Top 5 Stock Market Crashes Ever Happened

More On Share Market

Are you aware of the biggest stock market crash that hit the stock market till yet? In this detailed review, you will get to know about what leads to the major crashes in the stock market and prevent yourself from facing the same.

Find the complete information of the biggest stock market crash events that led to recessions and economic crises around the world.

Before moving further here are some basic information on the stock market crash India, its causes, and its effects.

Also Read: Stock Market Movies and Sectors in Stock Market in India

Stock Market Crash Information

From a definition point of view, a stock market crash implies a severe drop in the stock index within a day or two of trading that then results in a stock market crash.

The major indices that are used here to analyze the stock market crash events are:

- Dow Jones Industrial Average: Tracks the stock prices of the top 30 companies in the US.

- Standard & Poor’s 500: Another index that is used to track the stocks of 500 large-cap US companies.

- National Association of Securities Dealer Automated Quotation System: It is the electronic equities exchange in the US. Being the largest, NASDAQ handles around 14.1 percent of the total equities trade of the US.

The major causes behind every stock market crash event are economic crisis, catastrophic events, the collapse of the speculative-bubble active, etc.

In simple terms, the stock market crash is a sudden drop in the stock index in the double-digit percentage within a few days.

Causes of Stock Market Crash

There are some general causes of all the stock market crashes that occurred till yet. Some of them are:

- Unexpected economic event

- Catastrophe

- Sudden Crisis

Also, the crashes occur at the end of the extended bull market when there is an irrational increase in the stock prices to the unsustainable level.

Also Read: Is the Bull Market good or bad?

Also Read: Where to invest in the bull market?

Effect of Stock Market Crash

The major effect of the stock market crash is the loss of jobs due to recession.

Since stocks are all about the cash inflow of the corporation that they use to grow their business, the sudden drop in the stock prices leads to the slow growth of the corporates.

This eventually leads to less productivity thus restricting the workers to stay financially sound.

The less productivity of workers reduces their potential to do work that drives less revenue. The process continues and eventually leads to a major decline. All these factors lead to more recession during the Great Depression period of 1929, a Recession Period of 2001, and the 2008 Great Recession.

Let’s talk at a bit depth now!

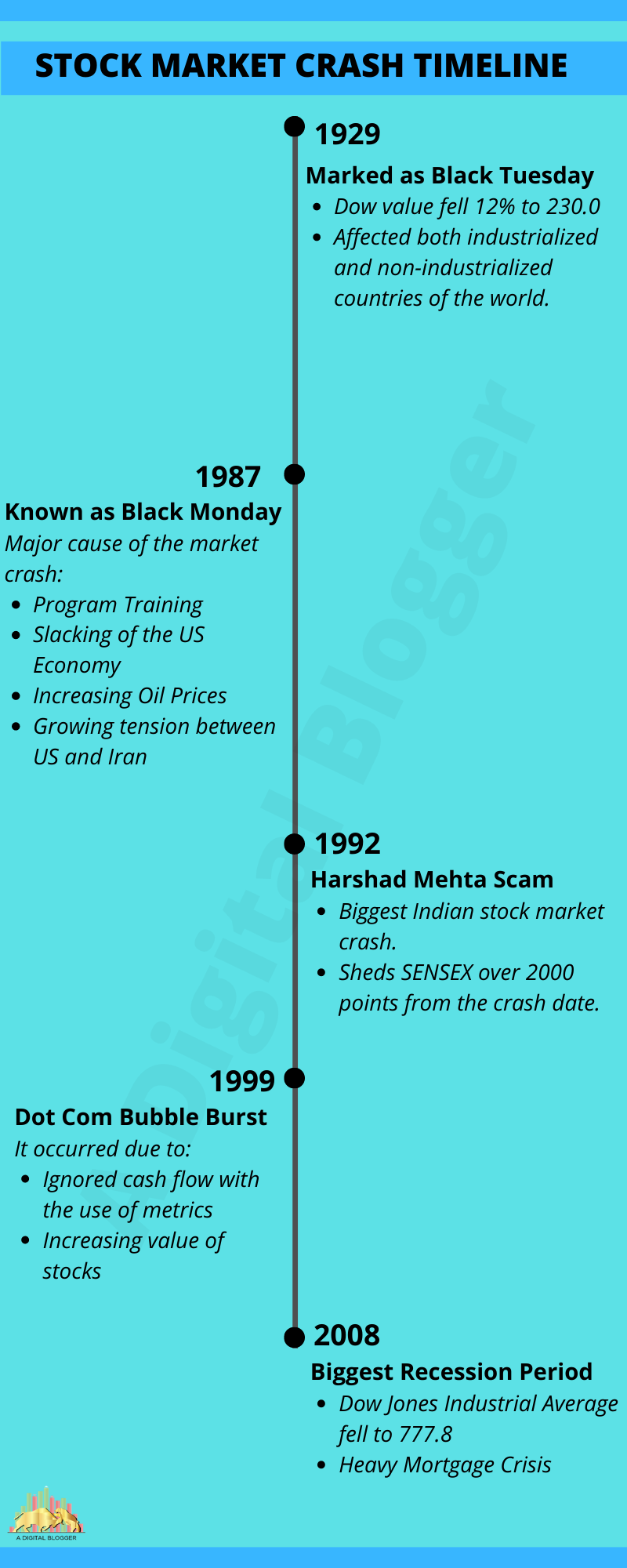

Stock Market Crashes Timeline

The major crashes are highly unpredictable and whenever it hit the market it took a good time for the market to recover the losses.

Many cases affect the personal experience of the investors which was reported during the 1987 stock market crash.

Here is the timeline for the major stock market crashes that hit the market till yet.

- Stock Market Crash 1929: Commonly known as the Black Tuesday in the history of the stock exchange. The crash contributed to the Great Depression of the 1930s that affected both industrialized and non-industrialized countries of the world and lasted for approximately 10 years.

- Stock Market Crash 1987: Marked as the Black Monday and the first-ever crash in the history of the modern financial system. The major reason for the crash was – computer trading.

- Stock Market Crash 1992: It was actually a scam commonly known as the Harshad Mehta scam that led to one of the biggest stock market crashes in India.

- 1999 Stock Market Crash: Dot Com market collapse that occurred mainly due to the sudden rise of technology and the interest of people on the internet. The crash affected many internet companies around the globe.

- Stock Market Crash 2008: The biggest recession period that occurred due to the mortgage crisis, credit crisis, and bank collapse. It is due to the series of events that eventually lead to the failure of some of the largest companies in the US.

Stock Market Crash 1929

Stock Market Crash 1929 is the worst economic event known till yet. This stock crash is also known as the Great Crash resulted in a sharp decline in the US stock market value.

There is no wonder that the crash resulted in the Great Depression of 1930 that lasted for around 10 years and affected both industrialized and non-industrialized countries of the world, as mentioned earlier.

Warning Signs Before the 1929 Stock Market Crash

Before the crash hit the market in 1929, there were few warning signs being displayed which were overlooked by the investors due to the overgrowing economy of the nation.

The first warning sign was seen on March 25, 1929, when the stock market corrected and fell to 10% as compared to its status in the last 52-days.

The fall in the stock market increased the panic state among the investors but was then reassured by the bankers who continued to lend money. This recovered the market at the time but the same did not work when the Black Thursday on October 24, 1929, hit the market.

Another warning sign which was ignored by many was the graduals abate of the Steel production, Car sales, and Homebuilding.

The major reason why the warning signs being overlooked was the high hit record of the Dow Jones Industrial Average (382.17) up to 27% compared to the past year.

After the market crash, the Dow Jones was not able to reach the peak value until 1954.

Stock Market Crash 1929 Facts

The stock market crash 1929 began on October 24, Black Thursday, and continued for four days till October 29, Black Tuesday. Those four days collapse the stock prices and resulted in the decline of US history.

During the crisis, the Dow Jones Industrial Average crashed to 25% and lost the market value equals to $30 billion.

The crash broke the confidence of the Wall Street market and resulted in the Great Depression.

- The crash started with the opening of Dow at 305.85 on Black Thursday. This resulted in the felling of the price to 11% thus signaling for the stock market correction.

- All this increased the trading rate three times the normal value. The Black Thursday dropped the Dow just by 2%.

- Another day the market witnessed the positive momentum and the Dow rose 1% that is equal 301.22 but this gain became equal on Saturday when the Dow closed at 298.97.

- The major drop was analyzed on Black Monday on October 28 when the Dow fell 13% to 260.64 and lastly on Black Tuesday when the value fell 12% to 230. 07.

- The sudden falling of the value increased the panic among the investors who then sold 16,410,310 shares in a single day.

Stock Market Crash 1929 Causes

Although multiple factors contributed to the stock market crash of 1929 some of the major highlighted reasons are:

- Tight Monetary Policy

- Overconfidence Among the Market and Public

- Easy Availability of Credit for Buying Stocks

- Increase Interest Rates in the Federal Reserves

- Ongoing Agricultural Recession

- International Lending and Trade

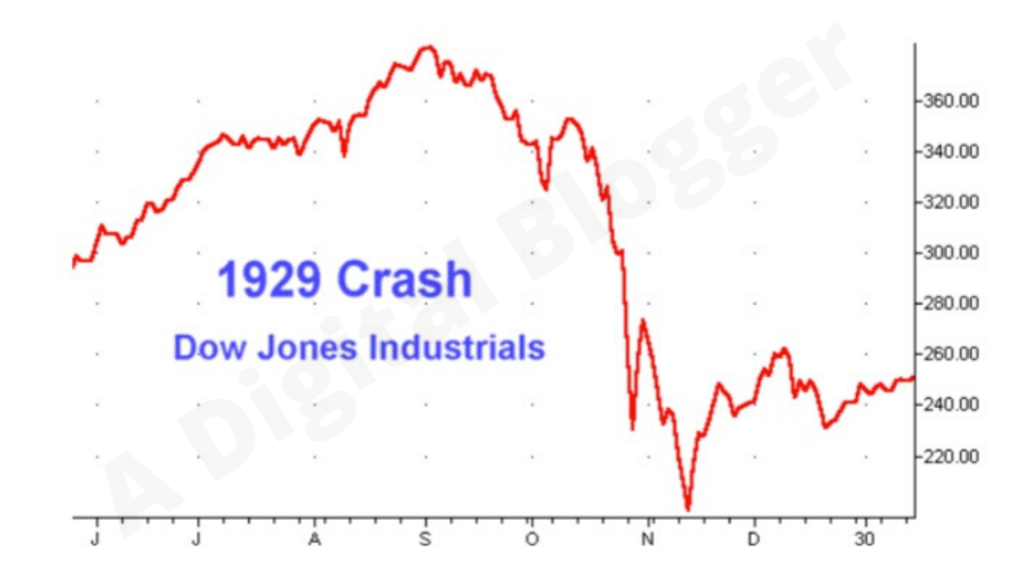

Stock Market Crash 1929 Chart

Here is the chart explaining the fall of Dow Jones Industrialist Average 1929.

Stock Market Crash 1987

Another major crash that hit the stock market was the stock market crash of 1987 that is commonly known as Black Monday in the history of the stock market. It is considered the first known crash of the modern financial system.

During the crash, the Dow-Jones Industrial Average (DJIA) tripled in the last 5 years. The crash dropped the Dow index to 22% on October 22, 1987 (Black Monday). The crash hit the US but affected other stock markets around the globe. Around 19 out of 20 stock markets were declined by 20% or more.

Although the drop was severe, the market was able to balance within a few years and recovered all its losses.

Stock Market Crash 1987 Causes

There are many theories that are associated with the 1987 crash like the one linked to the program trading. In this, the programs were installed in which the human-decisions were interpreted according to the equation.

This automatic trading resulted in the automated generation of the buy and sell orders as per the price levels of benchmark indexes or specific stocks.

At the time the concept was new to the warehouses and the untested program trading resulted in a huge loss.

Other potential reasons for the crash were:

- Slacking of the US economy

- Due Correction of the Bull Market

- Widespread Media Coverage

- Portfolio insurance

- Digital Trading

- Decrease oil prices

- Increasing tension between Iran and the US

Stock Market Crash 2008

September 29, 2008, another black day in the stock market when the Dow Jones Industrial Average fell to 777.68 points during the intraday trade. The stock market crash of 2008 was the biggest drop in history to date.

The finances that wiped out left the big chunks on the American’s retirement savings and put the long-lasting effect on the economy of the stock market.

During the crash, the market lost around 30% of its value thus marked the most horrific period in the history of the U.S. financial market.

Stock Market Crash 2008 Causes

The major causes of the crash were:

- Mortgage Crisis

- Credit Crisis

- Bank Collapse

- Government bailout

Although the market crash occurred in 2008 the warning signs were visible from the years ahead from the late 90s when financial institutions like Fannie Mae started lending loans to the borrowers with a low credit score.

This although fueled the housing growth but also increased the home values. Since the bank began to offer loans to people who are unable to pay them the bank started repacking these mortgages and started selling them to investors in the secondary market.

This slow build-up of the bad debts resulted in the series of government bailouts initiating with the Bear Stearns followed by the Fannie Mae and Freddie Mac.

Finally, the crash was marked by the collapse of the investment firm Lehman Brothers due to the overexposure to the subprime mortgages.

This was known to be the biggest bankruptcy filing in the history of the U.S.

Another biggest bailout was the American International Group, Inc. (AIG) that ran out of cash due to the subprime mortgage game.

Stock Market Crash 2008 Effects

The huge financial loss and crash had effected many different sectors including the percentage of job losses and mortgage defaults. The data defined that from mid-2007 and mid-2009 the economy lost nearly 8.7 million jobs thus marking the period of the Great Recession.

Since the crash left many automakers on the verge of bankruptcy, the federal government participated and took over the General Motors Company and Chrysler LLC in March 2009. The Term-Asset-Backed Securities Loan Facility bailout the Ford Motor Company.

Apart from these, the home prices began to decline that make homeowners pay increased mortgage value.

Later the American Recovery and Reinvestment Act of 2009 in February Congress passed the jump-start the economy to generate jobs thus putting a desirable effect, boosting economic growth and investor confidence.

Stock Market Crash 1992

The stock market crash of 1992 was actually a scam did by Harshad Mehta. The scam resulted in the stock market crash by more than 50% over the year. It was one of the biggest stock market crash in the history of the Indian stock market.

The stock market crash 1992 sheds the SENSEX over 2000 points from the crash date.

Even the small investors were hit badly and the market remained in the bearish mode for more than two years.

Beginning of the Harshad Mehta Scam 1992

During the early 90s, the banks were not allowed to trade in the stock market thus they bought stocks and bonds from other stockbrokers and banks respectively. Thus, there was a big loophole in the system which gave the idea of reaping the benefit to Harshad Mehta.

In one of the deals called Ready Forward Deal in which the stock instead of moving from one bank to another, the seller bank issued a Bank Receipt to the Buyer Bank as the confirmation of the sale of securities.

Harshad Mehta became a mediator and used the Government Securities and borrowed money to himself.

He used that money in the stock market for personal trade to maximize profit. To return money to the seller bank he used to find another buyer bank and transfer the securities. The process continued and became worst when he started using fake Bank Receipt to grab money from the Banks.

He used this fake BR and gave shape to one of the biggest scams of the stock market in India.

He was exposed by Suchita Dalal in April 1992. Finally, the court charged him with the 72 criminal offenses and 600 civil action suits were filed against him.

Also, he was barred from the stock market for life.

Stock Market Crash 1999

Stock market crash 1999 occurred at a lightning fashion which is commonly visualized as a dot.com market collapse.

At the time, the interest of investors grew more towards the internet stocks and the prices of shares like AOL, Pets.com, Webvan.com, GeoCities, etc increases the price of their shares.

The dotcom bubble or the internet bubble rose the US technology substantially thus fueled up the investments by the investors in the internet-based market.

The exponent growth of the equity market along with the growing dominance of technology Nasdaq rose from 1,000 to more than 5,000 from 1995 to 2000.

With the bubble burst in 2001 and 2002, the equities entered the bear market. The sudden market crash leads to a loss of $5 trillion for the investors.

The crash resulted in the drop of the Nasdaq index to 1,139.90 which previously rose by five-fold between the years 1995-2000. Other internet-based companies that lost their value by 80% were Cisco, Intel, and Oracle.

It took around 15 years for Nasdaq to regain its peak position.

Major Causes of the Dot-Com Bubble Burst

The two major reasons were highlighted for the internet bubble burst:

- Ignored Cash Flow with the Use of Metrics

- Overvalue of the Stocks

Next Indian Stock Market Crash Prediction

The stock market crash generally occurs when it is least expected. Therefore, it is quite challenging for investors to predict the crashes beforehand.

But considering the top market crashes that took place in the stock market in the past help in moving forward and know about when the market is about to dip.

Some of the major causes of the stock market crashes in today world are:

- Over-valued market

- Type of financial engineering and contraption

- The external catalyst that is generally unrelated to the stock market.

On the basis of experiences gained over the years, it is always good to get yourself prepare for the next market crash. Although, it is not completely possible the early preparation can prevent you from facing much loss.

If you are looking to know more about the Indian Share Market basics, here are some reference tutorials for you: