What happens if Stock Broker Goes Bust in India?

Check All Frequently Asked Questions

So what really happens when a stockbroker goes bust or goes out of business? What happens to your trading account balance? What about your shares?

Is everything at risk?

Nothing Really!

Your money and stock entities are going to stay as yours at the end of the day. Indian Stock Broking industry is quite a regulated space with SEBI keeping a close eye on any suspicious movements and actions taken by stockbrokers.

It has placed some strict regulations through its exchanges (NSE, BSE, MCX etc) and provided freedom to retail and institutional clients to directly complain against the broker to these exchanges. Whatever stocks you have purchased are actually stored in the depository and not with the broker (CDSL or NSDL).

The major concern is not the stocks but the trading account balance you have kept with the broker.

In case your stockbroker goes bust or bankrupt, all you need to do it file a claim with complete details of your Demat and trading account, and corresponding action will be taken up by the depository (CDSL or NSDL).

Let’s talk about different security checkpoints placed for you, as retailed traders and investors:

- There is something called IPF or Investor Protection Fund which is basically a “money godown” set up by SEBI to meet up on such occasions. The money into this depository is collected through different depository participants, exchange earnings etc.

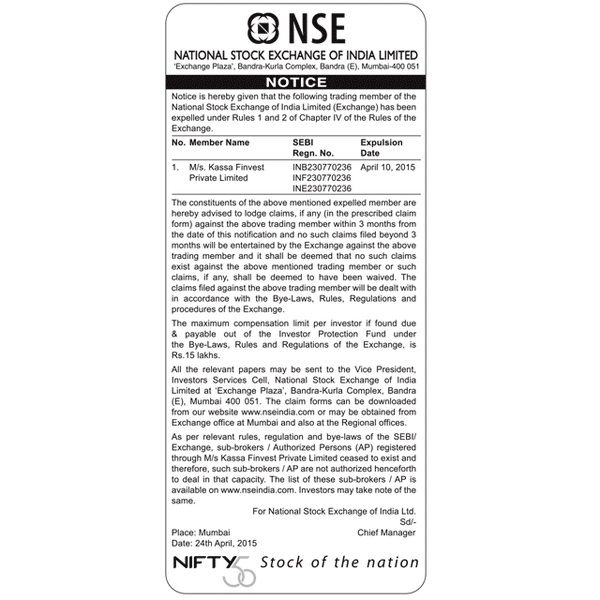

- If the claim is raised within a stipulated time period, retail investors will be eligible for compensation against the losses (maximum of ₹15 Lakh)

- If the claim is raised within 3 years of the time period, the decision of compensations lies with IPF Trust.

- If the claim is raised after 3 years of the time period, the retail investor is NOT eligible for compensation anymore.

- To remain a stockbroker in India, there have been multiple scrutinies placed by SEBI such as:

- Huge entrance cost

- Strict financial disclosures at discretion of SEBI

- Regular audits and inspections carried out over trading experience and financial books of the stockbroker

- If a client does not use his/her trading account money in excess of 3 months, the stockbroker is not allowed to keep the money

- There is no way a stockbroker has any right whatsoever on the stocks placed in your Demat account. They will need your confirmation before these stocks can be used in any forms by the broker. Many times, a stockbroker might ask for the power of attorney, so that they can make quick transactions in case of profit opportunities. Even if you provide the power of attorney to the stockbroker, keep a close eye on the kind of transactions done.

- A stockbroker is obliged to provide you with the latest transaction reports and statements. You need to keep a close eye or rather make a habit of going through the statements on a regular basis so that you are sure what exactly is happening with your credits and debits.

The only way your money can go down the drain is if your stockbroker (or Depository Participant) is involved in some sort of malpractices or forgery. There have been instances in the past of such nature:

source – Economic Times

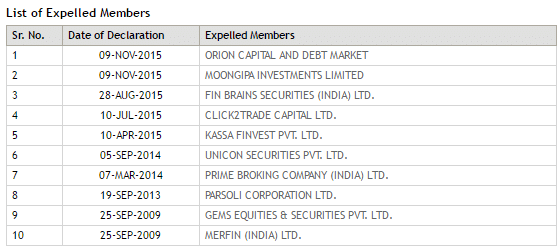

For further reference, here are a few stockbrokers that have either been Expelled through NSE:

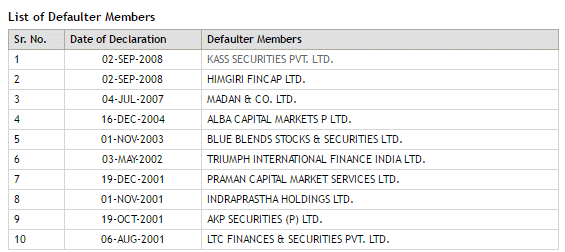

And here are a few that have been termed as Defaulters:

source – NSE

In case you feel a little unsure about your stockbroker or there seems to be anything fishy happening with your funds or stocks, you can give a written complaint to your stockbroker.

If you don’t get a relevant resolution in time, you can write a complaint against the stockbroker to SEBI. There are multiple levels of complaints as shown:

- Non-Issuance of the Documents by Stockbrokers

- Non-receipt of funds/securities within a stipulated time period

- Non-receipt of margin/security deposit given to the Trading Member (TM)

- Non-Receipt of Corporate Benefit (dividend / interest / bonus etc.)

- Auction value / closeout value received or paid

- Execution of Trades without Consent

- Excess Brokerage charged by Trading Member / Sub-broker

- Non-receipt of credit balance as per the statement of account

- Non-Receipt of Funds / Securities kept as margin

- Excess Brokerage Charged (other than on Option Premium)

As an investor or trader, you can put up a complaint on these areas and more against your stockbroker if they are not able to fix it within a stipulated time period.

At the same time, Bankruptcy is not the only area you must be concerned about, there are other ways your stockbroker might be misleading you, such as:

- They might be asking you to place trades which might not be beneficial for you but will invariably generate brokerage for them.

- Make you concentrate on one particular trading segment and thus, putting all your eggs into the same basket

- It might execute trades from your account without using your consent

- Make improper and illegal use of your Power of Attorney (PoA)

- Get you confused with exposures provided and thus, you might lose out a much larger monetary value.

Thus, you have to keep your eyes and ears open while you work with a stockbroker. Although, you have the option of raising a complaint to NSE or BSE but its better to be cautious in the first place itself.

Things You can take care of:

- Check the membership license numbers of your stockbroker with different exchanges. Confirm the same on the NSE and BSE websites

- Go through the complete booklet and account opening form while opening the account with the stockbroker. One of the areas being, Power of Attorney which you can untick and thus, not give any consent on that.

- Do not say yes to every trading call recommended by the stockbroker. Make sure you do your analysis at a parallel level before executing the order.

- Check out the number and percentage of complaints raised against your stockbroker. With an increase in the number of clients, the number of complaints may also rise. Just keep a regular check on how a stockbroker is fairing overall keeps your confidence high with your stockbroker. If you see severe issues being raised against your stockbroker, it’s better to pull out and look for any other stock broker for your trading.

Lastly, it’s difficult to say that such disputes can happen with one kind or size of stockbrokers. So be it full service, discount or bank-based stockbrokers – you must know how your money is being played out.

In case you are not sure which stockbroker to choose, you can provide us with the following details and we will set up few callbacks for you with Trusted stockbrokers:

SEBI IPF is also available for people who trade in MCX? And how much time SEBI TAKE to give that amount to account holder is broker get bust?please reply