HDFC Securities Delivery Charges

Check All Brokerage Reviews

HDFC Securities, the bank-based full-service broker, offers many services and benefits to its clients. Needless to say that apart from the HDFC demat account charges, there is a certain brokerage that is imposed by the broker in the equity segment. In this article, you will get complete information on HDFC Securities delivery charges.

Let’s begin!!

HDFC Securities Equity Delivery Charges

Many beginners open a Demat account to plan their long-term investment. This makes it even more important to know how much the broker charges to trade in the delivery trade.

As per the standard plan, the HDFC Securities delivery charge is equal to 0.5% per trade. However, the minimum brokerage to be paid is equal to ₹25.

Let’s understand this calculation of brokerage charges with the help of an example.

Suppose Aadarsh is a delivery trader who buys 100 TCS stocks at ₹760 per share. Here the total turnover value of the trade is ₹76000.

Evaluating the brokerage, the total fees to be paid is:

0.5%*76000

₹85

On the other hand, if he carried out the small trade of let’s say the turnover value of ₹10000. Then the brokerage would be (0.5%*10000) ₹10. Since the minimum fees charged by the broker is ₹25, Aadarsh ends up paying ₹25 to execute the trade.

The detail of the charges is tabulated below:

To understand the concept of trading in penny stocks in a more meticulous way, let’s assume an example. Here, for trading in penny stocks, the broker has a different brokerage plan where you have to pay 0.05/ per unit.

If Aadarsh purchases the 8,000 shares of ABC company that consume ₹8 per share, so the total amount of share will be ₹64,000. So here, the brokerage that is to be paid is ₹0.05 of 8,000, i.e., ₹400.

HDFC Securities Equity Delivery Value Plan

Along with the above delivery brokerage charges, the broker offers the brokerage plan that helps you to trade at the minimum price.

Under this plan, you can reduce your HDFC Securities charges for trading up to 0.07% by paying the upfront fees of ₹1,00,000. Other than this, there are many other options, the detail of which is given in the table below:

Let’s assume what would be the brokerage charges if Rajeev has opted for the Value Plan. To understand the HDFC Securities delivery charges, let’s assume an example.

With the value plan VPD 15, by paying an upfront fee of ₹1,00,000, Aadarsh will be allowed to invest in the stocks free of cost (without brokerage) up to the volume of ₹12 crores.

After the free volume expires, Aadarsh will have to pay 0.07% of the brokerage as an effective delivery brokerage, which means, with the total turnover of ₹10,000, he will be required to pay ₹7.

After the scheme’s validity is over, Aadarsh will pay 0.15% as a brokerage under the value plan. Therefore, with a total turnover of ₹10,000, he will pay ₹15 as a brokerage.

After such conditions in delivery trading, it can be easily derived that Rajeev will pay lesser brokerage with the Value Plan as compared to the Standard Plan.

HDFC Securities Brokerage Calculator

Still wondering how to calculate brokerage in HDFC Securities?

Here is the seamless way for you.

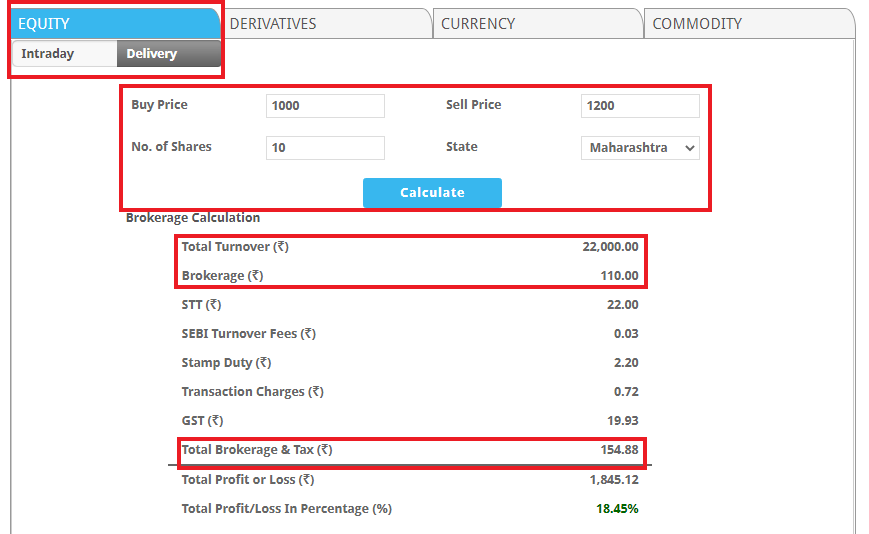

Just fill in the necessary details and click on ‘Calculate’ to get the detailed information of the HDFC Securities delivery charges.

The brokerage calculator will showcase the Total Turnover, Brokerage as well as Total Brokerage & Tax.

Conclusion

As said, HDFC Securities allows the clients to select any of the brokerage plans according to their preferences and the suitable trading style.

The value plan is created and useful for the traders or investors who are active in the share market. Whereas, for the traders or investors who execute the orders according to the time, a standard plan of the HDFC Securities delivery charges is the best option.

Apart from the brokerage mentioned above charges, there are some more changes that are levied on the trader or investor as the tax that are discussed above.

Henceforth, it is advisable to check the trading style, go through each plan and select accordingly.

Willing to start trading? Open a Demat account for Free!

More on HDFC Securities