Earning Yield

More on Share Market Analysis

Earning Yield is the ratio of the Net Income and Market Capitalisation or Annual Earning Price of Share and Stock Price.

It simply implies that when Net Income is divided by Market Capitalisation or when Annual Earning Price of Share is divided by Stock Price we arrive at the Earning Yield (EY) of the company.

Earning Yield Basics

There are no surprises to know that Earnings are the single most important factor of any company. Hence, Earning Yield is an important tool and is used for comparison with a lot of other tools as well, like earning yield and return on assets go hand in hand. This is one of the most important factors considered in the fundamental analysis of stocks.

Similarly, EY & return on equity and even EY & stock return are used together to get a complete overview of the company.

In this detailed article about Earning Yield, we will learn about the various aspects related to EY :

- How to compute Earning Yield

- The significance of Earning Yield

- Limitations of Earning Yield

- Difference between Earning Yield and Price Earning Ratio

- Ideal Earning Yield

Earning Yield Computation

The formulae used to calculate EY is as follows :

Earning Yield: Net Income / Market Capitalisation

or

Earning Yield: Annual Earning Per Share / Stock Price

Now let us discuss these in detail:

Net Income :

Net Income refers to the excess of the proceeds from the sales of goods and services after deducting all the sales expenses, administrative expenses, advertising expenses, operating expenses, depreciation, interest, taxes and other expenses.

In other words, Net Income is the income after deducting all the expenses and taxes.

Market Capitalisation :

Market Capitalisation is the total valuation of the company, it is calculated by multiplying the current price of the share with the total number of outstanding shares of the company. It is one of the most important factors which helps the investor to determine the return and risk involved in the shares of a company.

For example, let’s say a company has 10 million outstanding shares and the current price of a share is ₹100, then, in that case, the market capitalisation is ₹(10 million * 100) which is equal to ₹(100,00,000 *100) = ₹100 crores.

The stock market is divided on the basis of the market capitalisation into 3 parts :

- When Market Capitalisation is more than 10,000 crore its called Large Cap

- When Market Capitalisation is less than 10 crore and more than 2 crore its called Mid Cap

- When Market Capitalisation is less than 2 crore its called Small Cap

Annual Earning Per Share :

Annual Earning Per Share is the total earning of the company divided by the total outstanding shares at one given point of time. It is used to see how the company produces profit for the shareholders of the company.

Stock Price :

Stock Price is the price of the single unit of the share which is sold in the market.

Stock Price is the highest price a person is willing to pay, it is often fluctuating and is dependent on a number of factors, it keeps changing as per market volatility.

Profits of the company and dividends distributed together play a big role in the determination of the share price.

Earning Yield Example :

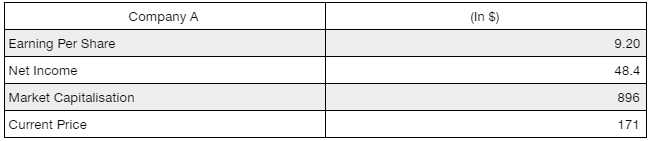

Let’s understand EY with the help of an example for both the formula. In both cases, the result will be the same:

Earning Yield: Net Income / Market Capitalisation = 48.4 / 896 i.e. 5.4 %

OR

Earning Yield: Annual Earning Per Share / Stock Price = 9.20 / 171 i.e. 5.4%

Earning Yield Interpretation:

As said before, in both cases the result had to be same, the ideal EY of 7% and above is considered good, in this case, its 5.4% which is not bad, it’s reasonably good. It goes to show the earnings are quite satisfactory in this case. Hence investors should keep a check on other metrics as well before making any investment in the company.

Earning Yield Significance

- Earning is the one and only important metric of the progress of a company, everything else is dependent on the earnings of the company, even the dividends are also based and dependent on the earnings of a company, hence it becomes all the more important to have a fair picture of the various angles of the earnings of the company.

- Earning Yield is one of the fundamental measures in the company profitability, it can be related to a lot of other measures as well.

- EY is a rational measure of corporate performance.

- EY improves the accuracy of the performance measurement over the earnings which can be manipulated by the management.

- Earning Yield may be expected to vary in size and volatility. Volatility is the uncertainty of the cash flows in future, highly volatile firms will have a lot of uncertainty in their cash flows while on the other hand, less volatile firms will have less uncertainty in their cash flows.

- Higher the volatility, higher is the market risk and vice versa.

- High EY does not necessarily mean a good investment, however, EY is a good and effective metric to find out a low valuation.

- EY can be used as the first metric to find out valuation, and if the value seems reasonable then other metrics must be applied to get a fair picture of the overall scenario.

- Earning Yield is a rate of return metric, it tells about the return on investment

- EY is a rate of valuation metric also because the earning are divided by the current value, so valuation can be derived.

- EY is also used to calculate the dividend payout ratio.

Earning Yield Limitations

- Current earning yield is a metric for of valuation of the current earnings of the company, hence it fails to give a picture of the future.

- Current high earnings yield does not comprehend a high future return as well.

- EY cannot be used as a metric for investment in a vacuum, it is needed to compare the earnings yield with the other metrics as well before making any investment decision.

- EY is extremely volatile, it is very prone to fluctuations.

- Earning Yield is tricky because it is based on past earning and interpretation of the future cannot be made on the basis of past earnings.

Difference between Earning Yield and Price Earning Ratio

- Earning Yield is the opposite of the Price Earning Ratio.

- EY is calculated as a ratio of Earnings and Price while Price Earning Ratio is calculated as a ratio of Price over Earnings.

- EY is expressed in percentage form while the P/E Ratio is expressed in ratio form.

- Its easier to compare the percentage form EY to other ratios as compared to ratio form Price Earning Ratio.

- EY and Price Earning are both for the same purpose but EY provides a better and clear comparison.

Earning Yield Ideal Value

In normal parlance, higher the earning yield better it is for the company, on an average an EY of 7% and above is considered to be quite reasonable. High EY or low EY are not full proof measures, hence it’s not fair to base judgement only on the basis of EY, because they are based on past earning and future earnings.

At the same time, if you are looking to get started with stock market investments, let us assist you in taking the next steps further: