Groww Brokerage Charges

Check All Brokerage Reviews

Tushar has been skeptical about opening a Demat account with Groww but has no idea of the brokerage fees. And of course, he is not alone. There’d be a lot of users who would have that sort of confusion. To help him and others let us take a quick glance at Groww Brokerage Charges.

Brokerage charges are often the first concern of not just Tushar but all the other investors and traders as well. Everyone wants to make the best of the services and at the best possible price available in the market.

So, let us now see if Groww fits the puzzle for Tushar and all the other investors looking for its brokerage charges. If yes, then maybe he can go ahead with the Groww account opening process.

Groww Brokerage

What is a brokerage fee? Whenever an individual executes an order successfully, there is a minor amount that is levied by the brokers. This means it serves as a fee for the broker.

Different stockbrokers have different brokerage charges and so does Groww. Groww is a discount broker and also assures that they have one of the lowest brokerage charges in India.

Many investors wonder, “can we buy us stocks in Groww?” Yes! You won’t believe that you don’t even need to pay any Groww US Stocks charges if you want to invest in the American stock market. However, there will be some fees levied on users related to foreign brokerage account.

The brokerage charges also depend on the segment that you choose for your trading. Unlike other brokers, you need not worry about Groww quarterly charges or any fees on a monthly basis. It’s because there aren’t any.

And if you are confused about any charge for the pledging of shares on this stockbroker app, no Groww pledge charges will be levied on you.

Now, let us have a look at the different segments and the brokerage charges levied by Groww.

Groww Intraday Charges

With the growing millennials in the stock market, the popularity of intraday trading has also increased. Intraday trading demands you to buy your shares and then sell them on the same day. So, if you are looking forward to opening an account for a day trade, then know how to do intraday trading in Groww app and know the charges imposed by the broker to execute the trade.

Groww like any other broker charges brokerage on intraday trades, the details of which are given as follows.

| Groww Intraday Charges | ||

| Intraday Brokerage Charges | 0.05% of trade or ₹20/- (whichever is lower) | |

Groww Equity Delivery Charges

Delivery trading still manages to be one of the most loved segments of trading. The brokerage charges levied by Groww on delivery trades are as follows.

| Groww Delivery Charges | ||

| Delivery Brokerage Charges | 0.05% of trade or ₹20/- (whichever is lower) | |

Let us understand this with the help of an example. Suppose Tushar decided to do delivery trading. So according to the brokerage plan, he will either be charged ₹20 flat or 0.05%., whichever is lower.

Case1- Total Trade of ₹ 20,000

0.05% of ₹ 20,000= ₹ 10

So in this case, he will be charged ₹ 10

Case2- Total trade of ₹ 50,000

0.05% of ₹50,000= ₹ 25

So in this case ₹ 25 is greater than the ₹20 flat fees, so he will be charged ₹ 20.

Apart from this, you have to pay DP charges in Groww on selling delivery shares.

Groww Currency Brokerage Charges

The other segment is popular among traders in currency trading. It is available only on options and futures. So the brokerage charged by Groww for this segment of trading is as follows.

| Groww Currency Brokerage | ||

| Currency Futures | ₹20 per order | |

| Currency Options | ||

Groww F&O Charges

Derivatives are another segment that people commonly trade. One of the most famous ones is the options contract. The orders are executed on a future day if the person who paid the premium doesn’t leave the contract. The investors acquire either a buy position or writer depending on their analysis of the market.

The brokerage charges if you want to do futures and option trading in Groww are as follows.

| Groww Futures and Options Charges | Groww Margin Facility | |||

| Trading Segments | Futures | Options | ||

| Equity Trading | ₹ 20 per order or 0.05% | ₹ 20 per order or 0.05% | ||

| Currency Trading | ₹ 20 per order | ₹ 20 per order | ||

| Commodity Trading | NA | NA | ||

Note- Groww is not registered with the commodity exchanges like MCX and NCDEX, so you cannot trade in the commodity segment using the Groww Demat account.

Groww Hidden Brokerage Charges

Also, apart from the brokerage charges, there are other charges like:

- Groww STT charges

- Groww transaction charges

- GST

- Stamp Duty charges

The details of the fees are given in the table below:

| Groww Hidden Brokerage Charges | ||||||||

| Types of Charges/Segments | Equity | Futures & Options | ||||||

| Delivery | Intraday | Futures | Options | |||||

| STT | 0.1% (Both Side) | 0.025% (on Sell Side) | 0.01% | 0.05% (On Premium) | ||||

| Transaction Charges | NSE: 0.00345% | NSE: 0.00345% | 0.002% (Both Side) | 0.053% (Both Side) | ||||

| BSE: 0.00345% | BSE: 0.00345% | |||||||

| Stamp Duty | 0.015% | 0.003% | 0.002% (On Buy) | 0.003% (On Buy) | ||||

| SEBI Turnover Charges | 0.00005% | 0.00005% | ||||||

| GST | 18% of Brokerage and Transaction Fees | |||||||

Let’s understand now how Groww charges a brokerage to trade in any segment.

Suppose Tushar executed an intraday trade and buy 100 shares of SUN PHARMA at ₹200 each. Later he sold his shares at ₹210 each.

Now total buying value is ₹20,000 while the selling value is ₹21,000.

Total turnover is ₹41,000 (₹20000+₹21000)

Brokerage= 0.05% of ₹41,000= ₹20.5

Here he paid the flat fees of ₹20 as intraday trading charges.

Now looking at other charges for intraday trading

| Groww Brokerage Example | ||||

| Brokerage | ₹20 | ₹20 | ||

| STT Charges | 0.025%*21000 | ₹5.25 | ||

| Stamp Duty | 0.003%*20000 | ₹0.60 | ||

| Transaction Charges | 0.00345%*41000 | ₹1.41 | ||

| SEBI Turnover Fees | 0.00005%*41000 | ₹2.05 | ||

| GST Charges | 18%*21.41 | ₹3.85 | ||

| Total | ₹33.16 | |||

Apart from this, there is other hidden charges associated with the delivery trading, DP charges. DP charges in Groww are minimal and are equal to ₹13.5+GST per scrip.

So, when investing in delivery shares it is important to consider this fee, as well since the broker, generally does not display the charges information in the contract note.

But here comes another question, does the broker charges the least? To get the answer for this, compare its brokerage fees with another stockbroker. To make it easier, begin with Groww vs Upstox.

This helps you to know about the services, charges, and benefits of opening an account with any of the brokers.

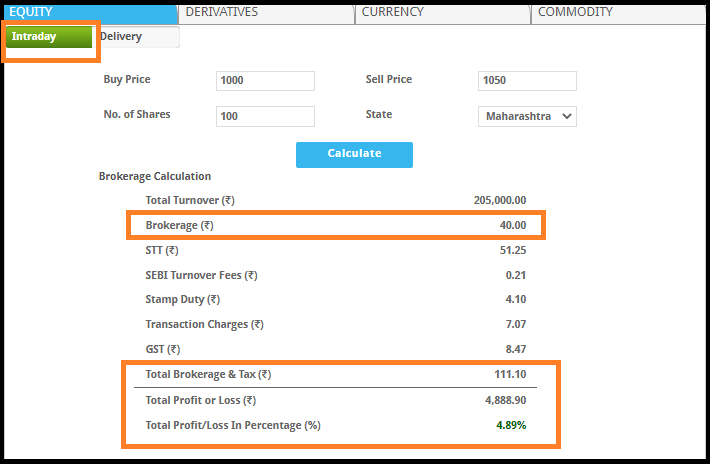

Groww Brokerage Calculator

So now, you know how much you need to pay for buying shares in Groww. Also, we explained how much Groww charges for selling stocks in different market segments.

Clearly, there is not only brokerage but other charges associated with trading in different segments. Evaluating brokerage charges for a specific trade is sometimes difficult (as shown above), especially for beginners and therefore here is the brokerage calculator for you.

The Groww brokerage calculator will give you the exact brokerage that will be charged. You will also get to know the other details like profit and loss data as well.

Conclusion

The brokerage charges of Groww definitely give it an edge. We hope that your doubts regarding the Groww brokerage charges have been solved now, and just like Tushar finally made a decision, you were also able to take one.

Have a happy trading journey!

Looking forward to start trading, open your Demat account for FREE.

More on Groww