Dhan Brokerage

Check All Brokerage Reviews

Dhan is an emerging discount broker that comes with exclusive services, advanced strategies in the trading app, and lots more. these features attract most investors and traders. But before you get started, it is important to know the complete details of Dhan brokerage.

No doubt that the broker charges flat brokerage charges but it varies across the different trading segments. So, let’s dive in to know the trading fees.

Dhan Brokerage Charges

The broker is registered with all the major trading exchanges and thus you can trade in all the segments including commodity and currency. The maximum brokerage fee charged by the broker is ₹20 per trade.

Apart from this, there is a minimum brokerage fee. For women investors who are looking forward to trading and investment opportunities in the share market, they are provided with the additional benefit that you they can trade by paying 50% brokerage.

Here is the complete detail of Dhan brokerage charges across segments.

Dhan Delivery Brokerage

Like most of the discount brokers in the industry, the broker does not impose any fees for delivery trading. So along with women, here all kinds of investors can do unlimited trade using the Dhan app.

But there are certain taxes in which no relation is offered to any investor and here is the detail in the table below:

Dhan Intraday Charges

Along with the equity delivery one can place intraday trades in the different segments for which Dhan brokerage is 0.03% or ₹20 per trade whichever is lower. For women, the maximum brokerage is however ₹10.

Here is the complete detail of the intraday trading charges.

Dhan Option Trading Charges

Option trading is the most popular trading these days and so the broker comes with the benefit of a flat brokerage of ₹20 per trade. So, whether you trade in one or 10 lots you just have to pay ₹20 per trade.

Below is the table with the brokerage and taxes details for options trading in Dhan.

Dhan Future Trading Charges

Like Options, futures are also traded in lots. Here the brokerage charges are similar to the intraday trading segment i.e. 0.03% or ₹20 per trade.

Dhan Commodity Brokerage

As discussed, you can trade in commodities along with the equity segment using the Dhan app. Commodities are traded in the future and options market and hence the charges depend upon the type of derivative you pick for a trade.

Here is the complete detail along with taxes.

Dhan Currency Brokerage

Currency trading in India allows you to make a profit with the change in the value of a currency with respect to the Indian rupee. You can trade currency in the derivatives market and brokerage is similar to a commodity. However, the taxes are a little different.

Check the details in the table below:

Dhan Brokerage Calculator

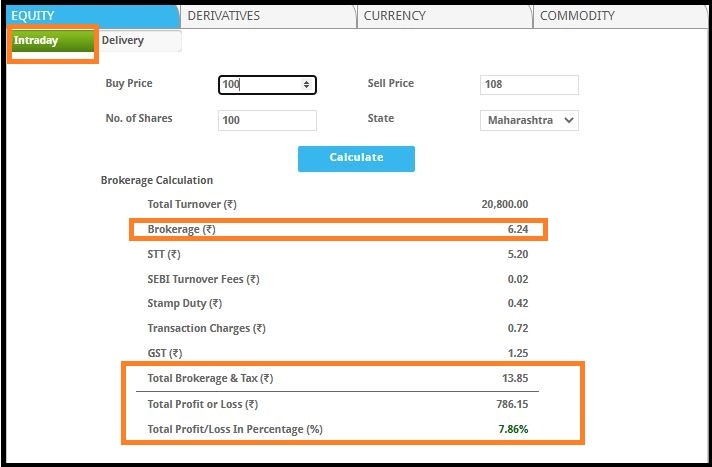

Now as discussed above, the trading charges are not limited to brokerage. One has to pay taxes and other fees. To set profit it is therefore important to consider and calculate all these charges beforehand.

No doubt it is difficult and a little complex for beginners because taxes are calculated on the basis of turnover value. But using the brokerage calculator makes this easier for you.

Just enter the detail of the buy and sell prices along with quantity and the calculator calculates brokerage and other taxes associated with the trade.

Conclusion

Dhan brokerage is almost similar to other discount brokers. So, if you are willing to use their services it is important to consider other aspects too like the trading apps and customer care support.

On the basis of all these parameters, it becomes easier to make the right decision.

But in case you are confused and not able to choose the right stockbroker, then fill in the details below and we will provide complete details and in opening a demat account online for FREE!

More on Dhan