Return on Assets

More on Share Market Analysis

Return on Assets (ROA) is a financial ratio which is used to calculate the percentage of profit earned from its total assets. In other words, it measures how well the company is using its assets to generate profits during a given period. This is one of the most important fundamental analysis tools.

Return on assets is a key profitability ratio, to see how the company is using each penny invested in the resources of the business i.e.its assets to generate income for the business and of course its shareholders.

It is calculated in percentage form.

Sometimes it is also referred to as Return On Investment (ROI).

Return On Assets Formula:

The formula used to calculate Return on Assets is as follows:

ROA = Net Income After Tax / Average Total Assets

or

ROA = Net Income After Tax / End of Period Assets

Let’s dig a bit deeper into what each of these terms implies:

Net Income :

In an accounting year, the excess of revenue over the expenses is called Net Income or Net Profit.

Revenue is the money earned from the sale of goods of the business or services rendered by the business.

There are various expenses incurred during the course of business that are classified as operating expenses, non-operating expenses, interest paid on debt, and income tax due to the government.

Operating expenses can include the cost of goods sold, production overhead, administrative and marketing expenses and amortisation and depreciation of equipment and property.

Net Income appears at the bottom of the income statement.

Also Read: How to Read an Income Statement in 5 Minutes

Total Assets :

Anything that is owned by the business and is used to generate income or can be converted into cash is called an asset.

An asset is broadly divided into two parts: Current Assets and Non-Current Assets.

Current Assets :

Assets that can be converted into cash easily are known as current assets and they have a life of 12 months. They are also known as short-term assets.

Examples of current assets are trade receivables, prepaid expenses.

Non-Current Assets :

Assets that can not be converted into cash easily are known as non-current assets and they are the investment of the business for a longer period of time that is more than one financial year. They are known as long-term assets.

Non-current assets can be further divided into tangible assets and non-tangible assets.

Examples of non-current assets are plant and machinery, equipment, goodwill.

Return On Assets Calculation

There are two acceptable ways to calculate return on assets :

First method using average total assets; average total assets is equal to ending assets minus beginning assets divided by 2.

Second, using total assets on the exact date, this method uses the assets on a specific date, usually the end of period assets.

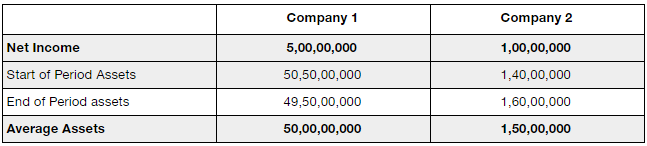

Now let’s learn with the help of an example the two methods to calculate Return on Assets:

ROA for Company#1 (Using Average Assets method):

5,00,00,000/50,00,00,000 = 10%

ROA for Company#2 (Using Average Assets method)

1,00,00,000/1,50,00,000 = 67%

Return on Asset is calculated using the average total assets method, start period assets plus the end period assets is added and divided by 2, hence the average assets.

The return on assets for company 1 is 10% and return on assets for company 2 is 67% which means that company 2 is making better use of its assets to generate income

or

we can also say that even with the lesser amount of assets involved in the business the company 2 is making better profits.

ROA for Company#1 (Using End Period Assets method):

5,00,00,000/49,50,00,000 = 10.1%

ROA for Company#2 (Using End Period Assets method):

1,00,00,000/1,60,00,000 = 62%

The return on assets for company 1 is 10.1% and return on assets for company 2 is 62% which means that company 2 is making better use of its assets to generate income. Hence both the methods show the same result, some industries use the first method while some use the second.

Return On Assets Interpretation:

Here is how you should ideally be interpreting return on assets while different companies provide their financial information:

- Return on Assets is an important ratio in analysing a company’s profitability.

- The ratio can be used to compare a company’s performance between different periods of time.

- The ratio can be used to compare the company’s performance to other companies of similar size and nature.

- Return on Assets gives an indication of the capital intensity of the company.

- It is very industry specific because a capital-intensive industry will possess a high value of fixed assets for its functioning for example an airline company or a thermal power plant will have lesser return on assets since it has a large assets base as compared to less capital intensive industry like a software company where there are fewer assets involved and hence the higher return on assets.

- It is very important to consider the scale of business and operations performed when comparing two different firms using return on assets

- For instance, a business that is capital intensive and possesses high value fixed assets will have a higher assets base as denominator as compared to a similar business with a lower assets base as denominator, even if the two may earn similar income, the business that is more capital intensive may have a lower return on assets due to a larger denominator.

- Return on Assets can also show companies as to how to improve the efficiency of their company and also how they can make better use of there assets.

Ideal Percentage of Return of Assets:

As a general rule, a return of assets under 5% is considered an asset-intensive business while a return of asset above 20% is considered an asset-light business.

Hence lower the return on asset, the more asset-intensive a company and higher the return on asset, the lesser asset-intensive a company is.

Any percentage of return on assets above 5% is considered to be a good indicator of its performance.

Return of Assets Limitations:

You also need to know the darker side of the coin and here are a few concerns you must take care of while using ROA as a metric to calculate company performance:

- Return on assets should not be compared across the industry. The assets utilised by various industries are different, for example, some industries will require expensive plant and machinery, equipment to generate income as compared to other industries which do not require such expensive or large base of assets.

- Therefore these companies would naturally have a lower return on assets when compared to companies that do not require a lot of assets to do their business.

- Return of assets does not account for the borrowed capital in the company and hence it is one of the limitations.

- Sometimes the declining return on assets is a cause of worry to investors and owners, but they should bear in mind that it does not include outside liabilities and hence the profits can be higher as compared to the derived profits.

Return of Assets Summary :

After a detailed analysis and discussion about the return on assets, we can conclude that return on assets is a good indicator to measure the company profitability but it is very industry specific hence due care must be taken while making a comparison of the ratio of one company to another company within the same industry as well.

Overall it’s easy to compute and understand the significance of the ratio.

But do make sure, it is part of your fundamental analysis while you decide on which stocks to invest in.

In case you are looking to invest in the stock market, let us assist you in taking the next steps forward: