Axis Direct Brokerage

Check All Brokerage Reviews

Now, like we have mentioned various times, that bank-based stock-brokers are the most expensive ones in the Indian stockbroking space – Axis Direct is no exception. In this detailed review, we will talk about the different charges levied by this broker apart from the Axis Direct Brokerage and respective plans.

Axis Direct is a full-service stockbroker that provides a 3 in 1 Demat account. The reason is simple, the broker comes from a banking background.

Axis Direct Brokerage Charges

Let’s start with the basics and see what are the upfront costs levied by Axis Direct. But before that this needs to be known that the account opening costs and in fact, a lot of other related charges are based on the type of demat account you end up opening up with Axis Direct.

There are 2 types of demat accounts Axis Direct offers to its clients:

- Regular Account

- Basic Services Demat Account (BSDA)

Let’s quickly have a look at different kinds of Axis Direct charges:

- Account Opening Charges

- Regular Account: ₹0

- BSDA: ₹0

- Annual Maintenance Charges

- Regular Account: First Year Free, ₹650 from Second Year

- BSDA: Depends on the Holding Value

- ₹0 to ₹50,000: Free

- ₹50,001 to ₹2 Lakh: ₹100

- More than ₹2 Lakh: First Year Free, ₹650 from Second Year

- Credit Transactions

- Free for both accounts

- Debit Transactions

- Regular Account: 0.04% of Transaction Value or ₹25, whichever is higher

- BSDA: 0.06% of Transaction Value or ₹50, whichever is higher

- Dematerialization Charges

- ₹5 per certification or ₹50 per request for both account types for dematerialization.

- Ad-hoc Statement:

- ₹100 per statement for both account types

As far as the Axis Direct brokerage charges are concerned, the broker has different types of plans in place for different types of client requirements and trading preferences.

Here are the details:

| Segment/Plan Type | Fixed Plan | Investment Plus Plan | Now or Never Plan | |||

| Subscription Fees | ₹0 | ₹1500 | ₹5555 | |||

| Account Opening Charges | ₹999 | ₹0 | ₹0 | |||

| Free Delivery for Turnover | ₹0 | ₹3,00,000 | ₹12,00,000 | |||

| Validity | NA | 6 Months | 10 Years | |||

| Brokerage | ||||||

| Equity Delivery | 0.50% | 0.50% | 0.25% | |||

| Equity Intraday | 0.05% | 0.05% | 0.03% | |||

| Equity Futures | 0.05% | 0.05% | 0.03% | |||

| Equity Options | ₹10 Per Lot | ₹10 Per Lot | ₹10 Per Lot | |||

| Offer | Free 20 Call & Trade Calls | Free 20 Call & Trade Calls | Free Access to DirectTrade for 12 Months | |||

Axis Direct Brokerage Plans

Unlike a lot of other prominent stockbrokers, Axis Direct Brokerage comes with different plans. This gives complete flexibility to the trader about which kind of brokerage plans suits his/her trading requirements.

Based on his/her preference, the corresponding brokerage plan can be picked.

Let’s try to understand the above-mentioned plans in simpler terms:

1. Axis Direct Fixed Brokerage Plan

If you opt for the Fixed Plan, you do not need to pay any subscription charges at an upfront level.

However, you will be required to pay ₹999 as account opening charges. Axis Direct brokerage charges will be charged as the conventional rate this full-service stockbroker charges to its clients normally (as mentioned above).

Furthermore, you will get the first 20 calls made under call and trade facility for free each month.

This plan is generally suitable for beginner level traders or people who are just testing the waters with a limited trading turnover.

2. Axis Direct Investment Plus Plan

Under the Investment plus plan, you will be required to pay an upfront subscription fee of ₹1500. This amount is valid for 6 months and provides you with few perks as listed below:

- No Account Opening Charges

- Brokerage Free trading under Equity Delivery for a total transaction value of ₹3,00,000

Apart from that, the brokerage charges are similar to what is charged under the Fixed Plan (as listed above).

Under this plan as well, you will be entitled to 20 free call and trades each month.

This plan is suitable for intermediate level traders and who are expecting the provisions listed above.

3. Axis Direct 5555 Brokerage Plan

If you plan to choose Now or Never Plan, then you will be required to pay ₹5555 as subscription price. These charges, however, are valid for 10 years of your account activation.

Here are some of the provisions you will be entitled to under this plan:

- No Account Opening Charges

- Brokerage Free trading under Equity Delivery for a total transaction value of ₹12,00,000

- Axis Direct Brokerage charges are pretty low, here are the specific details:

- Equity Delivery: 0.25%

- Equity Intraday: 0.03%

- Equity Futures: 0.03%

- Equity Options: ₹10 Per Lot

This plan obviously suits expert level traders and who are willing to put in a reasonable upfront price. The plan also allows you to use an advanced level trading application – DirectTrade for 12 Months without paying any separate charges.

The best way to understand all the brokerage charges and the corresponding taxes such as (GST, STT, Stamp Duty etc) is to use this exhaustive Axis Direct Brokerage Calculator.

This will assist you in understanding the gist of the Axis Direct Brokerage charges levied along with your profit/loss at the end of your trade(s).

Axis Direct Intraday Brokerage Charges

When it comes to intraday trading, the brokerage charges levied by Axis Direct are in the range of 0.03% to 0.05%, depending on the plan. Having said that, you should try and negotiate as much as you can during your account opening process with the executive.

To understand it clearly, let’s say you bought 100 shares of Reliance Power at ₹150 each and sold them off at ₹165 each the same day.

Thus, the total trade turnover would have been: ₹(150 + 165) X 1000 i.e. ₹3,15,000.

The brokerage would have been 0.03% of 3,15,000 i.e.₹94.50

At the same time, if the trade turnover would have been smaller, let’s say ₹10,000. In such a case, you’d need to pay a minimum brokerage charge of ₹25.

Axis Direct Options Brokerage

Recently, Axis Direct has come up with a ZERO Brokerage plan for options traders.

As unbelievable as it looks, as per the broker claims, if you are squaring-off your position the same trading day, then you can trade at 1 paisa per lot in options trading.

However, if you carry forward your order the next day, in that case, the Axis Direct Options Brokerage will be ₹10 per lot.

Prior to this, the broking house had a turnover based brokerage plan for options trading. However, the zero-brokerage plan is something that has been recently introduced. You may choose to use it as long as it stays.

Axis Direct Brokerage Charges For NRI

When it comes to NRI Trading, the brokerage charges do see a small jump.

For instance, the account opening fee is ₹2500 which includes the stamp duty charges as well. This is a one-time cost.

As far as Axis Direct brokerage charges for NRI trading are concerned, you are supposed to pay a brokerage of 2.5% of your trade turnover amount.

Taking the same example above, if it were a delivery trade, then the brokerage for a trade turnover of ₹10,000 would have been ₹250.

The minimum brokerage charges for NRI Trading is kept at ₹50.

Axis Direct Brokerage Charges For Mutual Funds

As far as Mutual fund investments are concerned, the broker has set up specific fees at different levels. Here are the details:

- Debit Transactions: ₹25 per instruction

- Pledge confirmation: ₹25 per instruction

- Converting Mutual Fund Units into Demat: Free

- Mutual Funds Redemption: ₹25 per instruction

Minimum Brokerage Charges in Axis Direct

The minimum brokerage charged for the equity segment is kept at ₹25 by Axis Direct, be it delivery or intraday trading.

At the same time, if you are into mutual fund SIP investments, then the stockbroker charges a minimum of ₹20. Lastly, as mentioned above, the NRI traders end up paying a minimum of ₹50 per executed order if their trade turnover is on the lower side.

Then, some traders put their money into something called Penny Stocks. If the securities value goes below ₹10, then the minimum brokerage in such case is kept at ₹0.25 by the broker.

Axis Direct e Margin Brokerage Charges

If the position is not squared off on the ‘T’ day, then the brokerage charged for e Margin is the same as the delivery brokerage.

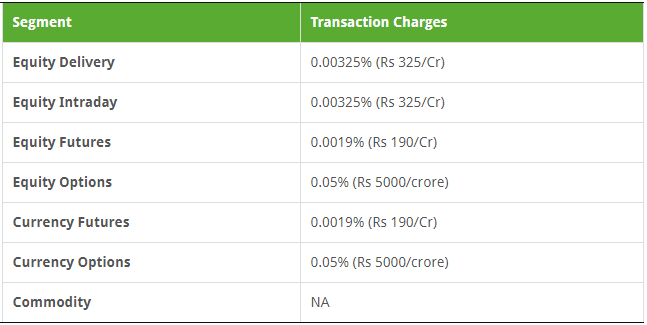

Axis Direct Transaction Charges

Apart from different taxes and the brokerage charges, like any other stockbroker, Axis Direct charges transaction charges as well. These charges are applicable across all the trading and investment segments.

Here are the details:

Before we wrap up this piece on Axis Direct Brokerage Charges, let’s quickly have a look at some of the lesser-known areas around the different payments:

- If you opt for a conventional Axis demat account (without a 3 in 1 Demat Account facility), then the AMC or Annual Maintenance Charges levied are in the order of ₹2500 per year.

- Mutual fund pledge of shares confirmation is charged at ₹25 per instruction.

- If you are looking to open a free demat account in Axis Bank, here is the Axis Demat Account Form for your reference.

In case you want to get started with the account opening and want us to arrange a callback with a suitable broking company, let us assist you in taking the next steps forward.

Just fill in some basic details in the form below:

Also, check the brokerage charges levied by other stockbrokers in India here: