Dividend Yield

More on Share Market Analysis

Dividend yield or DY is a ratio of the total dividend distributed in the last 12 months divided by the share price.

In other words, the company distributes an annual dividend each year to its shareholders and when you divide this annual dividend by the current share market price of the company stock, you get the dividend yield of the company.

Thus, make sure you understand how to invest in dividend stocks in the first place in order to enjoy the benefits of this format of investing.

Dividend Yield Meaning

Dividend Yield is calculated in percentage form and is one of the most important metrics when it comes fundamental analysis of stocks.

In this detailed article about Dividend Yield we will learn about the various aspects related to DY :

- How to compute Dividend Yield

- Significance of Dividend Yield

- Limitations of Dividend Yield

- Difference between Dividend Yield and Dividend Payout

- Ideal Dividend Yield

Let’s get started.

Dividend Yield Computation:

It is easy to calculate the dividend yield of the company. DY can be computed by using the below-mentioned formula.

Dividend Yield Formula:

It can be calculated as follows :

Dividend Yield: Annual Dividend Per Share/ Current Share Price

Now let us understand these terms first :

Annual Dividend:

In the simplest terms possible, the sum total of money paid by the company from its reserves and profits to its shareholders annually is known as the dividend.

The dividend is mostly paid annually, some companies even pay it quarterly and there are others that pay it two times a year as well. Decisions related to the dividend are mostly taken by the Board of Directors and are based on the voting rights given to the shareholders.

Current Share Price:

A share is a unit of ownership held by the shareholder in lieu of the amount paid by them to the company. The price at which the shareholder buys the share is called the share price, the share price is set with the help of a lot of factors.

Current Share price refers to the actual price of the share at which it is trading at the stock exchange or any other trading portal. It is also called the present value of the stock.

Current price refers to the last price at which the stock was traded. It does not refer to the future price because that will be determined by the forces of demand and supply.

Now let us understand this further with the help of an example :

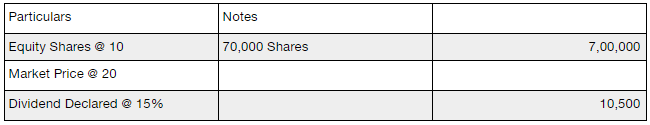

Company A

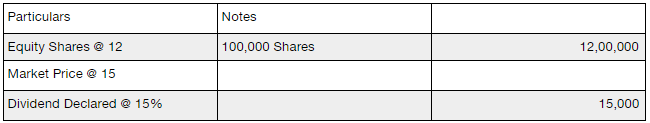

Company B

Dividend Yield: Annual Dividend Per Share / Current Share Price

Company A

Annual Dividend Per Share: Total Dividend/ Total Value Of Shares

: 10500/700000

: 1.5

Dividend Yield: 1.5/25*100

: 6%

Company B

Annual Dividend Per Share: Total Dividend/ Total Value Of Shares

: 15000/1200000

: 1.25

Dividend Yield: 1.25/15*100

: 8.3%

Dividend Yield Interpretation:

Company A has a dividend yield ratio of 6% while that of Company B is 8.3%, in comparison Company B has a better yield ratio than Company A, but overall if we see both have a good yield ratio.

In case of Company A, the market price is higher than the share price but the dividend distributed is not much and similar for Company B as well, hence before investing any of these companies, it is important to study the trend of DY for minimum 3 years.

Dividend Yield Significance:

Let’s understand how DY plays an important role in your investments directly and indirectly:

- It helps to understand whether the stock is giving any return or not.

- Dividend yield is calculated according to the current price

- DY with an increasing trend is considered a good indicator to buy the stock because in this case, the dividend has a steady graph.

- Sometimes the dividend is calculated by adding up the dividend of 4 quarters and dividing by the current share price, in such cases the investor will buy considering the current yield of the stock, in case the company decides to omit dividend or reduce the dividend the yield will decline, hence its important to know the actual yield and to be sure about the dividend before making any investment.

- Dividends are usually tax-free, hence it is a good investment opportunity for investors. So companies with higher DY usually attract a lot more investors as compared to companies which do not have a high dividend yield.

Dividend Yield Limitations:

At the same time, this share market research ratio comes with a few concerns as well that you must stay aware of:

- One of the biggest limitations of the dividend yield ratio is that it alone cannot give a fair picture of the progress of a company.

- Sometimes the companies do not give any dividend but these companies do have a good return on its income.

- Many times the fluctuations in the market which can lead to an increase or decrease in the price of the share, can be misleading because it will lead to a sudden increase or sudden decrease in the DY ratio

- In the case of market fluctuations, it is advisable to use a trend of DY ratio or an average of 3-5 years of DY ratio, to have a fair picture of the growth.

- Some companies reinvest their profits in the business as reinvestment, in such cases the DY is quite low, but the companies are quite profitable and provide a good return on the investment.

- On the other hand, there are some companies which give a very high dividend to its shareholders because they do not have good reinvesting opportunities, so in that case, the dividend yield ratio is quite high, but the overall return on profitability is less.

- So in such cases, all the other parameters must also be studied and weighed well.

Dividend Yield Ratio Vs Dividend Payout Ratio:

Dividend Yield Ratio is calculated to know the percentage of dividend (mainly cash dividend) that is distributed to the shareholders by the company on the other hand Dividend Payout Ratio is used to calculate the percentage of the earnings of the company that are used to distribute the dividend.

DY is the relationship of Annual Dividend and the share price while the Dividend Payout is the relationship between Net Income and dividend payment of the company.

DY helps to know whether the investment made gives a fair return or not but on the other hand Dividend Payout helps in making a future assessment of the stock of the company.

Ideal Dividend Yield Value:

As per the general rule, higher the dividend yield ratio the better it will be for the investor, lower DY means lesser growth for the investor.

But when the investor looks at an investment return it comprises of two parts which is called the total return, the first is the dividend part and second is the capital appreciation.

Dividend part is the return on the dividend and capital appreciation is the increase of the stock price. So in case, there is a good yield return on the dividend say 6% but the stock did not appreciate in price, say had a decline of 15%. Hence, in this case, the investor is at a loss overall.

So it is important to weigh all the factors before concluding about the dividend yield of any company.

Dividend Yield Summary :

High dividend yield ratio is considered to be a good indicator to buy a stock of the company but alone dividend yield is not conclusive about the company, hence there are many other factors like past dividends, investment policy, dividend trends and dividend policy that should be looked and considered while making an investment in any company.

If you want assistance in stock market trading through research and tips, let us assist you in taking the next steps forward: