EquityMaster

List of all Advisory Firms Reviews

EquityMaster is one of the earliest entrants into the Indian Stock Market Advisory services domain. It was established back in the year 1996 when the share trading space was in an evolving stage, especially from the online perspective.

EquityMaster Review

The advisory firm offers multiple free as well as paid services to its clients. There is quite a bit of flexibility offered by Equitymaster when it comes to paid services where user inputs are taken at investment style, time horizon and a few other related aspects.

Based on the client’s requirements, the advisory form claims to provide personalized trading solutions.

In this review, we will talk about multiple aspects including the kind of services provided by EquityMaster, the corresponding pricing of these services, positives as well as negatives of this advisory firm so that you get a complete 360-degree viewpoint before you make your final judgement.

EquityMaster Services

As mentioned above, EquityMaster offers both free as well as paid services and all these offered services cover a wide range of stock market investments.

Let’s see the complete bifurcation of these services so that it becomes clearer to you that which of the services make the most of sense related to your trading style.

EquityMaster Free Services

1. Company Info: With this service, you can check specific factsheets of companies listed on the stock exchanges, company reports and then compare different companies in areas such as financials, Equity share data, balance sheet data, income statement data, cash flow etc.

2. Sector Info: Going a level up, you can check reports on different company sectors or industries and results at the sector level to understand which particular business domains are picking momentum in the market and which ones are losing.

3. Stock Screener: this is a unique feature that can be accessed from the website of EquityMaster. Using this feature, you can check out specific stocks that are most undervalued, overvalued, fastest-growing companies by profit, revenue, stocks with best dividend yield values and so on.

4. Newsletters: There are a bunch of newsletters that the advisory firm publishes at a set frequency for each respective edition type. Here are the different kinds of newsletters:

5. 5-Minute Wrap-up: This is a bi-weekly newsletter that talks about specific current market movements, blogs, current business affairs etc.

6. Honest Trust: These are blog articles written and shared by Ajit Dayal, founder of the research firm EquityMasters. These newsletters do not follow any set frequency but are published on as & when basis.

7. Vivek Kaul’s Diary: This is another set of blog articles shared on a daily basis. These blogs are written by Vivek Kaul who is an editor at this research & advisory firm.

8. Smart Contrarian: This type talks about different types of trading and investment products on a bi-weekly basis.

You can read this review in Hindi as well.

EquityMaster Paid Services

Here is a quick look at the paid services offered by this advisory firm to its clients:

A. Fundamental

1. Stock Select: Users looking for long-term investments can check out this reports product where users are provided with at least one research report every month.

Most part of these research reports talks about blue-chip stocks and how an investor can go about investing for a horizon period of 2 to 3 years. However, there are no customized tips or recommendations offered by this service by EquityMaster.

2. The Indian Letter: This service recommends high growth stocks on a monthly basis for long-term investments. The stocks recommended through this service see a horizon of 3 to 5 years.

Again, even in this service, there are no custom or tailored tips provided on an individual basis.

3. Hidden Treasure: This publication on a monthly basis provides recommendations on small-cap stocks and as per the research firm, the stocks are recommended only after the management of the listed company.

The time horizon for these investments is again in the range of 3 to 5 years with a single recommendation every month.

4. Smart Money Secrets: This is a monthly service where users are provided with a report containing recommendations on small and mid-cap companies.

These stocks are picked after tracking the investments of more than 40 top investors in India that this research firm monitors on a parallel basis.

5. ValuePro: In this stocks recommendation service, users are provided with tips on stocks with an expected return of 4 to 6 times over a horizon period of 5 to 10 years. The service works on the Value Investing principle and thus, the fundamentals of different companies are looked at.

6. MicroCap Millionaires: This service is based on the Deep Value Investing concept where microcap stocks are recommended on a monthly basis.

Users subscribed to this service, investing in microcaps need to stay invested for at least 3 to 5 years in order to see reasonable returns, as claimed by the research firm.

7. EquityMaster Insider: In this service, one of the lead research analysts at EquityMaster picks any one specific stock from the rest of the paid services. This could be a small-cap, mid-cap stock, an upcoming IPO etc and corresponding viewpoints are provided on a weekly basis.

Although the newsletter is provided daily, there is one stock discussed at length each week.

8. Profit Velocity: In this particular, small and mid-cap stocks that have shown a consistent returns performance in the past along with the showing reasonable momentum through its balance sheets, income statements etc are recommended.

There are 2 reports published on a monthly basis while the service can be subscribed at a yearly level.

B. Learning

1. DeriVantage: This is an online course with video lectures, teaches about derivatives segment trading. It is a simple learning web-based tutorial course that can be accessed online at any point in time. The course is a yearly subscription one and charges accordingly.

2. TradeMaster: This is another online course where users are taught how to learn reading charts, understanding market moves etc and comes at a yearly subscription price.

3. EquityMaster’s Secrets: You can learn about tips and tricks on how to pick specific stocks for your trading and investments through this online course. The course contains video tutorials, lectures, course material in the form of a DVD.

C. Portfolio Tracker:

This is an online tracking tool by EquityMaster to monitor the performance of stocks and mutual funds. This paid tool assists users by providing charts, reports at both web and mobile versions.

The tool also allows its users to set up watch lists, notifications, alerts along with accessing reports such as annualized reports, currency reports, transaction summary etc.

EquityMaster Fees

Here are the details on the pricing across different paid services provided by Equitymaster:

| Service Name | Duration | Price |

| Stock Select | 1 Year | ₹6000 |

| MicroCap Millionaires | 1 Year | ₹1 Lakh |

| DeriVantage | 1 Year | ₹9,950 |

| Profit Velocity | 1 Year | ₹1 Lakh |

| Smart Money Secrets | 1 Year | ₹6000 |

| Hidden Treasure | 1 Year | ₹6000 |

| EquityMaster Insider | 1 Month | ₹5000 |

| ValuePro | 1 Year | ₹30000 |

| EquityMaster's Secrets | 1 Year | ₹5000 |

| Portfolio Tracker | 1 Year | ₹330 |

For a few subscriptions, you might find pricing way out of line while the others are available at pretty reasonable levels. However, pricing can all be fine as long as it brings the corresponding value to investors and traders.

A good part of these plans is that most of these have a 30-day money-back guarantee with them.

However, you will still need to make the payment first to get started.

EquityMaster Complaints

Every advisory service gets its share of unhappy users and so is the case with Equitymaster. The complaints raised against the firm are of varied types. Some of those are listed below:

- Hidden Charges at the time of subscription payment.

- The Equitymaster app is relatively basic and as per a few users, full of premium services advertisements.

- Some existing users have complained that the service team tries to sell them upgradations of their current packages even if there is no requirement of it.

Overall, the complaints give an understanding that the advisory definitely needs to bring in transparency in their services while improving on the technology front.

EquityMaster App

EquityMaster also provides its users with mobile apps in both Android as well as iOS versions. Some of the features offered in this mobile app include:

- Daily Market Updates

- Newsletter access

- Stocks tracking

- Portfolio tracking

- Views on the latest market news

- Access to Paid services (mentioned in the Paid Services section above)

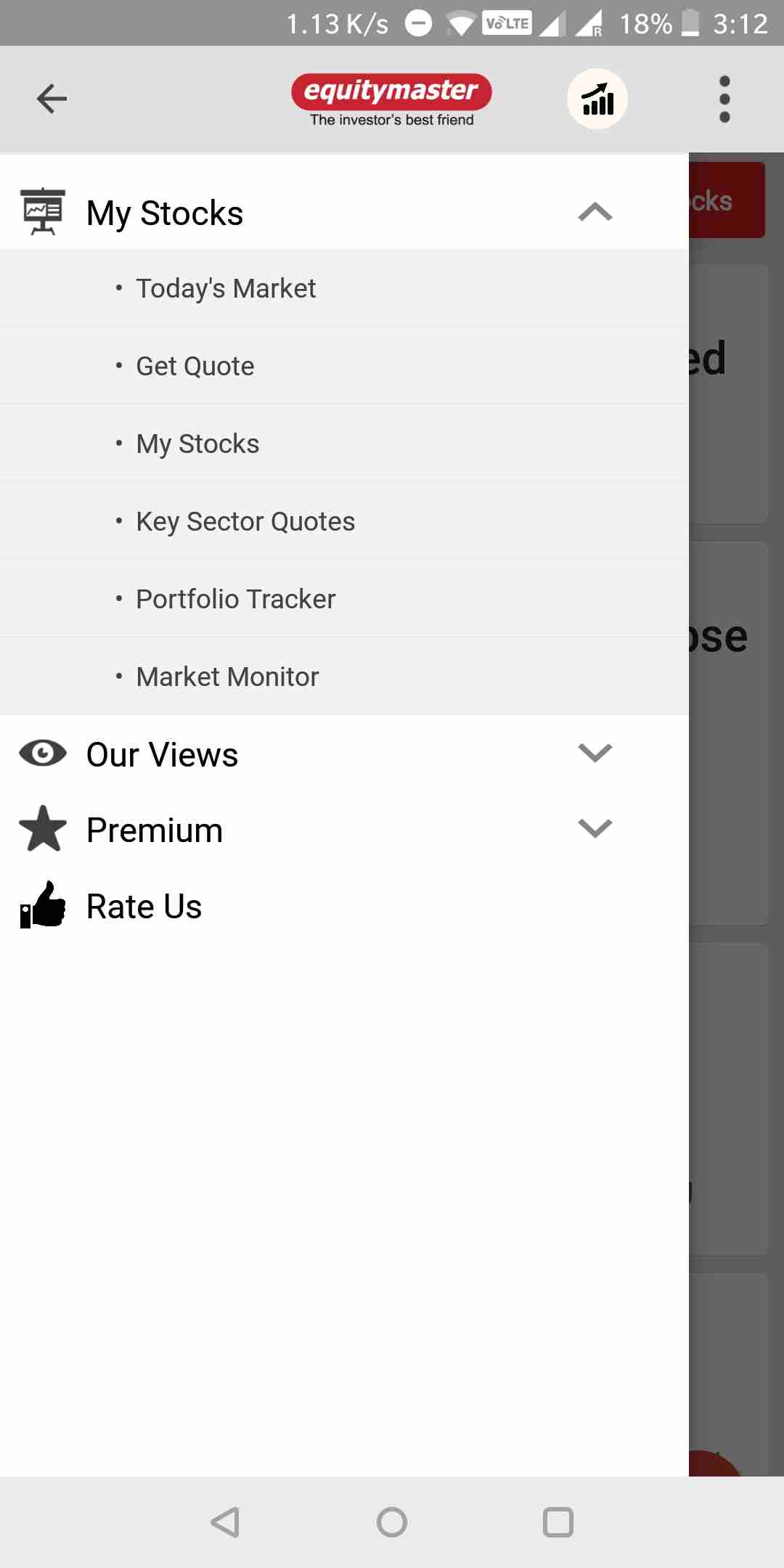

This is how the mobile app looks like:

At the same time, some of the concerns raised by users of this mobile app are:

- Number of features can be higher and detailed in length

- Performance issues in the loading of advanced charts

- Charting functionality not apt for quick technical analysis

Here are the stats on this mobile app from Equitymaster from the Google Play Store:

| Number of Installs | 100,000 - 500,000 |

| Mobile App Size | 5.6 MB |

| Negative Ratings Percentage | 12.3% |

| Overall Review |  |

| Update Frequency Cycle | 3-4 weeks |

EquityMaster Customer Care

The advisory service has limited communication channels open to its clients. The different ways you can reach out to Equitymaster are:

- Web-form

- Phone /Toll-Free Number

- Fax

There are no offline branches, web-chat provision, email facility and in this day and age, it seems that the firm is still relying on the old-school offline methods mostly.

Furthermore, the support team is available between 10 am to 6 pm on business days. Here are the contact details for your reference:

- Toll-Free: 1800 2093 786

- Fax: 91-22-22028550

EquityMaster Disadvantages

Here are some of the concerns about this research and advisory firm, that you must be aware of:

- Limited services for traders or users looking for short-term quick gains.

- Too much of something also impacts the quality and this is what happened with the way Equitymaster keeps on introducing way too many new services while existing clients complain about the quality of the services they had availed.

- Customer service is relatively laid back as far as the attitude towards customers who have already paid is concerned.

- Newsletters shared are very long and it will take a good time to read out the whole thing. It must rather be crisp and concise in nature.

EquityMaster Advantages

At the same time, you get the following advantages if you use the services of EquityMaster:

- A wide range of free as well as paid services offered for different kinds of investors.

- Web as well as a mobile app available for users to access different reports, charts and analysis.

- 30-day money-back guarantee available across paid services

- Relatively an old name in the industry thus may enjoy the trust factor as compared to the new peers launched.

With this, we would like to wrap up our review on EquityMaster. Feel free to let us know your experience for other readers’ reference.

Are you looking to know about the Best stock market Advisory services in India?

Provide your details in the form below and we will set up a callback for you, right away:

Also Read:

Here is a quick look at some of the other advisory services available:

Just Awesome information boss.

Thanks for sharing information

Good job