Goodwill Commodities Partner

View All Sub-Broker Reviews

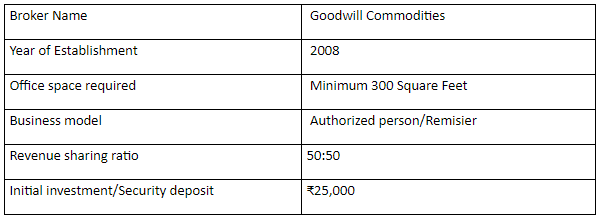

Goodwill Commodities is a Chennai based full-service stockbroker established in the year 2008. As its name suggests, the company has expertise in commodities trading and investment. The broker has one of the largest distribution networks and provides a wide range of products and services to its clients.

As a Goodwill Commodities partner, in any form, there are a reasonable number of business opportunities that you may capitalize upon. In this detailed review, we will have a look at exactly what and how it can be done.

Goodwill Commodities Partner Review

Goodwill Commodities has a presence over 27 locations in India through its branches and business partners. The broker has an active client base of more than 7,000. The annual turnover of the company is up to ₹50 lakhs. It means, if we talk about the size of the company, it is one of the smallest broking houses in India.

The broker has a good in-house research team that provides research reports to the clients to help them in taking the right investment decision. Not only this, the broker has a professional relationship with 24 banks through which you and your clients can easily transfer the funds.

As a Goodwill Commodities partner, you will be able to provide the following products and services to your clients.

In this article, we will discuss many important aspects of the Goodwill Commodities Partner like its business model, revenue sharing ratio, costing, eligibility, offers to the sub-broker etc.

Goodwill Commodities Partner Advantages

You will get the following advantages of starting a partnership business with the Goodwill Commodities:

- The broker provides specialized services in the Commodities segment. So, you can offer your clients all the services related to the Commodities service.

- You will be benefited by the latest technology used by the company for the trading purpose. Also, the company has experience in the broking field over a decade.

- The broker offers two business model to start a partnership business with them one is a Remisier model and another is the Authorized person model.

- The security deposit which is required to start an Authorized person model is very low. Anyone who wants to enter in the broking business with a minimum amount can choose this broker.

- An opportunity to earn higher by generating higher revenue and this slab of revenue sharing increases in your favour with the increase in your revenue generation.

Goodwill Commodities Partner Eligibility

If you are looking to be a partner of any stockbroker in India, you need to meet a few conditions at different levels. Following are the criteria which are required to fulfil to become a Goodwill Commodities Partner:

- A Person should have a good track record in the financial market or other businesses with a good number of the customer base.

- Should have 2-3 years of experience in selling financial products.

- Should have sufficient funds to meet the working capital requirements.

Goodwill Commodities Partner Types

Goodwill Commodities offer two types of business model

- Authorized person

- Remisier

Authorized person:

The authorized person is the first model offered by the Goodwill Commodities. This model is suitable for those who can set-up their own with some basic infrastructure requirements like the required office space must be a minimum of 300 square feet within the accessible location.

There should be at least two computers with the latest configuration and one dealer. There should be one admin or marketing staff.

The authorized person will get the right to access all the technology and tools used by the Goodwill Commodities. As a business partner of the broker, you will get almost all support to stand in the competitive market.

Benefits:

- Easy to attract those clients who want to get services, especially in the Commodities segment.

- Right to access all tools and technology used by the broker.

- A minimal security deposit required which is refundable.

- An opportunity to earn a higher profit with higher revenue.

Remisier:

Remisier is a common business model offered by the broking houses.

Under this model, you are not required to set-up an office to work. No security deposit is required to work under this model. You are just supposed to bring a productive client to the company and then the company will handle everything.

The broker will provide you with infrastructure support like the trading terminal, dealing desk, and direct Land-line phone. A remisier will get back-office as well as product support to run their business smoothly.

Benefits:

- No security deposit/initial investment required.

- Right to work under the roof of the Goodwill Commodities.

- Your work is client acquisition only, Rest will be done by the broker.

- Revenue sharing ratio is in-line with the industry.

Goodwill Commodities Partner Revenue sharing

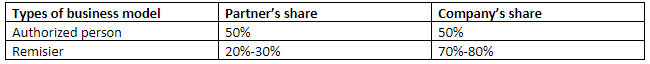

Authorized person:

The revenue sharing ratio between the Goodwill Commodities and the authorized person is 50:50 in the initial stage. This range is in line with most of the brokers in the initial stage. However, It increases steadily as your trading turnover increases.

Here, you can find more detail of the revenue sharing ratio between the AP and the broker.

- 50:50 revenue sharing between the AP and the Goodwill Commodities in the initial stage.

- 60:40 revenue sharing between the AP and the Goodwill Commodities for ₹150 Cr and above monthly turnover.

- 65:35 revenue sharing between the AP and the company for ₹250 Cr and above monthly turnover.

- 70:30 revenue sharing between the AP and the company for ₹300 Cr and above monthly turnover.

- The board takes the decision of revenue sharing ratio if the monthly turnover goes above ₹350 Cr.

Remisier:

As the work of a remisier is limited to client acquisition, its revenue sharing ratio is also accordingly. A remisier can get 20%-30% of the revenue generated by his/her acquired client. The rest will be the company’s share.

This is justified also, the company handles the client, their requirements, profit or loss everything. So, they are supposed to keep the maximum percentage of the revenue.

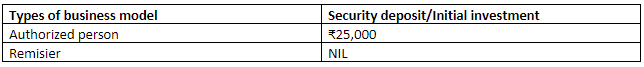

Goodwill Commodities Partner Initial deposit

Authorized person:

Goodwill Commodities demands a minimal security deposit of ₹25,000 only from the authorized person. This security deposit is refundable without any interest when you exit from the agreement with them.

Apart from this, the company can ask for ₹5,000 authorized person fees in which 50% will be reimbursed when an authorized person achieves the target.

AP can deposit ₹1,00,000 for VSAT (optional) which is refundable only after 3 years. You are also required to pay the terminal license fee of ₹250 per month.

Remisier:

A Remisier need not to deposit security money to start the partnership business with the Goodwill Commodities.

Goodwill Commodities Partner Registration

By going through the following steps, one can become a business partner of the broker.

- Fill-up the registration form available on the website. Here is the form:

- Get a call from the call centre executive, they will verify your interest in the partnership business with the Goodwill Commodities.

- You will get another call from the sales executive of the company to fix an appointment with the sales team.

- At the meeting, You are free to ask everything related to the partnership business. They will make you understand each point very clearly so that there remains no confusion later.

- You will be asked to submit all the required documents for the verification purpose with security deposit cheque in case of AP.

- After verification of documents, an account ID will be provided to you.

- Now you can immediately start your business.

The whole process will take almost 4-6 business days to complete.

Goodwill Commodities Partner Summary

Goodwill Commodities is a decade old broking house. It has a good quality of Commodity service like research reports in this segment is valuable. It provides two options in the business model to the customers. Security deposit for the AP model is minimal and affordable.

The revenue sharing ratio is also appreciable, it increases with the increase in the monthly turnover target.

On the other hand, the company is not focusing seriously on the in-house trading platform used by them. Research output in the equity and Currency segment is of average quality. The customer service turnaround time is relatively more than others.

So considering all these, Goodwill Commodities can be an average rating broking house and can be put somewhere in the list of a good broking house for the partnership business.

If in case you are looking to get started with the stockbroking business, then let us assist you in taking things forward:

Goodwill Commodities Partner Expansion location

Goodwill Commodities has a presence in the following locations of the country: