How to Open a Demat Account?

Check All Frequently Asked Questions

Have you taken a decision to enter the stock market and wondering how to open a Demat Account?

Well, the process is simple and straight and we are here with the complete guide that helps you to get into a trade easily.

Before opening a Demat Account, its good to know about Demat Account Rules. This will help you to begin your journey in a smarter way and in accomplishing your financial goals.

Since the world of trading and investing brings you ample opportunities so it is important to be clear about the process associated with the opening of a Demat account.

So, let’s get started!

Procedure for Opening a Demat Account

If you want to start trade in the share market then it is important to have a Demat and trading account. On one hand where trading account holds the cash to trade in stocks, on the other Demat account is useful to hold your stocks in the electronic form.

So if you are planning for a long term investment then having a Demat account is mandatory to keep your stocks safe and secure.

To open a Demat account is a piece of cakewalk these days with some of the stockbroking firms claiming to offer you account details within 4 hours.

By the time, this duration will get even smaller and probably be competing with some of the pizza delivery promises! You never know.

Also, technology advancement has now made it easy for everyone to open a Demat account without leaving their comfort zone. In simple terms, you can now open an account with a reliable stockbroker online.

For the online Demat account opening process, you just have to ensure that you have a good internet connection and a laptop or desktop.

Just sit online and fill the account opening form, upload the documents, make a payment, and on verification, you will get the account details in your email id.

To know the detailed information, here we are with the review where we will talk about how to open a Demat account with the complete process of the different steps involved. Besides opening the account know how to use your Demat account.

Also Read: 5 Stock Brokers that Open Account Online

Let quickly jump onto the real deal now!

How to Open a Demat Account Online?

Before getting an answer How it is important to know Where to open a demat account. No doubt it was a hassle earlier but with the growing usage of the internet and technology, there are multiple ways to open a demat account online in India.

To get the answer for this here is the complete process and factors that includes finding the right stock broker, keeping all documents ready, and knowing about the charges associated with the demat account opening.

So, let’s get started!

Step 1: Choose the Best Stock Broker

First things first, you’d need to narrow down onto a specific Stockbroker through whom you’d carry out trading and investments.

In the current scenario, there are 3 types of Stockbrokers you can choose from:

1. Bank-based Stockbrokers

When thinking of opening a demat account you can look for a bank-based stockbroker. Bank-based stockbrokers provide you with a perception of safety (although most of the SEBI registered stockbrokers are safe in nature) since they come from the roots of a banking brand.

Such types of brokers are known to provide a reasonable quality of customer support, 3 in 1 Demat Account, etc.

However, banking stockbrokers are the most expensive ones. Generally, they end up charging you 0.4% to 0.6% of your trade value (in the delivery segment) which kills the profit you can potentially make from your trades.

Some of the examples include ICICI Direct, AxisDirect.

2. Full-Service Stockbrokers

Full-service stockbrokers provide mainstream stock market trading and investment services.

Although the kind of value this type of broker provides are in similar lines of what is provided by bank-based stockbrokers, these are relatively less expensive as compared to the latter.

A small fraction of full-service stockbrokers also provides high-quality research and recommendations along with offering reasonable offline presence through their sub-brokers and franchise offices.

Some of the examples of the full-service broker with whom you can open a demat account include Angel Broking, Motilal Oswal.

3. Discount Stockbrokers

Discount brokers are no-frills low-cost stockbrokers that offer no research, no offline presence, average customer support. However, the trading platforms provided are of high performance to go along with low brokerage charges across trading segments.

You can also get in touch with us for stockbroker selection where we can help you narrow down the most suitable stock broker as per your preferences and requirements.

Some of the examples include Zerodha, My Value Trade

Once you have finalized the stockbroker to open a Demat account for yourself that works the best for your requirements, the rest is primarily the formalities involved in the process.

If you already have a Demat Account and want to transfer shares from one broker to another, you can do this with Demat Account Transfer Form.

Step 2: Documents Required to Open a Demat Account

Once you have been able to decide on which stockbroker to go ahead with, the next obvious thing (in the process of how to open a demat account) you need to do is set up a callback and get started with the formalities involved. These formalities include:

- Fill up the registration form (like the one shown at the end of this review)

- Attach the following documents

- PAN Card

- ID Proof (any of these – Voter Id, Aadhar Card, Passport, Driving License)

- Address Proof (any of these – Ration Card, Driving License, Passport, etc)

- Bank Statement for the last 6 months

- Deposit fees (account opening charges, annual maintenance fees, etc) and margin money (or trading balance)

- Dispatch the documents or get a pick up arranged by the stockbroker

Apart from these documents, you will be required to sign a POA document.

POA or Power of Attorney, as per the regulatory bodies, is not a mandatory document.

However, in case you are looking to trade in the delivery segment where the stocks you buy will be stored in your demat account, in such cases, signing a POA is required.

Otherwise, if you are looking to trade at the intraday or in the derivatives segment, then in such cases, there is no need to sign a POA.

For more information, check this detailed review on the documents required for the demat account.

Make sure to get a copy of the account opening form, POA, or any other documents you might have signed.

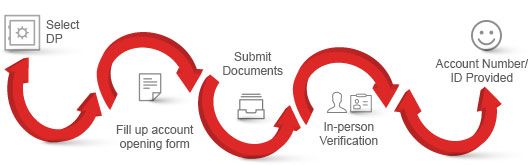

Here is a quick infographic on How to Open a Demat Account in India

Step 3: In-Person Verification

Once you have dispatched the documents, the stockbroker will perform an IPV or an In-Person verification where they’d either:

- Send an authorized person to your address and verify you in person or

- Get the IPV done online through Skype, Whatsapp or any other video calling mechanism

The latter option has been recently adopted by one and many stockbrokers to quicken the process of onboarding a client. This step is taken to make sure the submitted details match with the actual person, thus, to avoid any sort of unforeseen forgery issues.

For instance, if you are looking to open a Zerodha Demat account, you need to click your photograph using your laptop or phone along with displaying an OTP that is sent to you for Zerodha IPV

Common confusions – Is my Demat account number the same as my DP ID?

Step 4: Verification

In the final step, you don’t really need to do anything.

This is the step where the stockbroker verifies all the details, generate a client ID or an account number for you. You also get user id and password for different trading platforms to access.

Once you receive these credentials, you are good to go and start trading.

This also needs to be noted that a lot of stockbrokers are opening trading accounts online. This makes the whole process much simpler, quicker, and efficient.

For reference, you can check a couple of articles here:

Furthermore, if you are someone who prefers a physical connection with the local sub-brokers and wants to open your demat account offline, you can perform all the formalities offline as well.

In such a case, the account opening procedure is even quicker.

Eligibility to Open a Demat Account

Apart from you checking a suitable stockbroker for yourself, there will be a few eligibility grounds that you need to take care of while you look to open a demat account for yourself.

Here is a quick review of the eligibility criteria for opening a demat account:

- There are no age criteria, as such like many users may think of. If you are a minor, then you can open a demat account with the PAN card details of your parents/guardian.

- You must be an Indian resident, otherwise, you’d need to open an NRI Demat Account.

- You’d need to provide a set of documentation that we have discussed in the next section.

How to Open Demat Account Without Aadhar Card?

Now according to the process described above, one must have a PAN Card and Aadhar card to open a demat account.

But what if you do not have an Aadhar card?

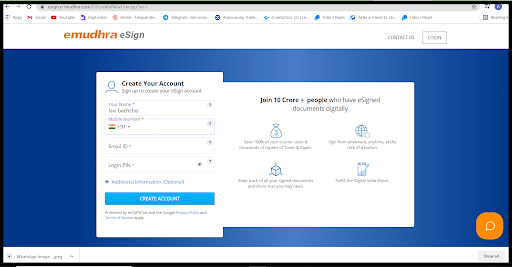

In that case, you need to follow a little different process to open a demat account, where you can verify your details using eMudhra.

It involves the process of in-person verification where you need to shoot a video of few seconds mentioning your details and displaying your Government approved ID card other than Aadhar card.

Charges for Opening a Demat Account

When you open a demat account, there are specific types of charges involved, that you need to incur. Some of those charges are one-time costs, while a few of those are recurring in nature.

Here are the details:

- Demat Account Opening Charges (one-time)

- Demat Account Annual Maintenance Charges (recurring every year)

- Transaction charges (based on your trading)

- Brokerage charges (based on your trading)

- Remat Charges (one-time)

- GST (based on your trading)

- STT (based on your trading)

- Trading Platform charges (not with every broker, recurring monthly/yearly)

For more information, check this detailed review on Demat Account Charges in India.

Where to Open a Demat Account?

So, you might now be clear with the demat account opening process. Now get the best guidance and assistance to find the broker and to open the demat account.

However, it is good to take into consideration, a few important tips and points that help you to understand how to open a demat account:

- Your stockbroker can revise any charges levied on you by giving you a 30-day notice. You have the option to continue or switch to any other stockbroker.

- There is no mandate from SEBI that you need to have a minimum share balance on your demat account.

- The stockbroker cannot charge you for closing a demat account. This must be done for free.

- The stockbroker cannot even charge you for transferring your shares to some other stockbroker. You can read more details on how to transfer your shares here.

If you are still confused about where to open a demat account, then here we are to assist you.

Now open a Demat Account for FREE!

Open a Demat Account Frequently Asked Questions

Here are some of the most frequently asked questions one may look answers for when in the process to open a demat account:

Q. How many trading account types are available for me to pick from?

There are at least 6 types of trading or demat accounts available viz:

- Equity Demat Account

- Derivatives Trading Account

- Commodity Demat Account

- Commodity Trading Account

- Discount Broking Account

- Full-Service Demat Account

To trade in the stock market with regular buy and sell transactions, you would need at least 1 demat and 1 trading account against your PAN card.

Also, to get into commodity trade, you have to open the NCDEX Demat Account or MCX Demat Account.

Q. Can I Open a Demat Account for Free?

Yes, you can. There are a few stockbrokers in India, that provide the facility of a free demat and a free trading account. Furthermore, some even allow a demat account with zero AMC i.e. Annual maintenance charges.

For more information, you can check this detailed review on Free Demat Account in India.

Q. Are there any problems associated with a demat account?

There is a con side to every entity in any space. When it comes to stock market investments, the demat account has its set of concerns that you should be aware of.

Some of those are listed below:

- You need to be tech-savvy. An understanding of how to operate mobile trading apps or web-applications is important as call and trade facilities may lead to opportunities being missed.

- Regular check on your stockbroker

- Additional contract inspection to be done by the trader.

For more information, you can check this detailed review on the disadvantages of the demat account.

Q. What are the benefits of a demat account?

And of course, there are multiple benefits when you look to open a demat account as listed below:

- Automatic transactions of shares

- No problems related to theft or even mutilation of shares as they are stored in a digital format.

- Multiple investment products can be availed.

- Complete control of your trades.

For more information, you can check this detailed review of the benefits of the demat account.

Q. What is the importance of a demat account?

The demat account comes with its own importance to traders and investors. For instance:

- It works as a store for the shares you have bought from the stock market.

- Completely safe

- Totally convenient and can be used with the help of a mobile app

- Allows keeping multiple investment instruments.

For more information, you can check this detailed review on the Importance of Demat Account.

Q. I just opened a demat account. How can I use it?

Once you have gone through the process to open a demat account, now you are supposed to use it to trade in the stock market. You need to follow some basic steps to go about it, as listed below:

- The stocks you buy move to the demat account in an electronic format i.e. you do not get any physical copies of the shares bought.

- Regularly keep an eye on the stored shares and other investment products bought by you.

- You can use your demat account to transfer the shares as well.

- Feel free to add a nominee in the demat account who can own the shares

- You can add/edit information to your demat account through an online process without any need for any outside assistance.

Q. Which is the best demat account in India?

Well, this is a very subjective question as the definition of the word “best” for a demat account varies from one trader to another. This is for the simple reason that one trader may look for lower brokerage while someone else may look for a top trading application.

Nonetheless, for some reference, here is a detailed review of the best demat account.

Confused or need any advice on how to open a demat account or to whom to open it with? This is a very crucial step and can be a difficult one as well.

Why don’t you send us your details and we will arrange a free callback for you and help in resolving your concern!

Read this review in Hindi here.

Please clarify if nomination in trading account is advisable.

Also if authorisation to transact given to close relative in opening form is to be expressly mentioned in account.

Thank you.

Yes, you may add a nominee. It only helps! But the person must be trustworthy enough.

It is generally asked in the account opening form about the authorization. Depends on the broker as well.