Reliance Securities Franchise

View All Sub-Broker Reviews

Reliance Securities Franchise business is widely acclaimed, especially due to its brand equity built over the years since its existence. If you are looking to set-up a sub-broker or franchise business within the stockbroking space, then this is one of the options you may look out for.

In this detailed review, let’s have a quick look at some of the offerings provided by the broker and then you may decide whether to go ahead with this broker or not.

Reliance Securities Franchise Review

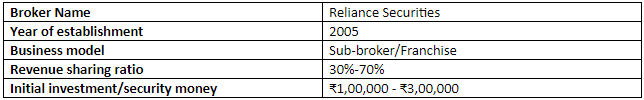

Reliance securities, as is known, is the trading arm of the Reliance Dhirubhai Ambani Group (ADA) and one of the largest broking houses in India. The company was established in the year 2005 with the aim of providing best broking service. The headquarter of the company is in Mumbai.

Reliance securities have over 8 lakhs customers all over the country. It has a wide network of outlets and branches in 1,700+ cities. Their business expansion program is still in the full swing. The company is trying its best to reach all potential markets in India through its business associates.

Reliance securities offers a wide range of products and services to its customers.

It has an above industry average and innovative product offering for its business partners as well as its clients. Furthermore, it provides up-to-date services to customers in research and support.

Following is the list of products and services offered to the clients.

- Equity

- Derivative Trading

- Mutual funds

- IPOs

- Currency

- Bonds

- Corporate FDs

- Portfolio management services (PMS)

- Wealth management

- Life and general insurance

- Gold coins.

This wide range of products and services or we can say the company offering helps clients to fulfil their investment needs and objective under one roof.

If you start a franchise business with the reliance securities, then you will be benefited from the brand name, goodwill, and reputation associated with the company.

Again, you will be able to save the time of business set-up, can easily attain the break-even, the profitability target can also be reached easily with the help of reliance securities.

In this article, we are going to discuss different aspects of Reliance securities like its offer, revenue sharing ratio, security deposit, costing etc.

Reliance Securities Franchise Advantages

You will get the following advantages if you start a partnership business with Reliance Securities.

- You will be able to provide the latest technology-based trading platform to your clients. It will help them to generate more revenue through an easy and advanced way.

- With the help of innovative products offered by the broker, your clients will be able to grasp the intra-day trading opportunity arises from the market movements. You can say their buying power will maximize.

- An Excellent risk management system will facilitate you to monitor the online reports of your clients on a real-time basis. And finally, it will help you to limit the number of trades to minimize the losses of your clients.

- A well-researched report published by the broker research experts on weekly, monthly and yearly basis will help you and your clients to take the right decision for trading and earn a good profit.

- The broker offers the centralized back office, to you and your clients to manage efficiently the excessive of operational and service workload.

Reliance Securities Franchise Models

Sub-broker/Franchise is the first and only model offered by Reliance Securities to its potential business partners.

Those who want to start a partnership business under this model are required to make some security deposit. The sub-broker can access all tools and technology used the main broker.

It is just like you have started your own business with the only difference being you are using an established brand name.

To get started, you will be required to set-up your own office from where you can work with your clients. The broker will help you in the marketing of your business through advertisements in the newspaper, banners, pamphlets, TV channels, mouth-to-mouth publicity etc.

You will get a share of revenue generated by your all clients as your income. The revenue sharing ratio between you and the broker can be increased also depending on some terms and conditions.

Reliance Securities Benefits:

If you choose to be a business partner of Reliance Securities, you will be provided with the following benefits on a regular basis:

- Right to access technology, trading platform, trading tools, research analysis, and reports everything.

- Attractive revenue sharing.

- Innovative product offerings.

- Right to change the charge structure to acquire more clients for your business.

- Benefit from the business and recognition.

Reliance Securities Franchise Revenue Sharing

Reliance Securities provides an attractive revenue sharing to their clients. The range of revenue sharing ratio is 40%-70%.

This range is in line with the industry. It may be a bit higher or lower also, depending on how your discussion with the broker executive goes. At the same time, it has a lot to do with your business background and existing client scale.

The upper percentage can be increased by bargaining with the broker. It depends on various factors like the security deposit, revenue generated, profit, regular performance etc.

Reliance Securities Franchise Security deposit

Under the Sub-broker model, you will have to deposit some security money with the broker for the different reasons. The range of initial investment is between ₹50,000 – ₹3,00,000. You can deposit the minimum or the maximum or any amount in between as a security deposit.

Generally, a broker with a high brand image in the market has a higher range of security deposit.

Depending on the deposited money, the revenue sharing percentage will also vary. This money will also be used by the broker to provide you the necessary infrastructure and office equipment required for your business.

The security deposit will be refunded when you exit from the agreement with the Reliance Securities.

Reliance securities Franchise Support

You will get the following support by the Reliance securities to run your business and to earn a handsome revenue through your clients.

- Marketing support: You will get proper marketing support like educational programs and various seminars will be arranged for your clients. It will help them to generate more business through knowledge and market updates.

- Training Modules: Various kinds of comprehensive training modules will be arranged for you to understand the products of the broker. It will, ultimately help you to make these understand to your clients.

- Operations and system training: For smooth functioning of your business, you will be provided training of day-to-day operations along with trading and data repository system.

- Sales training: To make you efficient enough to easily acquire talent for your business, comprehensive sales training will be provided. Acquisition of the right client will boost your revenue and profitability of the business.

- Regulatory Training: You will get training to know the rules and regulations related to the trading market. This will help you in the smooth running of your business and your clients will also able to know their rights.

- Regular contest and quiz: To engage you in your business, the broker organizes a regular contest and quiz. They distribute cash prize as well as other methods to motivate their employees. Sometimes clients are offered foreign tours also.

Reliance Securities Franchise Registration

By going through the following steps, you can become a business partner of Reliance Securities.

- Fill-up the registration form available on the website with the required details. You may choose to fill the below form as well:

- A call centre executive will call you to verify your interest.

- Another call will be to give the brief of the partnership business like types of business model, offerings, any investment required etc. In the same call, an appointment will be fixed to discuss in detail.

- In the meeting with the team member of Reliance Securities, details of the partnership business will be discussed. You can clear your queries and ask questions if any.

- You will be asked to submit the required documents with the initial deposit cheque for verification purpose.

- After verification of documents, an account ID will be provided to you.

- Now, you can start your business with the help of Reliance Securities to the earn profit.

Above all steps will take 7-10 business days to complete before you are provided with the account details.

Reliance Securities Franchise: Summary

Reliance Securities help its business partners by offering a wide range of products with an innovative and latest technology for trading. It helps their business partners in the way that they can give a new high to the company.

The broker is a brand name and easily be recognized among the financial market players. So, it will be quite easy for business partners to acquire clients for their business. Proper training is provided by the company, they also help you to stand strong in the competitive world of the broking business.

Hence, if you are thinking to start your own business in the broking space you can choose Reliance Securities and become a successful business partner.

To get started in order to become a franchise or a sub-broker, just fill the below form: