Niveza

List of all Advisory Firms Reviews

Niveza is a Pune based research & advisory firm and is one of the prominent advisory companies in India. The research firm, along with its advisory services, offers a unique service where specific investors can get their profiles listed and users can follow them.

Niveza Review

Users following get complete information about the stocks traded or invested by the listed investor along with the data. This is something like Zerodha Open trade which has more or less a similar model of users following other investor users.

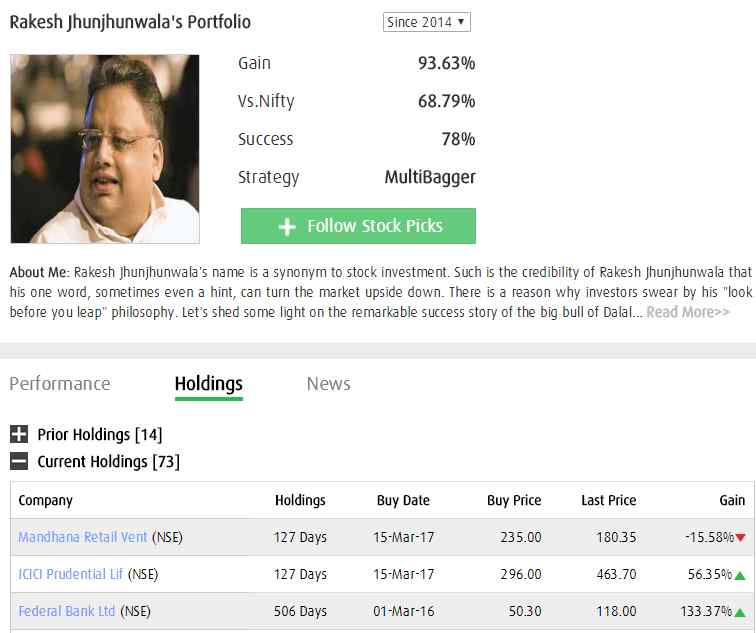

This is how the investor profile looks like:

“The SEBI registration number of Niveza Research is INH000002558″.

Niveza Meaning

A lot of users have their query about the meaning of the word ‘Niveza’.

Well, the word Niveza comes from the Sanskrit language where it means ‘Investment’. Looking at the company business, the name of the firm definitely goes inline.

Now, whether they live up to the expectations of their clients, that is a different matter altogether.

Niveza Services

The firm provides services across different trading and investment segments including:

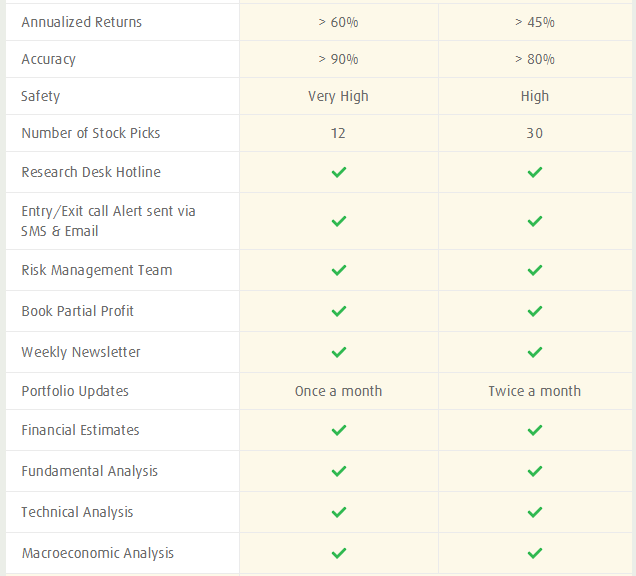

- Short term stock picks

The firm’s research team identifies undervalued industries and corresponding stocks. Post this, a detailed analysis of the balance sheets, profit and loss statements, cash flow statement of the last 5 years is performed to get a vibe of the stock situation.

Post a few discussions with company management, the firm claims to produce the financial estimations for the next two years.

The research team continues to monitor these stocks for judging the right time to enter into these fundamentally strong stocks.

Under this service, the clients get 2 to 3 recommendations per month with a total of 30 recommendations for the whole year. The holding period of these stocks is generally between 1 to 3 months. Recommendations and tips are provided through Email and SMS.

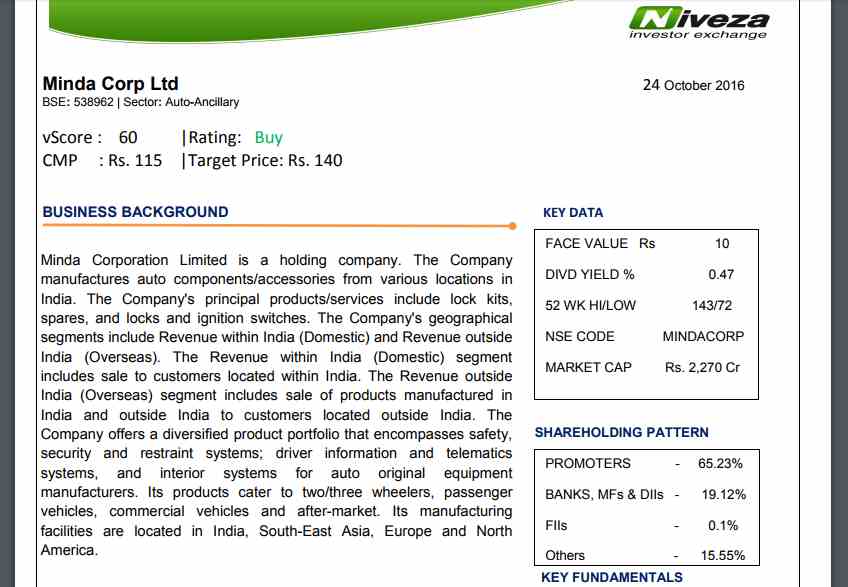

This service suits users looking for relatively short-term investments. Here is a sample report:

- Multibagger stock picks

The stock tips provided under this service are relatively for a longer duration investment. The process of research and stock picking is more or less the same as in case of short-term stock picks, however, the parameters and metrics observed in this research are certainly different.

Under this service, users are provided 1 recommendation every month with a total of 12 recommendations for the whole year. The holding period, in this case, is around 1 year to 1.5 years with notifications provided through Email and SMS channels.

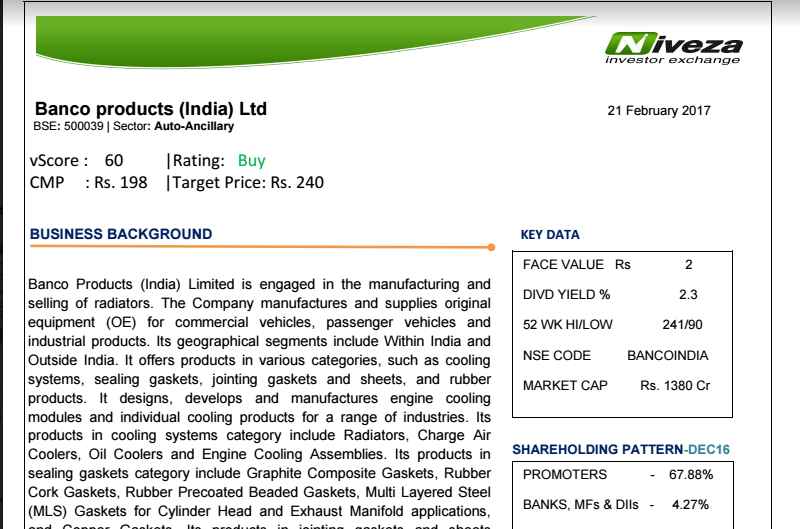

This service suits users looking for long-term investments. Here is a sample report:

- Premium Combo stock picks

If you are looking for both short and long-term investments, then Niveza offers this particular service where you can avail tips and recommendations of both short-term and multi-bagger types.

Overall pricing is certainly discounted and you should adhere to the recommendations along with their respective holding periods.

- Personalized research service

This service is for HNI (High Net Worth Individuals) with a capital investment of ₹25 Lakh or more. Here the trades are placed by Niveza research team itself and the clients are provided with an estimate of return percentage along with a timeline.

Since clients using this particular service deal in large capital amounts, thus the service quality and personalization offered by the research firm is relatively better as well. Even the pricing of this particular service is made available after a discussion with the client, overall capital value, risk appetite etc.

Niveza Charges

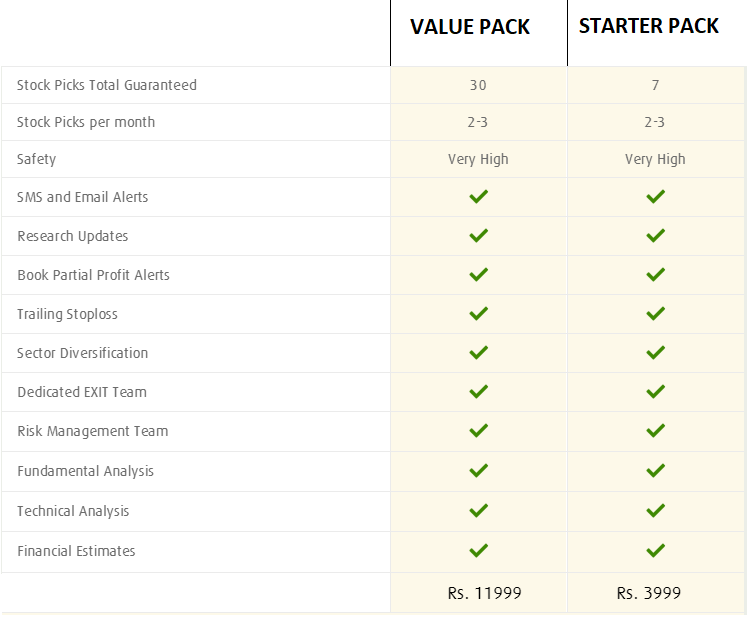

As far as pricing of the above-mentioned services is concerned, the firm offers plans at different time period level. Here are the details:

- Short term stock picks

Under this plan, you have the option to either go ahead with a yearly plan where you are provided 30 picks in that duration. Otherwise, if you want to test the advisory firm on its promise of service and accuracy, then you can pick the starter pack in which you get stock tips with a period of around 2-3 months.

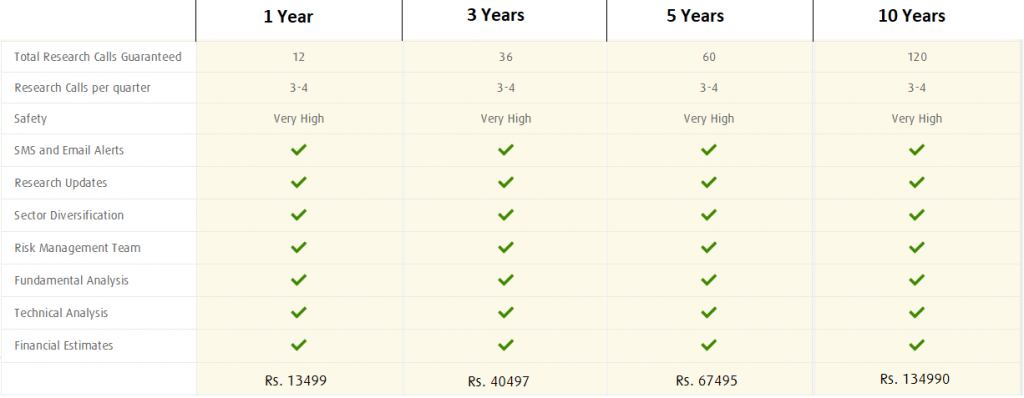

- Multibagger stock picks

In this long-term investment plan, there are multiple options based on the commitment you can make with the advisory firm. We, however, feel that the pricing under this plan does not make much of a sense.

If a client is ready to make a long-term commitment to the advisory firm, then he or she must get some incentive in terms of a discount price for a longer duration plan. Under these plans, the prices are just multiplied by the number of years a client is looking to commit.

Nonetheless, there are four options under this plan of 1, 3, 5 and 10 years respectively.

- Premium Combo stock picks

If you are looking to use both short-term picks and multi-bagger, then there is a combo plan offered by Niveza. You can subscribe to this plan at a discount rate of ₹22,948 which seems pretty reasonable looking at the industry benchmarks.

Now, let’s talk about some positives and negatives of using the services of Niveza Research.

Niveza Free Trial

Unlike most of the advisory firms out there, Niveza does not offer any free trial to its clients.

Thus, if you are interested in any of the services offered, you will have to make the payment to get a subscription. In this competitive space, it is quite a bold step to not offer any free trial to potential customers.

Niveza PMS

Although Niveza is not known as a complete portfolio management services house, it still offers services in this investment domain. Some of the benefits of using Niveza PMS services are:

- You can maximize the returns on your investments by using these services.

- While using this, you may build a custom investment portfolio based on your risk appetite, investment horizon and disposable capital.

- Portfolio managers can also design your plans based on a risk management plan.

While using the services of Niveza PMS, there are a few limitations as well that you might have to face:

- You will need to put in a high initial investment to get started.

- The advisory offers NO performance guarantee, which is definitely a big concern

Thus, looking at these pros and cons, you may choose to go ahead with these services of Niveza.

Niveza Complaints

The advisory company has seen its share of complaints in the recent past. Primarily, the complaints have been in the following areas:

- Customer Care, especially phone calls do not get picked at times by the support staff

- Confusions related to Rakesh Jhunjhunwala endorsing the company while he does not.

Having said that, each advisory and stockbroking business gets their set of complaints raised and it’s really difficult to judge a business based on these problems.

Readers are advised to use their discretion while making a decision on going ahead with the advisory or not.

Niveza Contact Details

If you are looking to get in touch with this Pune based advisory firm, you can use the following channels:

- Phone

- Web-form

Here are the contact details for your reference:

Niveza Disadvantages

Here are some of the concerns of using the advisory services of Niveza:

- The firm has nothing to offer when it comes to intraday trading or short-term quick profits.

- A limited number of communication channels with Email and SMS notifications only.

- The overall number of services are very limited in terms of segment, duration, asset class etc.

Niveza Advantages

At the same time, you will get the following merits of using this research firm:

- The advisory firm claims to renew your subscription for free, if you do not get any positive returns or in case of zero profit or loss. (Be sure to validate that claim, because if +1% is positive, thus, there must be some floor percentage decided upfront).

- The customer service seems to be relatively better than most of the advisory firms that have opened up their offices in Indore and around and are just looking to customer acquisition.

- Regular blogs, articles and research reports are provided for free. This helps in getting an idea of the quality you may get post buying the subscription from the advisory firm.

Overall, clients have received a mixed combination of positive and negative experiences from the research firm.

If you are looking to subscribe to their services, it must be noted that their multi-bagger services have performed relatively much better than any of the rest. Thus, be wary of this aspect before committing your capital with the advisory firm.

You may choose to read this review in Hindi as well.

Furthermore, if you view the website of Niveza, you will come across a lot of images of the serial investor Rakesh Jhunjhunwala.

This needs to be known that the investor has nothing to do with the advisory firm directly or indirectly.

The only guess that can be made at this point is, that Niveza is leveraging the brand equity of Rakesh Jhunjhunwala post taking a paid/unpaid confirmation from the latter.

Are you looking to know about the Best stock market Advisory services in India?

Provide your details in the form below and we will set up a callback for you, right away:

Also Read:

If you wish to know about other stock market advisories, here are a few references:

Niveza performance is 50:50, it’s my experience, 5 calls are gain 4 calls are under loss till today

I subscribed for a Niveza m360 for a year but in last 18 months they only subscribed 10 stocks instead of 12 and 11 out of 12 stocks is giving a loss of 35%. Even when the stock market was gaining Nivea’s recommended stock was losing and they always maintained to stick to their recommendation which i followed and eventually my loss exceeded from 15%-20% to 35%.

Their research is absolutely rubbish. They claim to provide you multibagger with 70-80% return but you will eventually loss your 35%-40% of capital.

After all the losses they will not even call you to guide on what should be your next steps, either accept the loss and quit from certain stocks.

I would not recommend anyone to avail their service.

Hi Ajay , will you provide me your contact number to know more about niveza

I will certainly not recommend niveza to anyone. Their analysis is very weak. They are not even sure of their own recommendation that’s why they don’t follow the stop losses and this the only reason why my portfolio is down by 30%. When it comes to trading or investing one must strictly follow risk management otherwise it becomes gambling. So if someone wants to gamble with their own money please go ahead and take services from them otherwise I would suggest to stay away from this company. It may be possible that their one or two recommendation can turn out to profitable but eventually you will end up losing money.

Yes , I totally agree there has been capital erosion by 40 percent – revommended Pennar industres bought at 59 is trading at 37 !

I’d enrolled for M360 plan in Apr 2018. So far I have got only 5 recommendations whereas they had to provide me 12 as per the plan. All the recommendations are in loss up to 50%. My friend who had enrolled for v360 has lost 70% of money. Their research is bullshit. I am asking to refund my money or provide remaining 7 recommendations but the relationship executive don’t respond at all. They don’t even have proper communication or escalation mechanism. PLEASE AVOID THIS…Manish Deoli

Hi, as mentioned above, their services are far from satisfactory. Holding nearly 2 years, losses are in terms of 50-80 percent. They don’t answer calls, updates are scare and poor. Despite overall poor performances, they insist to hold. Recently they sent a sell notice to almost all stocks(11 I guess), with heavy losses, they are not traceble over phone. Not a trust worthy group.

I subscribed two years ago. Invested exactly as per their recommendation and lost 40% in value even after 2 years of waiting !! Even when share market is increasing, their recommended shares went on loosing value. My experience is very bad !! Keshav

A fraud Company – donot fall for it , my friend committed suicide after their recommendation fell by 70 percent . Asked to buy Tata motors at RS 380 /- Now at Rs 120 /- . Soon FIR to be launched !

Very Big fraud Company – all recommendations failed !