NJ Wealth

List of Stock Brokers Reviews:

NJ Wealth is one of the leading financial advisors and distributors of financial products in India. The company, operating as a full-service stockbroker, was incorporated in 2003 and has grown to a large extent from its humble beginnings.

The financial firm has a strong network in different capacities. If we talk about current partnerships, NJ Wealth has more than 33,000 network partners across 25 states in India. The overall offline presence stands at around 100 branches.

If you are interested in partnering with NJ wealth, here is a quick piece on NJ Wealth Franchise.

In this detailed review of NJ Wealth, we will have a quick look at the different services it offers to its clients and whether it makes sense for you to invest in the share market using their services.

NJ Wealth Review

NJ Wealth has exposure to financial investments, financial products and services, and portfolio management services. NJ Wealth is broadly divided into two divisions.

- NJ Fundz Network provides dedicated independent financial advisory services. It has many advisors who provide the support, products, and services in the financial advisory segment.

- NJ Wealth Advisors provides financial planning and portfolio management services to its clients. It provides unique and need-based financial advisory services and investment solutions.

The company also has a training division by the name of NJ Gurukul which provides the required knowledge and skills to the upcoming financial advisors. The technology to stockbroker is provided directly by its division Finlogic Technologies India Pvt. Ltd.

NJ Wealth Client

NJ Wealth reported 15,350 active clients as of FY 2019-20. The clients vary from individuals to corporates. The client base is very wide and is spread across the whole country.

Looking at the overall client base, the full-service stockbroker falls among the category of smaller stockbrokers as far as clientele size is concerned.

There is a possibility that the stockbroker has reasonable brand equity in very specific areas of the country. However, on a comparative basis, NJ Wealth is still a small broker.

Also Read: Top Stockbrokers in terms of Active Clients

NJ E-Wealth

NJ Wealth the most popular financial advisor and distributor offer a seamless way to its client to streamline transactions and trading.

This helps the existing client to track their investment.

NJ e-Wealth app gives access to its client to track their mutual funds, direct equity, IPOs, ETFs, bonds, at one single place.

With this platform, it becomes easy for clients to buy, sell or switch investment with your computer or smartphone at any time and from anywhere.

No wonder, it makes the whole transaction process fast, smooth and paperless.

Wondering why to download the app, then here are some of the perfect reasons.

- The NJ e-Wealth App is secured and user-friendly.

- Also, the app helps its clients to check their transactions and portfolio at any time.

- Thus it gives a better understanding of mutual funds, direct equity, ETFs, at one single place.

Here are the top features of the app that gives you the reason to download it right away.

- Allow you to view the portfolio online

- Allow to buy, sell, and invest anytime

- Easy and user-friendly interface

- Allow opening account without the involvement of any paper.

- Offer a convenient transaction option.

- Convenient and Secure Payment Options.

- Create comprehensive reports.

- Provide centralized customer care.

- No requirement of a signature.

- No physical application.

- Allow you to view your portfolio online.

- It gives you access to process everything online.

NJ E-Wealth Login

The app is available on the Google Play Store and App Store and thus is compatible with all devices.

To access the account one needs the login ID and password.

Here is how to get the information about it.

- Download the app from the Play Store or App Store.

- After installing the app, open the app, fill the form and upload the document to open the account.

- After verification of all the information, you will get the login ID and password that gives you permission to access the account.

NJ Wealth Products

In terms of products, NJ Wealth provides advisory services on investment products like mutual funds, Equity, ETFs, fixed deposits, Portfolio Management Services (check NJ PMS for more information), government bonds, infrastructure bonds and approved securities for charitable trusts.

The other products include real estate including commercial and residential properties. The firm also provides training and education consisting of certification share market courses, AMFI, CFP and training products.

The services of NJ Wealth include trading support and Demat account services. It is a registered member of BSE and NSE, and CDSL as a depository participant. The trading is restricted to trading in mutual funds as of now.

The depository services help the clients to hold securities in electronic form, which is safer and quicker. The services provided by the broker are safe, secure and efficient.

Again, looking at the range of the financial products, there are very limited options for you to invest in apart from Equity (in case you wish to invest in the stock market products primarily). However, if you are open towards the asset classes, then this can be seen as a varied range as well.

NJ Wealth Trading Platforms

The stockbroker offers the following trading platforms to its clients. There are some positives as well as concerns related to the performance and the overall user experience of these applications.

It is advised that you go through a demo of the platform before opening your account with the broker.

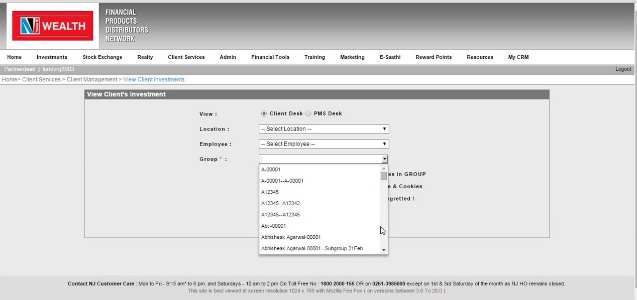

NJ Client Desk- E-Wealth-Web Platform

NJ Wealth has an online platform i.e. it can be accessed through a web browser without the need for downloading or installing any particular software. It provides access to the entire portfolio across mutual funds, direct equity, ETFs, IPOs, and bonds, along with the current valuation.

Since the application is responsive in nature, all the services can be accessed anytime from anywhere in the world through computers or smartphones.

The transactions do not require physical signatures or physical applications. The transaction and payment options are convenient and secured, with the process of transmission enabled. The platform also provides comprehensive reports and helps the clients keep track of their wealth effectively.

The platform provides services like purchase, redemption, SIP registration, SIP transaction, switch transaction, and SWP transaction. All the products and services are available through the platform. The SIP top-ups can also be done anywhere anytime through the online platform.

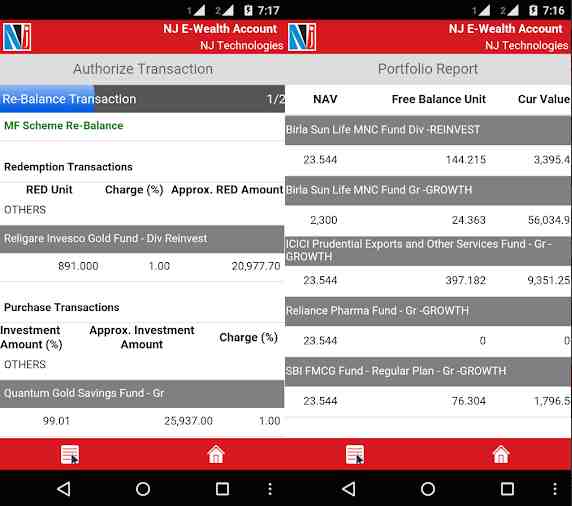

NJ Client Desk and NJ E-Wealth Account- Mobile Applications

NJ Wealth provides both client desk and trading services through mobile applications. The applications are easy to use and secured and can be used for transactions on the go. The clients can also check their transactions and portfolio reports.

The security is maintained through two-way authentication and encryption. However, there are certain drawbacks in terms of user-interface and user-friendliness.

The Client Desk application can be used to check the net worth, valuation report, P&L report, and last 10 transactions.

At the same time, here are some of the concerns raised by the clients of NJ Wealth when it comes to the broker’s mobile app:

- A limited number of features

- Login Issues

- Average user experience and interface

Here are some of the stats of this app from the Google play store:

NJ Wealth Client Desk

The customers may get in touch with the company with their grievances or suggestions using specific DP Helpdesk on email or phone. The customers can also connect with NJ Wealth at their physical offices.

The stockbroker claims to have a strict process to ensure high quality of products and services. The standards and processes are fixed and well-defined and taken seriously. The high-quality service to the customers is provided through the well-trained staff.

As far as communication channels are concerned, the broker has the following ways for you to get in touch with them:

- Phone

- Fax

- Offline Branches

Specific policies are in place to keep the customers’ information safe and confidential and efforts are made to improve the service standards from time to time.

Overall, the broker provides better than average customer support to its clients.

NJ Wealth Customer Care

NJ Wealth always remains active to address customer grievances and complaints seamlessly.

To get the best response it is good to call the customer care executive during the working hours on weekdays between 9:15 am to 6:00 pm and between 10:00 am to 2:00 pm on Saturdays (except second and fourth Saturday).

The toll-free number of the customer care executive is 1800 102 0155 and the non-toll free contact number is 0261-4025000.

Here are the contact details for various users:

NJ Wealth Account

NJ offers many benefits to its clients by offering a seamless way to trade.

The NJ Trading Account & Demat Account (TADA) service reduces the hassle and worries of physical transactions.

It reduces dependency and makes the transaction simple & cost-effective.

Here are the products under NJ TADA:

- Exchanges traded Mutual Fund Schemes

- Exchange-Traded Funds or ETFs.

- Direct Equity Stocks Traded on Exchange

The transaction options covered under NJ TADA are:

- Online Desk Transaction: Allowing transactions from NJ Trading Account Desk.

- Call & Transact: Transaction done by calling on a help-line number of NJ Wealth

- Offline Mode: In this, the transaction is done using the physical instruction form.

NJ Wealth Partner

With the growth and increasing demand, the NJ wealth looks forward to adopting the practice of quality distribution, customer-centric approach, and single window solutions.

This is achieved with the NJ Partner. It is the heart of the comprehensive distribution platform that is used by the partner.

With this, the partner gets access to multiple financial products and many-value added services.

The success of NJ lies behind the work that the partner does.

By becoming the part of NJ Wealth Distributor, NJ Partners enjoy the following benefits:

- Access to rich financial baskets and investment products like mutual funds, direct equity, real estate properties, etc.

- Get the strong, cutting edge technology that is useful for driving business services.

- High-class back-office operational services thus reducing the hassle to do operational tasks.

- Dedicated customer care services

- Strong trading and distribution practices that help in improving the distribution services.

Experience a difference by getting associated with the NJ Wealth Partner.

NJ Wealth Pricing

When it comes to charges, there are different ways a stockbroker may end up charging you. Thus, you are advised to get a clear-cut understanding of all payment types before opening the account.

- In the case of NJ Wealth, the account is opened with CDSL and there are no charges for opening a Demat account.

- The annual maintenance is free for the first year and it is Rs 354 from the second year onwards.

NJ Wealth Brokerage

Here is a quick glimpse of the brokerage charges levied by NJ Wealth:

- The company does not charge any brokerage on mutual funds.

- If the client wishes to trade in stocks through the company’s platform, the brokerage is 0.50% for Equity delivery and 0.05% for Intraday trading. From the industry’s perspective, the brokerage values are pretty high and certainly look tough as far as value for money is concerned.

Check this NJ Wealth Brokerage Calculator for more information on brokerage, taxes, GST, Stamp duty, etc.

NJ Wealth Margin

The broker provides exposure (or limit) as mentioned below:

- Since the company is not primarily in stock trading, it does not provide any leverage for stock trading. Stock trading is entirely the clients’ onus and choice.

Thus, in case you are looking for the limit on your trades or use margin trading, well, this is not a broker that you should be looking for.

NJ Wealth Advantages

The stockbroker has the following advantages for its clients:

- The coverage is across various parts of the country through its sub-broker offices.

- The transactions are safe and secure.

- Better known for mutual funds investments.

NJ Wealth Disadvantages

Here are a couple of concerns in case you are looking to be a client of this financial firm:

- Investment is restricted to mutual fund schemes only. The company does allow stock trading but it is on-demand and consent of the client. The company does not provide any broking or assistance for stock trading.

In case you are looking to get started with stock market investments or trading in general, then let us assist you in the overall process.

Just fill in some basic details in the form below:

NJ Wealth Membership Information

Here is a quick glimpse of the membership information of NJ Wealth with different regulatory bodies of the Indian Stock market space:

NJ Wealth Branches

The branches of NJ Wealth are located in Ahmedabad, Allahabad, Ambala, Amritsar, Anand, Aurangabad, Bangalore, Baroda, Bharuch, Bhavnagar, Bhilai, Bhopal, Bhubaneswar, Bhuj.

Also, NJ branches are in Chandigarh, Chennai, Coimbatore, Dehradun, Durgapur, Faridabad, Gandhinagar, Ghaziabad, Goa, Gurgaon, and Gwalior.

NJ Wealth also has branches in Himmatnagar, Hyderabad, Indore, Jabalpur, Jaipur, Jalandhar, Jamnagar, Jamshedpur, Junagarh, Kanpur, Kolhapur, Kolkata, Lucknow, Ludhiana, Mehsana.

Also, you can find its branches in Mumbai, Mysore, Nadiad, Nagpur, Nasik, Navsari, New Delhi, Noida, Palanpur, Patan, Patna, Porbandar, Pune, Raipur, Rajkot, Ranchi, Ratlam, Sangli, Surat, Trichy, Udaipur, Valsad, Vapi, Vijaywada and Vishakhapatnam.

More on NJ Wealth

If you wish to learn more about this stockbroking house, here are a few reference links for you: