Angel Broking Demat Account

More on Demat Account

Thinking of investing in the share market, but wondering how to get started? Well! it is no more difficult. You can now get into trade and investment simply with Angel Broking Demat Account.

Since Angel Broking is registered with NSE, BSE, NCDEX, and MCX thus you can trade in equity, commodity, currency, and derivatives with the account.

Apart from this, the demat account with Angel Broking gives you the opportunity to invest in mutual funds, IPO, etc thus offering you a wide range of options for trade.

Willing to experience trade with the renowned stockbroker, then here is the complete detail of the account opening and other benefits associated with the Angel Broking demat account.

Angel Broking Free Demat Account

The updated Angel One features and benefits make it one of the best Fintech companies offering services to one and many Millenials and GenZ clients like you.

Now the question comes that this free account opening is for a 2-in-1 account or Angel Broking 3-in-1 account.

3 in 1 account is the one that provides you the demat, trading, and bank account altogether. Generally, the bank-based stockbrokers offer you the 3 in 1 account thus making the process simpler and easier.

But when it comes to Angel Broking, although you cannot open 3 in 1 account as the broker does not offer you a specified bank account option, however, you can link your bank account directly while processing the account opening with Angel Broking.

In all with Angel Broking demat account, you can secure your shares, trade-in different segments and investment options, track your transactions, etc.

Moving ahead with the all-detailed concept, let’s discuss different types of Demat accounts that you can access by opening Angel Broking 3 in 1 Account.

Angel Broking Demat Account Types

Now demat account is further classified into three types:

1. Regular Demat Account: Traders residing in India can opt for this account type.

2. Repatriable Demat Account: NRI Indians who want to transfer funds abroad can get it done with this Demat account type. Furthermore, to get access it is essential to link the Demat Account with the NRE bank account.

3. Non-Repatriable Demat Account: Next comes another account for the Non-Resident Indians but here with this account, you cannot transfer funds abroad. To operate this account, you need to link it with the NRO bank account.

So depending upon your location and preference you can opt for any of the demat account types and operate it with Angel Broking.

Angel Broking Demat Account Opening

These days opening a demat account is no more hassle. You can simply get your account activated by following few simple steps.

Further, it is made easier by offering you the complete online process.

To make the whole process simpler make sure you have all the required documents and other details handy to avoid any last-minute hassle.

Apart from this, for the one who is not so tech-savvy, there is the complete offline process where one can easily download the form and send it to the nearest branch to activate the demat services.

Want to learn more? Here is the complete process that helps you in understanding the requirements and process involved in opening and operating Angel Broking demat account.

Angel Broking Demat Account Opening Online

As already discussed, Angel Broking offers a simple and streamline the process for opening a Demat account. Here, you can open an account online.

For online opening follow the steps:

- Visit the official website of Angel Broking

- Register yourself by filling in all your basic details like name, phone number, city.

- An OTP is then sent to your registered number. Upon entering the OTP, you will be redirected to the new form.

- Fill in KYC details like date of birth, PAN Card details, bank details.

- On further validation of information, your Demat account opens and its details will be sent to your registered email and mobile number.

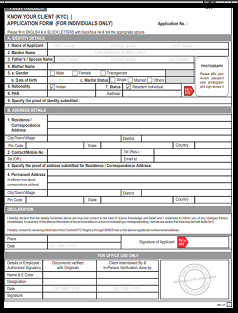

Angel Broking Account Opening Form PDF

Apart from the online process, you can apply for the Demat account opening, offline as well. For this, just visit the website to download the form available in the PDF form, or visit the nearest branch.

To get the Angel Broking demat account form, click here.

For the institutional investors, there is a separate link provided that helps you to open and operate the non-individual account with Angel Broking.

Now have a quick glance at the details required to be filled in to open the account offline.

- Fill in all the details like Name, Mobile Number, City.

- Other than this if you wish to open a joint demat account, then you are provided with an option where you can fill in all the required details of the second account holder.

- Next, you can also fill the nomination form provided along with the account opening form.

- Attach the self-attested photocopies of documents required to open the demat account.

- Send it to the nearest branch or to the head office of Angel Broking.

- On validation, the account opens in 3-4 business days.

Wish to open a Demat Account?

Angel Broking Demat Account Opening Documents

To open a Demat Account with Angel Broking, get started with the collection of some important documents. These documents should be submitted along with the application form.

So, for your convenience here is the list of documents that you should keep handy.

For identity proof, you can carry documents like:

- Voter’s ID

- PAN Card

- Passport

- Driving License

- Aadhar Card

For Address Proof, the applicant needs to submit the documents like:

- Residential Electricity Bill

- Residential Telephone Bill

For Bank Details, you need to submit

- Scanned copy or photostat of the front page of passbook

- Canceled cheque

- Account Statement

In case you want to do trading in the derivatives segment, then you have to submit additional documents for income proof, like

- ITR

- Salary slips (of the last three months)

- Last six-month bank Account statement

On verification of the document, the applicant will receive an email with login details that he or she can use to log in to the Demat account.

Angel Broking Demat Account Opening Time

Now the most important question that generally the investors remain keen on is the time in which their account gets activated.

Are you looking for the answer for the same?

Then here is the complete information below:

- Opening an account online yourself: 45 Minutes

- Opting for Offline mode to open an account: 2-3 business days

- Opening an account with Angel Broking executive: 30 minutes

- Reaching out to the A Digital Blogger executives: 10-20 minutes

Thus, the account activation time depends upon the option you choose to open the account.

Angel Broking Demat Account Opening Status

If you process account opening by either of the above methods but not getting any notification for opening an account, then do not fret.

Once your account is opened you will receive a message on your registered mobile number along with the mail that notifies you about your account opening status.

Other than this you can reach customer care to know the account opening status. Just tell the details like PAN card number and you will be able to know the opening status of your account.

Angel Broking Demat Account Charges

Availing of the service of a demat account is easy.

But wait, are these services provided to you for FREE or the broker charges some fees to activate the demat account services.

Wondering what is the cost of opening a demat account in Angel Broking?

Let’s dive into know the charges in detail.

Angel Broking Account Opening Charges

Activating demat services imposes the demat account opening charges that vary from broker to broker.

In general most of the full-service broker charges certain sum. But when it comes to Angel Broking, which is the hybrid stockbroker, you can reap the benefit of the free account opening across segments.

Angel Broking AMC Charges

Earlier the broker charges the Annual Maintenance charges to maintain demat account and to offer various services like:

- Transfer of funds online

- Advisory based on Analytics and AI

- For trading ideas derivatives.

With the evolution in the trading services, the broker now offers the same services under the name Account Maintenance Charges and thus charges the fees on the monthly basis.

Angel Broking AMC charges are thus reduced to ₹20 per month thus making it convenient for traders and investors to keep their account activated.

Further to offer additional benefits the broker does not charge the maintenance fees in the first year. Thus, you can enjoy the benefit of a Free Demat Account in Angel Broking.

Angel Broking Demat Account Without Aadhaar Card

Almost every other individual in India has Aadhar Card. No doubt the document is used to verify details and as valid proof.

Similarly in the demat account, it is one of the basic documents required for an account opening.

One having an Aadhar card linked with their mobile number is mandatory.

But what does it means, that you cannot open an account without Aadhar or if your mobile number is not linked with Aadhar?

Of course not!

You can open it via another method described below:

Apply for the account opening as discussed above.

Only in the step of e-sign where you need to enter the Aadhar and then OTP to validate your details, you need to switch to another option called eMudhra.

Now there are two cases:

Case 1: You do not have an Aadhar card

In this situation, you need to submit any other Government-authorized identity like Voter ID, Driving License, etc.

Case 2: Your Aadhar is not linked with Mobile Number

Here you need to validate your details by going through the in-Person verification process. In this, you have to record a short video with the complete detail of the name and client code. Along with this, you need to show your PAN card to validate the entries.

Once done your account opens in few minutes.

Facing difficulty in opening an account without an Aadhar card? Get in touch with us and open the demat account for FREE without any hassle.

Angel Broking Demat Account Number

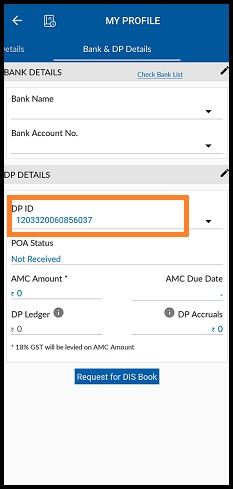

Now comes the demat account number which is the 16 digit code. Now since Angel Broking is registered both with CDSL and NSDL thus it is important to know the depository with which you open a demat account.

In the case of the NSDL demat account, the 14 digit code starts with alphabets IN followed by 14 digits. From this 14 digit code, the last 8 digits are your client ID while the first 6 digit is the DP ID.

Next in the case of the CDSL demat account, there is the 16 digit code. The first 8 digit is common and represents the DP ID while the last 8 digit is the client ID.

You can easily find your Demat account number in Angel Broking mobile app or any other trading app.

- Just click on your profit and then on Bank and DP Details.

- Click on DP ID to know your demat account number in Angel Broking.

How to Operate Angel Broking Demat Account?

So till yet, we discussed what is Angel Broking’s demat account is and other related information.

Now the question comes, how to use demat account.

Well! for this you just need to follow few simple steps mentioned below:

- Login to the web or trading app.

- Add funds to the trading account.

- Select and add scrip to the watchlist.

- Buy or sell shares by choosing the trading segment.

- Check the holding in your demat account.

Let’s discuss the process in detail.

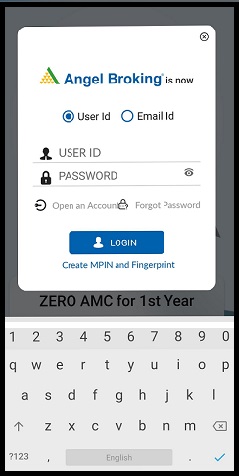

Angel Broking Demat Account Login

On the successful opening of the Demat Account, the confirmation email is sent to the registered email or mobile number.

The confirmation email consists of the login details i.e. the username and password that you can use to access your Demat and trading account.

After your first login, you can reset your password accordingly using the password reset option.

Now use the credentials to log in to the web or the Angel Broking trading app.

Once login you can proceed further to operate the demat account.

Angel Broking Demat Account Minimum Balance

Coming to the next step of maintaining the minimum balance and transferring funds to the Angel Broking demat account.

Since the broker provides both trading and demat accounts, hence you can transfer funds to the trading account from the linked bank account in few clicks.

Transferring the fund is the primary step to operate the demat account.

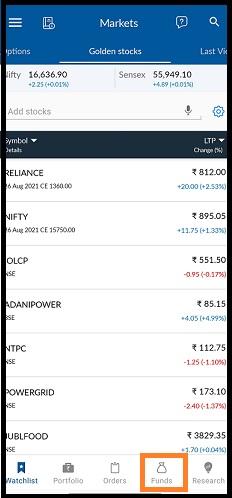

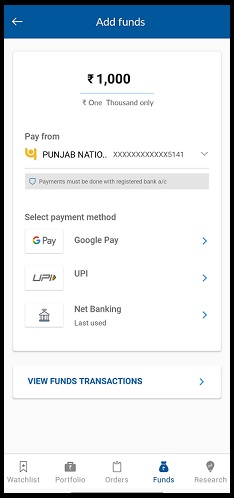

- All you have to do is to click on ‘Funds’ and then on ‘Add Funds’.

- Select the linked bank account and then the mode of payment (Google Pay, UPI, or Net Banking).

- Although there is no need to maintain a minimum balance you need to add and maintain a certain balance to trade seamlessly across segments.

Once the fund is added you can further trade in segments and check the status of your demat account by clicking on portfolio option available on the bottom bar.

Angel Broking Demat Account Refer and Earn

Once you open a demat account with Angel Broking, you can start earning apart from trading.

Wondering how?

By referring your friends, family, or relative to Angel Broking.

However, the broker has certain terms and conditions that make it a little difficult for the referral to reap the benefit of the refer and earn a demat account.

But again A Digital Blogger makes it easier for you. Just fill in the form below and enter the details like Client ID, your name, and your friend’s name.

As soon as your referral starts trading, the amount gets transferred directly to your bank account.

Fill the form below to open the demat account of your friend along with yours.

How to Close Angel Broking Demat Account?

Since Angel Broking charges the annual maintenance charges in such a case if you are not using your account currently or have zero balance in your Angel Broking Demat Account, then it is highly recommended to close the account.

It is quite tedious to close the Demat account than to open it.

This is because while opening an account you would get calls from stockbrokers and customer care executive who supports you in every step involved in opening the account.

In case you want to close the account you have to work yourself and need to submit a signed document via courier or by visiting the branch personally.

Angel Broking does not charge any fees for closing the account.

For closing the account download the Account Closure form from the Angel Broking website under the section “Important Documents”.

- Fill the form and submit it to the Angel Broking branch.

- To check the details of your debit and credit details, you can contact the registered branch.

- Before submitting the account closure form, it is good to keep a few things in mind:

- Make sure that the account does not contain any share.

- There should be no negative balance in the account.

- The member should submit the unused delivery trading rules booklet slip back to the DP.

- Once you ensure that all the steps are done, courier the form or submit it by visiting the nearest branch.

- Angel Broking Demat account is closed within 3-5 days after completing all the formalities.

Few important points that one should go through before placing a request for closing an account:

- No email or online request is accepted to close the Angel Broking Demat account. It is essential to submit the physical request for closing the account.

- If you have a joint Demat account with Angel Broking then it is essential to get the application signed by all the members.

- Do not skip filling in any relevant information essential for closing the account.

- Before closing the Angel Broking Demat account the client should clear all the debit in all the segments,

- Transfer your shares to other currently operating Demat accounts or sell them before closing the account.

Angel Broking Demat Account Customer Care Number

When it comes to the Angel Broking customer care helpline, the broker offers multiple communication platforms to offer the best assistance.

So, if you are looking ahead for any kind of assistance including the opening of a Demat Account, or regarding any investment, then feel free to contact the team.

The team offers the best support services and comes up with a valuable response to the query.

Here are the contact details for the Angel Broking Demat Account:

Angel Broking Demat Account Benefits

Many advantages are associated with the opening of a Demat Account with Angel Broking. Some of the highlighted are:

- Angel Broking is a hybrid stockbroker and comes under the top 7 brokers in NSE.

- It helps you to trade across segments at the flat fees of ₹20 per trade, thus helps traders to maximize their return.

- Other than this Angel Broking charges for delivery trade is Zero under Angel iTrade Plan.

- It offers a new investment engine, ARQ that helps clients in predicting stock information.

- It offers a large and wider range of trading and investment products like Angel Broking Equity, Trading, Commodity, Insurance, Mutual Funds, etc.

- Has franchise offices and branches at multiple locations.

- Offer large brand equity thus gained high trust among the clients.

- It provides the complete online process to its member thus offering convenient services.

Angel Broking Demat Account Disadvantages

Along with the advantages, there are some disadvantages associated with the Angel Broking Demat Account like:

- Traders usually face login issue to operate their demat account.

- Minimum brokerage charges for intraday and other segment is comparatively higher than other discount brokers.

Is Angel Broking Demat Account Safe?

Opening a Demat account with a registered DP like Angel Broking offer many benefits like reduced paperwork, lower transaction settlement time, cost savings, and security.

The broker is registered with the top exchanges and the major depositories which further makes it reliable.

Further, it is listed in the exchange that further assures its suitability and making it more secure when it comes to investing using its demat account services.

With time, Angel Broking is coming up with better technical and advance feature that adds on the value and makes it easier for traders to trade using its trading platform.

In all if you are using a pocket-friendly and secured platform to invest in the share market, then this is the one offering you the best services.

Angel Broking Demat Account Frequently Asked Questions

Here are some of the frequently asked questions about the Angel Broking Demat account that you may also have. We have compiled the whole list here with all the answers:

1. What is my Demat Account number in Angel Broking?

The Demat account number is a 16-digit unique code that is offered to you once your account opens with Angel Broking. The format of the Demat Account number varies for CDSL or NSDL.

The CDSL offers a 16-digit numeric character, on the other hand, NSDL starts with IN followed by the 14 digits unique numeric code.

2. How to open an Angel Broking Demat account?

Opening a Demat Account with Angel Broking is simple as it offers both online and offline methods. For the online method, visit the website and follow the steps as directed.

On the other hand, the offline process involves downloading the form, filling the form, and sending it to the nearest branch or the respective address of the Angel Broking.

For either of the method, you have to submit a few essential documents for KYC and identity verification.

If you are a minor and want to open a demat account, know How To Open Angel Broking Minor Demat Account in detail and reap its benefits.

3. How to close Angel Broking Demat Account online?

Angel Broking does not offer any means to close the Demat Account online. However, you can close the account by downloading the account closure form and sending it to the main office address.

Before closing the account, make sure there is no share in your Demat account and no dues to be paid to the broker.

4. How to transfer money to Angel Broking Demat Account?

To execute a trade, it is essential to have enough funds in your trading account. For this, you can use either of the fund transfer methods like NEFT/RTGS, any payment gateway or by paying a margin cheque/DD to the broker.

For instant transfer, make sure the bank is linked with your trading account.

5. Can I open Angel Broking Demat Account for Free?

Angel Broking does not charge any fees for opening a Demat Account, thus you can open the account for FREE.

Along with this, the broker waives off the AMC charges for the first year thus offering you the benefit of opening the Angel Broking free Demat account.

Finally, if you would like to get started with stock market trading or investments in general with a trading and Demat account, let us assist you in taking the next steps forward:

More on Angel Broking