Calculation of Brokerage Charges

Check All Brokerage Reviews

It is well-known that one needs a broker to trade in the stock market and every time you trade using the trading app, the broker charges a certain commission called brokerage. But what is challenging for traders and investors is understanding the calculation of brokerage charges.

So, in this article, we will be discussing specifically how you can calculate these charges and evaluate your profit or loss in trade.

How to Calculate Brokerage Charges?

Now this question could not be answered in a single line as different brokers come up with different plans.

However, the trick and formula are the same to evaluate the fees charged on your trading. On one hand, where the discount broker charges flat fees, a full service broker comes with a specific percentage of the turnover value.

Confused!

Let’s make this simpler for you!

Here let’s suppose there are two delivery traders X and Y having a demat account with full-service and discount brokers respectively. On one fine day, they both make an investment of ₹1,00,000 in ABC stock.

The calculation of brokerage charges totally depends upon the plan offered by the brokers. So, again let’s suppose that a full-service broker charges a fee of 0.5% of the turnover value while a discount broker charges 0.5% or ₹20 per trade.

So, here the brokerage charges for X will be calculated as follow:

0.5% of Turnover Value

=0.5%*1,00,000=₹500

Similarly, if we check the brokerage charged on Y would be:

0.05%*1,00,000

=₹500

Now as stated above, a discount broker charges a maximum of ₹20 per trade. So on the basis of turnover value, the brokerage evaluated is more than ₹20 and hence Y ends up paying ₹20 as a brokerage for that particular trade.

In this way, the discount broker comes up with specific benefits where you can save a lot, especially if you are doing multiple trades with high turnover value.

This is all about the broker charged by different brokers. When it comes to the calculation of brokerage in different segments, they too come up with specific differences. Let’s understand this in detail.

How is Brokerage Calculated in Intraday Trading?

Intraday trading is faster and has the scope for generating larger brokerages for the stockbrokers since the traders buy and sell more frequently in this form of trading.

This makes it even more important for a person to choose a stockbroker that meets his or her trading requirement and charges minimal brokerage fees. Now consider the same example as above, here let’s assume the full-service broker charges 0.05% of the turnover value for intraday trade, while the discount broker charges 0.05% or ₹20 whichever is higher.

Calculation of Brokerage Charges for X

0.05%*1,00,000= ₹50

Calculation of Brokerage Charges for Y

0.05%*1,00,000=50

Now discount broker comes with a maximum limit in brokerage which is equal to ₹20 per trade. Intraday trading involves buying and selling and hence the brokerage charges would be ₹40.

How is Brokerage Calculated on Options?

In options trading, securities are traded in lots and the brokerage is charged again differs depending upon the broker you have chosen.

For example, a full-service broker charges brokerage on the basis of per lot while a discount broker charges brokerage on the basis of per trade. To give you a clear understanding, let’s assume, the full-service broker charges you the fees of ₹20 per lot and the discount broker charges a fee of ₹20 per trade.

Traders X and Y traded in 5 lots of Nifty. X would be charged per lot and hence the brokerage would be

=5*20

=₹100

On the other hand, discount broker charges flat fees, and hence brokerage for Y

=₹20

Now, we have picked some of the stockbrokers to give you a demonstration of how brokerage is calculated for each.

How Brokerage is Calculated in Zerodha?

There are no Zerodha Brokerage in Equity delivery but it takes the lower value between ₹ 20 per executed order and 0.03% of the total trade value as a brokerage in every other trading segment.

We will continue the same example with a turnover value of ₹1,00,000 for different trades and 5 lots of Nifty for options with a total turnover of ₹1,00,000. On the basis of this, the brokerage charged by Zerodha would be:

| Calculation of Brokerage in Zerodha | |||

| Trading Segment | Brokerage | Calculation | Brokerage Charged |

| Delivery Trading | Nil | - | 0 |

| Intraday Trading | 0.03% or ₹20 (whichever is lower) | 0.03%*1,00,000= ₹30 | ₹30 |

| Futures Trading | 0.03% or ₹20 (whichever is lower) | 0.03%*1,00,000= ₹30 | ₹30 |

| Options Trading | 0.03% or ₹20 (whichever is lower) | 0.03%*1,00,000= ₹30 | ₹30 |

Here STT charges in Zerodha and other taxes are calculated separately from the brokerage.

How Brokerage is Calculated in Angel One?

Angel One is a hybrid stockbroker that recently comes up with a discount brokerage plan for its customer where it charges the maximum fee of ₹20 per trade with 0 trading charges for delivery trade.

Here is a quick review of the calculation of brokerage charges in Angel One.

| Calculation of Brokerage in Angel One | |||

| Trading Segment | Brokerage | Calculation | Brokerage Charged |

| Delivery Trading | Nil | - | 0 |

| Intraday Trading | 0.03% or ₹20 (whichever is lower) | 0.25%*1,00,000= ₹250 | ₹40 (both buy and sell) |

| Futures Trading | 0.03% or ₹20 (whichever is lower) | 0.25%*1,00,000= ₹250 | ₹40 (both buy and sell) |

| Options Trading | 0.03% or ₹20 (whichever is lower) | 0.25%*1,00,000= ₹250 | ₹40 (both buy and sell) |

If we carry out the Angel One vs Groww comparison based on brokerage charges, the former charges less fees than the latter. You can verify it by looking at the Groww brokerage amount below.

How Brokerage is Calculated in Groww?

As a Discount broker, Groww charges a flat brokerage of ₹20 or 0.05% of the turnover value whichever is lower for equity delivery and intraday.

For futures and options, the broker charges a flat fee of ₹20 per trade. Here let’s assume that a trader executed an F&O trade in 5 lots of Nifty and a trade of ₹1,00,000 in equity delivery and intraday.

Here is the detail of the Groww brokerage charges and their calculation:

| Calculation of Brokerage in Groww | |||

| Trading Segment | Brokerage | Calculation | Brokerage Charged |

| Delivery Trading | 0.05% or ₹20 (whichever is lower) | 0.05%*1,00,000= ₹50 | ₹20 |

| Intraday Trading | 0.05% or ₹20 (whichever is lower) | 0.05%*1,00,000= ₹50 | ₹40 |

| Futures Trading | ₹20 per trade | ₹20 | ₹20 |

| Options Trading | ₹20 per trade | ₹20 | ₹20 |

How Brokerage is Calculated in HDFC Securities?

The brokerage charges in HDFC Securities are a little complicated. Unlike the discount broker that comes up with the upper cap, here the broker charges with the minimum slab.

Also, the brokerage for penny stock is charged in a different manner. Now, assuming you paid a 1,00,000 premium to buy 5 lots of Nifty for options and keeping all other values as above let’s find out the brokerage calculation in HDFC Securities.

| Calculation of Brokerage in HDFC Securities | |||

| Trading Segment | Brokerage | Calculation | Brokerage Charged |

| Delivery Trading | 0.5% or ₹25 (whichever is higher) | 0.5%*1,00,000= ₹500 | ₹500 |

| Intraday Trading | 0.05% or ₹25 (whichever is higher) | 0.05%*1,00,000= ₹50 | ₹50 |

| Futures Trading | 0.05% or ₹25 (whichever is higher) | 0.05%*1,00,000= ₹50 | ₹50 |

| Options Trading | 1% of the premium or ₹100 per lot | 1%*100000=1000/5*100=₹500 | ₹100 |

Next comes the calculation of HDFC Securities brokerage for penny stocks in delivery and intraday trade. The broker charges 0.05 paisa per share for penny stocks. Here let say you buy 10,000 penny stocks.

The brokerage calculation will be done as follow:

| Calculation of Penny Stocks Brokerage in HDFC Securities | |||

| Trading Segment | Brokerage | Calculation | Brokerage Charged |

| Delivery Trading | 0.05 paisa per unit | 0.05*10,000= ₹500 | ₹500 |

| Intraday Trading | 0.05 paisa per unit | 0.05*10,000= ₹500 | ₹500 |

How Brokerage is Calculated in Upstox?

Being a Discount broker, Upstox charges brokerage purely on a flat fee basis. Its brokerage is even more than that charged by full-service brokers like Angel One. You can find it while going through the Angel One vs Upstox comparison.

Let’s find out how to calculate the brokerage for the turnover value of ₹1,00,000 and for trading in 5 lots of Nifty Options.

| Calculation of Brokerage in Upstox | |||

| Trading Segment | Brokerage | Calculation | Brokerage Charged |

| Delivery Trading | 2.5% or ₹20(whichever is lower) | 2.5%*1,00,000= ₹2500 | ₹20 |

| Intraday Trading | 0.05% or ₹20 (whichever is lower) | 0.05%*1,00,000= ₹50 | ₹40 |

| Futures Trading | 0.05% or ₹20 (whichever is lower) | 0.05%*1,00,000= ₹50 | ₹20 |

| Options Trading | ₹20 per trade | ₹20 | ₹20 |

Brokerage Calculator in Stock Market

When it comes to paying brokerage on a flat-fee-based brokerage model, knowing how much brokerage you’d pay is quite easy. You just have to abide by the charges set by the stockbroker.

But when it comes to a percentage-based brokerage model, calculating your brokerage manually can either be hectic or can lead to miscalculations at times.

This is why we have designed a brokerage calculator for you which, as the name says, calculates the brokerage automatically for you.

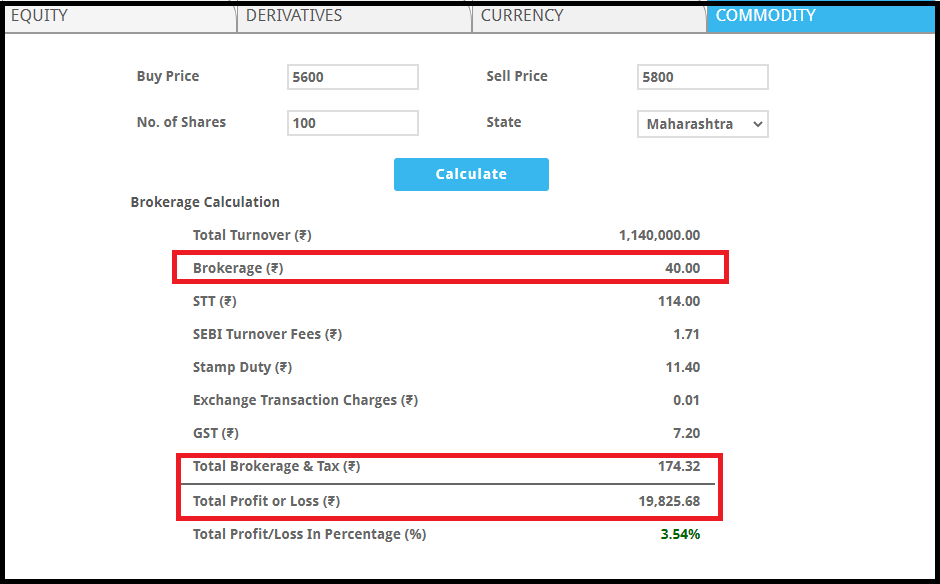

This automatic brokerage calculator gives you the option of selecting your stock broker, and then your trading segments such as Equity, Commodity, Currency, and Derivatives.

Then you can also pick your trading strategy by choosing from the options of Delivery, Intraday, Futures, and Options.

All you have to do to use this brokerage calculator is to put those required values at the top. You have to enter the buy price, sell price, number of shares, and your state and this brokerage calculator will give you all the information about the brokerage you will have to pay.

Additionally, it will also let you know the additional charges that you will have to pay every time you trade. Isn’t it relaxing to have a tool that does all the work for you so that you can solely focus on making profits through your trading? We know, right?

Here is how the calculation of the charge can be done.

Conclusion

Your brokerage basically depends upon two things. The first is your choice of stockbroker while the second is your trading segment and strategy.

Two people having the same stockbroker might end up paying different brokerages if they trade in different segments or two people who trade with different strategies may pay the same brokerage if they have their accounts with the same stockbroker.

Want to begin your investment journey in the stock market? Get started now!

Fill in the form below and we will assist you in choosing the right stockbroker and in opening a demat account online for FREE!