Aditya Birla Brokerage

Check All Brokerage Reviews

Incorporated in 1994, Aditya Birla Money is currently a big name and is a full-service broker. Being a full-service broker, it charges high brokerage fees but at the same time comes with some brokerage plans. So what are the Aditya Birla Brokerage charges?

In this article, we will provide you the detail of the fees and the plans offered by the broker to its clients.

Aditya Birla Brokerage Charges

Since Aditya Birla Money is registered with NSE, BSE, NCDEX, and MCX hence it allows the trader to trade in all the segments.

Here is the list of brokerage charges charged by the broker:

- Delivery Trading Charges

- Intraday Trading Charges

- Options Trading Charges

- Futures Trading Charges

Now, it is a full-service broker hence it charges a brokerage on the basis of turnover value, this means more the turnover, the higher will be the brokerage. Along with this, there are certain taxes like STT, GST, Transaction charges etc that are charged and vary according to the segment.

Let’s now have a look at the commission percentage:

Aditya Birla Delivery Charges

The delivery brokerage charges include not just the brokerage but also other fixed expenses like stamp duty, STT, GST, exchange fees, and turnover tax. Aditya Birla delivery brokerage is 0.3% of the turnover value.

This means that for a turnover value of ₹10,000/- the brokerage is equal to ₹30. Here is the complete detail of these fees along with other charges.

Aditya Birla Intraday Brokerage Charges

Since one can open multiple positions in the intraday trade, hence its brokerage is lesser than delivery trading, but you need to pay according to the turnover value only.

Below is the detail of Aditya Birla Money intraday charges.

Aditya Birla Options Brokerage Charges

A full-service broker generally charges option brokerage on the basis of lot size. The higher the number of lots more is the brokerage. Aditya Birla charged brokerage equal to ₹50 per lot for options trading.

So, for example, if you buy 10 lots of Nifty for options trading, then the brokerage would be:

= 10 * 50

=₹500

Other than this there are taxes that vary in the equity, commodity, and currency segments. The detail of these charges are given in the table below:

Aditya Birla Futures Brokerage Charges

Futures trading can be done in equity, currency, and commodity segment. For all these segments, the broker charges fees equal to 0.03% of the turnover value. Below is the detail of futures brokerage in Aditya Birla:

Aditya Birla Brokerage Plans

Apart from the default brokerage charges mentioned above, Aditya Birla has introduced some subscription models to reduce the brokerage pressure on its clients and to make it easy on their pockets. The plans vary in price range so that different consumers can buy them as per their interest and convenience.

There are on whole four Aditya Birla Money Brokerage Plans running currently which are described in detail below-

Aditya Birla Trade 20 Brokerage Plan

The first plan given by Aditya Birla Money is Trade 20. As the name suggests, under this plan the trader has to pay a fixed charge of ₹20 to trade in different segments. Here are the details about it-

Aditya Birla Trade 15 Brokerage Plan

By paying ₹999 subscription fees, you can reap the benefit of trading at a minimum brokerage of ₹15 per trade across segments. The plan comes with a yearly validity and one has to renew it by paying the amount if the plan remains valid till then.

Aditya Birla Trade 10 Brokerage Plan

Trade 10 is a little expensive subscription model but reduces your brokerage substantially to ₹10 per trade. This plan is beneficial for traders who are active in the market and place multiple trades in a day or month.

Here is the detail of the plan.

Aditya Biral Trade 5 Brokerage Plan

Trade 5 is the most expensive premium subscription option but helps a trader in saving a lot of brokerage charges. To subscribe to this plan one has to pay the sum of ₹3999/- to enjoy the benefit of ₹5 per trade brokerage charges.

Aditya Birla Brokerage Calculator

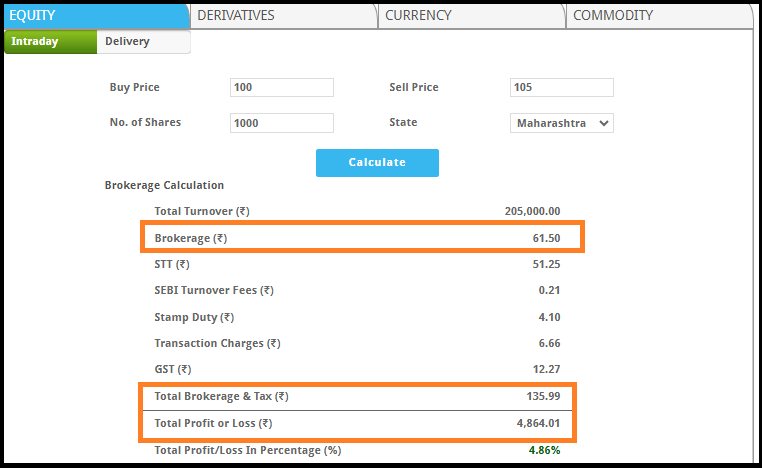

Aditya Birla Money Brokerage calculator allows the user to calculate the brokerage along with the taxes. Not only this, but a user can also calculate the breakeven points and the calculation of the profit or loss that can occur over stock in advance.

To use it, the trader has to enter the buy value, sell value, and quantity. On the basis of the total turnover value, the brokerage along with net profit/loss will be displayed on the screen.

Conclusion

Aditya Birla comes with different brokerage plans and hence multiple options for its clients that provide the flexibility in paying brokerage as per their trading style and maintaining a high-profit margin.

You can check other details of the broker, like trading app and services before opening a demat account with the broker.

In case, you are looking for the right stock broker, then fill in the details in the form below and we will assist you in choosing the right stockbroker and in opening a demat account online for FREE!