HDFC Securities Brokerage Plans

Check All Brokerage Reviews

HDFC Securities is the bank-based stock broker that generally levies high brokerage charges. But similar to other brokers, HDFC too comes up with different plans that offer relaxation to its customers from paying hefty fees. So let’s discuss the HDFC Securities brokerage plans and reap the benefit of trade at a minimal cost.

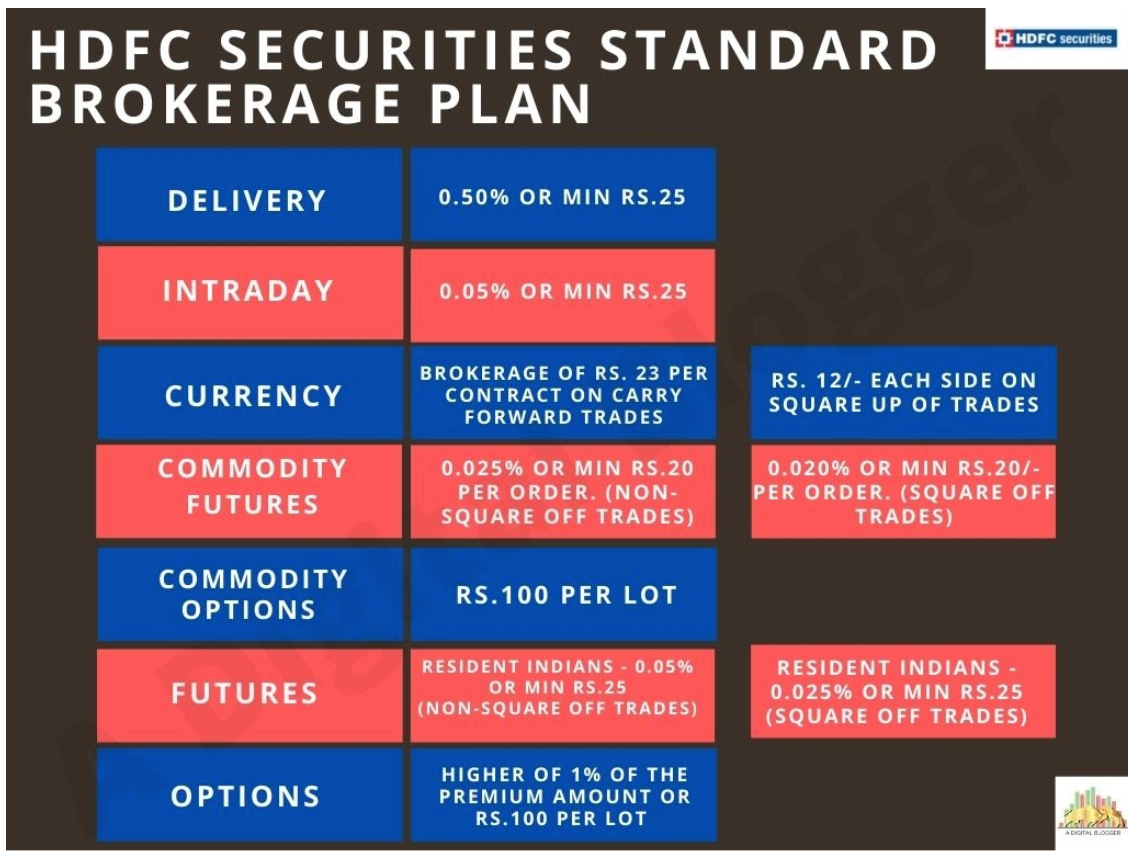

HDFC Securities Standard Brokerage Plan

After opening a demat account, apart from AMC and other HDFC Demat Account charges, it is also necessary to check the brokerage charges levied by the broker.

When the trader or investor opens the HDFC demat account, by default he gets the Standard Brokerage Plan. But of course, there are other HDFC Securities Brokerage Plans that you can choose from.

The details of which are given below:

To understand the brokerage charges of HDFC Securities in a more elaborated course, refer to the following table.

To make it more understandable, let’s assume an example.

Nitin is an intraday trader, having a Demat account with HDFC.

He executes a buy order to trade in 1000 shares of Tata Power available at ₹80 per share. Booking a profit at ₹100 the total turnover value of the trade is ₹18,000.

Now as per the brokerage plan, the intraday trading charges are in the range of 0.05% i.e. ₹90.

Let’s check how you can save more with the Value Plan offered by the broker.

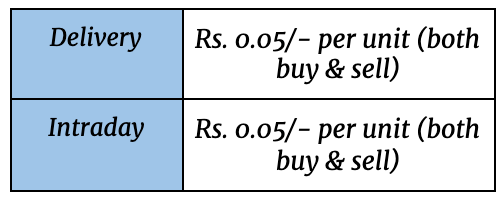

Apart from these charges, there are few more charges that are applied to the penny stocks. So, to know more about the penny stocks brokerage charges refer to the following table.

Hence being it intraday trading or delivery trading, the trader will be paying ₹0.05 or 5 paise as a brokerage. To understand more in detail, let’s go ahead with another example.

Ronit purchases the 2000 penny stocks of ZYX company that costs ₹7. The total of these stocks are ₹14,000. So here, he will pay ₹0.05 of the total shares purchased, i.e. 2,000. The brokerage will be ₹100.

In the same way, if he sells out those 2000 shares, he will be required to pay the HDFC Securities Intraday Brokerage of ₹100.

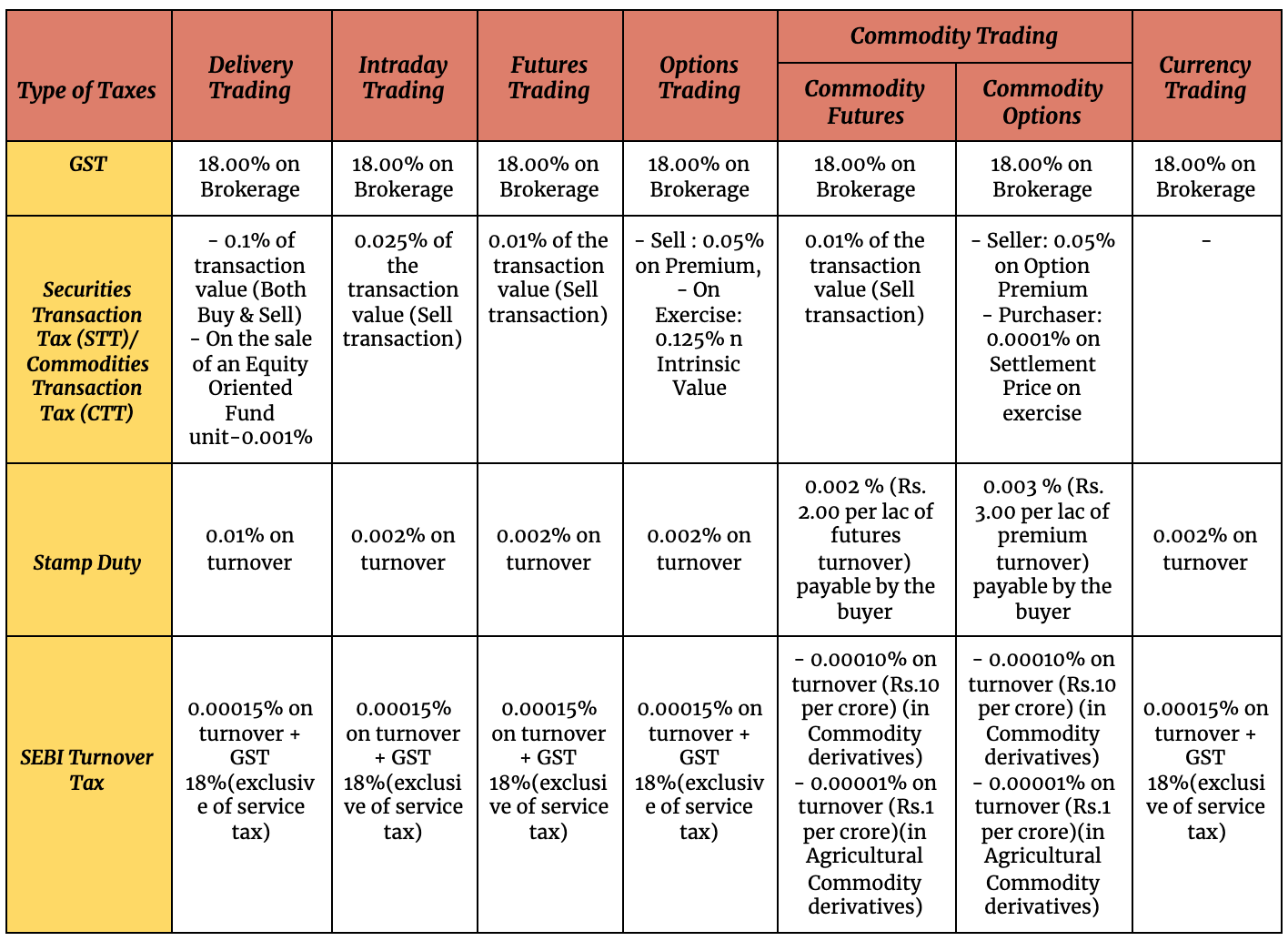

Apart from the brokerage fees in other segments, there are some additional charges that are to be paid by the traders or investors as taxes. Those charges are mentioned in the below table.

Let’s check how you can save more with the Value Plan offered by the broker.

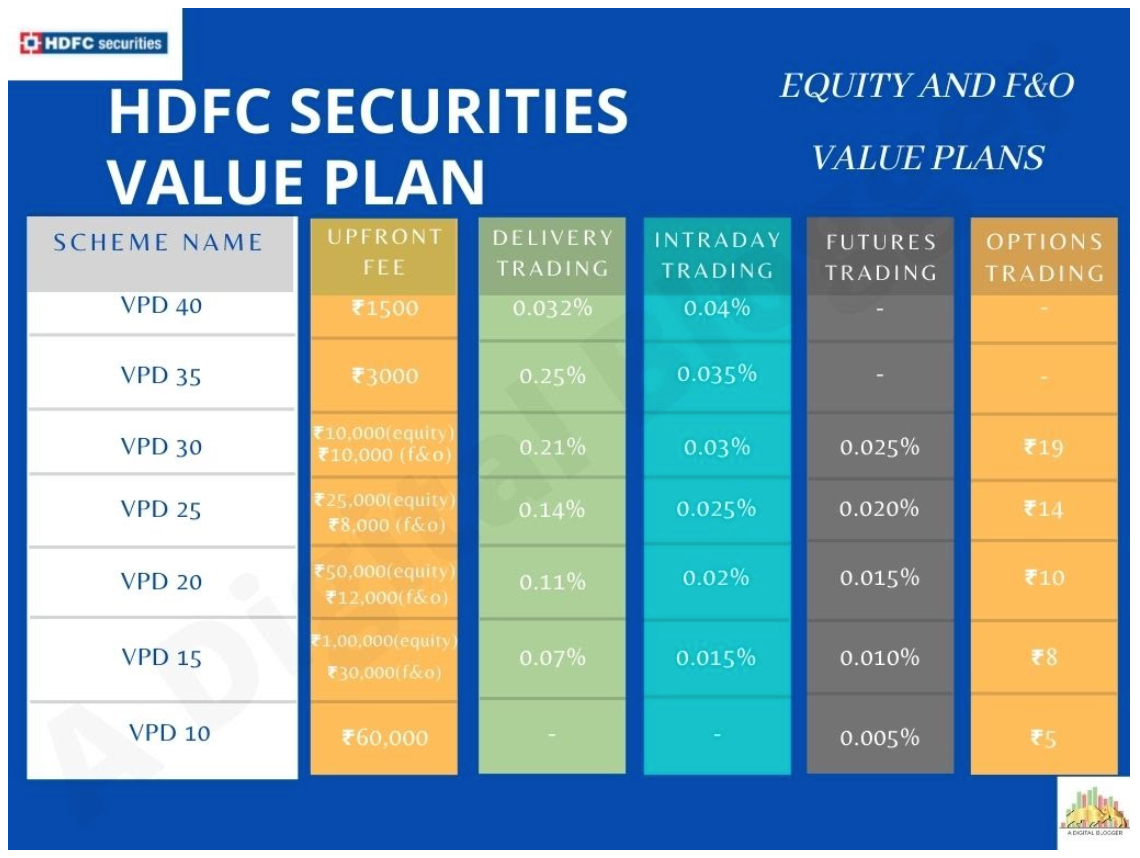

HDFC Securities Value Plans

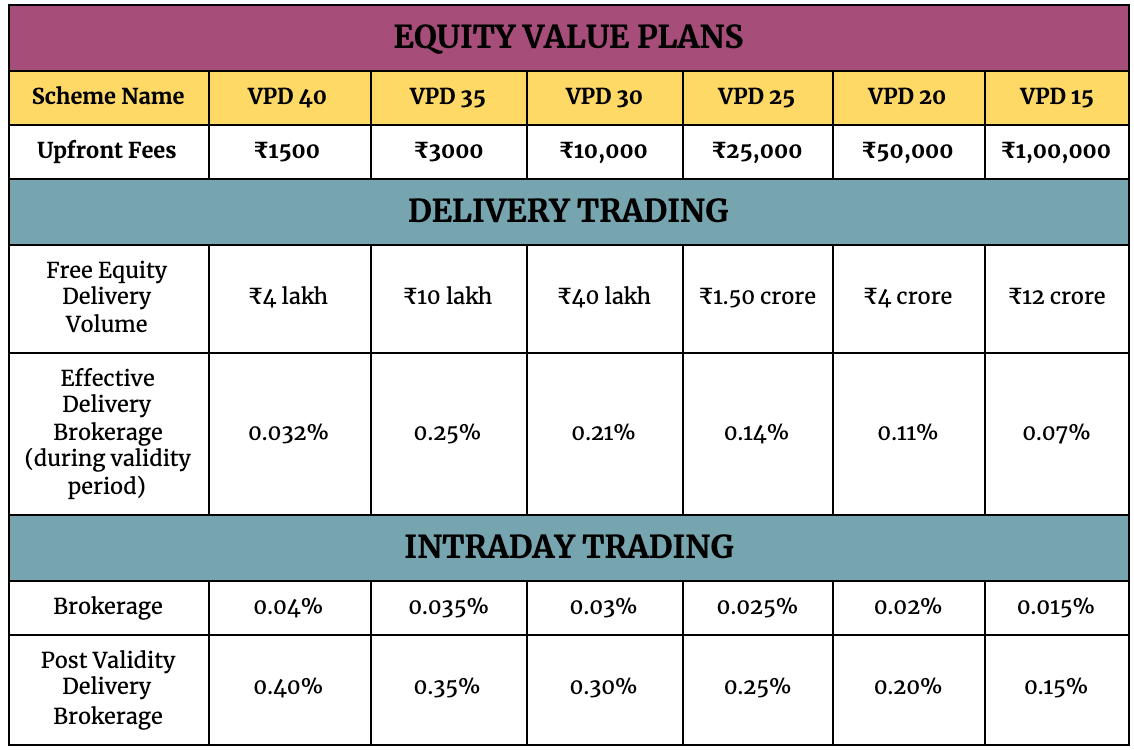

Being a trader or investor, you can reap the benefit of the minimum HDFC Securities charges of 0.07% to trade in the equity delivery. Apart from this, with the superior trading services with value plans, you can easily trade-in futures at 0.05% and in options with ₹5.

The plan is created for seasoned, new traders or investors in which for 360 days, a trader or investor can get the free delivery volume under each equity value plan. Whereas in the F&O value plan the trader gets the option lots for 360 days for free.

Moreover, it offers the opportunity to grab the Premia services of ₹2,999 without paying a single penny. The condition here is the subscription of any value plans of ₹10,000 or more that is VPE 30 plan or higher in the equity value plan.

In the case of the F&O value plan, the Premia services of ₹2,999 are offered free to those who subscribe to the plan of ₹12,000 or more, i.e. VPD 20 or more.

To get a better understanding of the data and charges, refer to the following table with the brokerage plan for HDFC Securities delivery charges and intraday trading fees.

*The minimum brokerage of ₹25 is applicable.

To understand the table in a more defined way, consider the following example.

Nitin if executes the same order as above by choosing the Value Plan VPD 30, then he would end up paying the brokerage of ₹54 (0.03%*180000).

Thus, one can save a lot by choosing the right Value Plan offered by HDFC Securities.

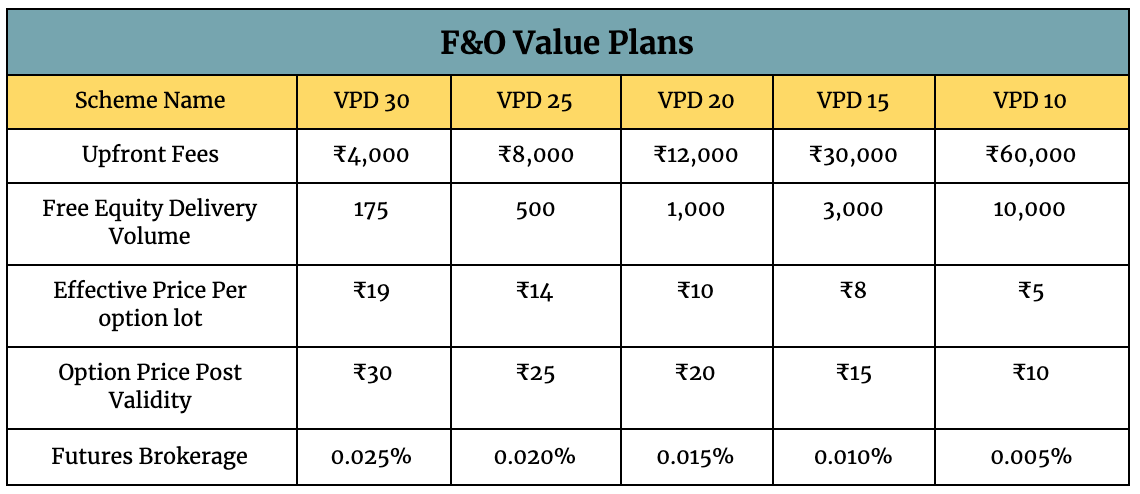

Apart from Equity Market, now, let’s check the value plan for the derivatives trading. These charges are applicable to trade in Futures and Options thus you can trade in currencies and commodities at the minimum cost. Check the latest HDFC commodity trading charges of the broker to compare how much you can save by choosing the right value plan.

So, on one hand where the broker charges the fees of ₹100 per lot to trade in options, with the Value Plan one can save more by paying the options trading charges of ₹30-₹10.

If you are an active trader, it is good to make a little investment by paying the upfront charge and increase the profit margin by paying less brokerage. Also, make sure you remember that the same charges are levied even when you use the HDFC Securities Call and Trade facility.

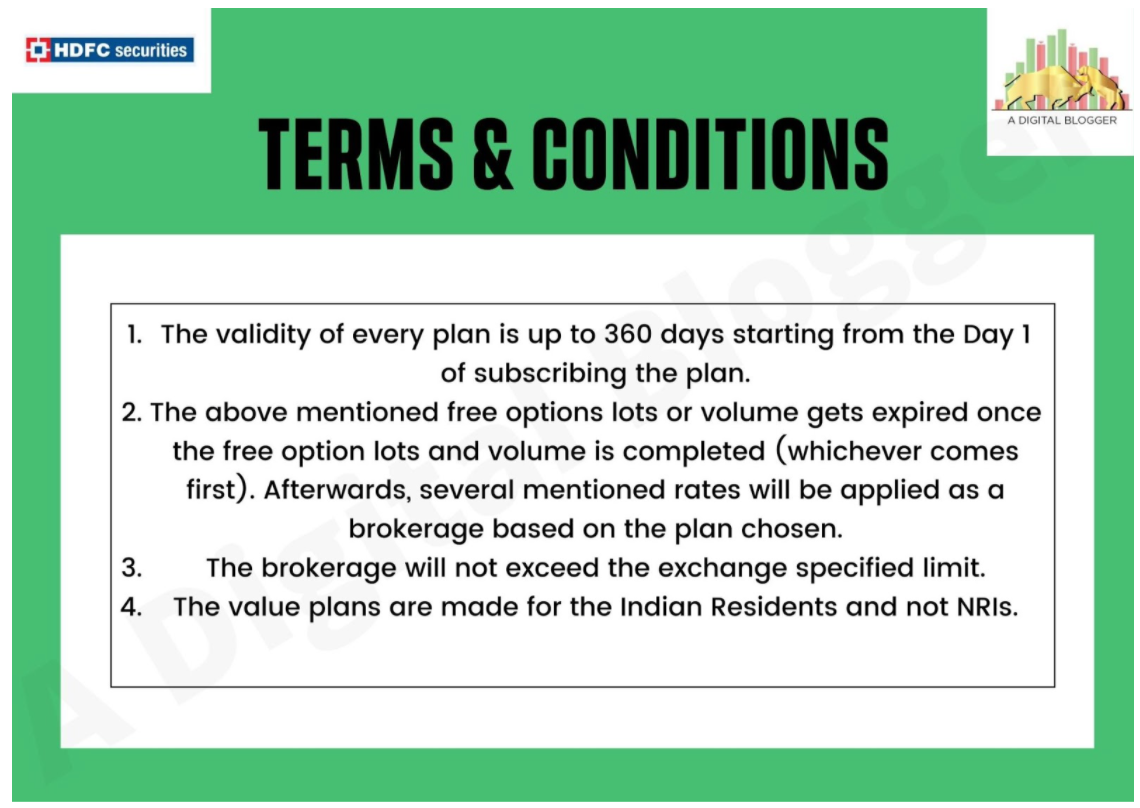

HDFC Securities Value Pack Terms and Conditions

Apart from the above-mentioned HDFC Securities Brokerage Plans, it is important to check the terms and conditions to avoid any confusion.

Conclusion

The broker, HDFC Securities, allows the clients to choose the brokerage plan according to their preferences and trading style.

Being an active trader, it is advisable to choose the value plans to execute trades on a regular basis. Whereas, if the trading is done in intervals, at that point, the trader can go with the standard brokerage plan.

Therefore, this is the time to know the preferences, trading style and select the plan accordingly. Also, to gain a better idea of how much charges are imposed it is good to know how to calculate brokerage in HDFC Securities?

In case you need some assistance from our end in taking it forward, just fill in a few basic details and we will call you back: