical options strategy that involves buying and selling two option contracts simultaneously, both with the same underlying security and expiry, but different strike prices...more | The long combo is used when the investor is bullish towards the market and is certain that the prices of the shares will go up...more |

| Investor Obligation | It involves buying and selling two option contracts simultaneously, both with the same underlying security and expiry, but different strike prices. | The strategy expects low initial investment, however, the trader needs to pay the premium on the trades irrespective of the trade result. |

| Market Position | Moderately Bullish | Bullish |

| Strategy Level Suitable for | Beginners | Intermediates |

| Options Traded | Call | Put, Call |

| Number of Positions | 2 | 2 |

| Action Needed | 1 ATM Call, 1 OTM Call | Sell One OTM Put, Buy One OTM Call |

| Risk for You | Limited | Unlimited |

| Profit Potential | Limited | Unlimited |

| Break Even Point for Investor | Strike price of Purchased Call + Net premium paid | Call Strike + Net Premium |

| Investor Intention | Let Options Expire Worthlessly | Low Upfront Investments, High ROI |

| Investor Expectation | Prices of the securities to Go Up moderately | Price of Stocks Go Up |

| Strategy Summary | Safe Play | Complex |

| Advantages | Limited Risk | Low Upfront Investment, Unlimited Profits |

| Disadvantages | Capped Profit | Unlimited Loss, High Premium |

| Market Scenarios - Profit | 3 | 1 |

| Market Scenarios - Loss | 2 | 1 |

| Also called as | NA | NA |

| More Comparisons | Bull Call Spread Vs Short Put | Long Combo Vs Short Put |

| Bull Call Spread Vs Long Combo | Long Combo Vs Long Put | |

| Bull Call Spread Vs Synthetic Call | Long Combo Vs Synthetic Call | |

| Bull Call Spread Vs Long Put | Long Combo Vs Short Call | |

| Bull Call Spread Vs Long Call | Long Combo Vs Long Call | |

| Bull Call Spread Vs Covered Call | Long Combo Vs Covered Call | |

| Bull Call Spread Vs Covered Put | Long Combo Vs Covered Put | |

| Bull Call Spread Vs Protective Call | Long Combo Vs Protective Call | |

| Bull Call Spread Vs Short Box | Long Combo Vs Short Box | |

| Bull Call Spread Vs Long Call Condor | Long Combo Vs Long Call Condor | |

| Bull Call Spread Vs Short Call Condor | Long Combo Vs Short Call Condor | |

| Bull Call Spread Vs Box Spread | Long Combo Vs Box Spread | |

| Bull Call Spread Vs Short Strangle | Long Combo Vs Short Strangle | |

| Bull Call Spread Vs Long Strangle | Long Combo Vs Long Strangle | |

| Bull Call Spread Vs Collar Strategy | Long Combo Vs Collar Strategy | |

| Bull Call Spread Vs Long Straddle | Long Combo Vs Long Straddle | |

| Bull Call Spread Vs Short Straddle | Long Combo Vs Short Straddle | |

| Bull Call Spread Vs Long Call Butterfly | Long Combo Vs Long Call Butterfly | |

| Bull Call Spread Vs Short Call Butterfly | Long Combo Vs Short Call Butterfly | |

| Bull Call Spread Vs Bear Call Spread | Long Combo Vs Bear Call Spread | |

| Bull Call Spread Vs Bear Put Spread | Long Combo Vs Bear Put Spread | |

| Bull Call Spread Vs Short Call | Long Combo Vs Bull Call Spread | |

| Bull Call Spread Vs Bull Put Spread | Long Combo Vs Bull Put Spread |

Thus, with this, we wrap up our comparison on Bull Call Spread Vs Long Combo option strategies.

If you are looking to put minimal initial investment and are open for unlimited profits as well as risks, then Long Combo options strategy can work wonders for you.

If you are in a moderately bullish market set-up and have a limited market risk appetite then you make consider using the Bull Call Spread strategy in your trades.

To add to that, the profit you get using this strategy is also limited in scope.

Furthermore, as told above, it also depends on the market situation.

In case you are looking to trade in options segment or share market in general, let us assist you in that. Just fill the form below and we will take you to the steps ahead.